Greg Abel Assumes Leadership and Its Impact on Berkshire's Market Strategy

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Greg Abel Assumes Leadership and Its Impact on Berkshire's Market Strategy

Breaking News: Leadership Transition at Berkshire Hathaway

Greg Abel has officially taken the helm as CEO of Berkshire Hathaway, succeeding the legendary Warren Buffett as of January 1, 2026. This pivotal leadership change marks a new era for the conglomerate, headquartered in Omaha, Nebraska, and renowned for its diverse portfolio ranging from insurance to railroads. Abel, previously the Vice Chairman of Non-Insurance Operations, steps into this role at a time when Berkshire's market strategy is under intense scrutiny.

Why It Matters: Market Strategy and Investor Sentiment

For investors, this leadership transition is significant. Berkshire Hathaway's stock has already seen a 2.5% increase following the announcement, reflecting initial investor optimism. Abel's leadership style and strategic priorities could reshape Berkshire's investment approach, potentially influencing market dynamics and investor sentiment. The immediate impact is a heightened focus on how Abel will steer the company in a rapidly evolving economic landscape.

- Market Impact:

- Potential shifts in investment strategy

- Increased focus on sustainability and technology

- Possible realignment of portfolio priorities

Context & Background: From Buffett to Abel

Warren Buffett, known as the "Oracle of Omaha," has been the face of Berkshire Hathaway for over five decades, building it into a powerhouse with a market capitalization exceeding $700 billion. Greg Abel's rise to CEO has been anticipated since 2021 when he was named as Buffett's likely successor. Abel's track record includes steering Berkshire's energy division to significant growth, emphasizing renewable energy investments.

- Key Stakeholders Affected:

- Shareholders anticipating strategic shifts

- Subsidiary companies within Berkshire's vast portfolio

What's Next: Monitoring Strategic Shifts

Investors should watch for Abel's first major strategic announcements, expected in the upcoming quarterly earnings call in February 2026. Potential scenarios include a stronger emphasis on tech investments or a pivot towards more sustainable business practices. MarketVibe's CW Index, currently at 5.53, suggests a stable risk environment, but investors should remain vigilant for any shifts in sentiment as Abel's strategy unfolds.

- Upcoming Events:

- February 2026 earnings call

- Potential strategic announcements

- Market reactions to initial decisions

Conclusion

Greg Abel's leadership marks a transformative period for Berkshire Hathaway, with potential implications for its market strategy and investor confidence. As the company navigates this transition, investors are advised to stay informed and consider how these changes might affect their portfolios.

Track how markets respond in real-time at 1marketvibe.com.

Sources:

