Dow Rallies 400 Points as Unexpected Jobs Data Boosts Market Resilience

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Dow Rallies 400 Points as Unexpected Jobs Data Boosts Market Resilience

Breaking News: December 04, 2025 – The Dow Jones Industrial Average surged by 400 points today, closing at a new high as unexpected jobs data signaled economic resilience. This rally comes on the heels of a surprising report from ADP, which revealed a 32,000 decrease in private payrolls for November, contrary to expectations of growth. The market responded positively, interpreting the data as a potential catalyst for a Federal Reserve rate cut in December.

Why It Matters

For investors, this unexpected drop in payrolls suggests a complex economic landscape where traditional indicators are defying predictions. The immediate market impact was a surge in major indices, reflecting increased optimism about potential monetary policy easing. This development is crucial as it may influence the Federal Reserve's upcoming decisions, potentially leading to lower interest rates that could further stimulate market activity.

The broader implications for investors include:

- Potential Rate Cut: Increased likelihood of a December rate cut, which could lower borrowing costs.

- Market Sentiment: A boost in investor confidence, as evidenced by the rally.

- Sector Performance: Tech stocks, particularly AI-related companies, saw significant gains.

Context & Background

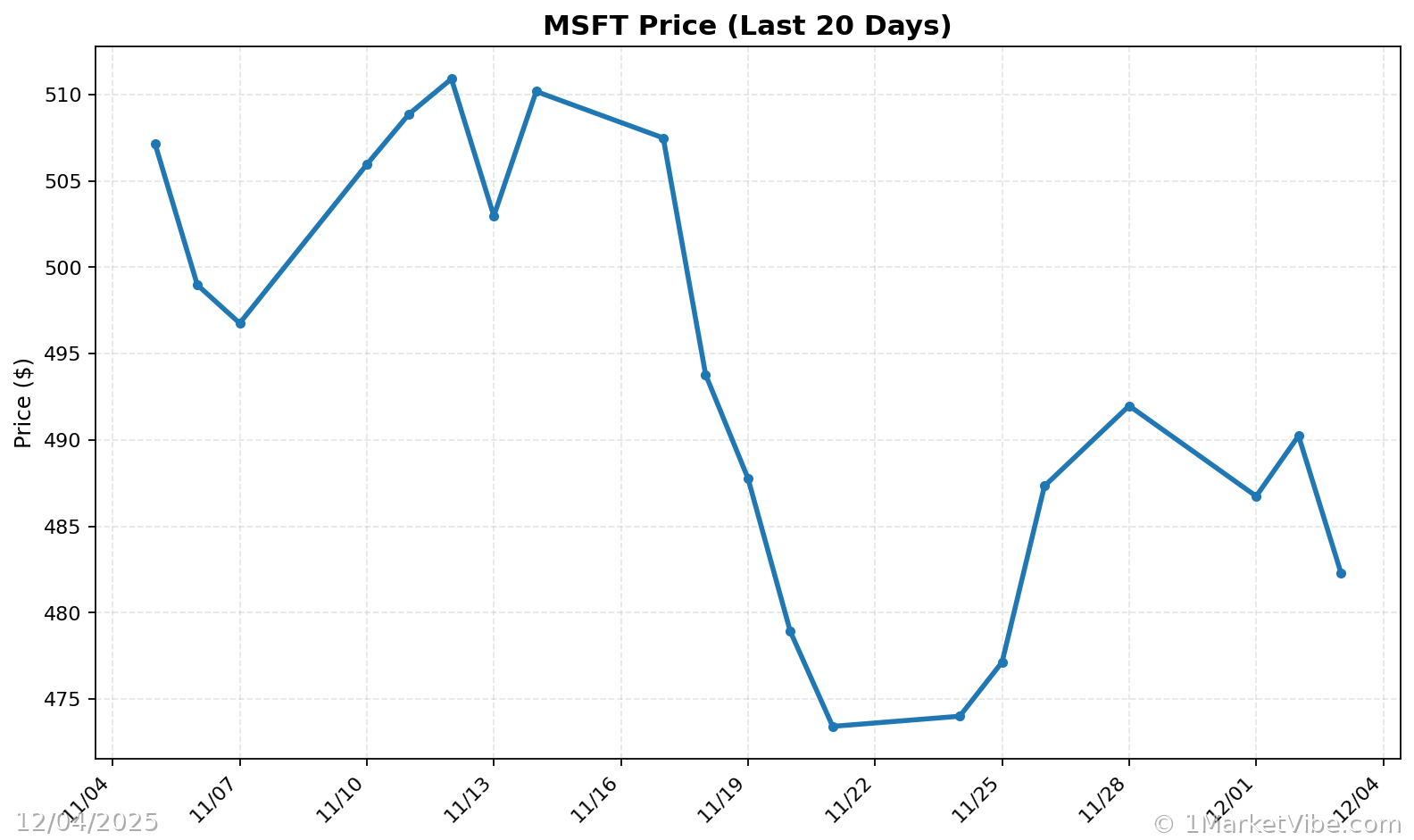

Historically, job data has been a critical indicator of economic health. The unexpected decline in payrolls, led by small business job cuts, marks a stark contrast to the upwardly revised 47,000 positions added in October. This shift highlights the volatility and unpredictability of the current economic environment. Key stakeholders, including tech giants like Microsoft, which saw a dip due to AI-related news, are closely monitoring these developments.

