US GDP Growth of 4.3% and Its Implications for Investors

- Authors

- Name

- MarketVibe Team

- @1marketvibe

US GDP Growth of 4.3% and Its Implications for Investors

Breaking News: The United States economy expanded at an impressive 4.3% annualized rate in the third quarter of 2025, as reported by the Commerce Department on December 23. This marks the fastest growth pace in two years, significantly surpassing the previous quarter's 3.8%. The surge was driven by robust consumer spending and a notable increase in exports.

Why It Matters

For investors, this unexpected GDP growth signals a resilient economic landscape, potentially altering market dynamics. The immediate market reaction saw the Dow Jones Industrial Average rally, reflecting investor optimism. However, the broader implications are nuanced. While the growth is encouraging, it raises questions about sustainability, especially given the mixed sentiment among consumers and the potential for future volatility. MarketVibe's CW Index, which currently reads at 5.9, suggests that this trend was somewhat anticipated, highlighting the importance of monitoring ongoing developments.

Context & Background

Historically, such rapid economic growth is rare and often driven by specific factors. In this case, increased consumer spending, particularly among wealthier Americans, and a rebound in exports played crucial roles. Federal spending also contributed, although future reports may reflect a downturn due to recent government shutdowns. President Trump's tariffs have been credited for some of the economic momentum, though they remain controversial and face potential legal challenges.

What's Next

Investors should brace for potential market fluctuations as new data emerges. Key upcoming events include the Federal Reserve's meeting next month, where interest rate decisions will be pivotal. Additionally, the fourth-quarter GDP report, expected to reflect reduced federal spending, will be crucial in assessing the economy's trajectory. Investors are advised to stay informed and consider adjusting their portfolios in response to these developments.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Sources

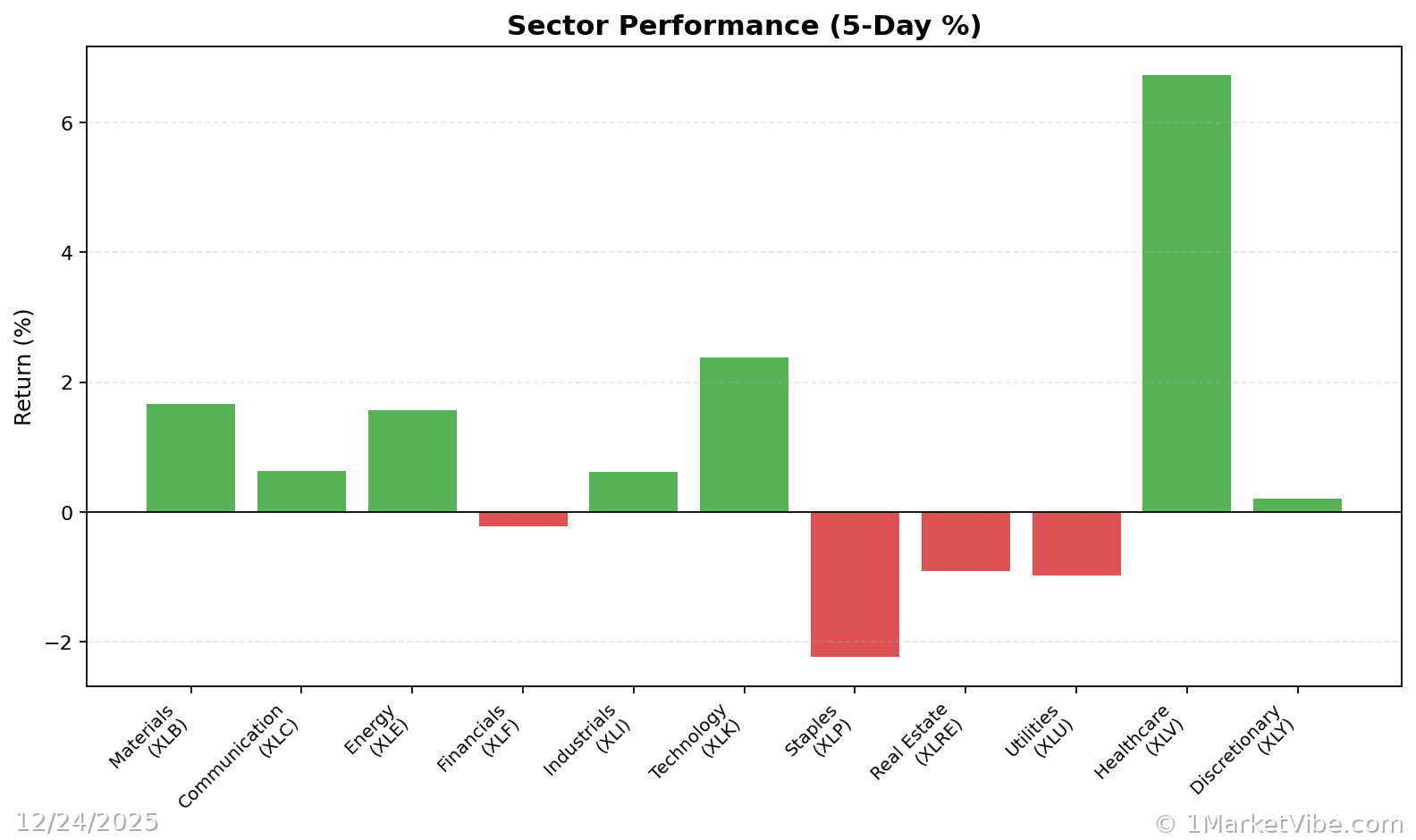

Charts