Eurozone Inflation at 2%: A Stabilizing Influence on Global Markets

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Eurozone Inflation at 2%: A Stabilizing Influence on Global Markets

Breaking News: As of December, Eurozone inflation has fallen to 2%, marking a significant milestone in the region's economic stability. This development, reported by the Financial Times, positions the Eurozone as a potential stabilizing force in the global market landscape, with economists suggesting that no interest rate cuts are expected this year.

Why It Matters

For investors, this inflation stability is a beacon of economic balance amid global uncertainties. The immediate impact is a potential boost in investor confidence, as stable inflation rates often lead to predictable economic conditions. This could influence global markets by providing a counterbalance to regions experiencing higher inflation volatility. The sentiment shift is cautiously optimistic, with markets reacting to the news by stabilizing after recent fluctuations.

Context & Background

Historically, inflation rates in the Eurozone have been volatile, influenced by various economic pressures, including energy prices and supply chain disruptions. The current 2% rate is a marked improvement from previous years, where inflation soared above 5% during the pandemic recovery phase. Key stakeholders affected include European businesses and consumers, who may benefit from more predictable pricing and purchasing power.

Market Implications

- Global Influence: Eurozone's inflation stability could serve as a model for other regions grappling with inflation challenges.

- Investor Sentiment: A stable inflation rate may encourage investment in European markets, perceived as less risky.

- Economic Policies: Central banks may adopt a wait-and-see approach, avoiding drastic monetary policy changes.

CW Index Connection

MarketVibe's CW Index, currently reading 6.1, aligns with this trend, indicating a stable risk environment. The Index's predictive capabilities suggest that this inflation stability was anticipated, providing investors with early warning signals.

Risks and Considerations

While the current trend is positive, potential risks remain. Factors such as geopolitical tensions, energy price fluctuations, and unexpected economic shocks could disrupt this stability. Investors should remain vigilant, monitoring these variables closely.

Global Economic Context

In comparison to other regions, the Eurozone's inflation rate is notably lower, with countries like the US and UK experiencing higher rates. This positions the Eurozone as a potential safe haven for investors seeking stability in their portfolios.

Conclusion

The Eurozone's achievement of a 2% inflation rate is a pivotal development for global markets, offering a semblance of stability in uncertain times. Investors should watch for any shifts in economic policies and market reactions as this story unfolds.

Monitor risk signals as this story develops at 1marketvibe.com.

Sources:

- Financial Times: Eurozone inflation falls to 2% in December

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

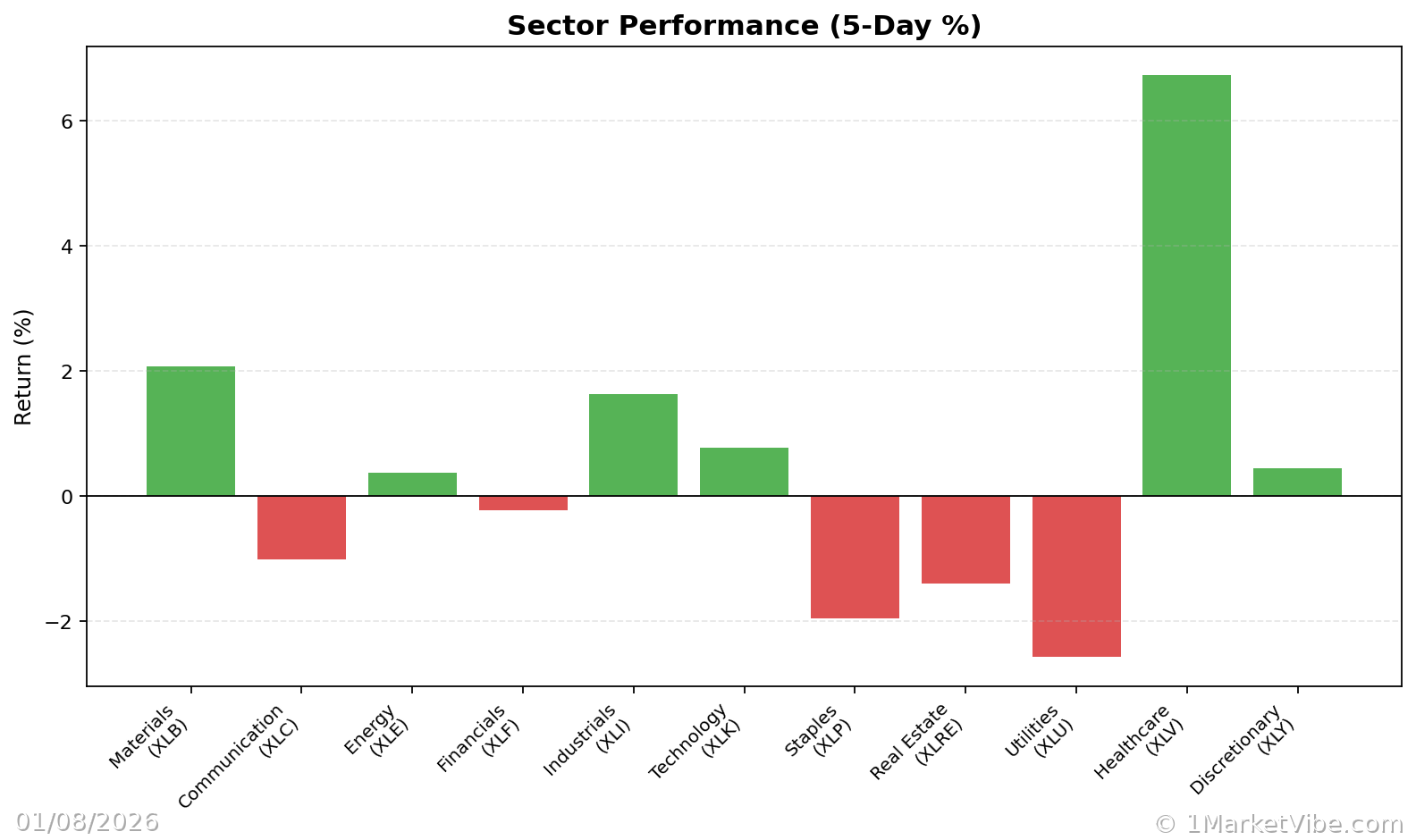

Charts