Fed Eyes December Rate Cut Amid Weak Labor Market

In a significant development, the Federal Reserve is considering a potential rate cut in December, citing a persistently weak labor market as a primary concern. This announcement comes as the latest employment data reveals a slowdown, with only 150,000 jobs added in October, falling short of economists' expectations. The Fed's decision-making process is closely watched by investors, as it could signal a shift in monetary policy aimed at stimulating economic growth.

Why It Matters

For investors, the Fed's contemplation of a rate cut is a critical signal. A reduction in interest rates typically aims to boost economic activity by making borrowing cheaper, which can lead to increased consumer spending and business investments. However, it also suggests underlying economic weaknesses that may pose risks to market stability. The immediate market reaction has been mixed, with stock futures showing little change as investors weigh the potential benefits of a rate cut against the implications of a sluggish labor market. Market sentiment remains cautious, reflecting concerns about the broader economic outlook.

Current Labor Market Trends

The labor market has been under pressure, with recent data indicating a slowdown in job creation. October's job growth of 150,000 is a stark contrast to the robust figures seen earlier this year. Factors contributing to this trend include ongoing supply chain disruptions and geopolitical tensions, which have dampened business confidence and hiring. The unemployment rate remains steady at 3.9%, but wage growth has stagnated, further complicating the economic landscape.

Fed's Historical Rate Decisions

Historically, the Fed has used rate cuts as a tool to combat economic downturns. The last significant rate cut occurred in March 2020, at the onset of the COVID-19 pandemic, which helped stabilize financial markets and support economic recovery. The current consideration for a December rate cut highlights the Fed's proactive approach in addressing economic challenges, although it also underscores the gravity of the current labor market situation.

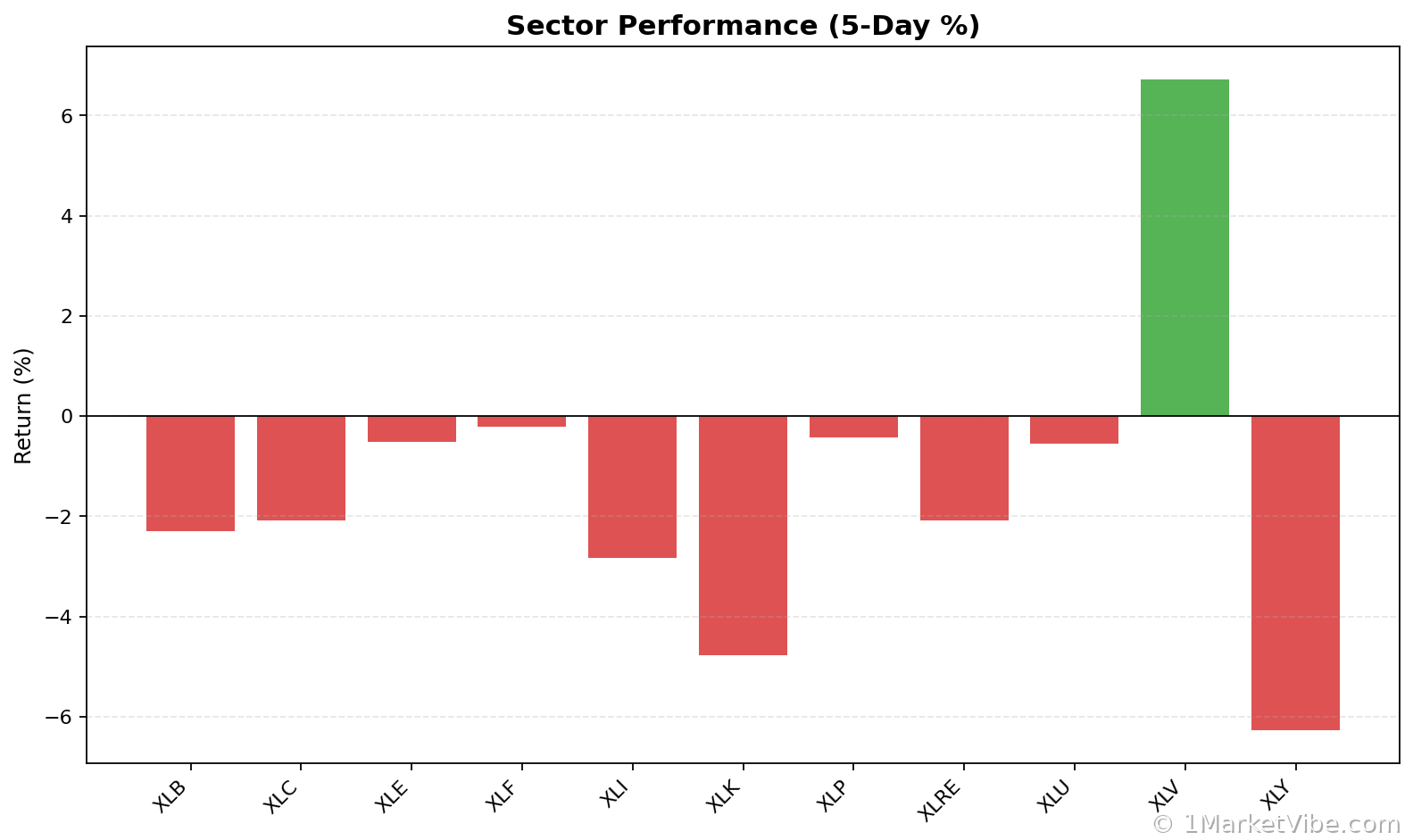

Market Reactions to Fed Signals

Markets have reacted with caution to the Fed's signals. While some sectors, such as technology, have seen slight declines, others remain stable. Nvidia, for example, saw a 2% decline on Monday, reflecting broader concerns about tech sector volatility. Investors are closely monitoring these developments, as any rate cut could influence sector performance and overall market dynamics.

Implications for Investors

For investors, this potential rate cut means reassessing portfolio strategies. Lower interest rates can lead to higher equity valuations, but they also suggest economic vulnerabilities. Investors may need to consider adjusting their risk exposure, particularly in sectors sensitive to economic cycles. The CW Index, which tracks market risk sentiment, has ticked up to 6.59, indicating heightened awareness of potential market shifts.

What's Next

Looking ahead, investors should keep an eye on upcoming Fed meetings and economic data releases. The next key event is the Fed's December meeting, where a rate decision will be made. Potential scenarios include a rate cut, which could spur market rallies, or a decision to hold rates steady, which might signal confidence in economic resilience. Monitoring these developments will be crucial for making informed investment decisions.

Track how markets respond in real-time at 1marketvibe.com.

Sources:

- CNBC: Stock futures little changed after tech slump weighs on markets

- Dexerto: GameStop’s “Trade Anything Day” even lets you sell them taxidermy

- Nvidia.com: NVIDIA and RIKEN Advance Japan’s Scientific Frontiers With New Supercomputers

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably.

Charts