Impact of the Fed's Third Rate Cut on the CW Index and Investment Strategies

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Breaking News: Fed's Third Rate Cut and Its Impact on the CW Index and Investment Strategies

What Happened

December 11, 2025 - In a decisive move, the Federal Reserve announced its third consecutive interest rate cut, reducing the rate by a quarter-point. This decision, made during the latest Federal Open Market Committee (FOMC) meeting, reflects ongoing efforts to stabilize the economy amid fluctuating market conditions. The announcement, made by Fed Chair Jerome Powell, has already sparked significant market reactions, with the S&P 500 nearing an all-time high and the Dow Jones Industrial Average surging by nearly 500 points.

Why It Matters

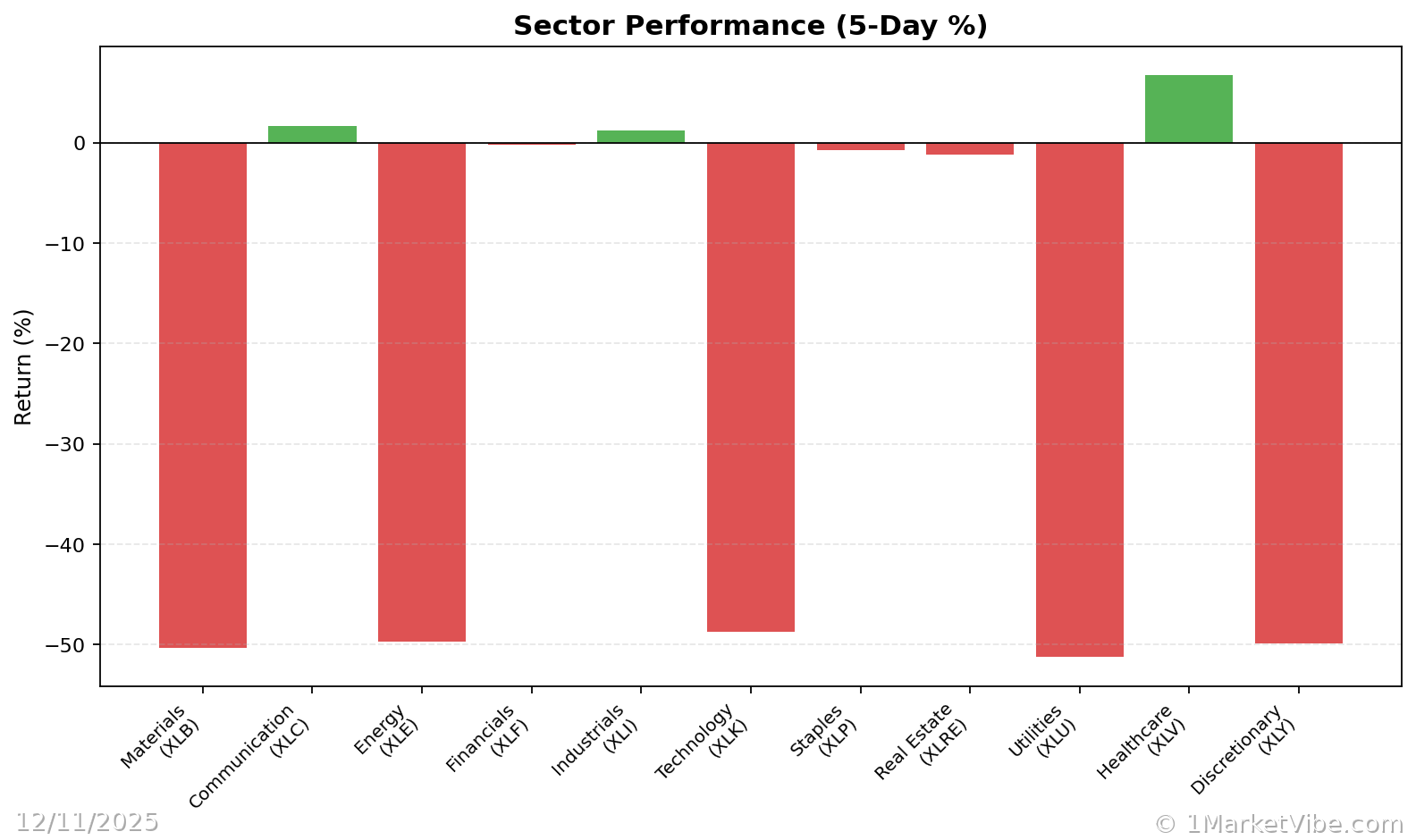

For investors, this rate cut signals a continued effort by the Fed to stimulate economic growth and counteract potential downturns. The immediate impact was a rally in interest-rate sensitive sectors, including a 3.22% rise in the State Street SPDR S&P Homebuilders ETF and a 1.8% increase in the State Street Consumer Discretionary Select Sector SPDR ETF. However, the split decision among FOMC members highlights underlying uncertainties about future monetary policy directions, which could influence investor sentiment and portfolio risk management strategies.

