Dow Futures Decline 300 Points Amid Powell Investigation

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Dow Futures Decline 300 Points Amid Powell Investigation

Breaking News: Dow futures have plunged 300 points as of January 13, 2026, following the announcement of a criminal investigation into Federal Reserve Chair Jerome Powell by the Department of Justice. This significant market movement comes just days before major Wall Street banks are set to report their earnings, adding to the market's volatility.

Why It Matters

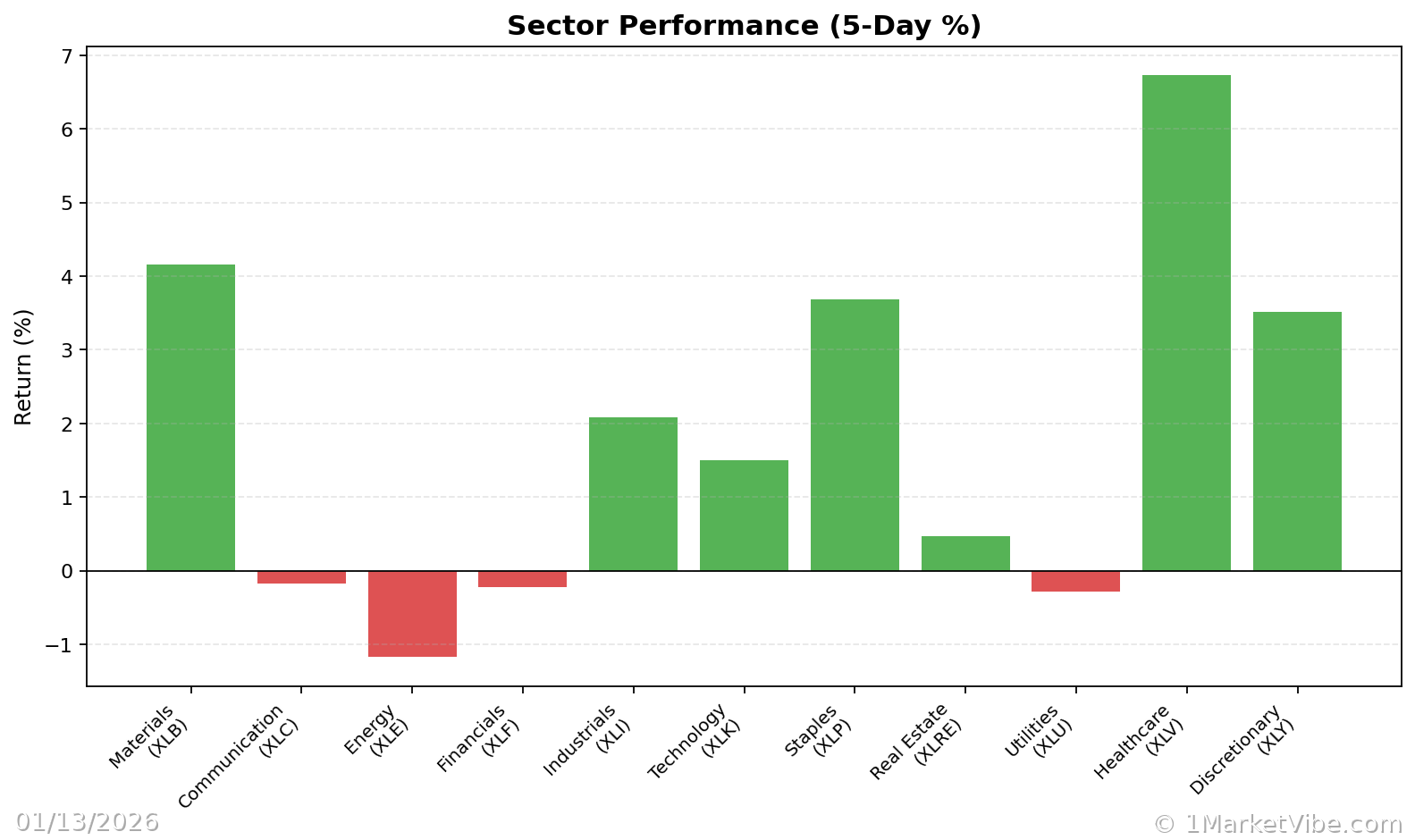

The immediate market impact is palpable, with investors reacting to the uncertainty surrounding Powell's investigation. This development raises concerns about potential disruptions in monetary policy at a critical time for the economy. The broader implications for investors include increased volatility and potential shifts in interest rate expectations, which could affect portfolio risk management strategies.

Context & Background

The investigation stems from Powell's recent Senate Banking Committee testimony regarding the renovation of Federal Reserve office buildings. This move by the DOJ is seen by many as an extension of former President Trump's attempts to influence the Federal Reserve's policies. Historically, the market has shown resilience to political pressures on the Fed, but the timing of this investigation—amidst an earnings season and economic recovery—adds a layer of complexity.

Key stakeholders affected include:

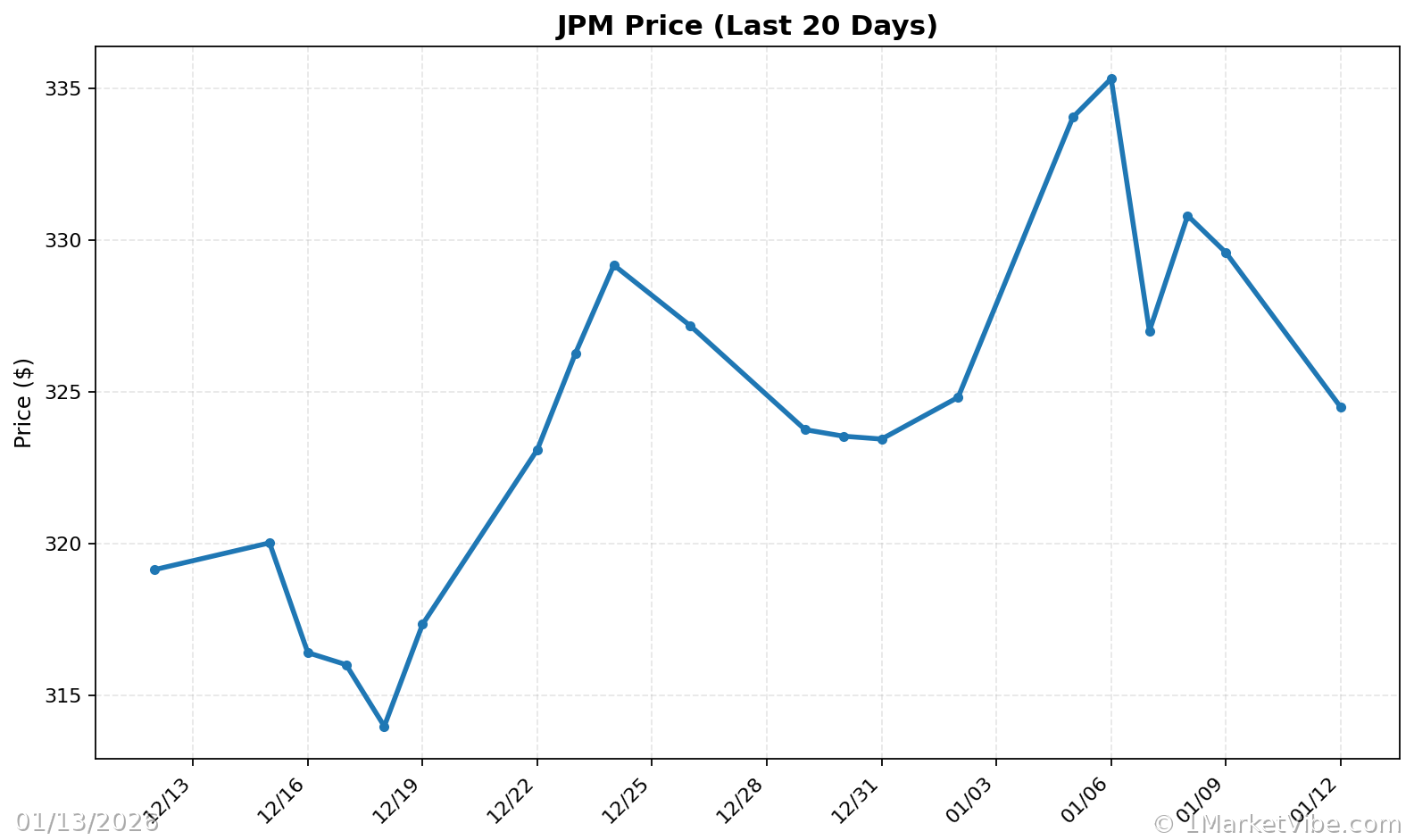

