Banking Sector on Alert as CW Index Signals Systemic Risk

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Banking Sector on Alert as CW Index Signals Systemic Risk

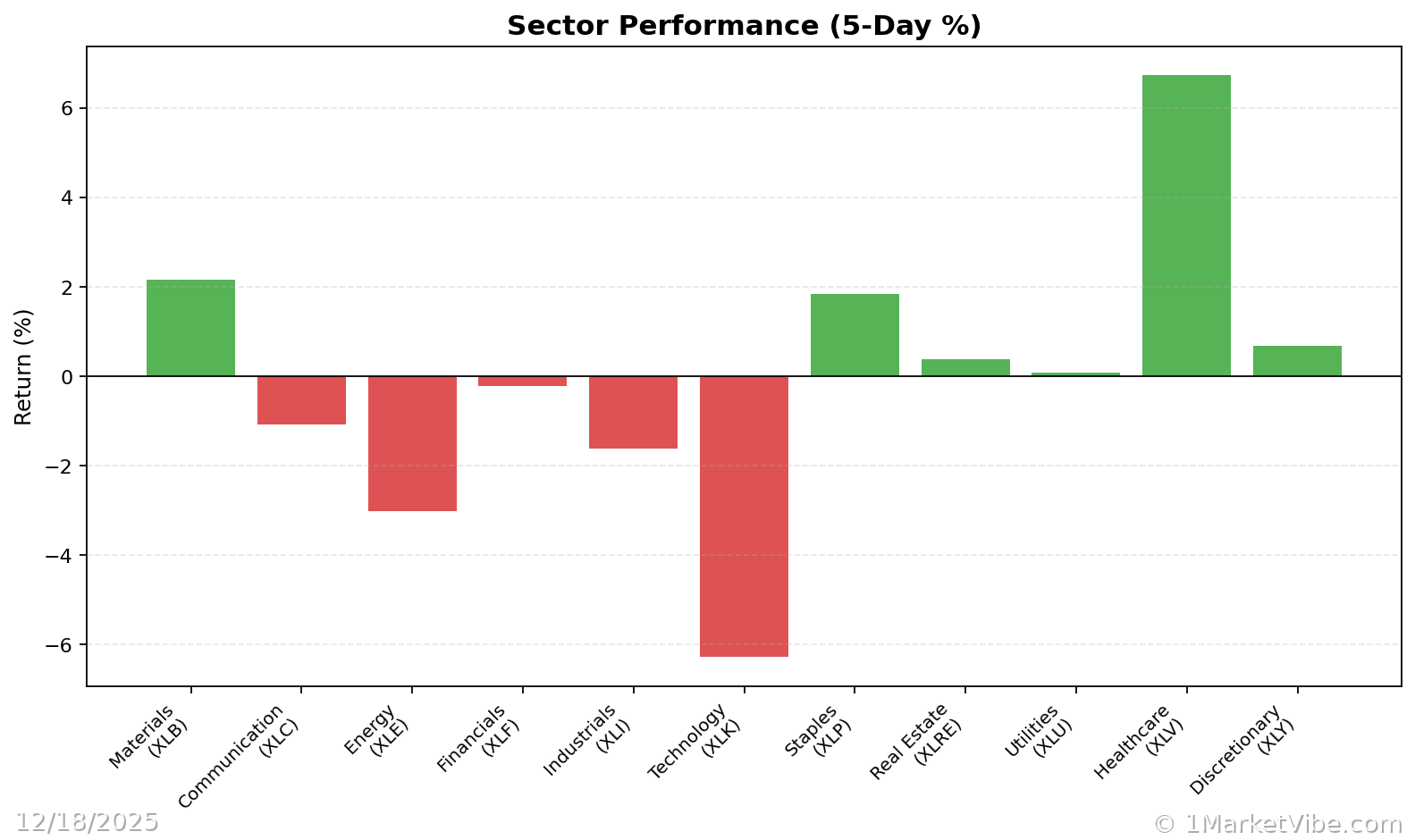

December 18, 2025 – In a development that has sent shockwaves through the financial markets, senior executives at Tricolor, a prominent subprime auto lender, have been charged with orchestrating a systematic fraud scheme. Prosecutors allege that these executives misrepresented collateral to secure billions of dollars in loans, a revelation that has heightened concerns about systemic risk within the banking sector. This news comes as MarketVibe's CW Index, a key risk indicator, signals an elevated risk environment with a reading of 6.29.

Why It Matters

For investors, the immediate impact is significant. The charges against Tricolor executives have not only tarnished the company's reputation but have also raised alarms about the stability of financial institutions linked to subprime lending. The broader implications suggest potential vulnerabilities in the banking sector, reminiscent of past financial crises. Market sentiment has shifted towards caution, with investors closely monitoring developments and potential ripple effects across the financial landscape.

Context & Background

Historically, fraud in the banking sector has often preceded broader financial instability. The Tricolor case echoes past incidents where fraudulent activities led to significant market disruptions. The current situation was precipitated by aggressive lending practices and inadequate oversight, which allowed Tricolor to inflate its financial standing. Key stakeholders, including banks and investors with exposure to subprime loans, are now reassessing their risk positions.

What's Next

Investors should watch for further regulatory actions and potential fallout in the banking sector. Upcoming announcements from financial institutions regarding their exposure to Tricolor could influence market dynamics. Additionally, the Federal Reserve's stance on interest rates, as highlighted by Fed chair candidate Christopher Waller's recent comments on maintaining central bank independence, may play a crucial role in shaping the economic outlook.

- Potential Scenarios:

- Increased regulatory scrutiny on subprime lenders

- Volatility in banking stocks

- Adjustments in monetary policy impacting interest rates

CW Index Analysis

The current CW Index reading of 6.29 underscores the heightened risk environment. This aligns with the systemic concerns raised by the Tricolor fraud charges, providing an early warning signal for investors to reassess their portfolio strategies. The CW Index's ability to anticipate risk trends offers a valuable tool for navigating uncertain market conditions.

Conclusion

As the situation unfolds, vigilance is key. Investors are advised to monitor developments closely and consider adjusting their risk exposure in affected sectors. The banking sector's response to these charges will be critical in determining the broader market impact.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.