Inflation Remains Steady at 2.7% as Markets Brace for Changes

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Inflation Holds Steady at 2.7% as Markets Brace for Changes

Breaking News: January 15, 2026 – The U.S. inflation rate remained unchanged at 2.7% in December, according to the latest data released today. This steady pace, reported by The Wall Street Journal, reflects a continuation of the economic conditions observed in previous months. The announcement comes as markets prepare for potential shifts in monetary policy and economic strategies.

Why It Matters

For investors, the steady inflation rate is a critical indicator of economic stability. While a stable inflation rate can suggest a balanced economy, it also raises questions about future interest rate decisions by the Federal Reserve. The immediate impact on the markets has been mixed, with some sectors responding positively to the predictability, while others remain cautious about potential policy changes. Sentiment among investors is currently one of cautious optimism, as they weigh the implications of stable consumer prices against broader economic uncertainties.

Context & Background

Historically, inflation rates have been a key driver of market sentiment and investment strategies. The current rate of 2.7% aligns with the Federal Reserve's long-term target, providing a sense of stability. This steadiness follows a period of softer-than-expected wholesale inflation and robust retail sales in November, as reported by CNBC. Key stakeholders, including policymakers and investors, are closely monitoring these trends to gauge the health of the economy and anticipate future movements.

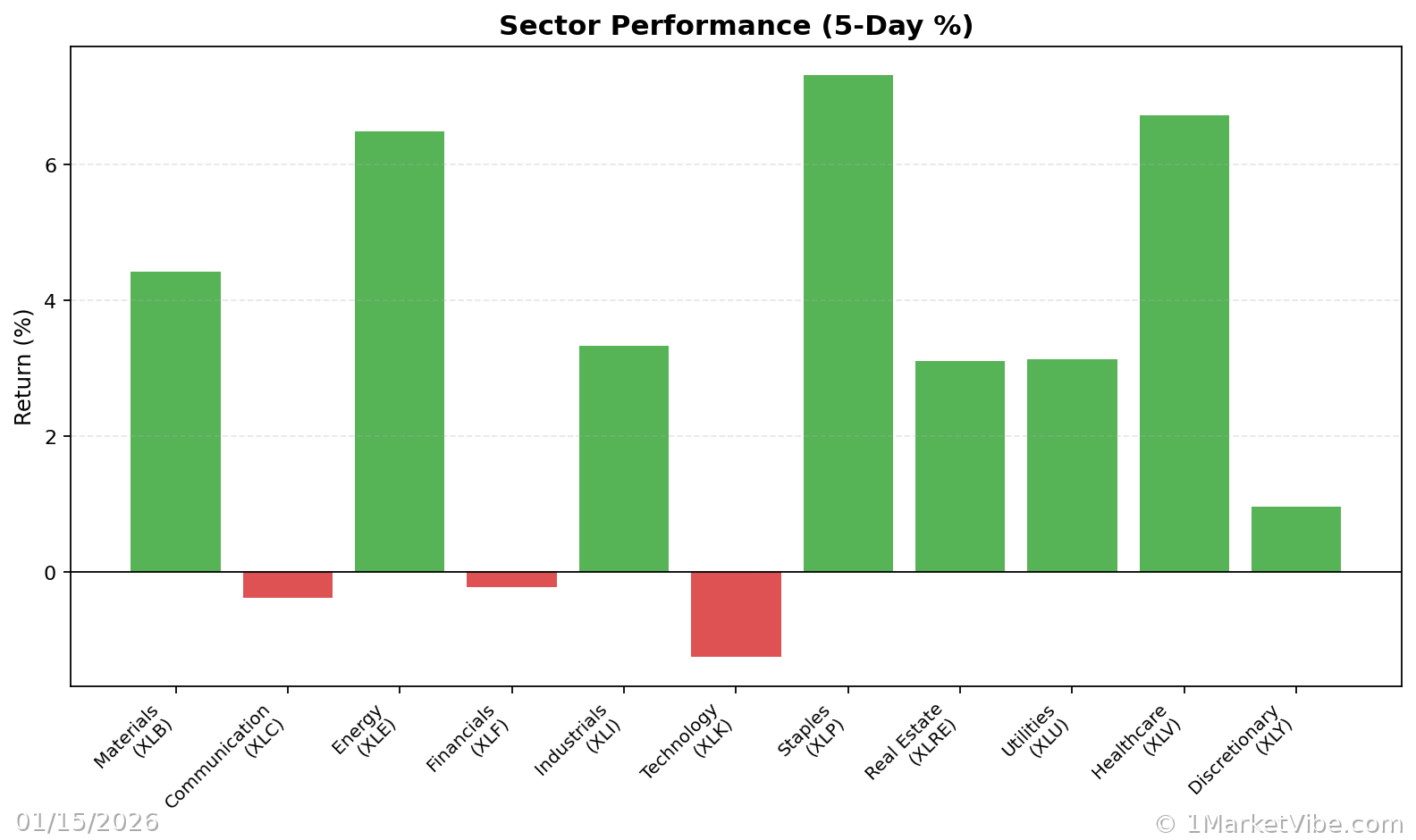

Market Reactions

- Stock Market: Initial reactions in the stock market have been subdued, with major indices showing little movement. Investors are digesting the news and considering its implications for future interest rate hikes.

- Investor Sentiment: The stable inflation rate has fostered a sense of predictability, though some caution remains due to potential policy adjustments.

- CW Index: MarketVibe's CW Index currently reads 5.5, indicating predictable trends and aligning with the steady inflation data.

Global Inflation Context

Globally, the Eurozone's inflation rate is reported at 2%, contributing to a stabilizing influence on international markets. This comparative analysis highlights the relative stability of inflation rates in major economies, which is crucial for global investors seeking to balance risk and return.

What's Next

Investors should remain vigilant as they monitor upcoming economic indicators and potential policy announcements. Key events to watch include the Federal Reserve's next meeting and any statements regarding interest rate adjustments. Potential scenarios range from continued stability to shifts in monetary policy aimed at preemptively addressing inflationary pressures.

Conclusion

The steady inflation rate of 2.7% provides a mixed bag of stability and uncertainty for investors. While it suggests a balanced economic environment, the potential for policy changes looms. As always, staying informed and adaptable is crucial.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Sources:

Charts