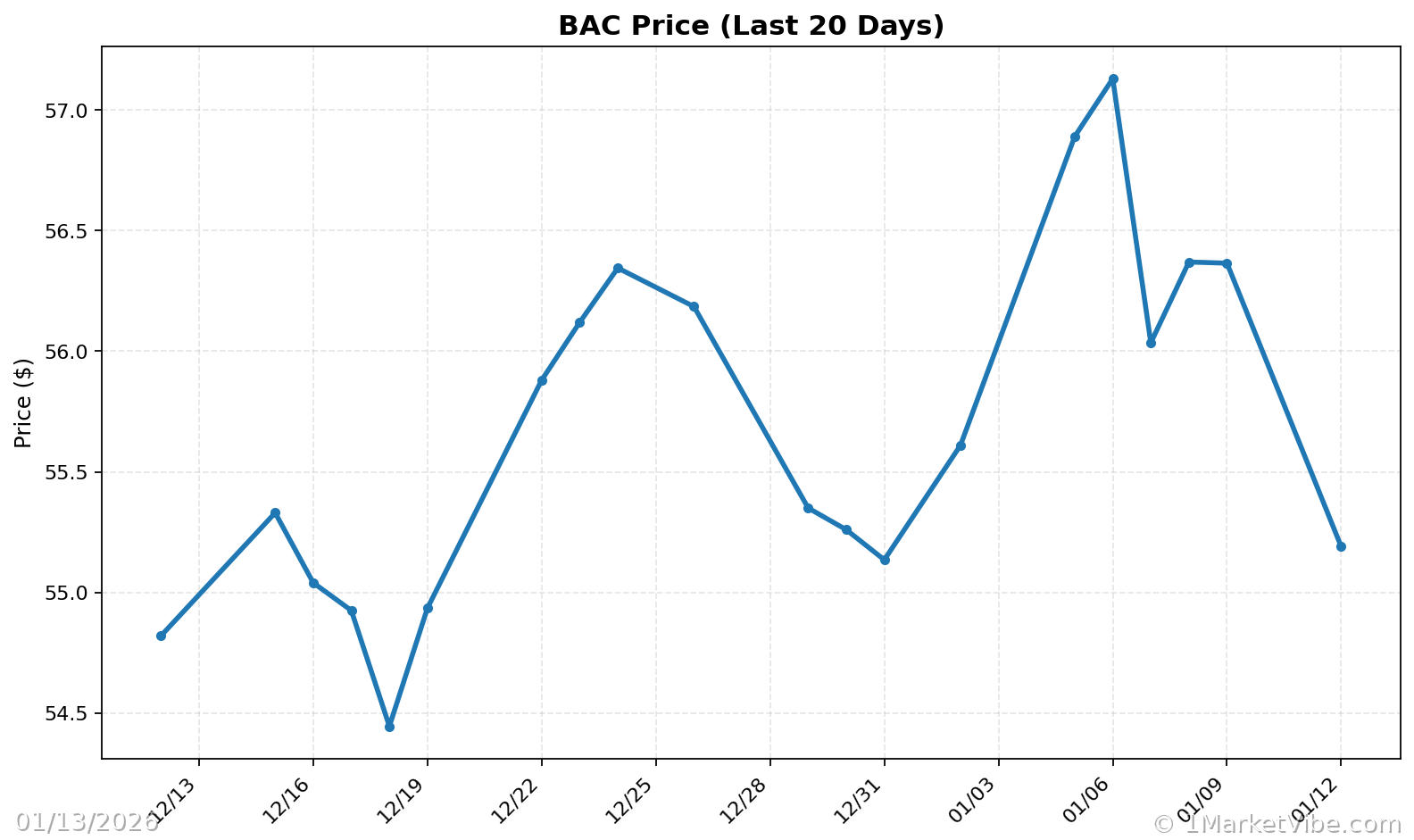

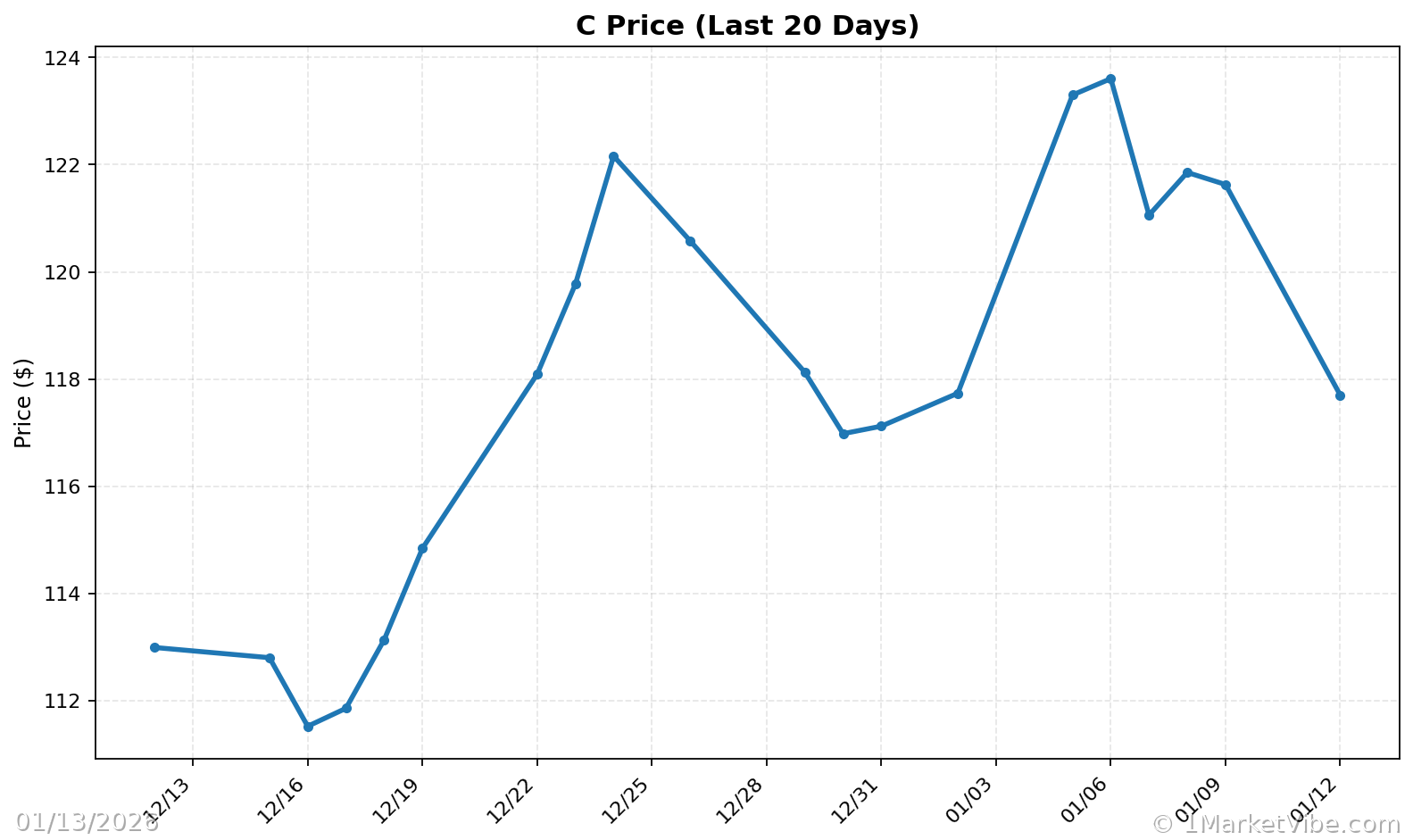

- Bank Stocks: Already under pressure, with Citigroup down 3% and JPMorgan and Bank of America each losing over 1%.

- Investors: Facing increased uncertainty and potential shifts in market sentiment.

What's Next

Investors should closely monitor upcoming earnings reports and the release of the consumer price index (CPI) for December, scheduled for tomorrow. These events could provide further insights into the economic landscape and influence market sentiment. Additionally, Powell's term as Fed Chair is up in May, adding another layer of uncertainty to the central bank's future direction.

Potential scenarios include:

- Continued Volatility: If the investigation deepens, expect further market fluctuations.

- Economic Indicators: Watch for CPI data and earnings results for clues on economic health.

For investors, this means staying informed and possibly adjusting risk exposure in affected sectors. As the situation develops, keeping an eye on how markets respond will be crucial.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts