Impact of BOE's 3.75% Rate Cut on Global Markets

Breaking News: The Bank of England (BOE) has slashed its interest rate from 4% to 3.75%, marking the lowest level since February 2023. This decision, announced on December 19, 2025, was made by a narrow vote of 5-4 within the Monetary Policy Committee. The cut aims to stimulate economic activity amid stagnant growth forecasts and is expected to influence borrowing costs across the UK and beyond.

Why It Matters

For investors, this rate cut signals potential economic weakness, as central banks typically reduce rates to encourage spending and investment during sluggish economic periods. The immediate market reaction saw a mixed response, with UK equities initially rising due to cheaper borrowing costs, while the pound experienced a slight dip against major currencies. This move has broader implications, potentially setting a precedent for other central banks and affecting global investor sentiment.

Context & Background

Historically, rate cuts by major central banks like the BOE are pivotal moments that can ripple through global markets. The decision comes as the UK grapples with no expected economic growth by year-end, although inflation is anticipated to fall closer to the BOE's 2% target sooner than expected. Governor Andrew Bailey noted that while the path for further cuts is "gradual," each decision becomes "a closer call," reflecting the delicate balance the BOE must maintain between stimulating growth and controlling inflation.

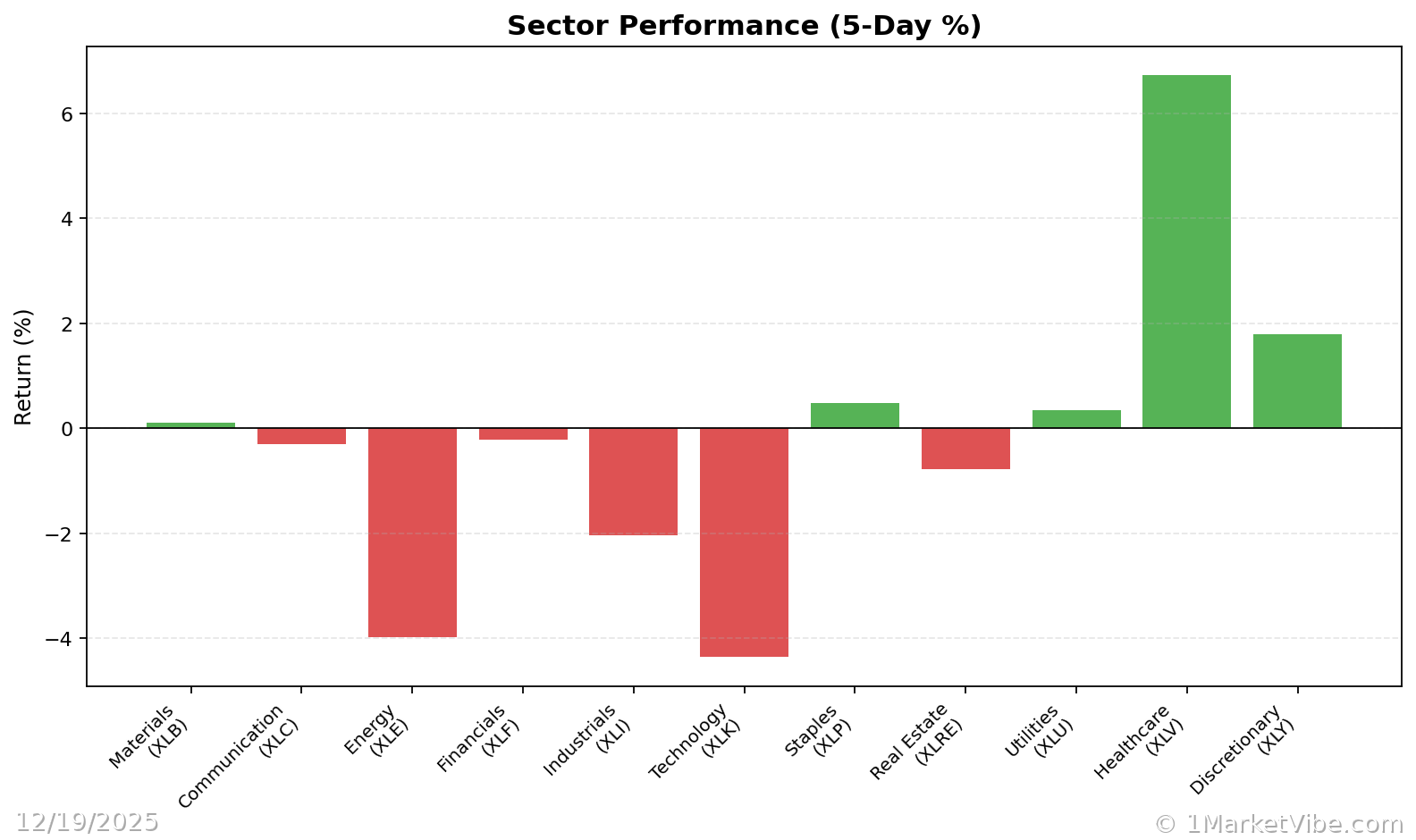

Market Reactions

- UK Equities: Initial uptick as investors anticipate cheaper borrowing costs could boost corporate profits.

- Currency Markets: The pound weakened slightly, reflecting concerns over the UK's economic outlook.

- Investor Sentiment: Mixed, with cautious optimism about growth prospects tempered by underlying economic concerns.

Global Market Impact

The interconnectedness of global financial systems means the BOE's decision could influence other central banks, particularly if economic conditions worsen. Investors worldwide are now recalibrating their strategies, considering potential ripple effects on interest rates and economic policies in other regions.

CW Index Connection

MarketVibe's CW Index, which provides early risk signals, ticked up to 6.21 following the BOE's announcement. This aligns with the predictive nature of the index, which had suggested a trend towards economic caution.

What's Next

Investors should closely monitor upcoming economic reports, particularly inflation data expected later this week, which could further influence central bank policies. The potential for additional rate adjustments remains, with the BOE indicating a cautious approach. In this volatile environment, maintaining a balanced portfolio and staying informed on economic indicators is crucial.

Conclusion

The BOE's rate cut to 3.75% is a significant move with immediate and far-reaching implications for global markets. As investors navigate this evolving landscape, staying informed and adaptable is key. Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts