2026 Market Outlook and Its Implications for Investors

January 1, 2026 - The stock market is poised for a pivotal year as we enter 2026, following a remarkable surge in 2025. Major indices like the S&P 500 and the NASDAQ hit record highs, with the S&P 500 closing the year up 18%. This rally has been driven by robust corporate earnings and a resilient economic recovery. However, as we step into the new year, investors are keenly watching for signs of sustainability in this growth.

Why It Matters

The immediate market impact is significant. With such a strong performance in 2025, investor sentiment is cautiously optimistic, but there is an undercurrent of concern about potential overheating. The broader implications for investors include the need to reassess portfolio strategies to manage risk effectively. The market's trajectory will hinge on several factors, including interest rate policies, geopolitical tensions, and technological advancements. Understanding these dynamics is crucial for maintaining a balanced investment approach.

Context & Background

Historically, periods of rapid market growth have often been followed by corrections or increased volatility. The 2025 surge was fueled by a combination of low interest rates, government stimulus, and a post-pandemic economic rebound. Key stakeholders, including institutional investors and policy makers, are now evaluating the sustainability of this growth. The Federal Reserve's monetary policy decisions will be pivotal, as any shifts could influence market dynamics significantly.

What's Next

Investors should keep a close eye on several upcoming events and potential scenarios:

- Federal Reserve Meetings: Watch for any indications of interest rate hikes, which could impact borrowing costs and market liquidity.

- Geopolitical Developments: Ongoing trade negotiations and geopolitical tensions could introduce volatility.

- Technological Innovations: Sectors like tech and renewable energy may continue to drive growth, but also face regulatory scrutiny.

MarketVibe's CW Index, a tool for tracking market risk, will be essential in navigating these changes. While it currently remains stable, any uptick could signal increased market volatility.

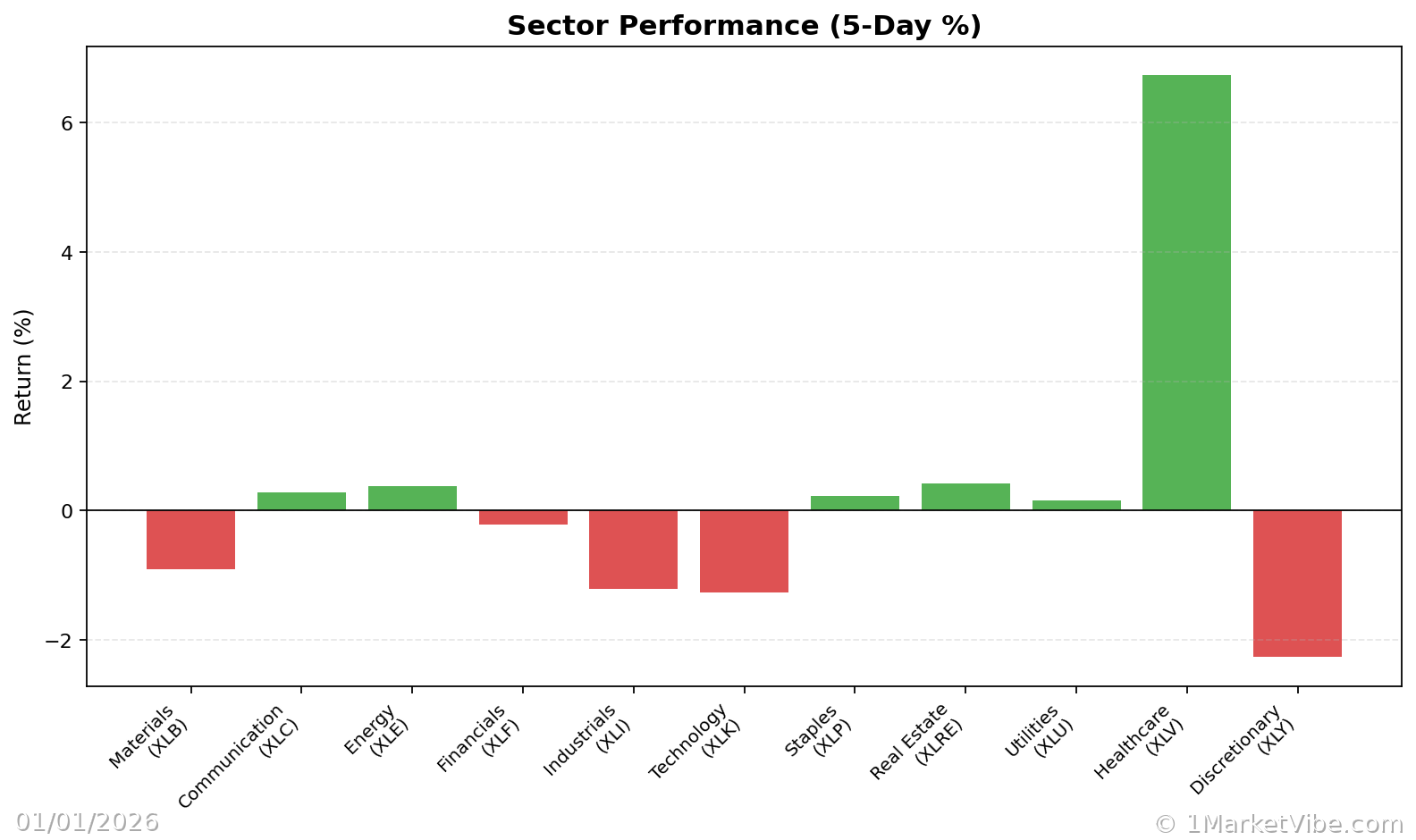

Sector Analysis

Certain sectors are expected to continue thriving, such as technology and healthcare, driven by innovation and demographic trends. Conversely, traditional energy sectors may face challenges due to shifting regulatory landscapes and the global push towards sustainability. Investors should consider diversifying across sectors to mitigate risks associated with these transitions.

Risks to Consider

Potential risks include:

- Inflationary Pressures: Rising inflation could erode purchasing power and impact consumer spending.

- Economic Slowdown: Any signs of slowing economic growth could trigger market corrections.

- Geopolitical Risks: Tensions in key regions could disrupt global supply chains and market stability.

Investor Sentiment

Current investor sentiment is a mix of optimism and caution. The strong performance in 2025 has boosted confidence, but there is a palpable awareness of the risks ahead. As market conditions evolve, sentiment may shift, influencing investment strategies and market movements.

Conclusion

For investors, the key takeaway is to remain vigilant and adaptable. The market outlook for 2026 presents both opportunities and challenges. By staying informed and monitoring key indicators, investors can better position themselves to navigate the complexities of the year ahead.

Track how markets respond in real-time at 1marketvibe.com.

Sources: ABC News, MarketVibe Data

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably.