Nvidia's Forecast Stabilizes Technology Sector and Signals Opportunity

Breaking News: Nvidia's Earnings Forecast Boosts Tech Sector

In a pivotal move for the technology sector, Nvidia's latest earnings forecast has eased fears of an AI bubble, leading to a notable rally in tech stocks. On Tuesday, Nvidia reported robust earnings that surpassed Wall Street expectations, projecting a strong outlook for the upcoming quarters. This announcement comes amid a backdrop of uncertainty, as the S&P 500 recorded its fourth consecutive losing session, marking its longest decline since December 2022.

Why It Matters: Market Impact and Investor Implications

For investors, Nvidia's optimistic forecast is a beacon of stability in a turbulent market. The immediate impact was a surge in tech stocks, with Nvidia shares climbing by 4% in after-hours trading. This development is crucial as it suggests a potential stabilization in the tech sector, which has been under pressure due to fears of an overheated AI market. The broader implications for investors include a renewed confidence in AI investments, which could lead to increased capital inflows into the sector.

- Immediate Market Reaction: Tech stocks rallied, reversing some of the recent losses in the S&P 500.

- Investor Sentiment: Shift towards optimism in AI-related investments.

- Risk Assessment: MarketVibe's CW Index ticked up to 6.42, indicating a positive sentiment shift.

Context & Background: Historical Parallels and Stakeholders

Historically, Nvidia has been a bellwether for the tech industry, often setting the tone for market trends. The recent downturn in the S&P 500, driven by concerns over rising interest rates and geopolitical tensions, had cast a shadow over tech stocks. Nvidia's strong performance and future guidance now provide a counter-narrative, suggesting resilience in the face of broader economic challenges.

Key stakeholders affected include tech giants and AI startups, many of whom rely on Nvidia's chips for their operations. Additionally, the US government's plan to approve the sale of advanced AI chips to Saudi Arabia's firm Humain highlights Nvidia's pivotal role in the global AI landscape.

What's Next: Future Outlook and Scenarios

Investors should watch for further developments in the AI sector, particularly regarding regulatory approvals and international partnerships. Nvidia's continued innovation and market leadership will be critical in shaping the tech industry's trajectory.

- Upcoming Events: Monitor Nvidia's next earnings report and any regulatory announcements regarding AI chip sales.

- Potential Scenarios: Continued growth in AI investments could lead to sustained tech sector rallies, while regulatory hurdles might pose risks.

As the tech sector navigates these developments, investors are advised to stay informed and consider adjusting their portfolios in response to emerging trends.

Track how markets respond in real-time at 1marketvibe.com.

Sources:

- CNBC: Stock futures little changed as S&P 500 notches fourth-straight loss, Nvidia earnings loom

- Bloomberg: US Plans to Approve Sale of Chips to Saudi AI Venture Humain

- Ars Technica: Tech giants pour billions into Anthropic as circular AI investments roll on

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably.

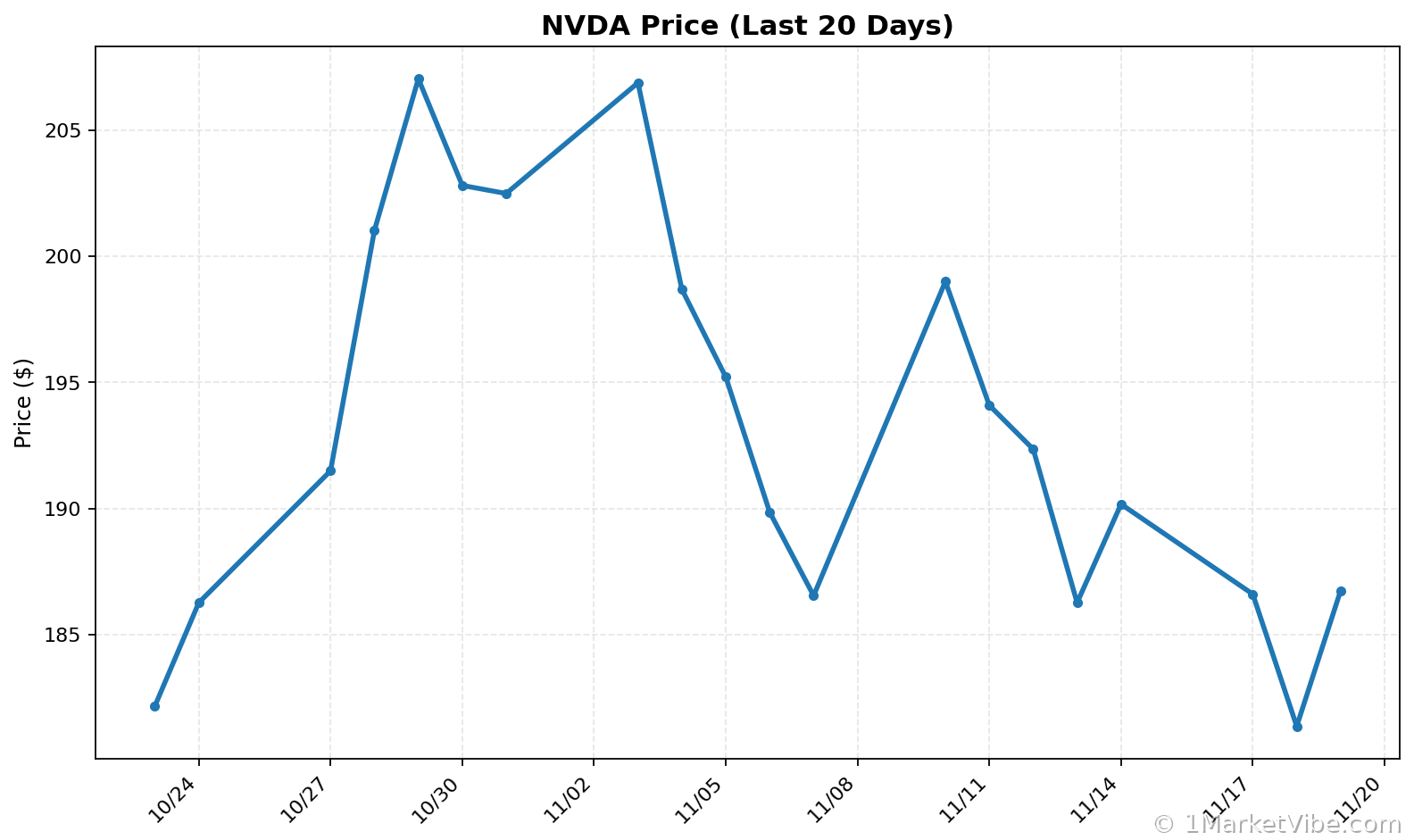

Charts