AI Boom Strengthens US Market Position Amid Risk Mitigation

- Authors

- Name

- MarketVibe Team

- @1marketvibe

AI Boom Strengthens US Market Position Amid Risk Mitigation

January 5, 2026 – The United States continues to solidify its position as a global leader in artificial intelligence (AI) with the announcement of a new $918 million plant in Benson, North Carolina. This facility, backed by the Pentagon, will manufacture rare-earth magnets crucial for modern technology, creating 1,000 jobs in a town of fewer than 5,000 residents. This development is part of a broader strategy to mitigate market risks by reducing reliance on foreign supply chains.

Why It Matters

The immediate market impact is significant as the US strengthens its technological infrastructure, potentially boosting investor confidence in domestic tech sectors. The establishment of this plant is a strategic move to secure critical components domestically, thereby reducing geopolitical risks associated with foreign dependencies, particularly from China. For investors, this means a potential decrease in supply chain vulnerabilities and an increase in the stability of tech-related investments.

Context & Background

Historically, the US has faced challenges with supply chain dependencies, particularly in the tech sector. The decision to build this plant in Benson is part of a larger trend of reshoring manufacturing to the US. This move aligns with the government's efforts to bolster national security and economic resilience. The town of Benson, strategically located near major interstates, provides an ideal location for such a high-tech facility, supported by North Carolina's favorable business environment and skilled workforce.

What's Next

Investors should watch for further developments in AI and tech manufacturing within the US. The plant's construction is expected to begin this year, with operations commencing by 2028. Key stakeholders, including tech companies and defense contractors, will likely benefit from this increased domestic production capacity. Potential scenarios include further investments in AI infrastructure and a possible uptick in tech sector stock valuations as the market adjusts to these strategic shifts.

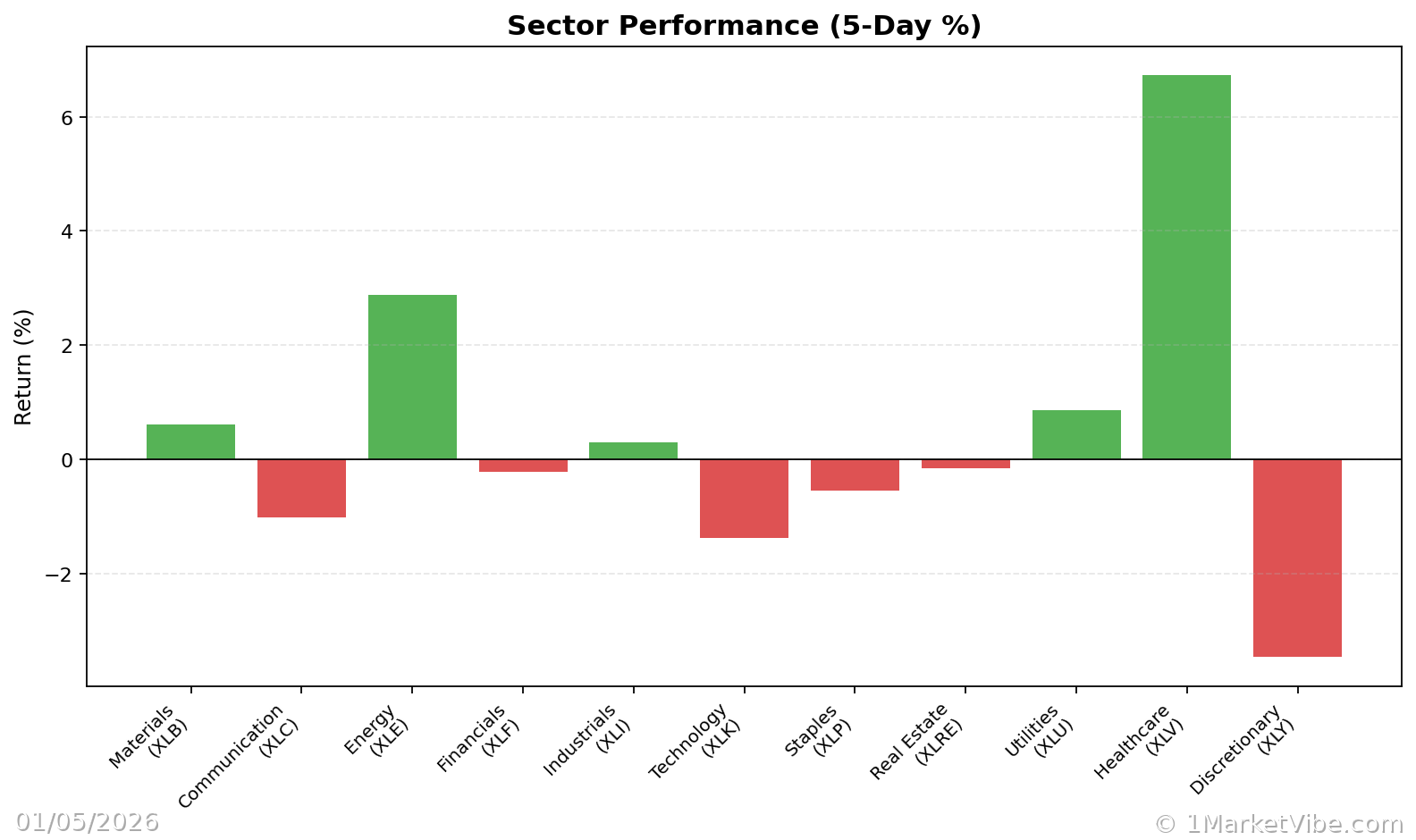

MarketVibe's CW Index has shown a slight increase to 5.91, reflecting the market's cautious optimism about these developments. The index's early warning capability suggests that this trend was anticipated, providing investors with a strategic advantage.

For investors, the focus should be on monitoring the progress of this plant and its impact on the tech supply chain. Adjusting portfolio risk exposure in line with these developments could be prudent.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Sources: