U.S.-Venezuela Tensions and Their Market Impact: Key Sectors to Watch

- Authors

- Name

- MarketVibe Team

- @1marketvibe

U.S.-Venezuela Tensions and Their Market Impact: Key Sectors to Watch

Breaking News: On January 6, 2026, escalating tensions between the United States and Venezuela have sent ripples through global markets, particularly impacting energy and commodities sectors. The U.S. government has imposed new sanctions on Venezuela, targeting its oil exports, a move that has already seen crude prices spike by 4% to $85 per barrel. This development follows a series of diplomatic breakdowns over the past week, with both nations exchanging heated rhetoric.

Why It Matters

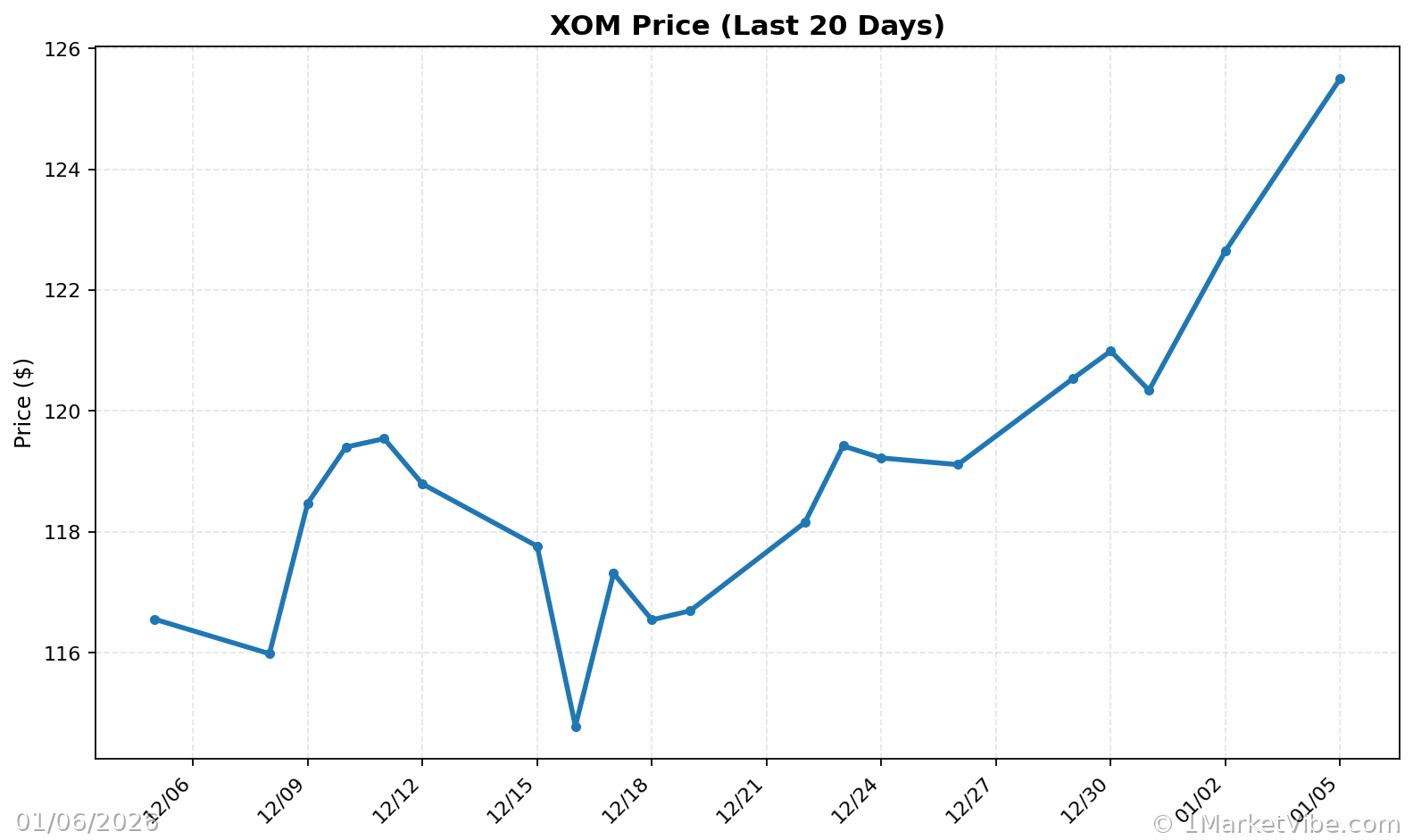

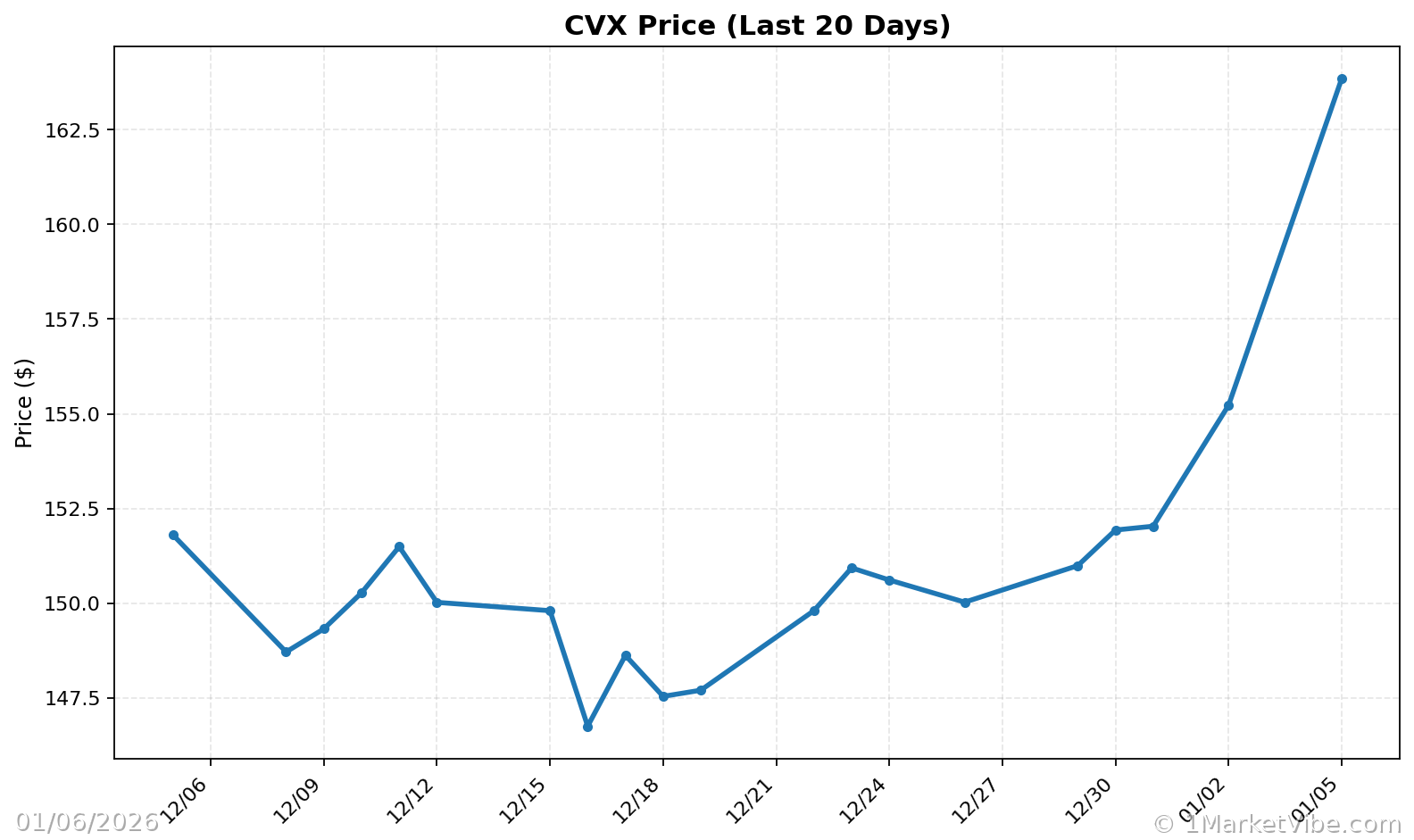

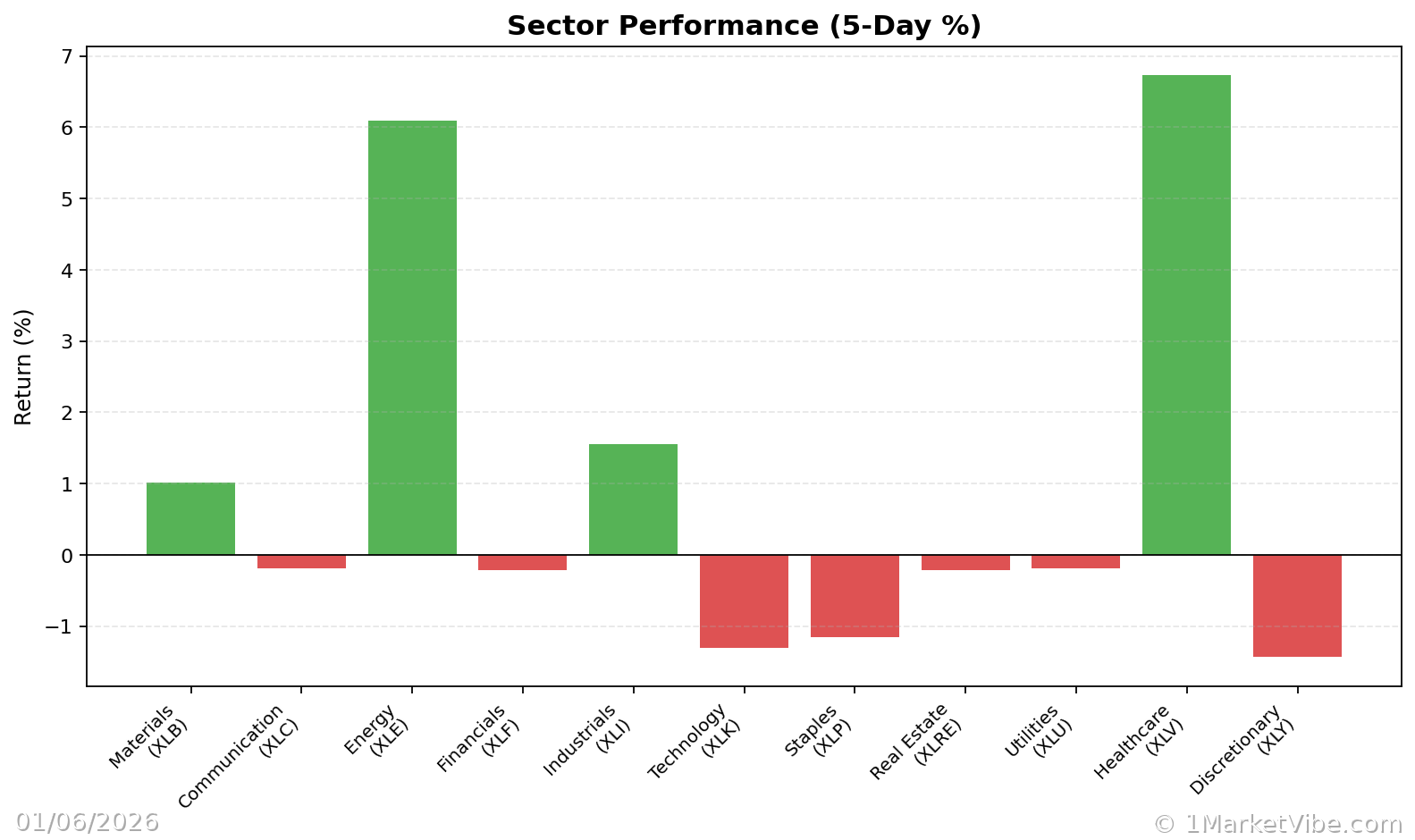

For investors, the immediate impact is a heightened risk environment, particularly in sectors sensitive to geopolitical shifts. The energy sector is experiencing increased volatility, with oil companies like ExxonMobil and Chevron seeing stock price fluctuations. Commodities markets are also reacting, with gold prices rising as investors seek safe-haven assets. MarketVibe's CW Index, which tracks geopolitical risk, has ticked up to 5.8, reflecting the growing uncertainty.

Geopolitical Context

The current tensions stem from long-standing political and economic disagreements between the U.S. and Venezuela, exacerbated by recent U.S. accusations of human rights violations and Venezuela's alleged interference in regional politics. Historically, similar tensions have led to significant market disruptions, as seen in the 2019 sanctions that caused a temporary halt in Venezuelan oil exports.

Market Analysis

- Energy Sector: With Venezuela being a major oil producer, the sanctions are likely to tighten global oil supply, pushing prices higher. This could benefit U.S. shale producers in the short term but also increase costs for industries reliant on oil.

- Commodities: As uncertainty looms, gold and other precious metals are seeing increased demand. Investors are advised to monitor these markets closely for further price movements.

- Stock Market: Volatility is expected to rise, particularly in sectors directly affected by oil price changes. Companies with significant exposure to Venezuelan markets may face additional risks.

Investor Sentiment

Investor sentiment is currently cautious, with many adopting a wait-and-see approach. The potential for further escalation could lead to increased market volatility. For investors, this means considering adjustments to portfolios, particularly in sectors directly impacted by these geopolitical tensions.

Risk Assessment

The risk of further sanctions or retaliatory actions by Venezuela could exacerbate market instability. Investors should be aware of the potential for rapid changes in market conditions and consider hedging strategies to mitigate risks. The CW Index's current level suggests a moderate risk environment, but this could change quickly depending on diplomatic developments.

Historical Comparisons

Past geopolitical conflicts, such as the 2014 Russia-Ukraine crisis, have shown that markets can react swiftly to international tensions, often leading to prolonged periods of volatility. Investors should draw lessons from these events to better navigate the current situation.

What's Next

Investors should watch for upcoming diplomatic meetings and any announcements from the U.S. or Venezuelan governments that could signal a shift in the current trajectory. Key dates include the upcoming OPEC meeting, where oil production levels will be discussed, potentially impacting global supply and prices.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly and unpredictably.

Charts