- Authors

- Name

- MarketVibe Team

- @1marketvibe

Nvidia's Earnings Surge and Its Impact on the AI Market

Breaking News: Nvidia has reported a record-breaking revenue of $13.5 billion for the third quarter of 2023, surpassing Wall Street expectations and sending its stock price soaring by 12% in after-hours trading. This significant financial achievement was announced on November 15, 2023, at Nvidia's headquarters in Santa Clara, California. The company's robust performance is primarily driven by its dominance in the AI chip market, a sector experiencing explosive growth.

Why It Matters

For investors, Nvidia's earnings report is a pivotal moment, highlighting the company's central role in the burgeoning AI industry. The immediate market impact is evident as Nvidia's stock surge reflects heightened investor confidence in AI technologies. This development is not just a win for Nvidia but signals a broader trend where AI is becoming an integral part of technological advancement and investment strategies. However, this also raises the stakes for competitors and could lead to increased market volatility as others scramble to catch up.

Context & Background

Historically, Nvidia has been at the forefront of graphics processing technology, but its strategic pivot towards AI has paid off handsomely. The company's GPUs are now essential components in AI data centers worldwide. This shift was catalyzed by the growing demand for AI-driven applications across various industries, from autonomous vehicles to healthcare. Key stakeholders, including tech giants and AI startups, are closely watching Nvidia's trajectory as it sets the pace for innovation and competition in the AI market.

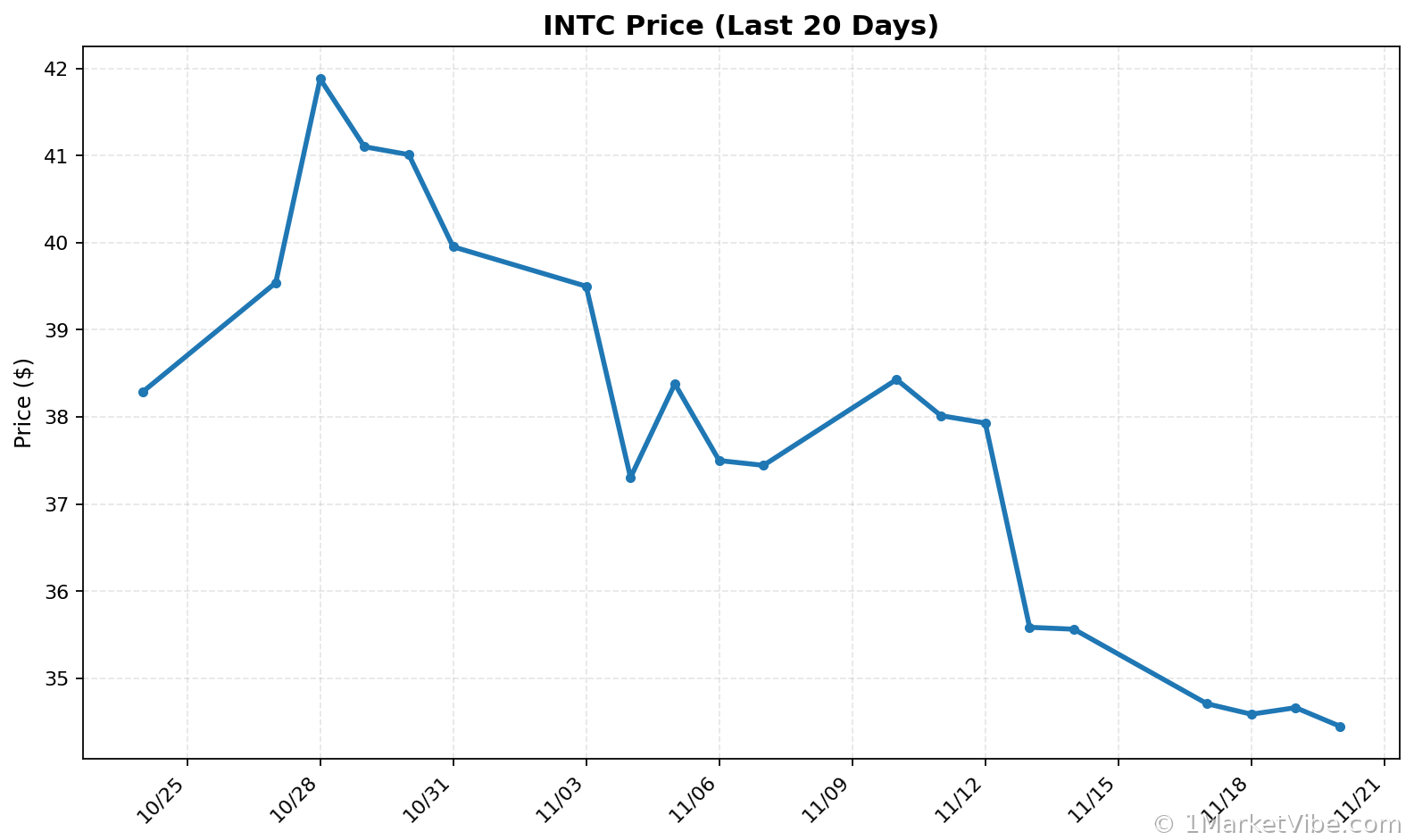

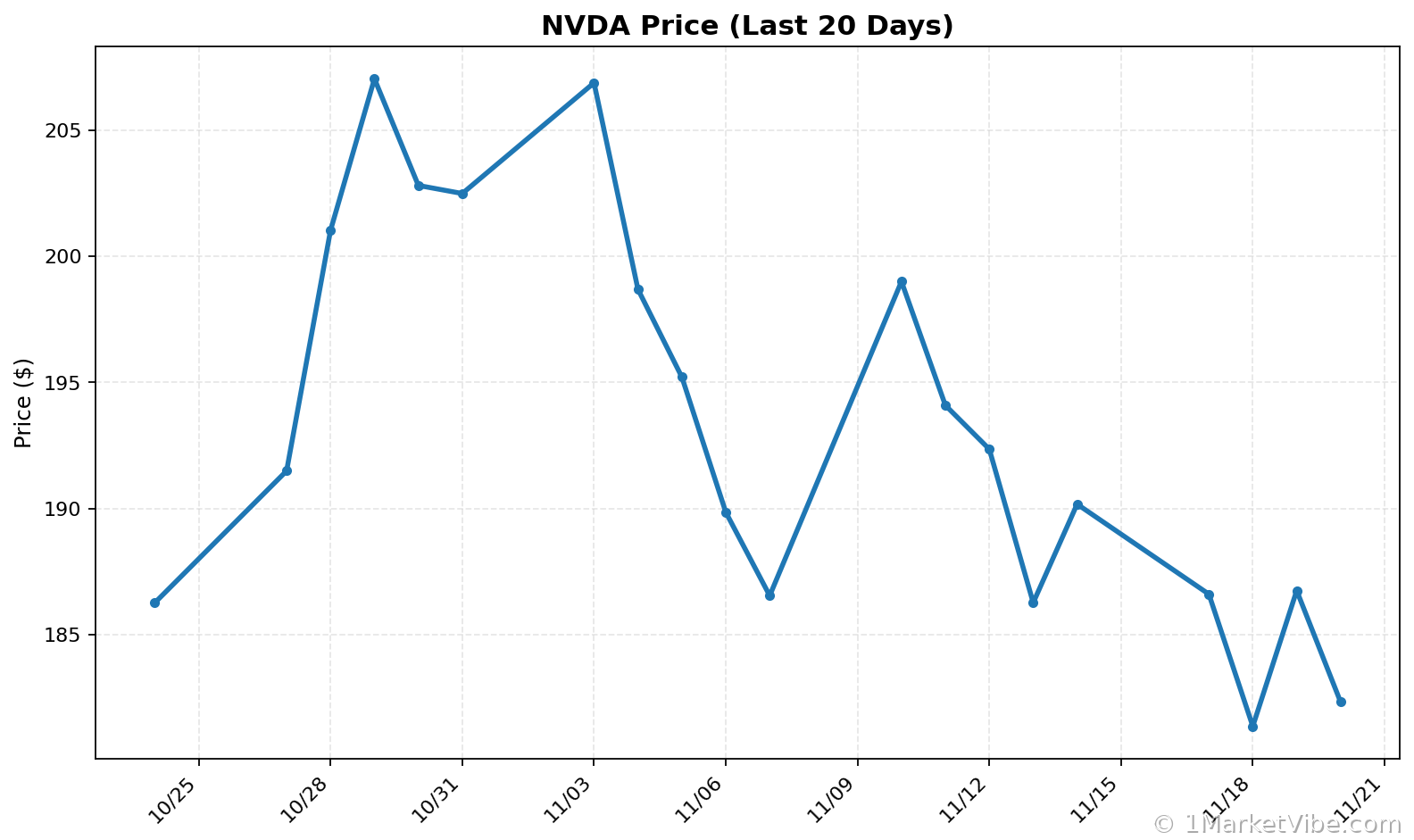

Stock Performance

Nvidia's stock performance following the earnings announcement is a testament to its market influence. The 12% increase in NVDA stock price is a stark contrast to its historical performance, where similar announcements have led to more modest gains. This surge underscores investor enthusiasm and the perceived value of Nvidia's strategic positioning in AI. It also places Nvidia in a favorable light compared to its competitors, who may struggle to match its technological advancements and market share.

AI Market Implications

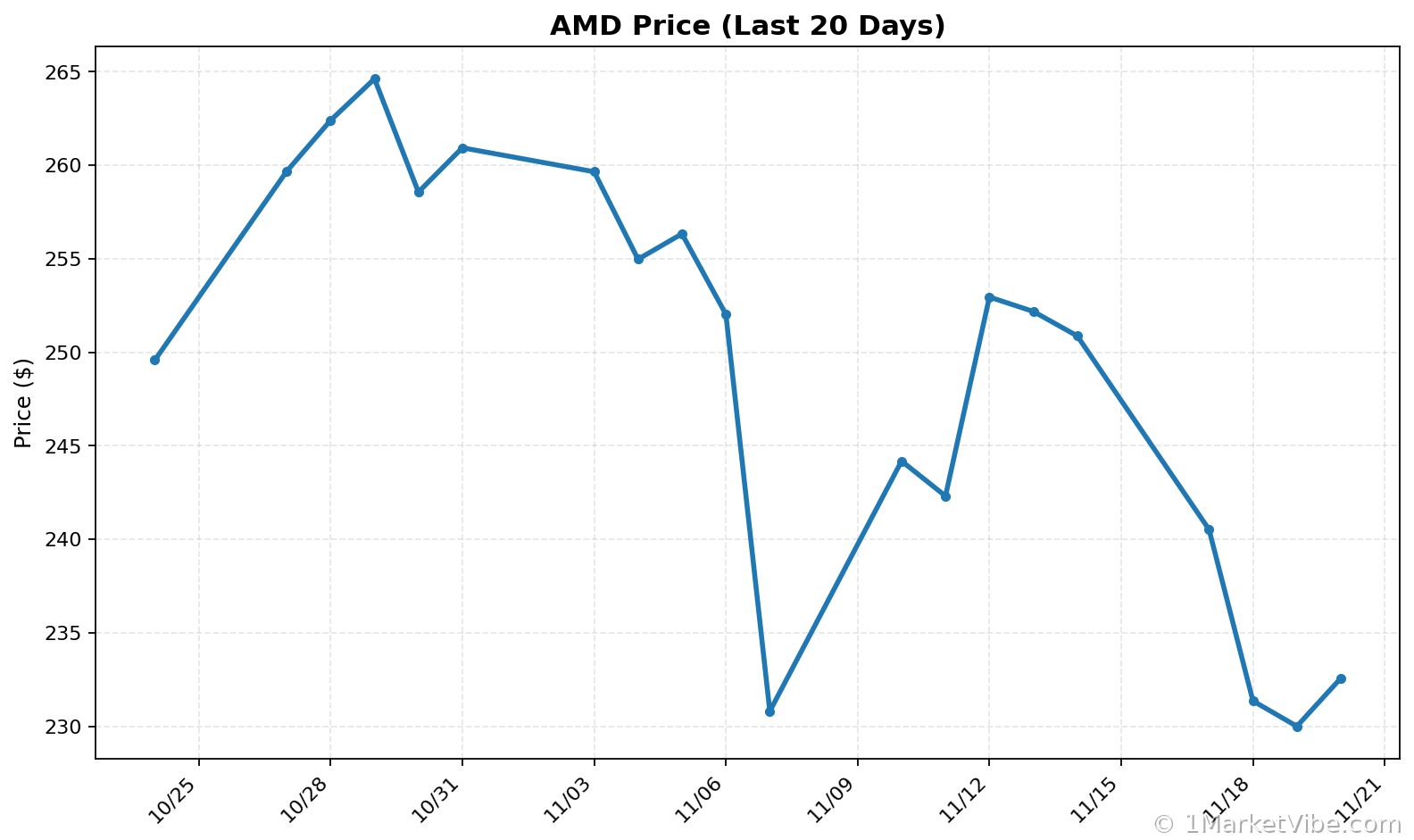

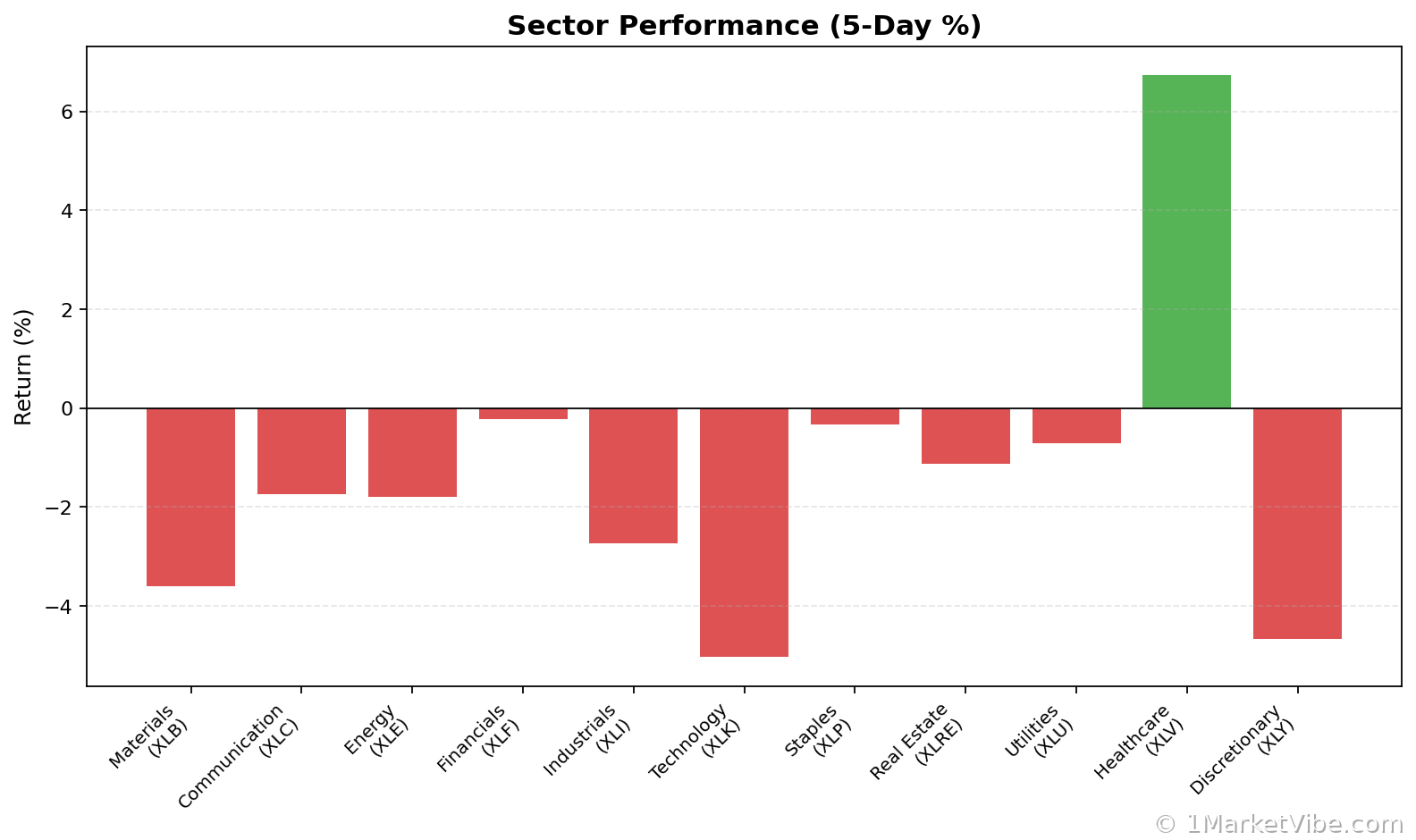

Nvidia's success has far-reaching implications for the AI landscape. As the company continues to innovate, it sets a high bar for competitors like AMD and Intel, who are also vying for a piece of the AI market. The ripple effects of Nvidia's dominance could lead to increased investment in AI research and development, potentially accelerating technological breakthroughs. However, this could also intensify competition, leading to potential market saturation and pricing pressures.

Investor Sentiment

Current investor sentiment towards Nvidia and AI stocks is overwhelmingly positive, buoyed by Nvidia's strong financial performance and growth prospects. This optimism is reflected in broader market trends, where AI-related stocks are gaining traction. However, investors should remain cautious of potential risks, including regulatory challenges and supply chain disruptions, which could impact future performance.

CW Index Connection

MarketVibe's CW Index, which provides early risk signals, ticked up to 7.19 following Nvidia's announcement. This aligns with the index's predictive capabilities, suggesting that Nvidia's earnings surge was anticipated by market trends. Investors can use this information to adjust their portfolios, considering the heightened risk and opportunity in the AI sector.

Risks and Considerations

Despite Nvidia's impressive performance, potential risks remain. Market volatility, driven by geopolitical tensions and economic uncertainties, could affect Nvidia's supply chain and production costs. Additionally, as the AI market becomes more competitive, Nvidia may face challenges in maintaining its market leadership. Investors should monitor these factors closely and consider diversification strategies to mitigate potential risks.

Conclusion

Nvidia's record earnings highlight its pivotal role in the AI market and its ability to drive innovation and growth. For investors, this means a promising outlook for AI-related investments, albeit with some caution due to potential market volatility. As the AI landscape evolves, Nvidia's performance will be a key indicator of broader market trends.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably.

Charts