S&P 500 Peaks: Five Essential Investor Strategies for Market Changes

- Authors

- Name

- MarketVibe Team

- @1marketvibe

S&P 500 Peaks: Five Essential Investor Strategies for Market Changes

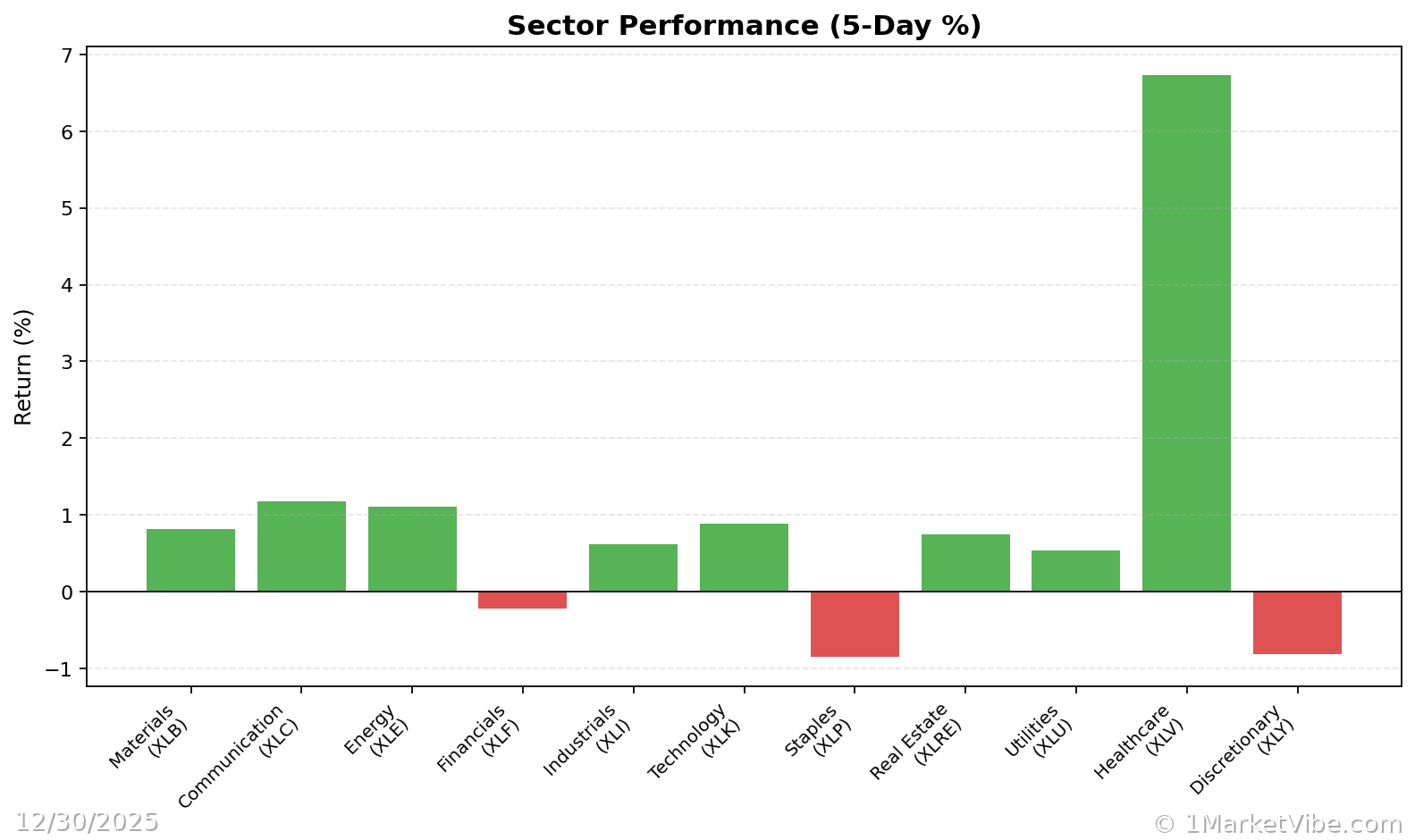

Breaking News: The S&P 500 has surged to new all-time highs as of December 30, 2025, closing at an impressive 4,950 points. This milestone comes after a robust holiday trading period, defying earlier concerns about a potential year-end slump. The rally was fueled by strong performances across tech and consumer discretionary sectors, with investors optimistic about the economic outlook for 2026.

Why It Matters

For investors, this peak signals a critical juncture. The S&P 500's ascent reflects heightened market optimism but also raises questions about sustainability amid potential economic headwinds. As the index reaches new heights, the risk of volatility increases, prompting investors to reassess their portfolios. Market sentiment is currently buoyant, but caution is advised as the economic landscape remains complex.

Context & Background

Historically, the S&P 500 reaching new highs often precedes periods of increased volatility. The current rally is reminiscent of the post-pandemic recovery in 2021, where rapid gains were followed by market corrections. Contributing factors to this surge include robust corporate earnings, consumer spending resilience, and a favorable interest rate environment. Key stakeholders, including institutional investors and retail traders, are closely monitoring these developments as they navigate the evolving market dynamics.

What's Next

Investors should keep an eye on several upcoming events that could influence market direction:

- Federal Reserve Meeting in January 2026: Any changes in interest rate policy could impact market sentiment.

- Corporate Earnings Season: Scheduled to begin in mid-January, providing insights into company performance and economic health.

- Geopolitical Developments: Ongoing international negotiations and potential conflicts could introduce new risks.

Potential scenarios include continued market growth if economic indicators remain positive or a correction if external shocks occur. Investors are advised to stay informed and consider strategies to mitigate risk.

Five Essential Investor Strategies

- Diversification: Spread investments across various sectors to reduce exposure to any single market downturn.

- Risk Assessment: Regularly evaluate portfolio risk levels, especially in high-performing sectors like technology.

- Hedging: Consider options and futures to protect against potential losses.

- Monitoring Economic Indicators: Stay updated on inflation rates, employment data, and consumer confidence reports.

- Strategic Rebalancing: Adjust portfolio allocations in response to market changes and personal financial goals.

MarketVibe's CW Index, which tracks market risk sentiment, remains stable, indicating cautious optimism among investors. This index serves as a valuable tool for assessing market conditions and making informed investment decisions.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts