Octopus Energy's $8.65 Billion Spinoff: A Game Changer for Tech Investments

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Octopus Energy's $8.65 Billion Spinoff: A Game Changer for Tech Investments

In a groundbreaking move, Octopus Energy has announced the spinoff of its tech arm, valued at a staggering $8.65 billion, effective December 31, 2025. This strategic decision aims to capitalize on the burgeoning demand for innovative energy solutions, positioning the new entity as a formidable player in the tech-driven energy market. The spinoff is set to take place in London, marking a significant shift in the company's operational focus and investment strategy.

Why It Matters

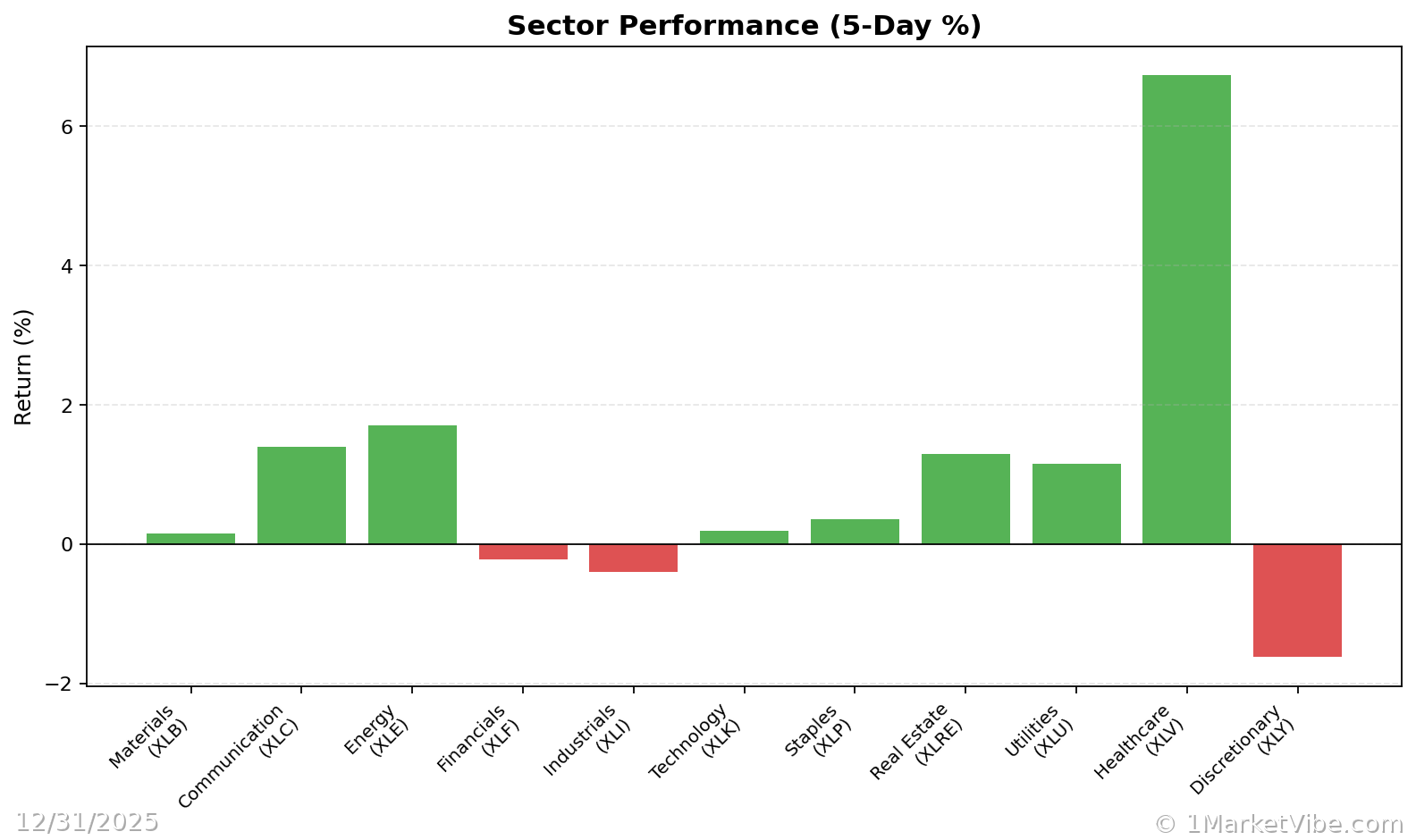

For investors, this spinoff represents a pivotal moment in the energy sector, potentially reshaping market dynamics. The immediate impact is a heightened interest in tech investments, as Octopus Energy's move could catalyze similar actions from competitors. The broader implications suggest a shift towards tech-centric energy solutions, which may lead to increased volatility in traditional energy stocks. Market sentiment is cautiously optimistic, with analysts predicting a surge in tech-driven energy investments.

Context & Background

Historically, spinoffs in the energy sector have led to increased specialization and innovation. Octopus Energy's decision follows a trend of energy companies diversifying their portfolios to include more tech-driven solutions. This move is influenced by the growing demand for sustainable and efficient energy technologies. Key stakeholders, including investors and industry analysts, are closely monitoring the situation, given its potential to disrupt established market norms.

