The Dollar's Decline and Its Impact on Market Volatility

- Authors

- Name

- MarketVibe Team

- @1marketvibe

The Dollar's Decline and Its Impact on Market Volatility

Breaking News: December 29, 2025 - The U.S. dollar has hit a significant low, declining by 2.3% against a basket of major currencies over the past month, marking its weakest performance since early 2023. This decline is attributed to a combination of global economic shifts and changing investor sentiment. The dollar's slide was particularly evident on December 28, when it fell sharply following the latest Federal Reserve meeting, which hinted at potential rate cuts in early 2026.

Why It Matters

For investors, this decline in the dollar signals potential volatility across global markets. A weaker dollar can lead to increased costs for U.S. imports, affecting corporate earnings and consumer prices. Additionally, it may prompt shifts in capital flows, as investors seek higher returns in other currencies. The broader implications include potential inflationary pressures and adjustments in global trade balances. MarketVibe's CW Index, which tracks market risk, has ticked up to 6.2, indicating heightened caution among investors.

Context & Background

Historically, the U.S. dollar has been the world's dominant reserve currency, providing stability and liquidity in global markets. However, recent economic data and geopolitical tensions have raised questions about its continued supremacy. Key factors contributing to the dollar's current weakness include:

- Interest Rate Dynamics: The Federal Reserve's dovish stance and potential rate cuts have reduced the dollar's yield advantage.

- Global Economic Shifts: Emerging markets and alternative currencies, including digital currencies, are gaining traction.

- Trade Policies: Ongoing trade negotiations and tariffs have created uncertainty, impacting currency valuations.

These elements echo past challenges to the dollar's dominance, such as during the 1980s when similar economic conditions led to significant currency realignments.

What's Next

Investors should closely monitor upcoming economic indicators and Federal Reserve communications for further insights into monetary policy directions. Key events to watch include:

- Federal Reserve Meeting: Scheduled for January 2026, where further rate policy clarity is expected.

- Global Economic Reports: Data releases from major economies that could influence currency markets.

- Geopolitical Developments: Any significant geopolitical shifts that might impact investor sentiment and currency stability.

Potential scenarios include continued dollar weakness, which could exacerbate market volatility, or a stabilization if economic conditions improve or if the Fed adjusts its policy stance.

For investors, this means staying vigilant and considering strategies to hedge against currency risks. Monitoring position sizes and adjusting exposure to sectors sensitive to currency fluctuations can be prudent steps.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

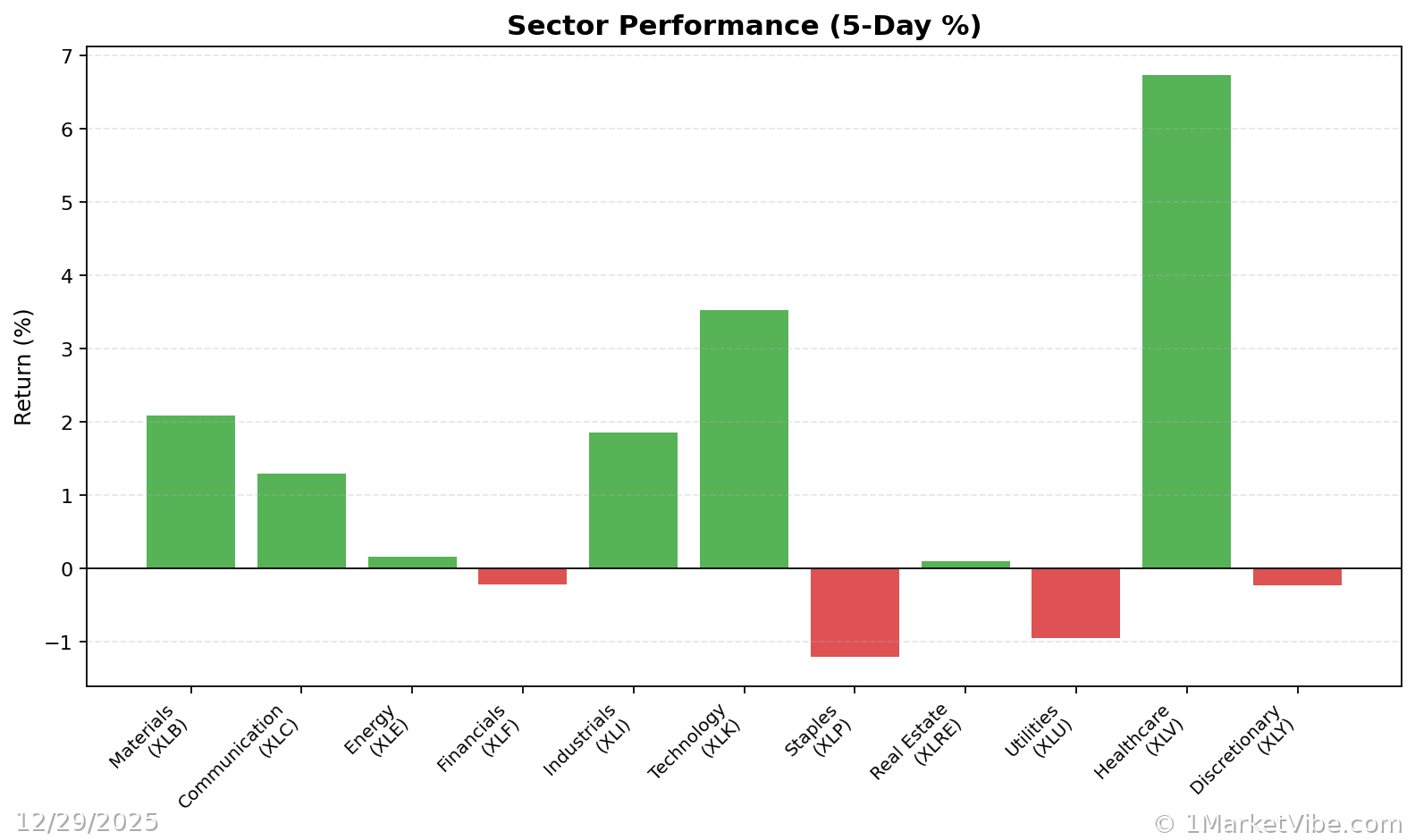

Charts