Bitcoin's Plunge Sparks $1 Trillion Crypto Market Loss

Breaking News: On Wednesday, the cryptocurrency market faced a staggering loss as Bitcoin's value plummeted to its lowest in seven months, wiping out over $1 trillion in market value. This dramatic downturn has sent shockwaves through the crypto world, highlighting the volatility that continues to define digital currencies.

Why It Matters

The immediate impact of this crash is profound, as investors grapple with the sudden devaluation of their crypto assets. The broader implications are significant, with potential ripple effects across financial markets. For investors, this means heightened risk and uncertainty, as the market sentiment shifts towards caution. The CW Index, known for its early warning capabilities, had signaled increased volatility, aligning with the current downturn. This underscores the importance of monitoring risk indicators in such unpredictable environments.

Context & Background

Historically, Bitcoin has experienced several dramatic price swings, often driven by regulatory news, market sentiment, or technological developments. This latest decline follows a period of relative stability, but underlying factors such as regulatory pressures and macroeconomic uncertainties have contributed to the current situation. Key stakeholders, including institutional investors and retail traders, are now reassessing their positions amidst growing concerns about market stability.

What's Next

Investors should watch for potential regulatory announcements and economic indicators that could further influence market dynamics. Upcoming events, such as central bank meetings and policy updates, may provide additional context for the crypto market's trajectory. Potential scenarios include continued volatility or a stabilization phase, depending on external factors and market sentiment.

For those navigating this turbulent period, it's crucial to stay informed and consider adjusting risk exposure accordingly. MarketVibe's CW Index, currently reading at 7.19, suggests that monitoring these signals can provide valuable insights into future market movements.

Track how markets respond in real-time at 1marketvibe.com.

Sources:

