AI Layoffs Surge as CW Index Signals Economic Warning

In a significant development, over 50,000 jobs have been cut in the artificial intelligence sector throughout 2025, marking a substantial shift in the employment landscape. This wave of layoffs, reported on December 22, 2025, has been felt across major tech hubs in the United States, including Silicon Valley and New York City. The layoffs come as companies recalibrate their workforce in response to evolving technological demands and economic pressures.

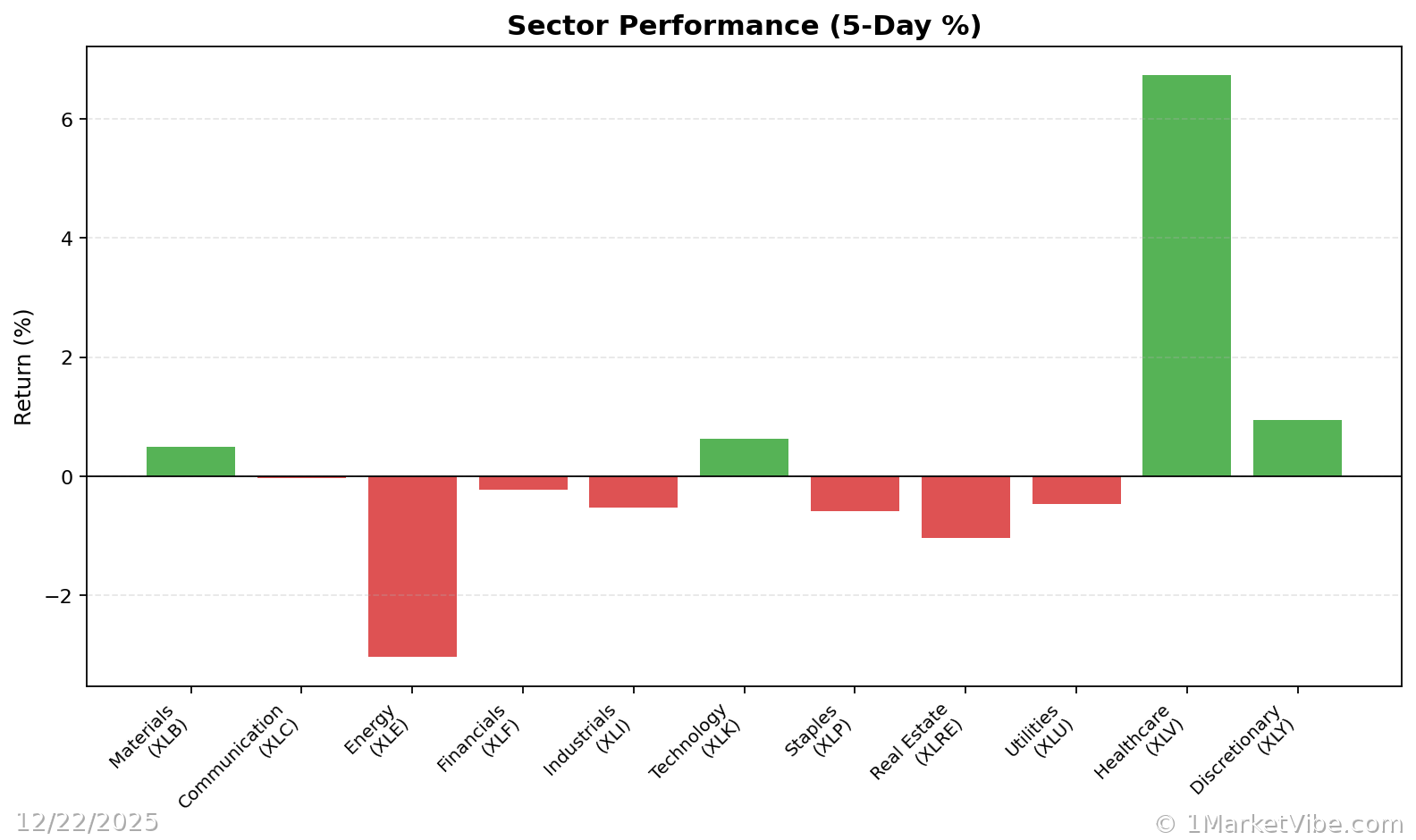

For investors, this surge in AI-driven layoffs is a critical signal of potential broader economic shifts. The immediate impact is a ripple effect through the tech sector, with potential implications for consumer spending and market confidence. MarketVibe's CW Index, which currently reads 5.11, has been tracking these developments, suggesting that such a trend was foreseeable. This index serves as an early warning system, highlighting increased risk levels in the market.

Context & Background

Historically, technological advancements have often led to workforce reductions, but the scale of these AI layoffs is unprecedented. The rapid integration of AI technologies has outpaced the ability of many workers to adapt, leading to significant job displacement. Key stakeholders, including tech giants and emerging startups, are navigating these changes, balancing innovation with workforce sustainability.

The current economic environment, characterized by fluctuating market conditions and consumer uncertainty, has exacerbated the situation. Companies are increasingly turning to AI to streamline operations and reduce costs, inadvertently leading to job losses. This trend is reminiscent of past industrial shifts, where automation led to similar employment challenges.

What's Next

Investors should closely monitor the tech sector for further developments. Key events to watch include quarterly earnings reports from major tech firms, which may provide insights into how companies are adjusting their strategies. Additionally, any policy changes or economic indicators that could influence market conditions will be crucial.

Potential scenarios include continued layoffs if economic pressures persist, or a stabilization if companies successfully integrate AI without further workforce reductions. Investors may consider adjusting their portfolios to mitigate risk, focusing on sectors less impacted by AI-driven changes.

Conclusion

The surge in AI layoffs is a stark reminder of the dynamic nature of the modern economy and the need for strategic investment decisions. As the market adapts, investors should remain vigilant, leveraging tools like the CW Index to navigate these changes effectively.

Monitor risk signals as this story develops at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Sources:

- The Washington Post

- AL.com

- The Cincinnati Enquirer