Fed Decision Impact: Three Key Insights for Market Stability

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Fed Decision Impact: Three Key Insights for Market Stability

Breaking News: The Federal Reserve has announced its decision to maintain the current interest rate at 5.25% as of December 8, 2025. This decision comes amid ongoing debates about inflationary pressures and economic growth prospects. The announcement was made in Washington, D.C., following the Federal Open Market Committee's (FOMC) latest meeting.

Why It Matters

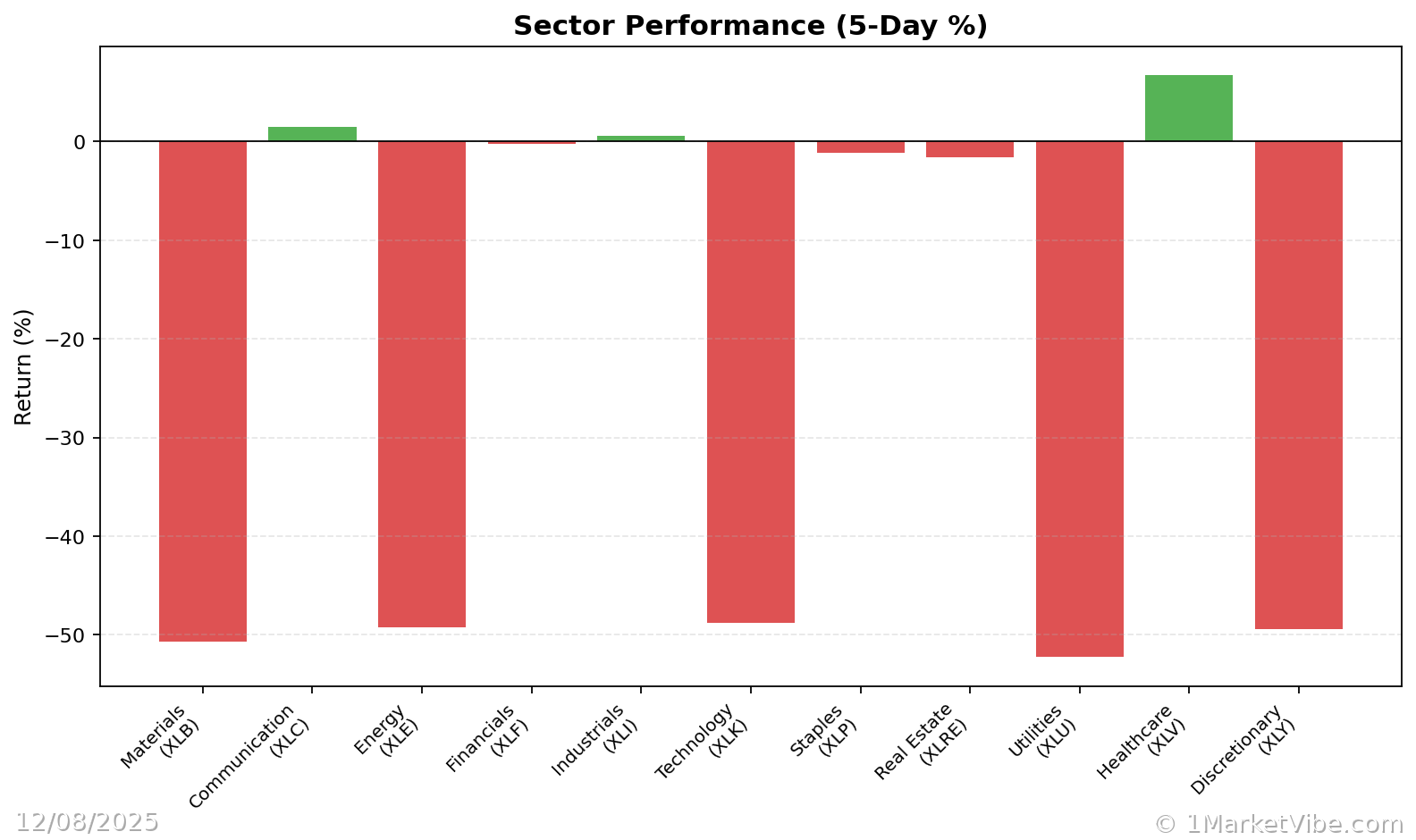

For investors, this decision signifies a cautious approach by the Fed in response to mixed economic signals. The immediate market impact saw a slight uptick in major indices, with the S&P 500 rising by 0.5% and the Dow Jones Industrial Average gaining 0.3%. This stability suggests that investors were largely expecting the Fed to hold rates steady. However, the broader implications include potential shifts in investment strategies as market participants reassess risk profiles amid persistent inflation concerns and geopolitical tensions.

Context & Background

Historically, the Fed's rate decisions have been pivotal in shaping market dynamics. The current rate hold reflects a balancing act between controlling inflation, which remains above the Fed's target at 3.8%, and supporting economic growth. Over the past year, the Fed has raised rates multiple times to combat inflation, drawing parallels to the early 1980s when similar strategies were employed. Key stakeholders affected include financial institutions, which may see stable borrowing costs, and consumers, who might experience steady loan interest rates.

What's Next

Investors should watch for upcoming economic data releases, particularly the Consumer Price Index (CPI) report due next week, which could influence future Fed decisions. Additionally, the Fed's next meeting in February 2026 will be critical, as it may provide further insights into the central bank's long-term strategy. Potential scenarios include a rate hike if inflation accelerates or a rate cut if economic growth falters.

CW Index Insights

MarketVibe's CW Index, which provides early risk signals, ticked up to 5.82 following the announcement, indicating a moderate risk environment. This aligns with the Fed's cautious stance and suggests that investors should remain vigilant in monitoring market conditions.

Conclusion

For investors, the Fed's decision to maintain the current interest rate underscores the importance of staying informed and adaptable. As the economic landscape evolves, monitoring key indicators and adjusting strategies accordingly will be crucial.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Sources:

- Federal Reserve Press Release, December 8, 2025

- Market data from Bloomberg, December 8, 2025

Charts