Impact on Major Stocks

- Microsoft (MSFT): Experienced a sell-off following AI software sales quota adjustments.

- Marvell Technology (MRVL): Soared due to strong performance in the AI chip sector.

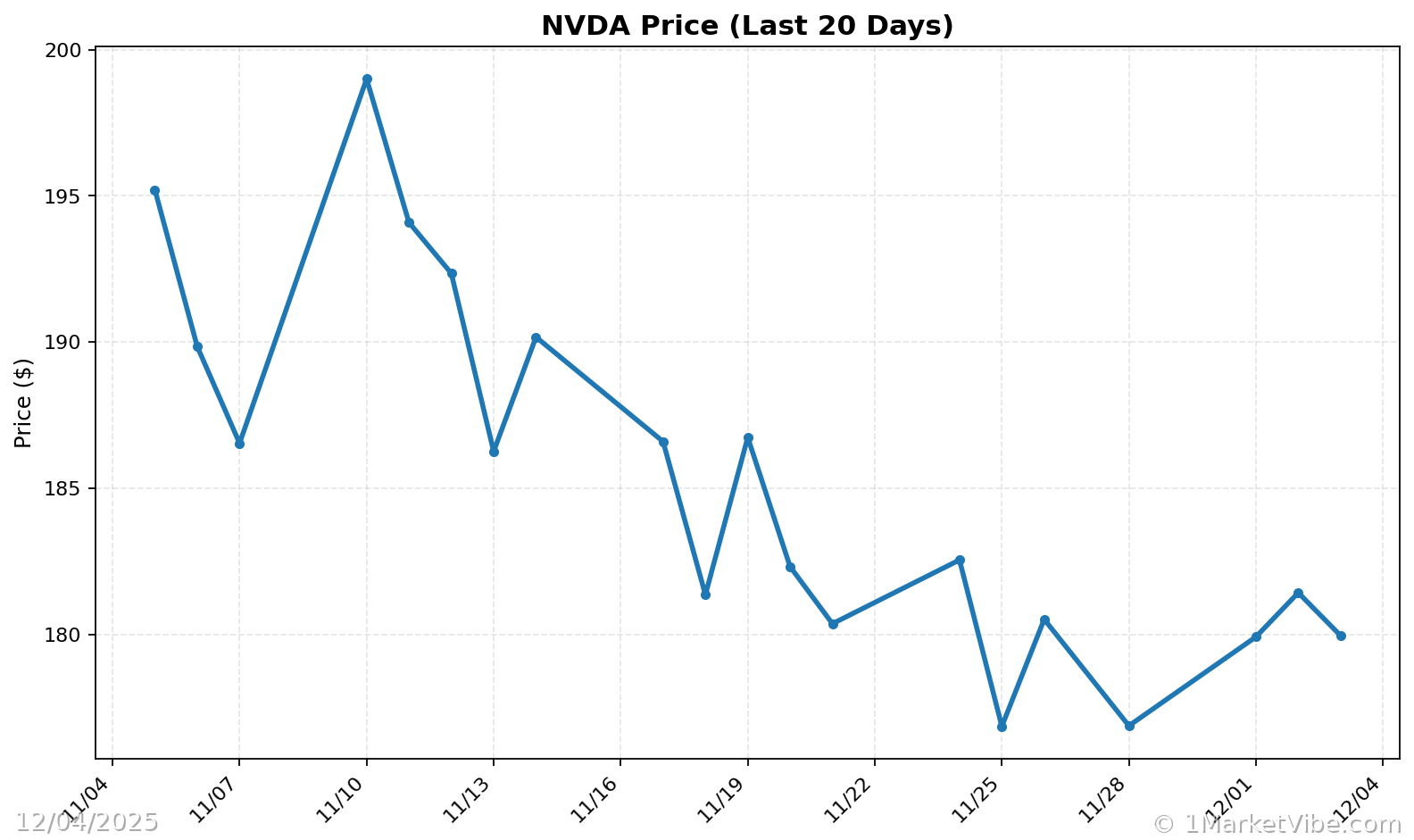

- Nvidia and Palantir: Continued to attract significant investment, reflecting confidence in tech growth.

Investor Sentiment

The market's reaction underscores a cautious optimism. While the drop in payrolls might typically signal economic slowdown, the potential for a rate cut has shifted sentiment positively. Investors are advised to remain vigilant, as the CW Index, which tracks market risk, has ticked up to 6.5, indicating heightened awareness of potential volatility.

Future Considerations

Looking ahead, investors should keep an eye on:

- Federal Reserve Announcements: Any hints of a rate cut in upcoming meetings.

- Sector-Specific Trends: Particularly in tech and small businesses.

- Global Economic Indicators: As they may influence domestic policy decisions.

The next few weeks will be critical as markets digest this data and adjust to potential policy shifts. Investors are encouraged to monitor these developments closely.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Always consult with a financial advisor before making investment decisions.

Charts