Context & Background

Historically, rate cuts are employed to lower borrowing costs, encouraging spending and investment. This latest cut follows two previous reductions aimed at bolstering the economy against global uncertainties and domestic challenges. The current economic climate, marked by low inflation and moderate growth, has prompted the Fed to adopt a more accommodative stance. However, dissent within the FOMC, with three members opposing the cut, underscores the complexity of balancing growth with inflation targets.

Market Reactions

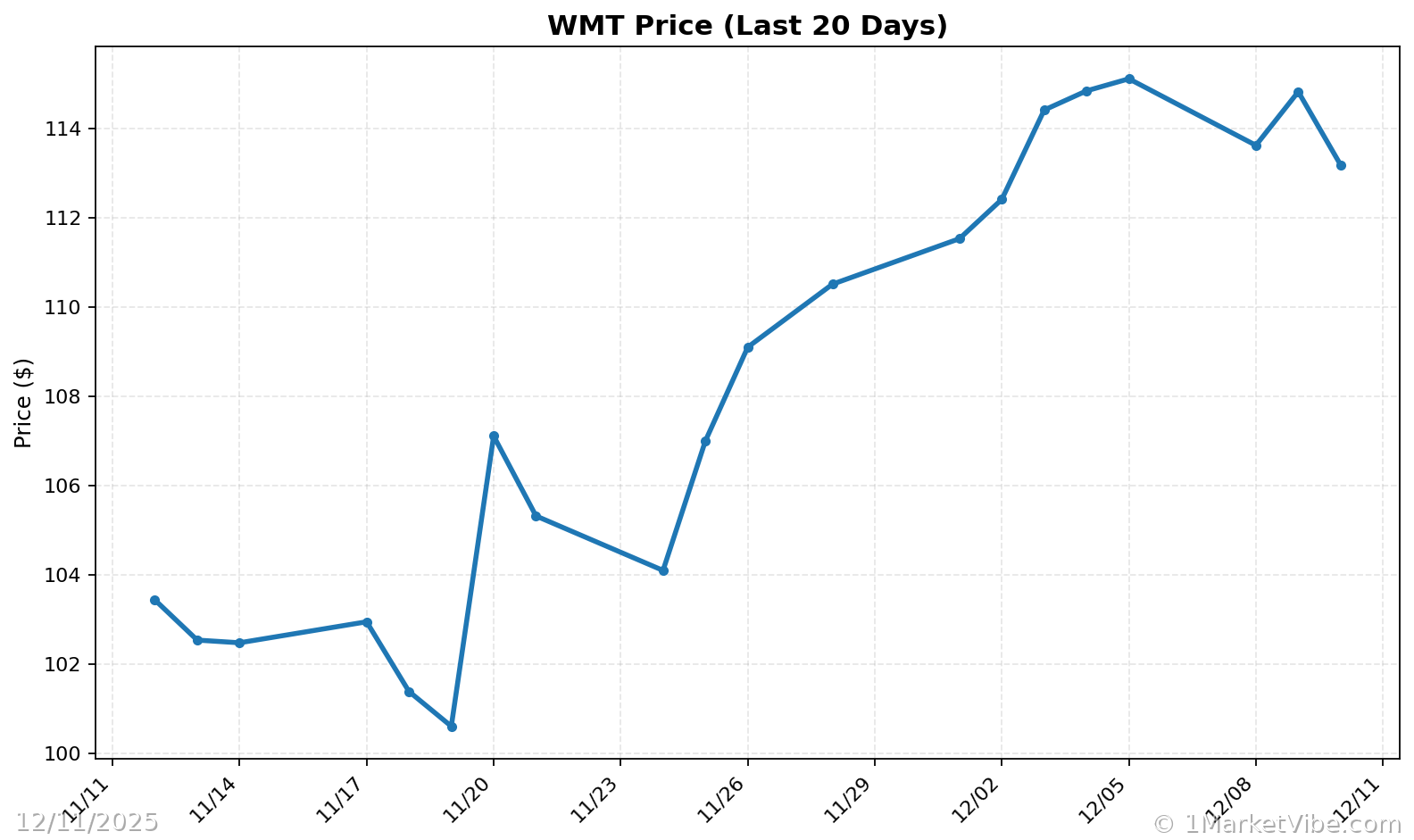

Investors have responded positively, with significant gains in key indices and sectors. The small-cap Russell 2000 index rose 1.45%, reflecting optimism in domestic growth prospects. Yet, the mixed signals from the Fed suggest that investors should remain vigilant. MarketVibe's CW Index, which provides early risk signals, has ticked up to 5.27, indicating a neutral sentiment but with potential volatility ahead.

What's Next

Looking forward, the Fed's next meeting on January 27-28, 2026, will be crucial as it will incorporate new labor market and price data. Investors should watch for further guidance from the Fed, especially regarding inflation targets and economic growth projections. Potential scenarios include continued rate cuts if economic conditions warrant, or a pause if inflationary pressures rise.

Conclusion

The Fed's latest rate cut presents both opportunities and challenges for investors. While the immediate market reaction has been positive, the underlying uncertainties necessitate careful portfolio management. Investors are advised to monitor risk signals and adjust strategies accordingly.

Track how markets respond in real-time at 1marketvibe.com.

Sources

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Charts