Venezuelan Oil Exports to the US Raise Geopolitical Concerns

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Venezuelan Oil Exports to the US Raise Geopolitical Concerns

January 07, 2026 — In a significant development, Venezuela has ramped up its oil exports to the United States, marking a pivotal shift in geopolitical dynamics. This move comes after years of strained relations and economic sanctions, with Venezuela exporting an estimated 500,000 barrels per day to the U.S. as of January 2026. This increase in oil flow is a result of recent negotiations aimed at easing sanctions and stabilizing Venezuela's economy.

Why It Matters

For investors, this development is a double-edged sword. On one hand, increased oil supply from Venezuela could help stabilize global oil prices, which have been volatile due to geopolitical tensions in other oil-producing regions. On the other hand, the geopolitical implications are profound, as this shift may alter existing alliances and economic dependencies. The immediate market impact is evident as oil prices saw a 2% decrease following the news, reflecting a potential easing of supply constraints.

Context & Background

Historically, U.S.-Venezuela relations have been fraught with tension, particularly under the previous U.S. administration which imposed stringent sanctions on Venezuela's oil industry. These sanctions were aimed at pressuring the Venezuelan government to implement democratic reforms. However, recent diplomatic efforts have led to a partial lifting of these sanctions, allowing Venezuela to re-enter the U.S. oil market. Key stakeholders affected include U.S. oil companies, which may benefit from lower input costs, and geopolitical analysts, who are closely monitoring the situation for potential shifts in regional power dynamics.

What's Next

Investors should watch for further developments in U.S.-Venezuela relations, as any changes in policy could significantly impact oil markets. Additionally, the upcoming OPEC meeting in February 2026 will be crucial, as member countries may adjust their production targets in response to Venezuela's increased exports. Potential scenarios include a stabilization of oil prices if Venezuelan exports continue, or renewed volatility if geopolitical tensions escalate.

MarketVibe's CW Index, which provides early risk signals, has ticked up to 5.6, indicating potential market turbulence as this story unfolds. Investors are advised to monitor position sizing and consider hedging strategies to navigate the evolving landscape.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

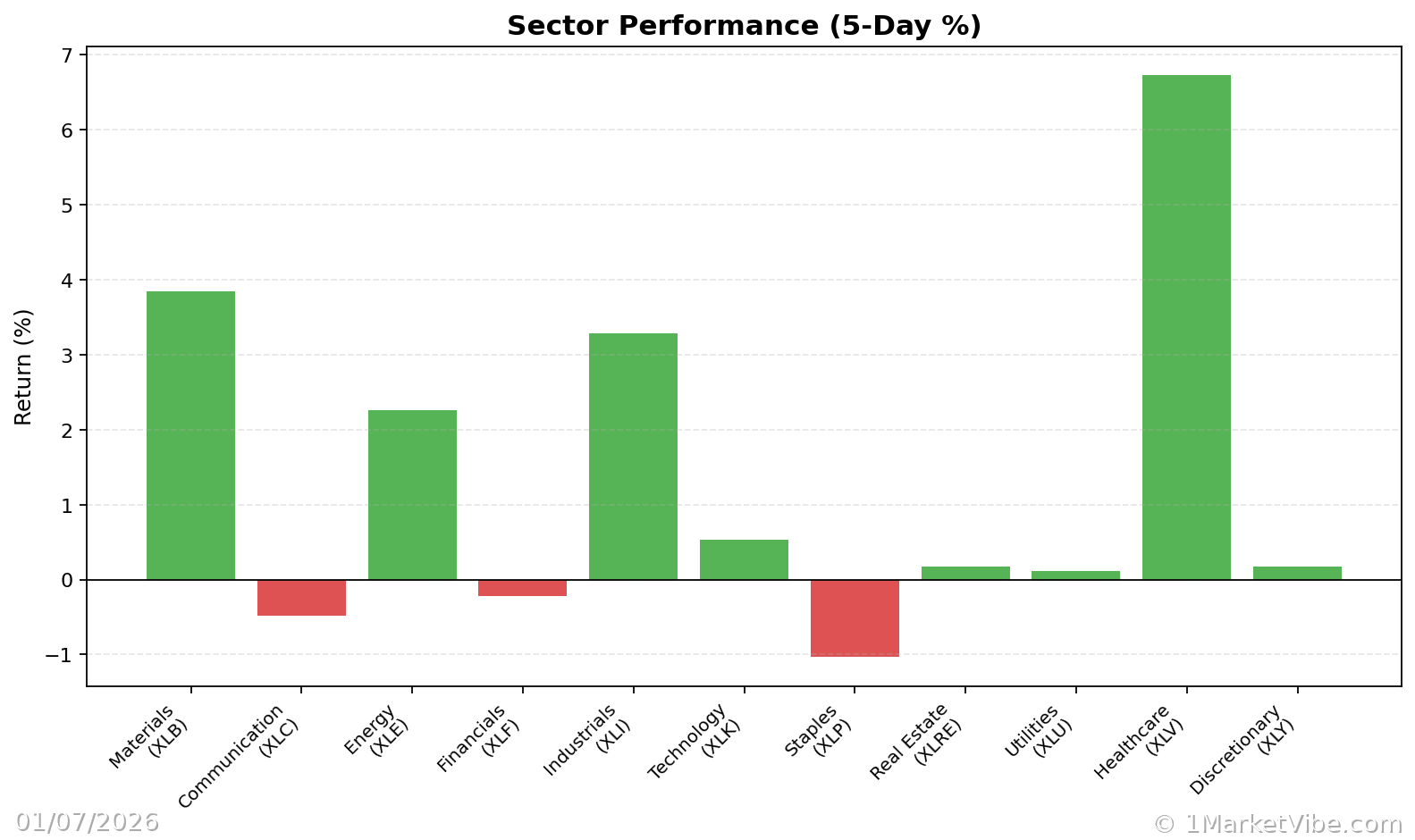

Charts