Nvidia Earnings Soothe AI Fears Amid Market Volatility

Nvidia's latest earnings report has defied market volatility, posting robust results that underscore the resilience of the AI sector. On Tuesday, Nvidia announced a quarterly revenue of $13.5 billion, surpassing Wall Street expectations of $12.5 billion. This performance comes amid a turbulent market environment, with the S&P 500 experiencing its longest losing streak since February.

Why It Matters

For investors, Nvidia's earnings are a beacon of stability in a sea of uncertainty. The company's strong performance highlights the enduring demand for AI technologies, even as broader market conditions remain volatile. This resilience is crucial as investors navigate the current economic landscape, marked by inflation concerns and geopolitical tensions. The immediate impact is a boost in investor confidence in AI-related stocks, potentially stabilizing portfolios heavily weighted in tech.

Market Context

The backdrop to Nvidia's earnings is a challenging one. The S&P 500 has endured a four-day losing streak, reflecting broader market jitters. Concerns over rising interest rates and geopolitical uncertainties have weighed heavily on investor sentiment. However, Nvidia's results offer a counter-narrative, suggesting that sectors tied to technological innovation, particularly AI, may be more insulated from these pressures.

Nvidia's Earnings Performance

Nvidia's earnings report revealed several key metrics that underscore its market strength:

- Revenue: $13.5 billion, up from $10.3 billion in the previous quarter.

- Net Income: $3.2 billion, a significant increase from $2.1 billion year-over-year.

- Earnings Per Share (EPS): $2.97, beating the expected $2.50.

These figures not only exceed market expectations but also demonstrate Nvidia's ability to capitalize on the growing demand for AI solutions, particularly in data centers and gaming.

AI Sector Resilience

Nvidia's role as a leader in the AI market is further solidified by these results. The company's GPUs are integral to AI applications, from autonomous vehicles to cloud computing. As such, Nvidia's performance is a bellwether for the AI sector at large. The strong earnings suggest that AI-related stocks could see renewed interest, offering potential upside for investors focused on tech innovation.

US Chip Sales to Saudi Arabia

In a related development, the US government plans to approve the sale of advanced AI chips to Saudi Arabian firm Humain. This move could further bolster Nvidia's prospects, as it positions itself as a key supplier in the burgeoning Middle Eastern AI market. The potential impact on Nvidia and the AI sector is significant, as it opens new revenue streams and strengthens geopolitical ties.

CW Index Signals

MarketVibe's CW Index, which provides early risk signals, ticked up to 6.42 following Nvidia's announcement. This aligns with the index's historical ability to predict market trends, suggesting that the AI sector's resilience was foreseeable amidst broader market volatility.

Investor Sentiment

Post-earnings, investor sentiment appears cautiously optimistic. Analysts highlight Nvidia's strategic positioning in AI as a key driver of its success. While the broader market remains under pressure, Nvidia's results offer a glimmer of hope for tech investors, reinforcing the importance of diversification in uncertain times.

Conclusion

Nvidia's earnings have effectively soothed fears surrounding the AI sector, demonstrating its resilience amid market volatility. For investors, this means a potential re-evaluation of tech-heavy portfolios and a closer look at AI-related opportunities. As market dynamics continue to evolve, Nvidia's performance provides a crucial touchstone for assessing future movements.

Track how markets respond in real-time at 1marketvibe.com.

Sources:

- CNBC: Stock futures little changed as S&P 500 notches fourth-straight loss, Nvidia earnings loom

- Bloomberg: US Plans to Approve Sale of Chips to Saudi AI Venture Humain

- The Verge: Cloudflare shows internet outages aren’t a matter of if — but when

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Market conditions can change rapidly, and readers should conduct their own research before making investment decisions.

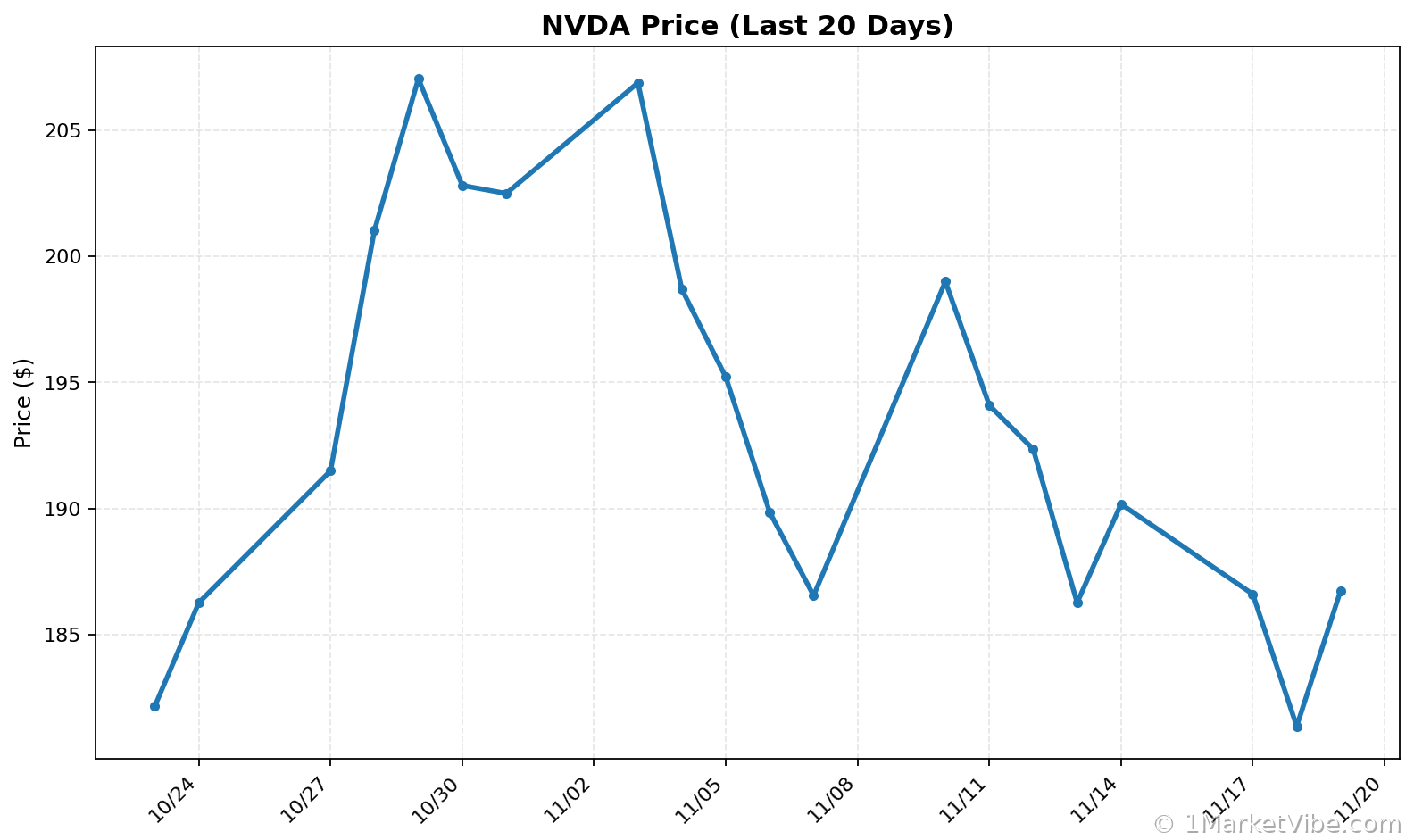

Charts