Nvidia's $20 Billion Groq Deal Signals Shift in AI Market Dominance

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Nvidia's $20 Billion Groq Deal Signals Shift in AI Market Dominance

Nvidia has announced a monumental $20 billion acquisition of Groq, a leading AI hardware company, marking a significant shift in the AI market landscape. The deal, finalized on December 25, 2025, positions Nvidia to further solidify its dominance in the AI sector. This acquisition, one of the largest in tech history, underscores Nvidia's aggressive strategy to expand its capabilities in AI processing and edge computing.

Why It Matters

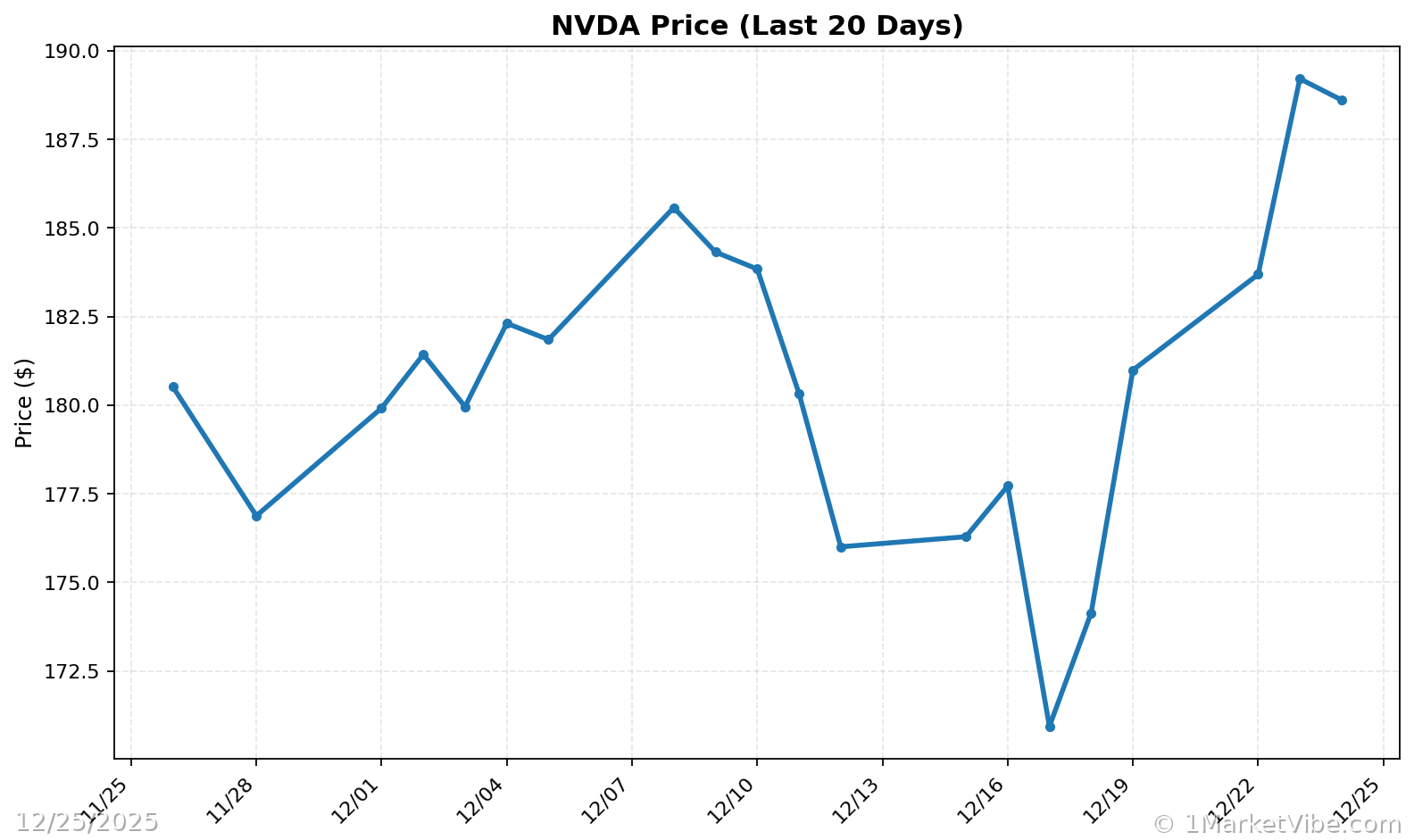

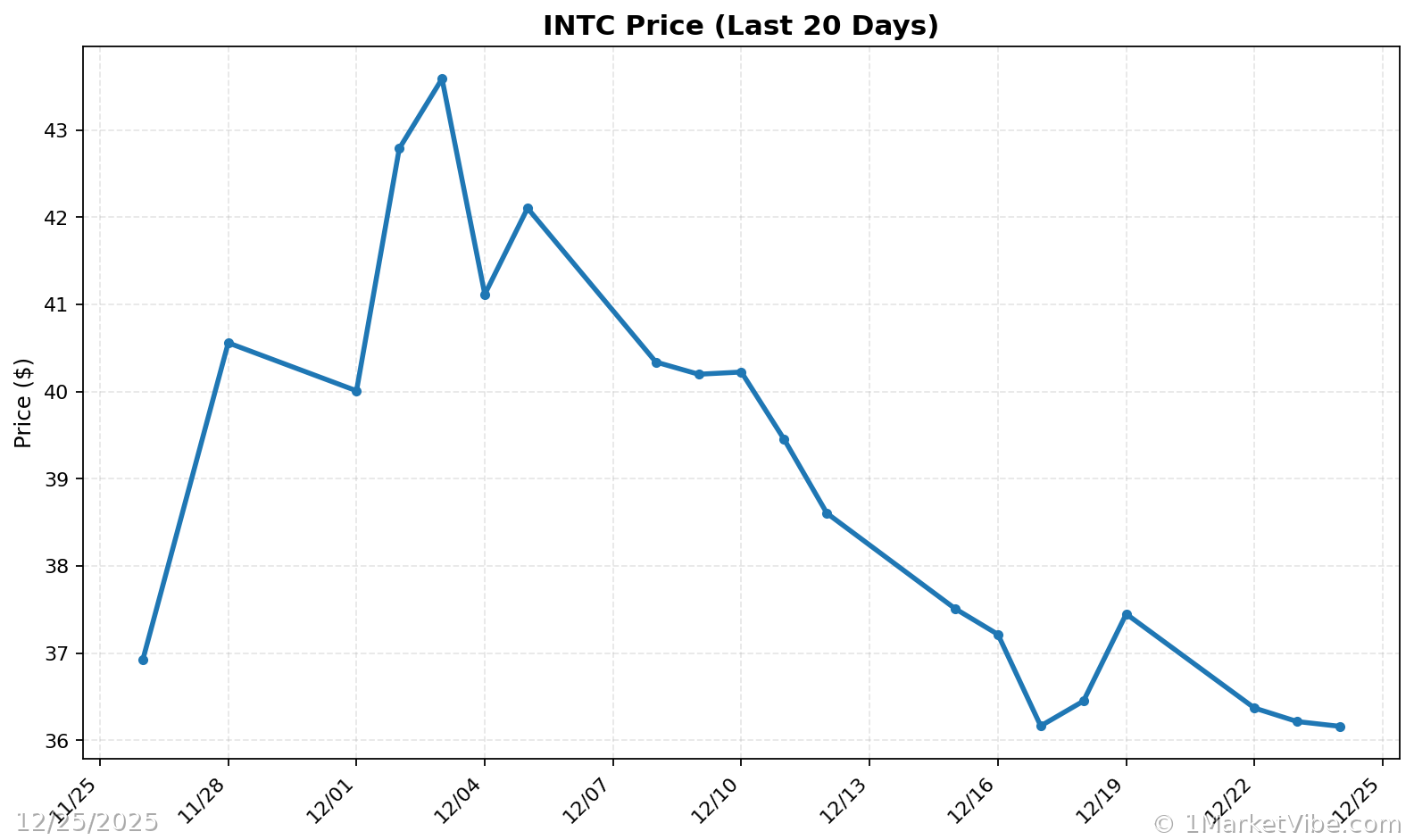

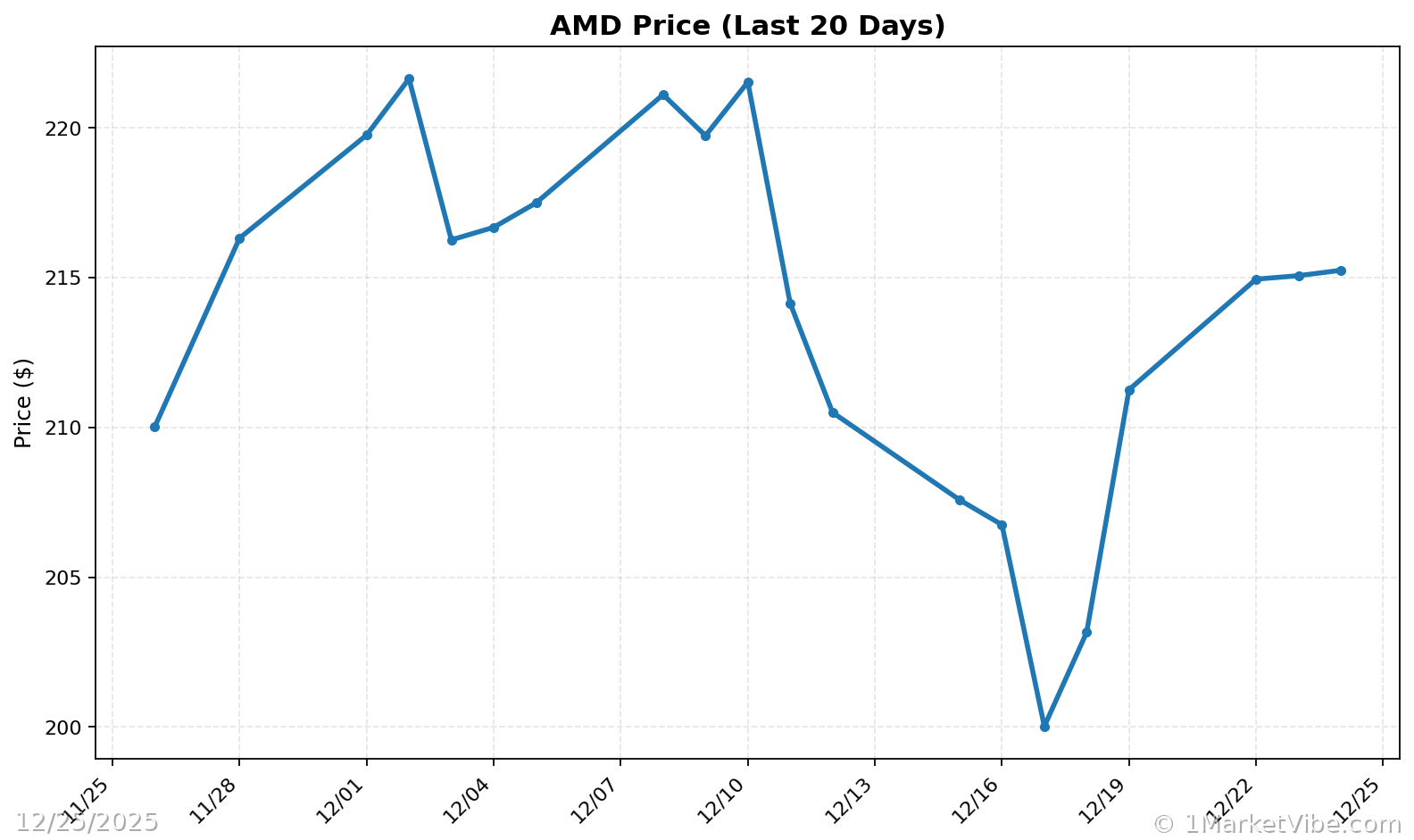

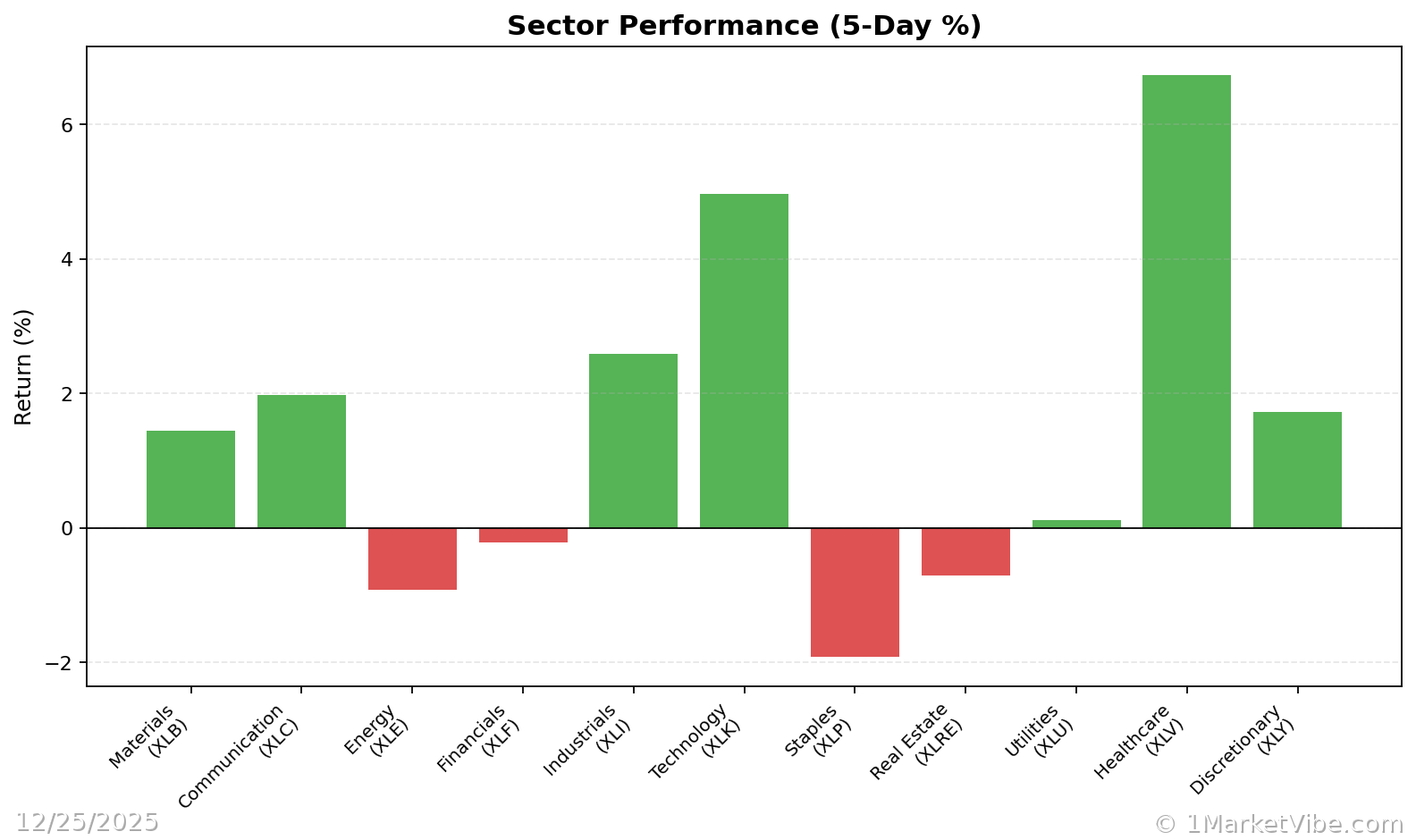

For investors, this acquisition is a clear signal of Nvidia's intent to lead the AI revolution. The immediate market impact saw Nvidia's stock rise by 3.5% in pre-market trading, reflecting investor confidence in the strategic benefits of the deal. The broader implications are profound: Nvidia's enhanced capabilities could redefine competitive dynamics, potentially outpacing rivals like AMD and Intel. However, this bold move also introduces risks, including integration challenges and heightened regulatory scrutiny.

Context & Background

Historically, Nvidia has been at the forefront of AI advancements, leveraging its GPU technology to power everything from gaming to data centers. The acquisition of Groq, known for its innovative tensor processing units, is reminiscent of Nvidia's past strategic acquisitions, such as Mellanox in 2019, which bolstered its data center business. This deal was driven by the increasing demand for AI solutions that require high-performance computing, a sector where Groq excels.

Key stakeholders affected include Nvidia's competitors, who may need to accelerate their own innovation strategies, and Groq's existing partners, who will now navigate a new corporate landscape under Nvidia's umbrella.

What's Next

Investors should watch for Nvidia's integration strategy and how quickly it can leverage Groq's technology to enhance its product offerings. Key upcoming events include Nvidia's Q1 2026 earnings call, where further details on the integration plan are expected. Potential scenarios range from a seamless integration boosting Nvidia's market share to possible regulatory hurdles slowing down progress.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Charts