Rate Cut Expectations Drive Dow Gains: Essential Portfolio Strategies

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Rate Cut Expectations Drive Dow Gains: Essential Portfolio Strategies

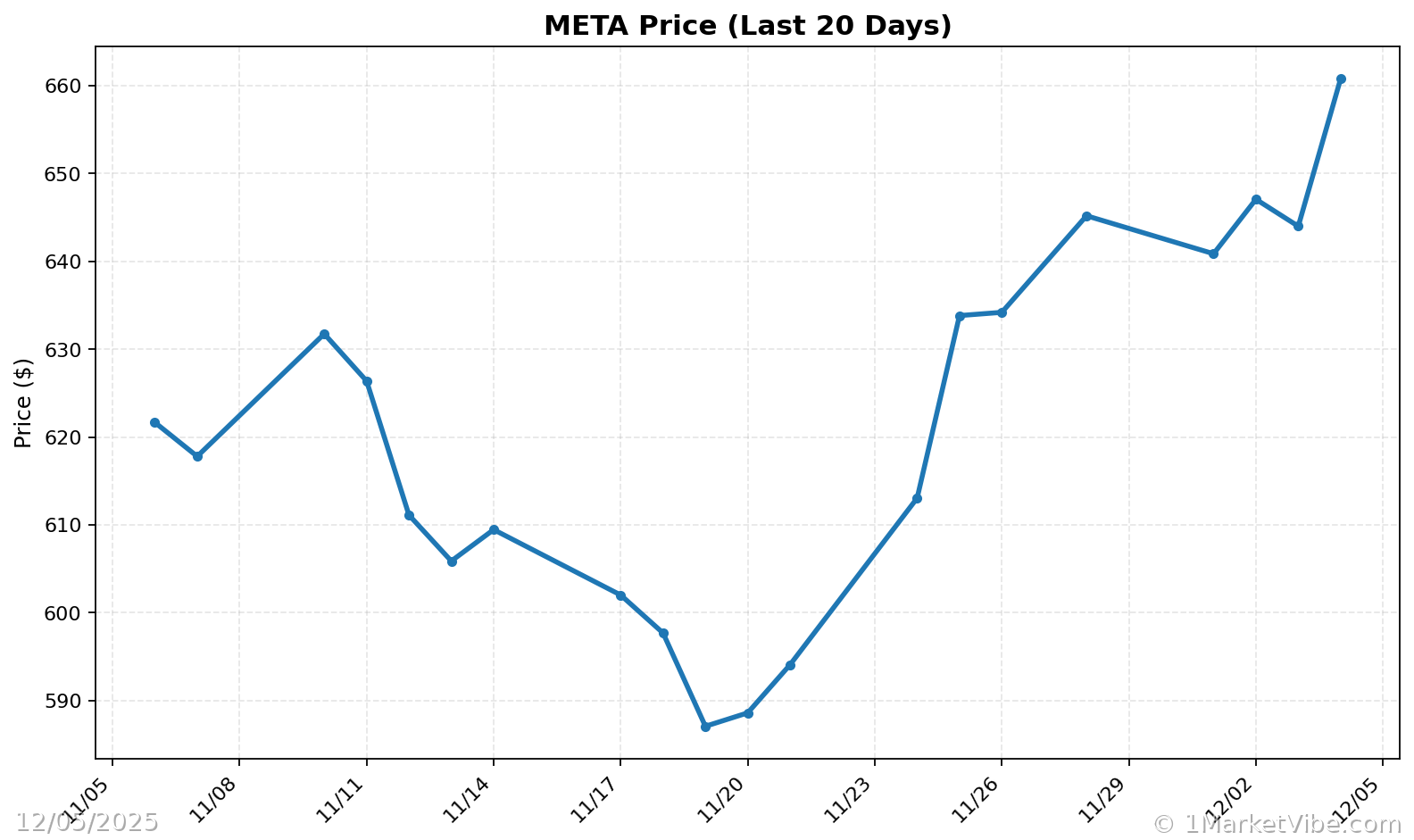

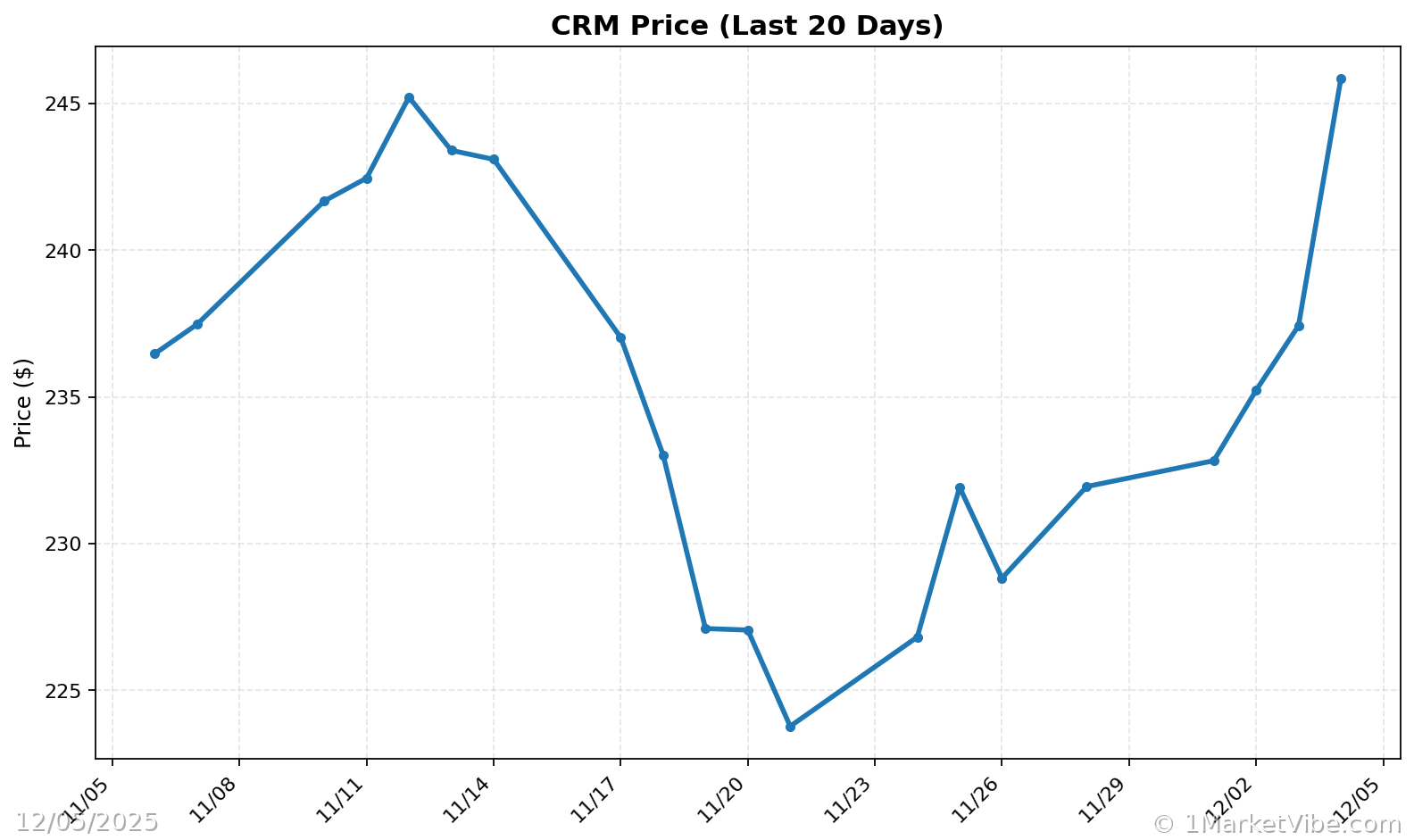

Breaking News: December 5, 2025 – The Dow Jones Industrial Average surged by 400 points today, closing at 48,250, as investor anticipation of a Federal Reserve rate cut intensified. This significant gain follows recent economic data suggesting a potential easing of monetary policy at the Fed's final meeting of the year, scheduled for December 10. Salesforce notably contributed to the Dow's rise, with its stock climbing by 5% amid strong investor confidence.

Why It Matters

For investors, the prospect of a rate cut signals a potential shift in the economic landscape. The immediate market reaction underscores a broader sentiment that the Federal Reserve may lower interest rates to support economic growth amid signs of a cooling labor market. This sentiment is reflected in the 87% probability of a rate cut next week, as indicated by the CME FedWatch tool. The implications for portfolios are significant, as lower rates can lead to cheaper borrowing costs and potentially higher equity valuations.

Context & Background

Recent data has painted a picture of a softening labor market, with job layoff numbers and the ADP report indicating a slowdown in private payroll growth. Additionally, jobless claims have hit their lowest level in three years, suggesting economic resilience despite the challenges. Historically, rate cuts have been used to stimulate economic activity, and the current market conditions echo past scenarios where the Fed has intervened to maintain stability.

Key stakeholders affected by these developments include tech giants like Salesforce, which saw its stock soar due to strategic moves and investor optimism. Conversely, Meta's announcement of significant cuts to its metaverse investments highlights the pressures within the tech sector to adapt to changing economic conditions.

What's Next

Investors should keep a close eye on the Federal Reserve's meeting next week, where a decision on the rate cut will be made. Additionally, upcoming economic releases, including consumer spending data and the University of Michigan's consumer survey, will provide further insights into the economic outlook. Potential scenarios include a confirmed rate cut, which could bolster market confidence, or a decision to hold rates steady, which might lead to increased market volatility.

Portfolio Strategy Adjustments

In light of these developments, investors are encouraged to consider strategic adjustments to their portfolios. Leveraging rate cut expectations, they might:

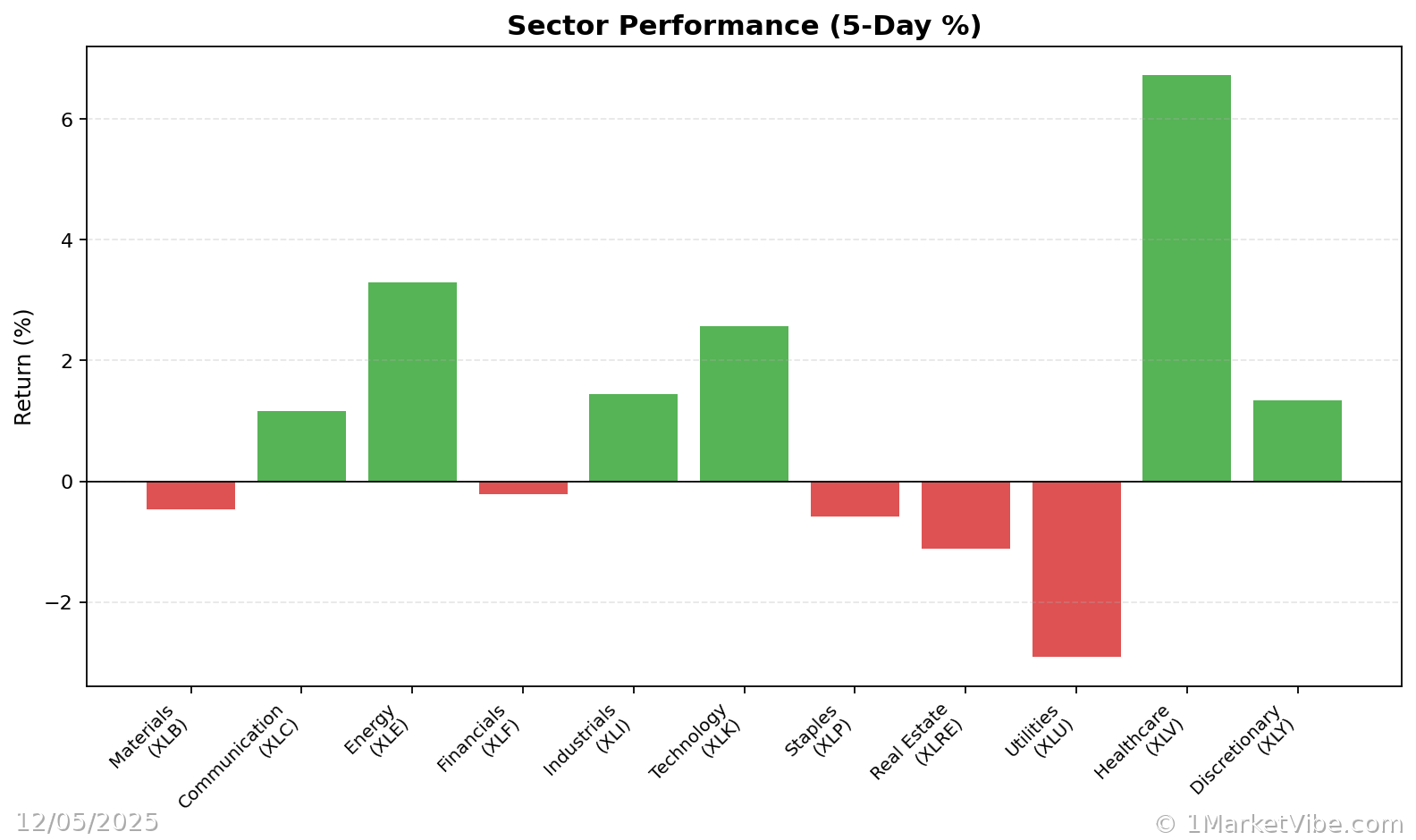

- Reallocate assets to sectors likely to benefit from lower interest rates, such as technology and consumer discretionary.

- Monitor position sizing to manage risk exposure, particularly in sectors sensitive to economic shifts.

- Consider hedging strategies to protect against potential market volatility if the rate cut does not materialize.

MarketVibe's CW Index, currently reading 6.36, suggests predictable market trends, offering a 4-6 week early warning capability that highlights potential shifts. This tool can aid investors in making informed decisions amid evolving market conditions.

Conclusion

The Dow's rise amid rate cut speculation underscores the importance of adaptive investment strategies. As the economic indicators continue to evolve, investors should remain vigilant and responsive to changing market dynamics.

Track how markets respond in real-time at 1marketvibe.com.

Sources

- CNBC: Dow opens higher as rate cut bets strengthen, Salesforce rises

- Bloomberg: Meta’s Zuckerberg Plans Deep Cuts for Metaverse Efforts

- MarketWatch: Jobless claims sink to 3-year low in no-hire, no-fire U.S. economy

Disclaimer: This article is for informational purposes only and should not be considered financial advice.

Charts