Stock Futures Steady and Implications of Two Winning Weeks for Investors

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Stock Futures Steady and Implications of Two Winning Weeks for Investors

What Happened

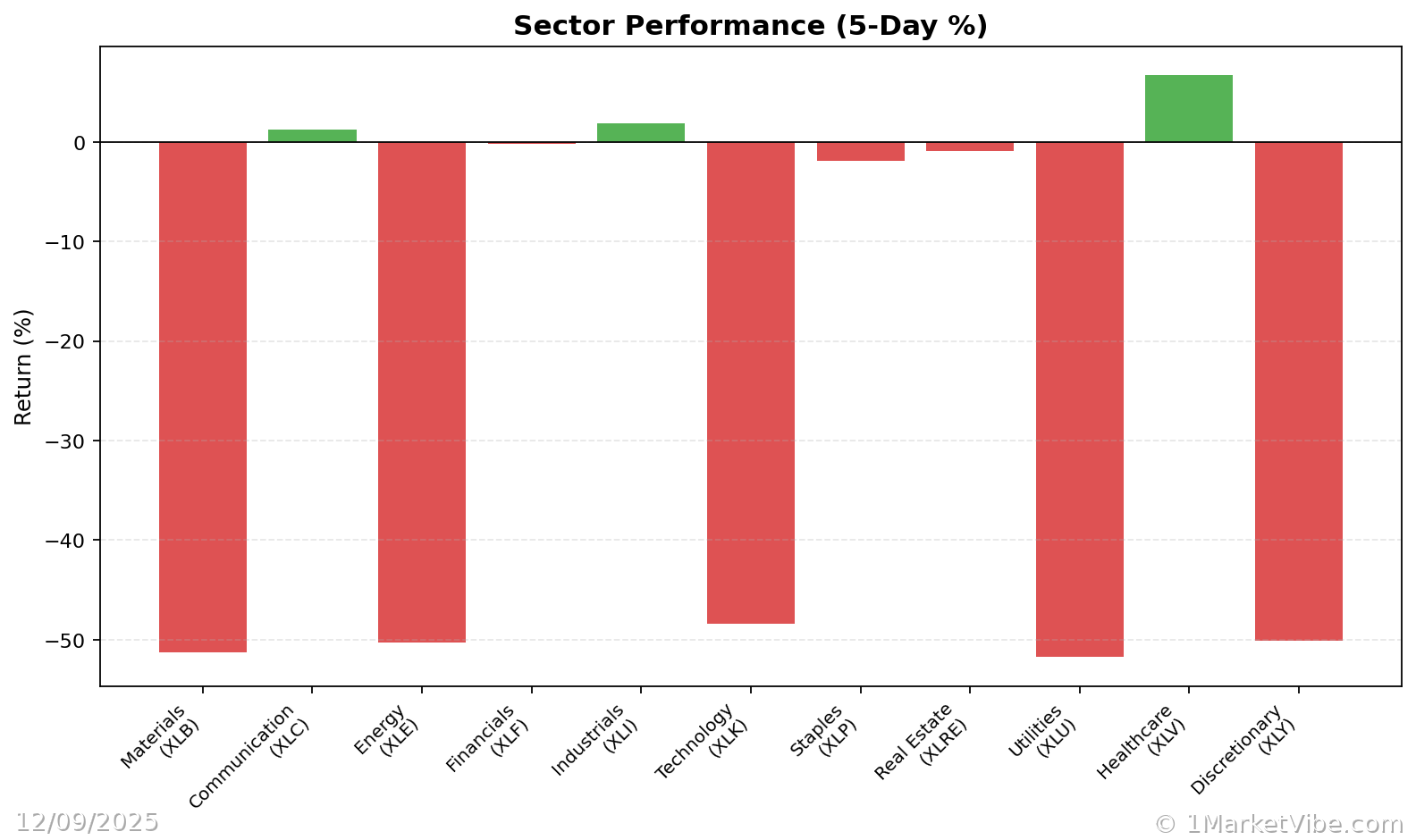

December 9, 2025 – Stock futures remained largely unchanged today, following Wall Street's achievement of two consecutive winning weeks. The S&P 500 closed at 6,846.51, down 0.35%, while the Nasdaq Composite ended at 23,545.90, slipping 0.14%. The Dow Jones Industrial Average fell 215.67 points to 47,739.32. This stability comes as investors anticipate the Federal Reserve's final meeting of the year, which is expected to influence market dynamics significantly.

