Market Shifts Following Fed Rate Cut: Key Insights for Investors

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Market Shifts Following Fed Rate Cut: Key Insights for Investors

Breaking News: The Federal Reserve has cut interest rates by 0.25% at its final meeting of 2025, marking the third reduction this year. This decision, announced on December 12, 2025, places the key overnight borrowing rate in the range of 3.5% to 3.75%. The move comes amid ongoing economic uncertainty and signals a cautious approach by the Fed as it rules out any immediate rate hikes.

Why It Matters

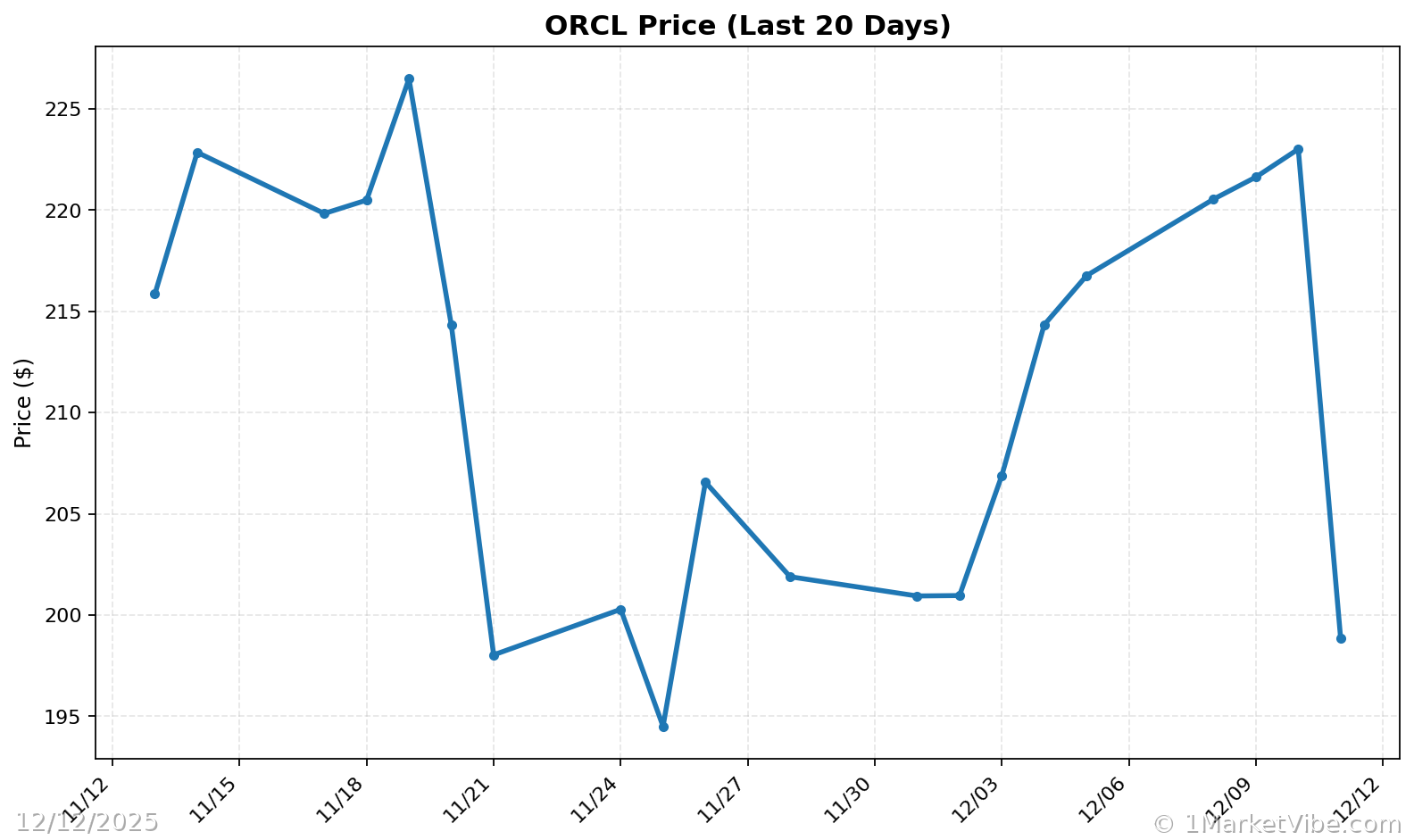

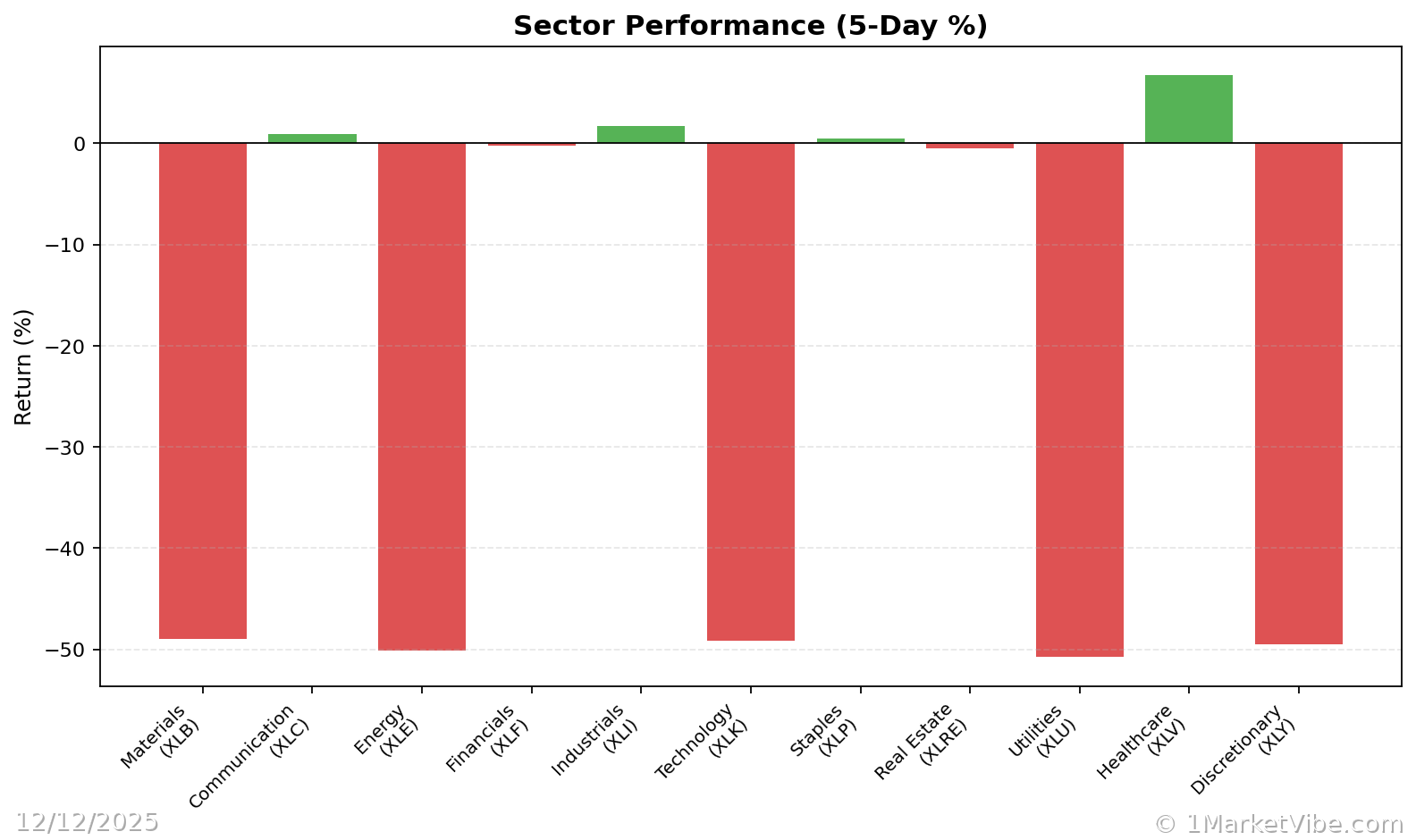

The immediate market impact was mixed, with major U.S. indexes reacting to the news. The Dow Jones Industrial Average surged by 646.26 points, closing at a record 48,704.01, while the S&P 500 also hit a new high, closing at 6,901.00. However, the Nasdaq Composite dipped slightly by 0.26%, reflecting investor concerns over tech stocks, particularly following disappointing earnings from Oracle. For investors, this rate cut suggests a potential shift in market dynamics, with smaller companies likely to benefit more due to lower borrowing costs.

Context & Background

Historically, rate cuts are used to stimulate economic growth by making borrowing cheaper, encouraging investment and spending. This latest cut follows a year of economic challenges, including fluctuating inflation rates and geopolitical tensions. The Fed's decision reflects a balancing act between fostering growth and managing inflation risks. Key stakeholders affected include tech companies, which are facing scrutiny over their AI investments, and small-cap stocks, which have seen a boost from the lower rates.

What's Next

Investors should watch for further market reactions as the implications of the Fed's decision unfold. Key events to monitor include upcoming economic data releases and any shifts in corporate earnings forecasts. The market sentiment may continue to fluctuate, particularly in sectors like technology and consumer goods. MarketVibe's CW Index, currently at 4.7, suggests a cautious outlook, highlighting potential risks and opportunities in the coming weeks.

Risks and Opportunities

While the rate cut aims to support economic growth, it also poses risks to market stability. Fed Chair Jerome Powell emphasized that there is "no risk-free path," indicating potential volatility ahead. Investors should consider strategies to mitigate risks, such as diversifying portfolios and adjusting exposure in affected sectors. Monitoring the CW Index can provide early signals of market shifts, helping investors navigate these uncertain times.

Conclusion

The Fed's rate cut is a significant development with far-reaching implications for the market. As investors digest the news, the focus will be on how these changes affect economic growth and market stability. Staying informed and proactive will be crucial in managing portfolio risks and capitalizing on emerging opportunities.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Charts