What's Next

Investors should watch for:

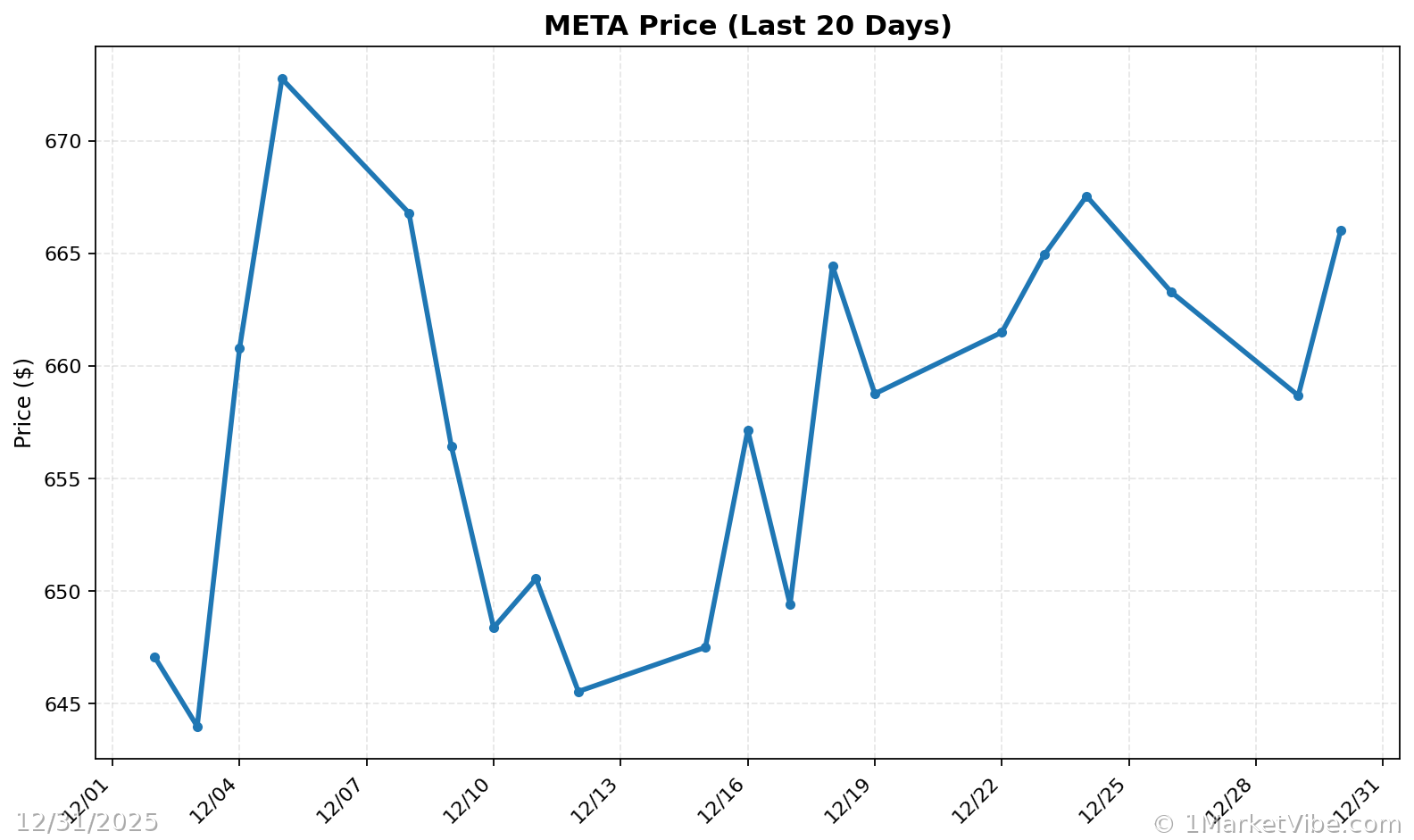

- Market reactions: Initial trading volumes and stock price movements post-spinoff.

- Competitive responses: Potential similar moves by other energy giants.

- Regulatory developments: Any changes in energy policies that could impact the new entity.

The timeline for these developments is expected to unfold over the next few months, with the new entity's market positioning becoming clearer by mid-2026. Potential scenarios include increased mergers and acquisitions in the tech-energy space, as companies strive to enhance their technological capabilities.

Investor Implications

- Risks: Increased market volatility and potential regulatory hurdles.

- Opportunities: New investment avenues in tech-driven energy solutions.

- Sentiment: Cautious optimism, with a focus on long-term growth potential.

MarketVibe's CW Index, while not directly impacted, provides a useful lens for tracking broader risk trends in the tech and energy sectors.

Conclusion

Octopus Energy's $8.65 billion spinoff is poised to be a game changer for tech investments, offering new opportunities and challenges for investors. As the energy market evolves, staying informed and agile will be crucial. Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always consult with a financial advisor before making investment decisions.

Charts