Rate Cuts Ahead: Strategic Investing Insights from the CW Index

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Rate Cuts Ahead: Strategic Investing Insights from the CW Index

Breaking News: Fed Signals Rate Cuts

In a pivotal move, the Federal Reserve announced today, December 10, 2025, its intention to cut interest rates by 0.25% at its upcoming meeting. This decision comes amid growing economic uncertainties and aims to bolster market confidence. The announcement was made during a press briefing in Washington, D.C., where Fed Chair Jerome Powell emphasized the need to support economic growth as inflation pressures ease.

Why It Matters

The immediate market impact was evident as major indices reacted positively. The Dow Jones Industrial Average surged by 2%, while the S&P 500 and Nasdaq both saw gains of 1.8% and 2.5%, respectively. For investors, this rate cut signals a potential shift towards a more accommodative monetary policy, which could lower borrowing costs and stimulate investment. However, it also raises questions about the underlying health of the economy, prompting a cautious sentiment among market participants.

Context & Background

Historically, rate cuts have been used as a tool to stimulate economic activity during periods of slowdown. The current decision follows a series of mixed economic indicators, including sluggish GDP growth and a cooling labor market. The Fed's move is reminiscent of the 2019 rate cuts, which were implemented to counteract trade tensions and global economic slowdowns. Key stakeholders, including financial institutions and tech companies, are closely monitoring these developments, as lower rates could enhance profitability and investment in these sectors.

What's Next

Investors should keep an eye on the Fed's upcoming meeting scheduled for December 15, 2025, where further details on the rate cut and potential future pauses will be discussed. The market will also be watching for any signals regarding the Fed's long-term strategy, especially in light of recent economic data. Potential scenarios include a continued easing cycle if economic conditions worsen or a pause if growth stabilizes.

Market Reactions and Risks

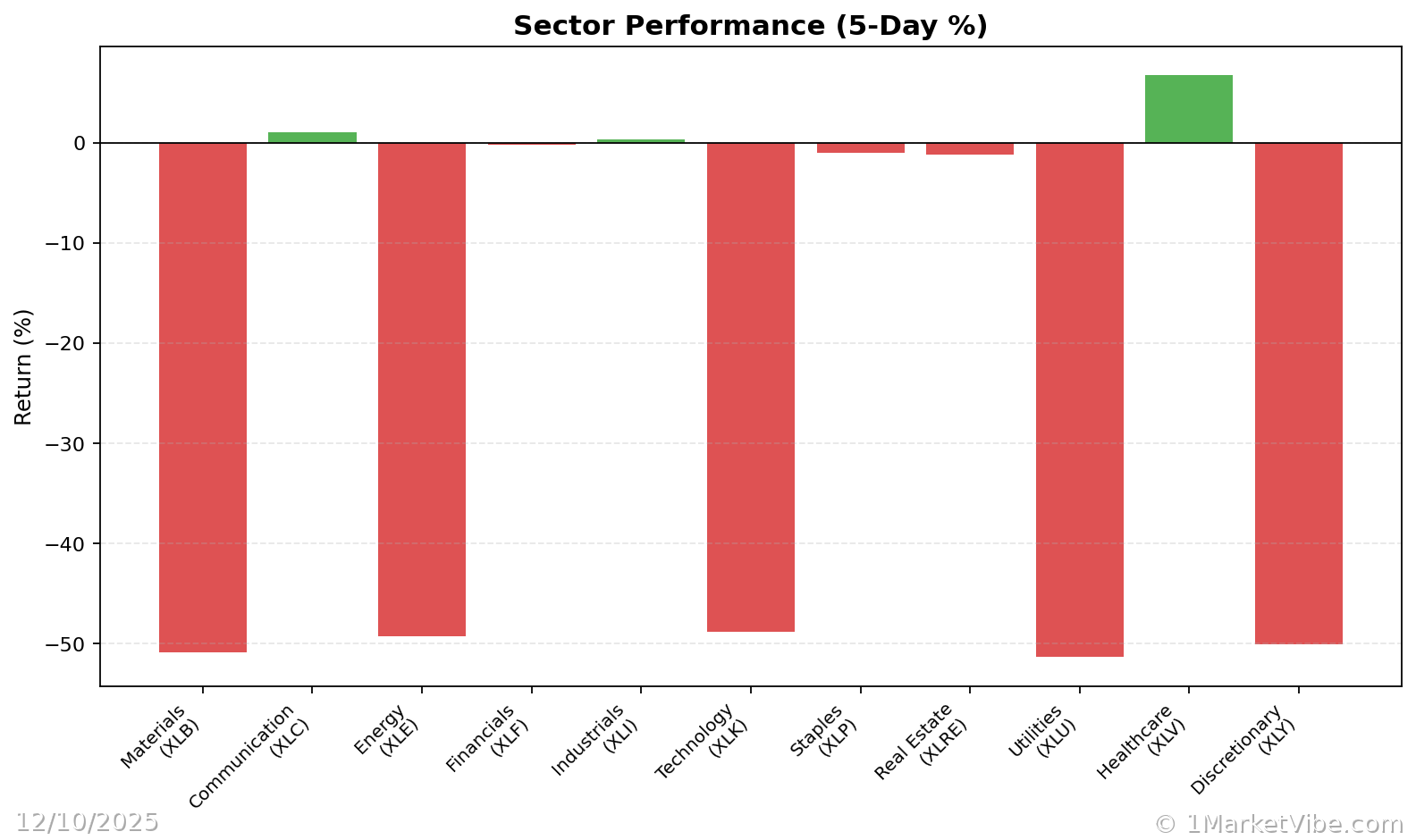

- Sector Performance: The tech sector, in particular, stands to benefit from lower rates, as reduced borrowing costs can fuel innovation and expansion.

- Investor Sentiment: While the initial reaction is positive, investors remain cautious about the broader economic implications.

- Risks: Potential risks include inflationary pressures if the economy overheats, and the challenge of reversing policy if conditions improve unexpectedly.

Conclusion

The Fed's decision to cut rates marks a significant moment for investors, offering both opportunities and challenges. As markets adjust to this new environment, strategic positioning and risk management become crucial. Investors are advised to stay informed and consider adjusting their portfolios in response to these developments.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a financial advisor before making investment decisions.