Five Key Economic Indicators to Monitor

December 26, 2025 – As the year draws to a close, investors are closely watching five critical economic indicators that could shape market dynamics in 2026. These indicators, ranging from inflation rates to technological advancements, provide insights into the potential direction of the economy. The U.S. economy has shown steady growth in 2025, despite ongoing concerns about inflation and employment, with artificial intelligence playing a pivotal role in this trajectory.

Why It Matters

For investors, understanding these indicators is crucial for navigating potential risks and opportunities. The immediate impact of these indicators is reflected in market sentiment, which remains cautiously optimistic. MarketVibe's CW Index currently reads 5.6, indicating a neutral market sentiment with a slight lean towards caution. This suggests that while growth is evident, underlying risks persist, necessitating vigilant monitoring of these economic signals.

Context & Background

Historically, economic indicators have served as reliable predictors of market trends. The current economic landscape is shaped by a mix of steady growth and inflationary pressures. Key stakeholders, including policymakers and investors, are particularly focused on:

- Inflation Rates: Rising inflation has been a significant concern, impacting purchasing power and consumer confidence.

- Employment Figures: While job growth has been steady, certain sectors continue to face challenges, affecting overall economic stability.

- Technological Advancements: The integration of artificial intelligence is reshaping industries, boosting productivity but also raising concerns about job displacement.

- Global Trade Dynamics: Tariffs, particularly those affecting raw materials like leather, have disrupted supply chains, influencing domestic manufacturing costs.

- Consumer Spending: As a primary driver of economic growth, shifts in consumer behavior can signal broader economic changes.

What's Next

Investors should keep a close eye on upcoming economic reports and policy announcements that could impact these indicators. Key events to watch include:

- Federal Reserve Meetings: Decisions on interest rates could influence inflation and borrowing costs.

- Trade Negotiations: Any changes in tariff policies could alter global supply chain dynamics.

- Technological Developments: Innovations in AI and other technologies will continue to affect productivity and market competitiveness.

Potential scenarios include continued economic growth tempered by inflationary pressures or a shift towards more restrictive monetary policies if inflation accelerates. Monitoring these indicators will be essential for adjusting investment strategies accordingly.

Conclusion

As we move into 2026, these five economic indicators will be pivotal in shaping market conditions. Investors are advised to stay informed and adapt their strategies based on the evolving economic landscape. Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Sources:

- The Washington Post: 10 charts that show where the economy is heading

- CNBC: Tariffs hit boots, bags and more as leather prices jump

- CBS News: Powerball $1.817 billion Christmas Eve jackpot

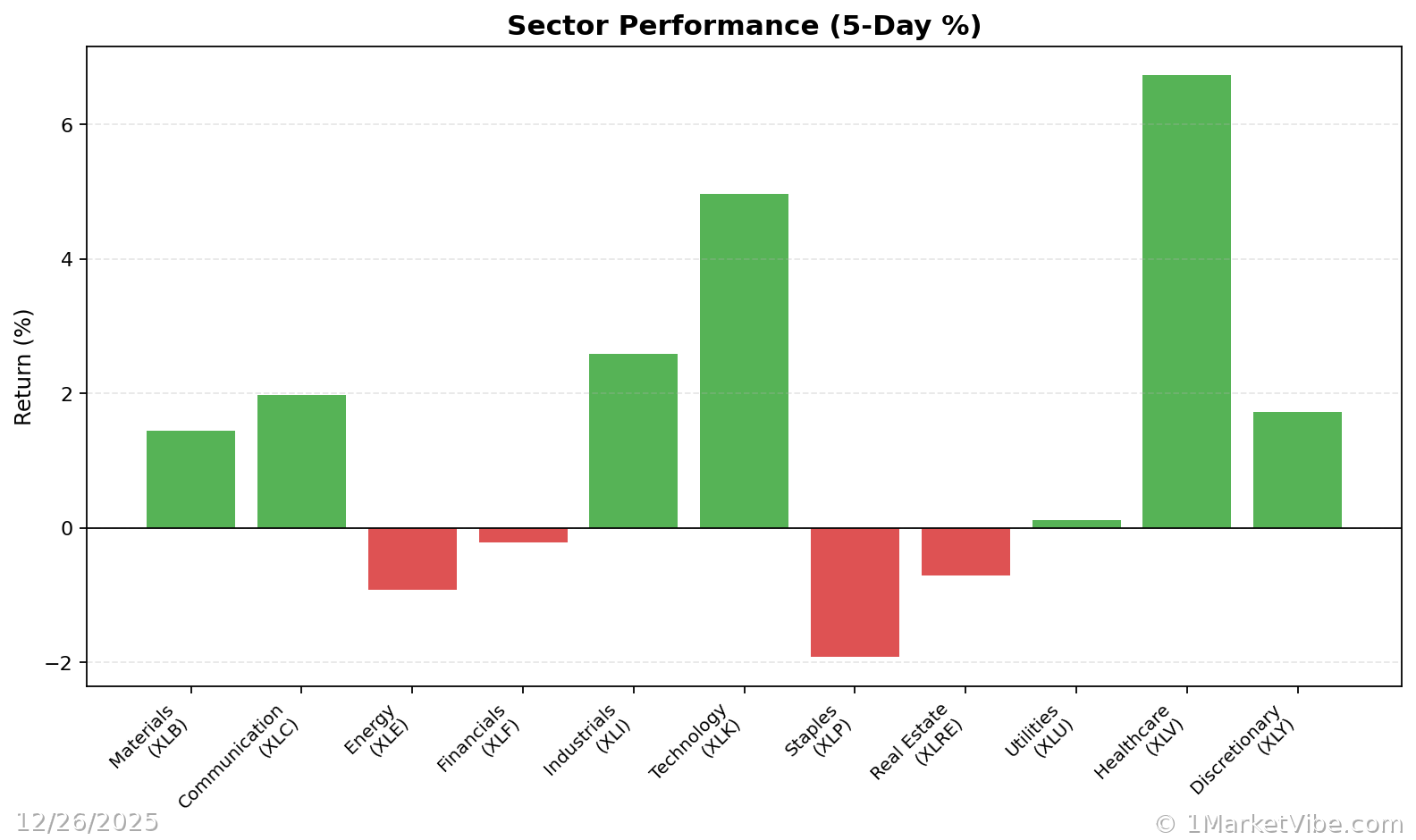

Charts