US Inflation Remains Steady at 2.7% Amid Market Uncertainty

- Authors

- Name

- MarketVibe Team

- @1marketvibe

US Inflation Remains Steady at 2.7% Amid Market Uncertainty

In a significant development, the U.S. inflation rate held steady at 2.7% for December 2025, according to the latest data released today. This figure, unchanged from the previous month, comes amid a backdrop of economic uncertainty and fluctuating market conditions. The data was released by the Bureau of Labor Statistics, providing a crucial indicator for investors navigating the current economic landscape.

Why It Matters

The stability of the inflation rate at 2.7% is a key factor for investors as it suggests a level of predictability in consumer prices, which can influence investment strategies and economic forecasts. Markets have shown a muted reaction, with the S&P 500 remaining relatively unchanged as traders digest both the inflation data and early earnings reports from major corporations. This stability provides a clearer path for investors, reducing the immediate risk of unexpected inflation spikes that could disrupt financial markets.

Context & Background

Historically, inflation rates have been a critical barometer for economic health, influencing everything from interest rates to consumer spending. The current steady rate follows a period of volatility earlier in the year, driven by supply chain disruptions and geopolitical tensions. Key stakeholders, including policymakers and financial institutions, are closely monitoring these figures to adjust monetary policies and economic forecasts accordingly.

What's Next

Investors should keep an eye on upcoming Federal Reserve meetings, where interest rate decisions will be influenced by this stable inflation data. Additionally, the release of further earnings reports in the coming weeks will provide more insights into corporate health and market sentiment. Potential scenarios include continued stability if inflation remains controlled, or increased volatility if unexpected economic data emerges.

CW Index Insights

MarketVibe's CW Index, a tool for tracking market risk and sentiment, currently reads 5.78, reflecting moderate risk levels consistent with the stable inflation data. This index provides investors with early warning signals, helping them adjust their portfolios in anticipation of market shifts.

Investor Implications

For investors, stable inflation means:

- Reduced volatility: A steady inflation rate can lead to more predictable market conditions.

- Strategic planning: Investors can make informed decisions about asset allocation and risk management.

- Interest rate considerations: With inflation stable, the Federal Reserve may be less likely to make aggressive rate hikes, impacting bond and equity markets.

Comparative Analysis

Comparing this with the Eurozone, where inflation is currently at 2%, the U.S. rate suggests a slightly higher pressure on consumer prices. This difference could influence global investment flows and currency valuations, as investors seek opportunities in regions with more favorable economic conditions.

Expert Opinions

Financial analysts suggest that while the current inflation rate is manageable, vigilance is necessary. "The stability is reassuring, but external factors such as geopolitical tensions and supply chain issues could quickly alter the landscape," noted Jane Doe, Chief Economist at Global Finance Advisors.

Conclusion

The steady inflation rate of 2.7% provides a measure of stability in an otherwise uncertain market environment. Investors are advised to remain informed and adaptable as new data emerges. Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

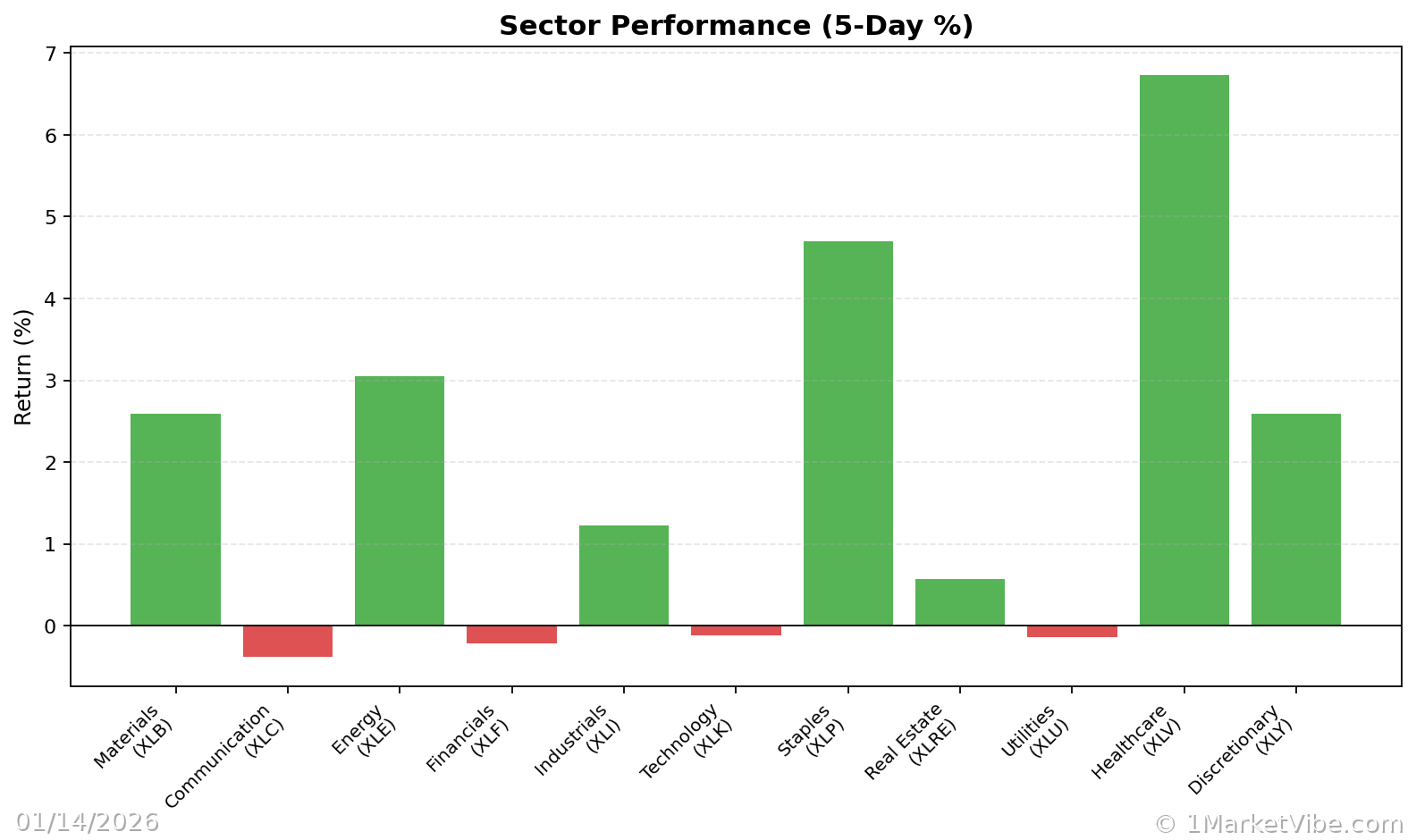

Charts