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

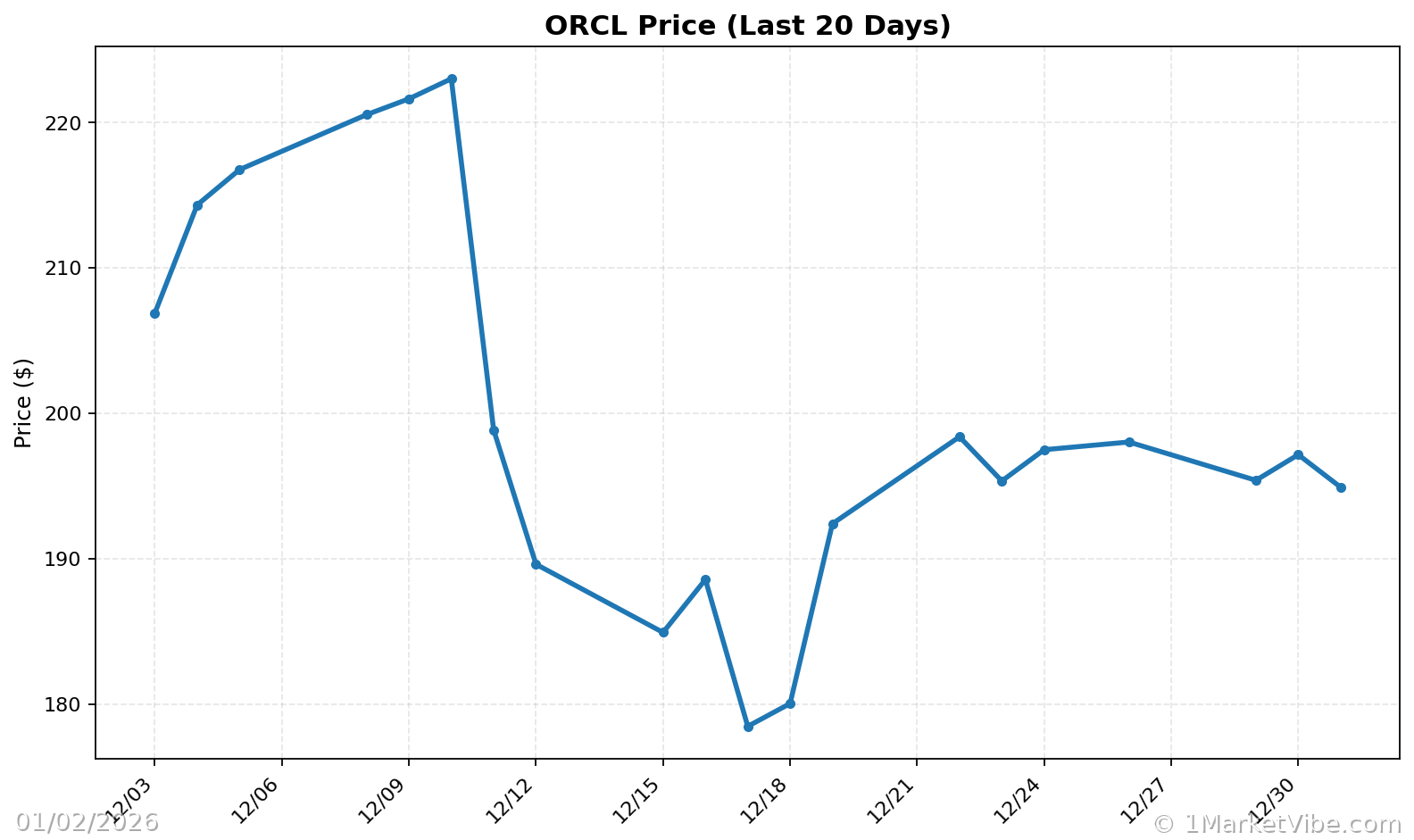

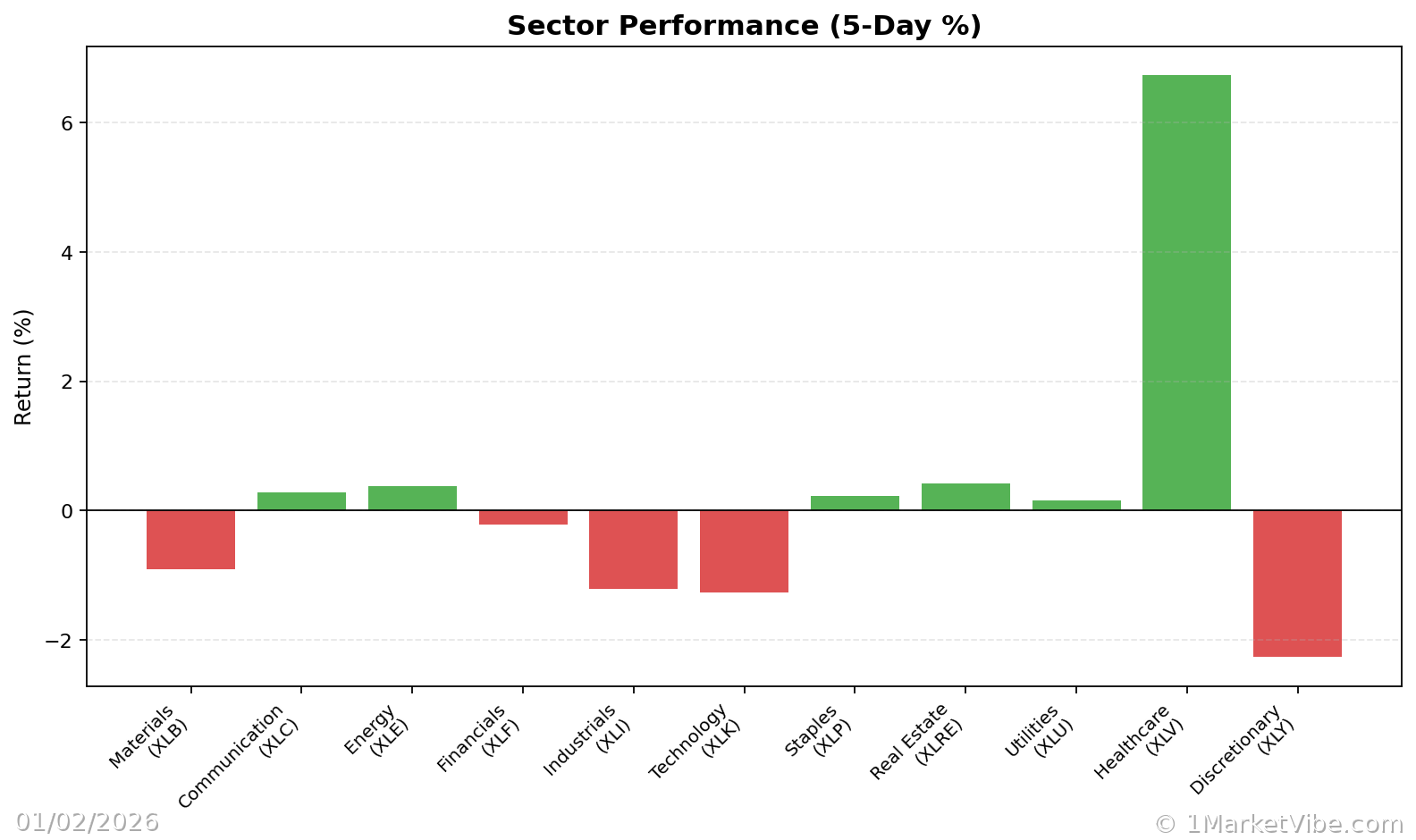

Charts