Why It Matters

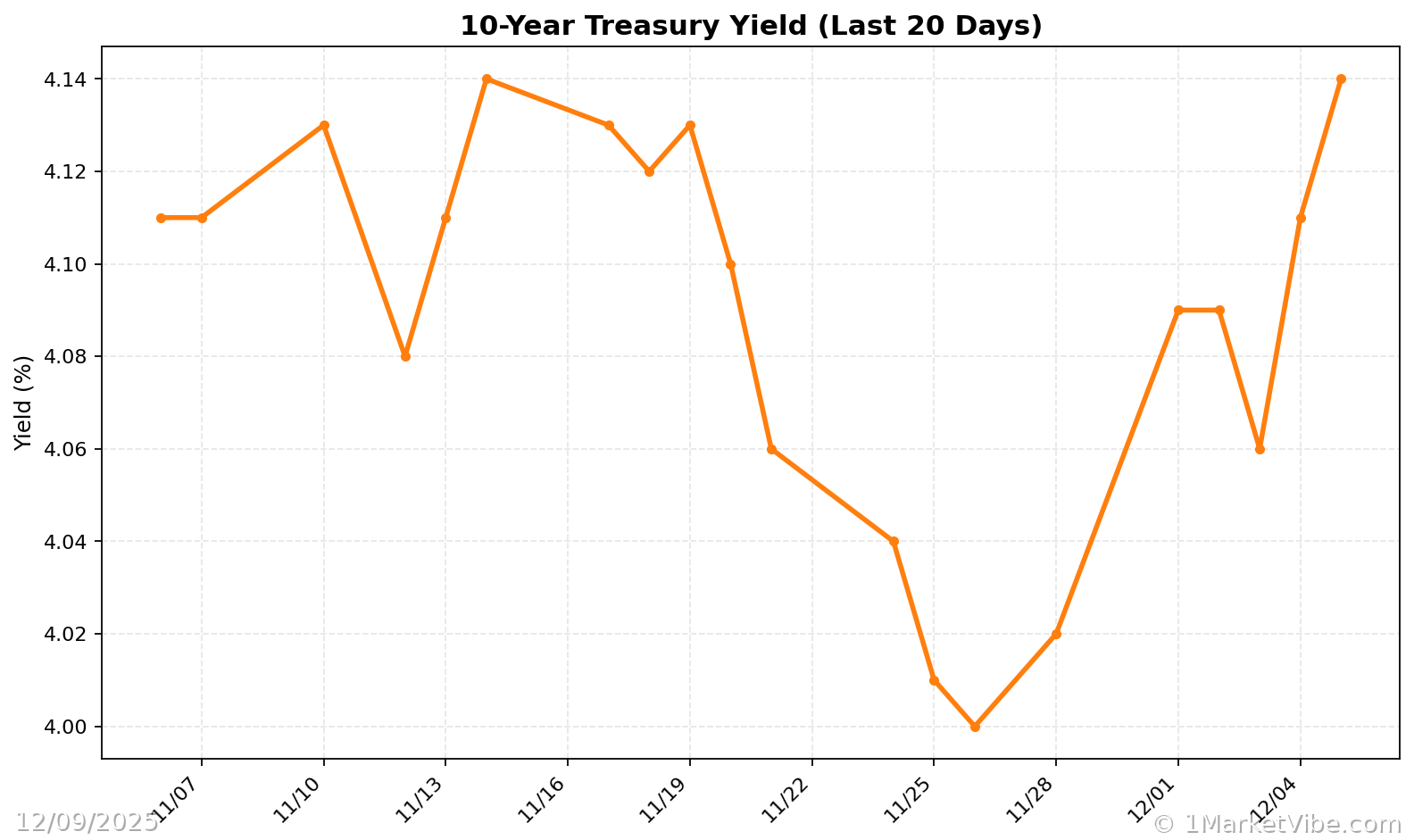

For investors, this steady performance amidst recent gains signals a cautious optimism. The market's resilience is underpinned by expectations of a potential interest rate cut by the Federal Reserve, which has buoyed sentiment. However, the rising 10-year Treasury yield poses a risk, reflecting concerns over inflation and future economic conditions. The broader implications suggest a market in wait-and-see mode, balancing between potential monetary easing and inflationary pressures.

Context & Background

Historically, back-to-back winning weeks often precede periods of volatility, especially when driven by central bank policy expectations. Recent optimism stems from the Fed's previous rate cuts in September and October, with the market pricing in an 89% chance of another decrease this week, up from 67% a month ago. This sentiment has been bolstered by softer-than-expected inflation data, which investors hope will prompt further easing from the Fed.

