Breaking News: CW Index at 5.29 and the Impact of Trump's Oil Threats

In a significant geopolitical development, former U.S. President Donald Trump has issued threats to strike Iran, a nation with substantial oil reserves, intensifying global tensions. This announcement on January 16, 2026, has sent ripples through the financial markets, with MarketVibe's CW Index currently reading 5.29, indicating heightened risk levels. The potential for military action in a region critical to global oil supply has investors on edge, as they weigh the implications for oil prices and market stability.

Why It Matters

The immediate market impact is palpable. Oil prices have already begun to fluctuate, reflecting investor anxiety over potential disruptions in supply. Historically, geopolitical tensions in oil-rich regions have led to significant price volatility, affecting everything from energy stocks to broader market indices. For investors, this means a reassessment of risk exposure in energy sectors and related industries is crucial. The CW Index's current level suggests that these developments align with broader risk signals, providing a predictive lens on potential market trends.

Context & Background

This situation echoes past geopolitical crises where threats of military action in the Middle East have led to sharp spikes in oil prices. The U.S.-Iran relationship has been fraught with tension, particularly concerning Iran's nuclear ambitions and regional influence. Trump's latest threats come amid ongoing unrest within Iran, as its authoritarian regime faces internal and external pressures. Additionally, Venezuela's oil exports continue to play a role in U.S. foreign policy, further complicating the geopolitical landscape.

Potential Market Reactions

- Oil Prices: Expect potential spikes if tensions escalate, impacting energy costs globally.

- Stock Markets: Energy stocks may see increased volatility, while broader indices could experience downward pressure.

- Currency Markets: Currencies of oil-exporting nations might strengthen, while importers could face depreciation.

CW Index Insights

The CW Index reading of 5.29 reflects a moderate risk environment, but with the potential for rapid escalation. This index, known for its early warning capabilities, suggests that investors should remain vigilant as geopolitical developments unfold. Monitoring the index can provide valuable insights into market sentiment shifts and potential volatility.

Risks and Considerations

The possibility of military action poses significant risks to global oil supply, which could have far-reaching economic implications. For the U.S. and its allies, energy security and economic stability are at stake. Investors should consider hedging strategies and reassess their portfolio's exposure to sectors most likely to be impacted by these geopolitical shifts.

What's Next

Investors should keep a close watch on diplomatic developments and any official statements from involved nations. Key events to monitor include potential U.N. Security Council meetings and any changes in U.S. foreign policy stance. The coming weeks will be critical in determining whether tensions will escalate or de-escalate.

For real-time updates and to track how markets respond, visit 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

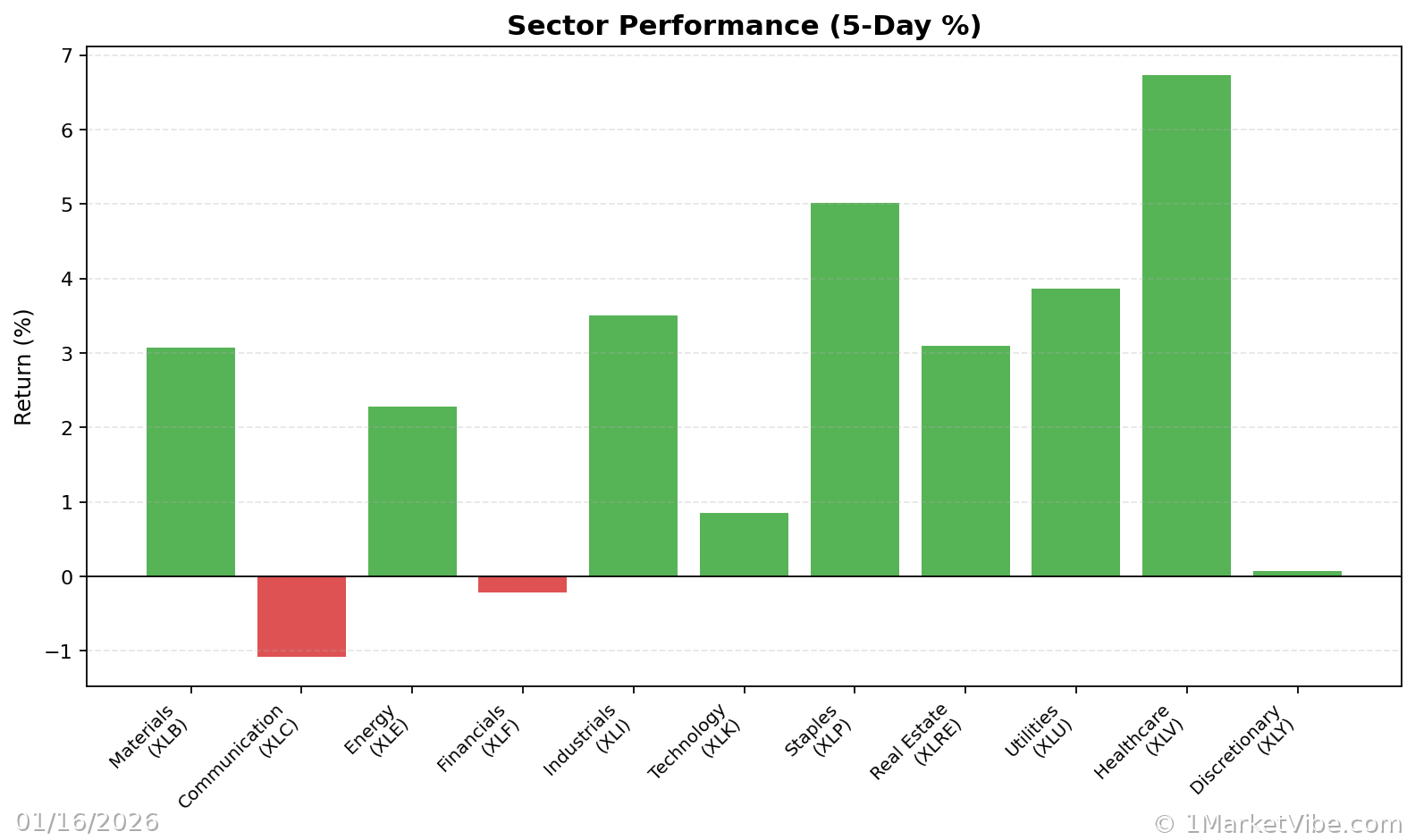

Charts