- Bloomberg: Crypto World Wipes Out $1 Trillion as Bitcoin Plunges Anew

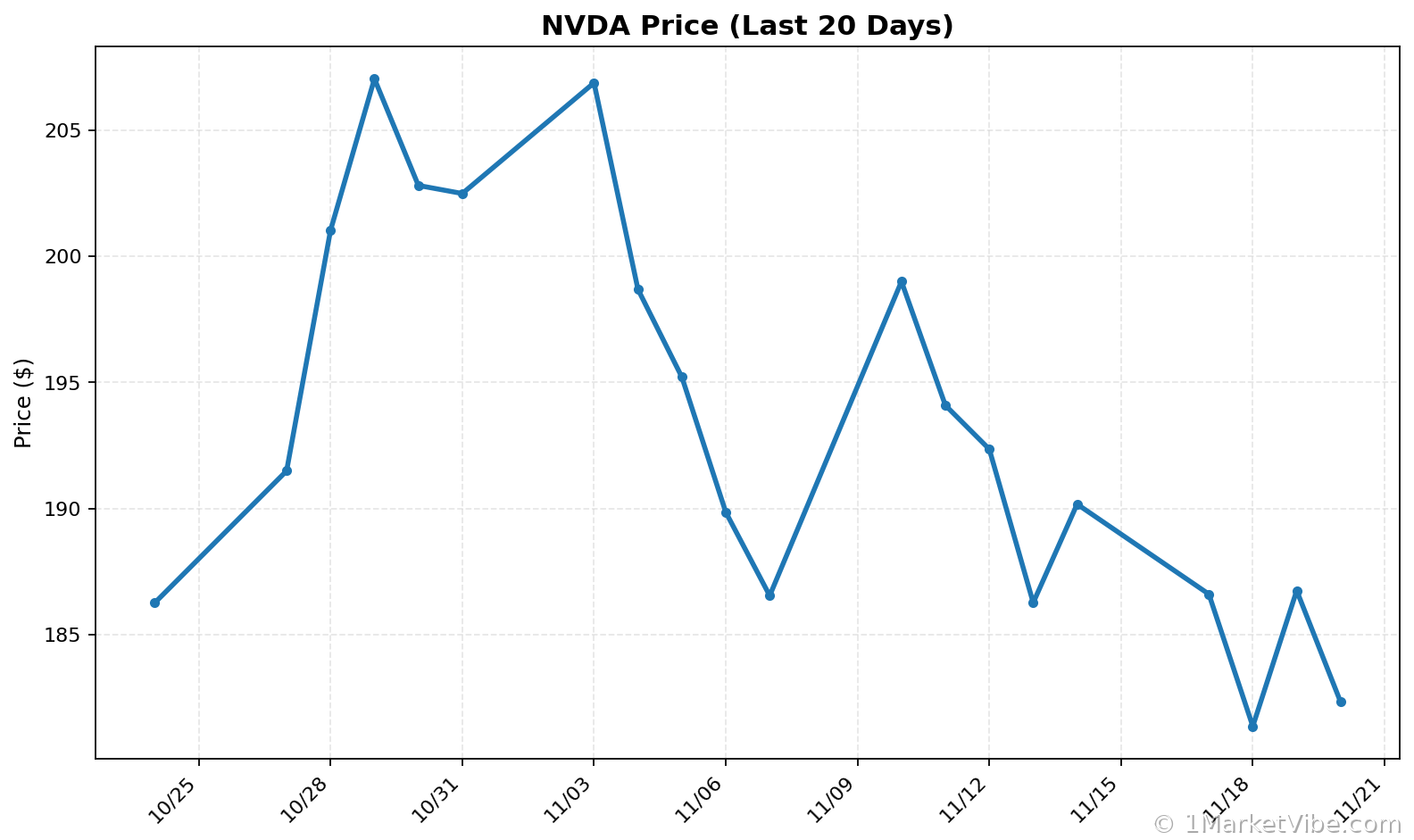

- CNBC: Stock futures higher as Nvidia's strong forecast reignites the AI trade

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably.

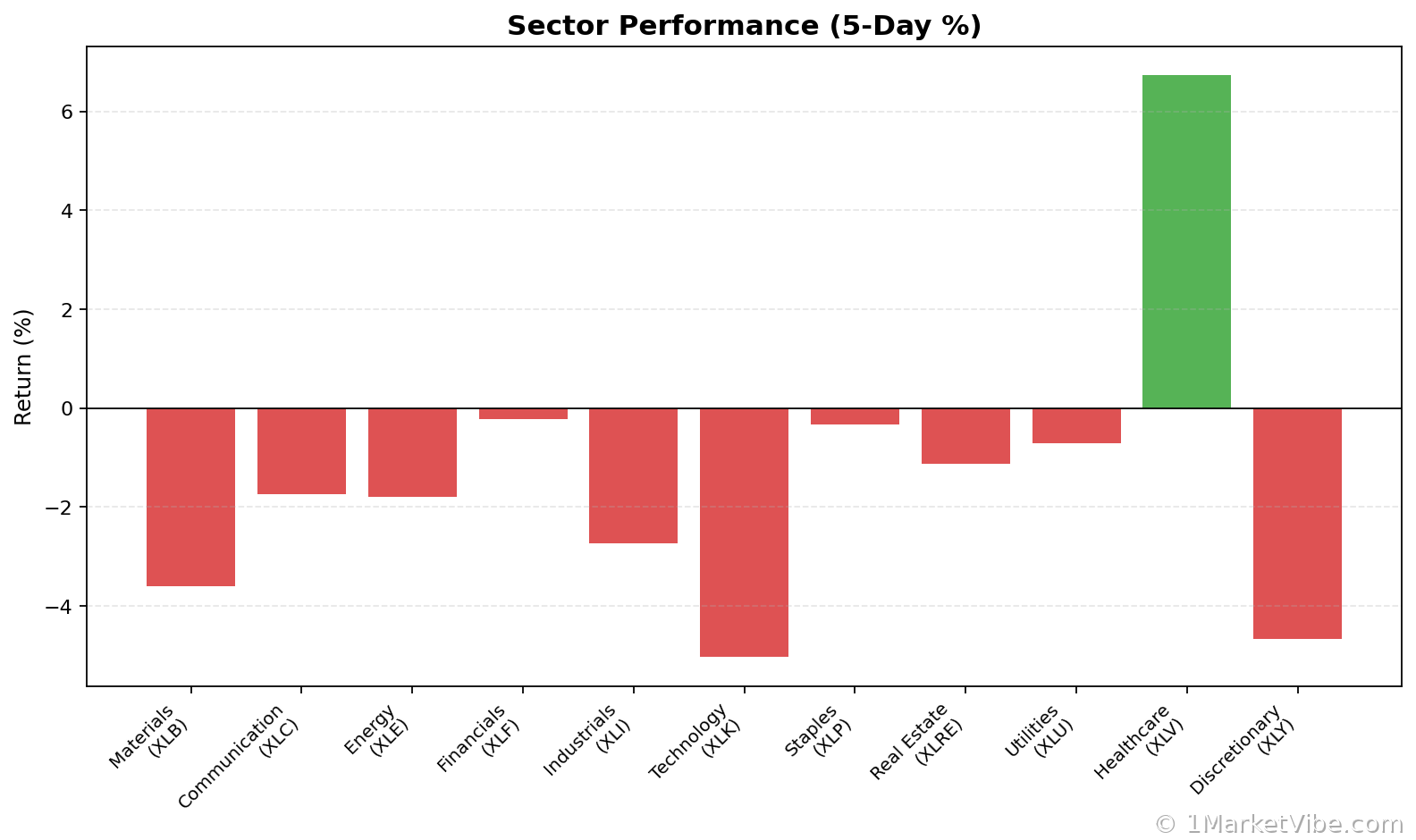

Charts