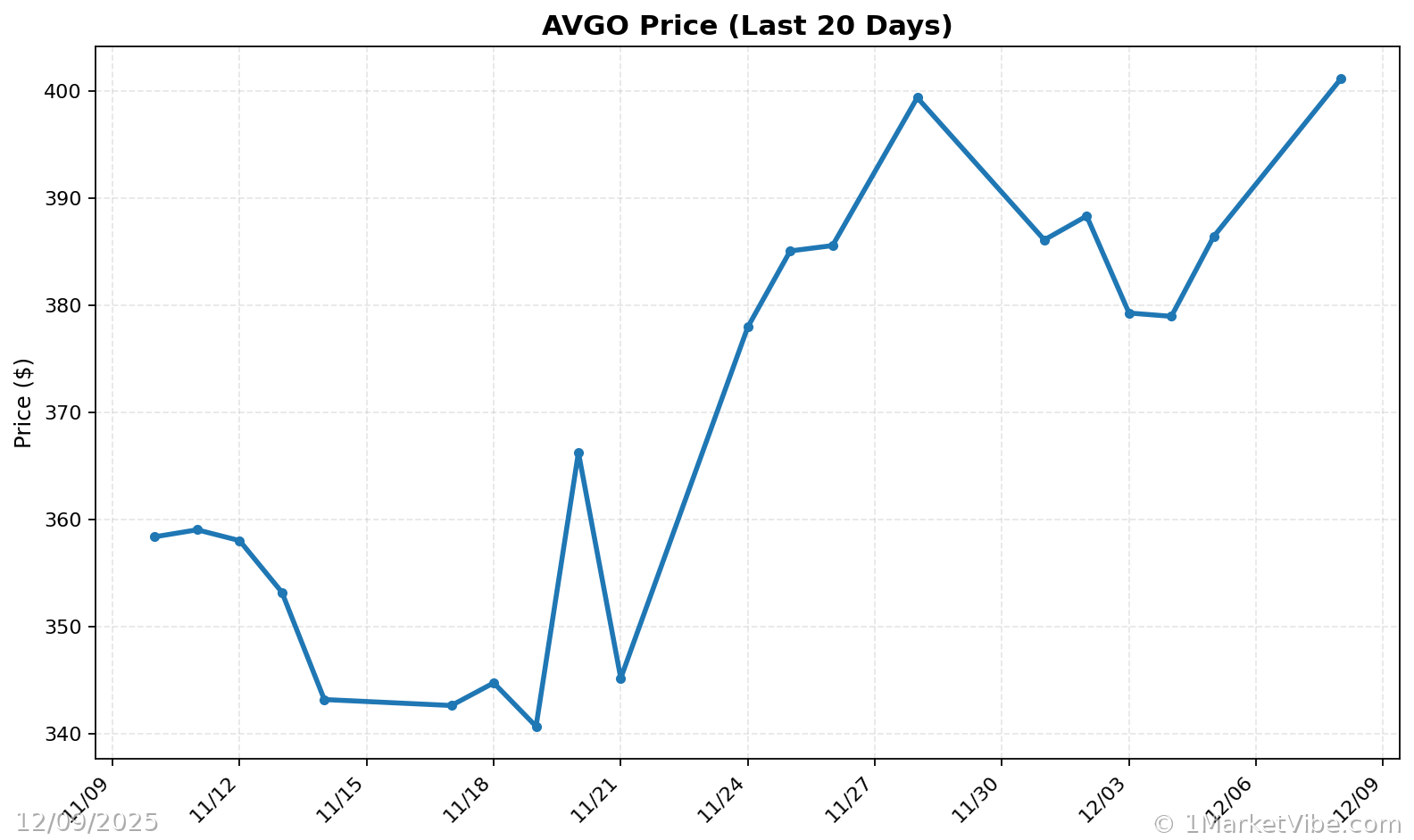

Key stakeholders include technology firms like Broadcom, which saw a nearly 3% rise, and Confluent, whose shares surged 29% following IBM's acquisition announcement. These sector-specific gains highlight the mixed sentiment across different market segments.

What's Next

Investors should closely monitor the Federal Reserve's meeting outcomes and any statements from Chair Jerome Powell, particularly regarding future rate paths and economic outlooks. The Fed's decision and subsequent guidance will likely set the tone for market movements in the coming weeks. Additionally, attention should be paid to upcoming economic data releases, which could further influence market sentiment and risk assessments.

As the market navigates these developments, investors are advised to stay informed and consider adjusting their portfolios in response to evolving conditions. MarketVibe's CW Index remains a valuable tool for tracking risk signals as these events unfold.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts