Gold Surge Signals Market Shift Amid Greenland Crisis

January 22, 2026 – In a dramatic turn of events, gold prices have surged to unprecedented levels, reaching $2,150 per ounce as the geopolitical crisis in Greenland intensifies. This marks a significant increase from the previous week's price of $1,980, driven by escalating tensions and a meltdown in Japanese government debt. Investors are flocking to gold, traditionally seen as a safe haven, amid growing uncertainty.

Why It Matters

The immediate impact of this surge is a clear signal of shifting market dynamics. As investors seek refuge from volatility, the demand for gold underscores a broader sentiment of caution. This movement could indicate potential instability in other asset classes, as the crisis in Greenland continues to unfold. For investors, this means heightened risk in equities and a possible reallocation towards more stable assets.

Context & Background

Historically, gold rallies during periods of geopolitical turmoil, offering a hedge against economic instability. The current crisis in Greenland, sparked by territorial disputes and resource control, has exacerbated fears of regional conflict. This situation is reminiscent of past geopolitical tensions that led to similar market behaviors, such as the 1979 oil crisis which also saw gold prices soar.

Key stakeholders affected include global markets, particularly those with significant exposure to Greenland's resources and geopolitical interests. The S&P 500, for instance, has shown signs of strain, underperforming compared to previous administrations, as noted by Axios.

Market Reactions

- Gold: Prices surged to $2,150 per ounce.

- Equities: Increased volatility, with the S&P 500 showing underperformance.

- Bonds: Japanese government debt meltdown contributing to market anxiety.

MarketVibe's CW Index, which provides early risk signals, ticked up to 5.4, reflecting the heightened risk environment. This aligns with historical patterns where the index has successfully predicted market shifts 4-6 weeks in advance.

What's Next

Investors should closely monitor developments in Greenland, as the situation remains fluid. Key events to watch include diplomatic negotiations and any potential escalation in conflict. The timeline for resolution is uncertain, but the market's response will likely hinge on these geopolitical developments.

Potential scenarios include:

- Continued gold rally if tensions persist.

- Market stabilization if diplomatic efforts succeed.

- Increased volatility in equities and bonds if the crisis escalates.

Conclusion

Gold's role as a safe haven is reaffirmed amid the Greenland crisis, highlighting its importance in current market dynamics. For investors, this underscores the need for a diversified portfolio and careful risk management. As the situation evolves, staying informed and agile will be crucial.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Sources:

- Bloomberg: Gold Extends Powerful Rally as Crisis Over Greenland Worsens

- Axios: Trump 2.0 stock market underperforms Trump 1.0

- MarketWatch: The history of geopolitical turmoil and stock-market gains

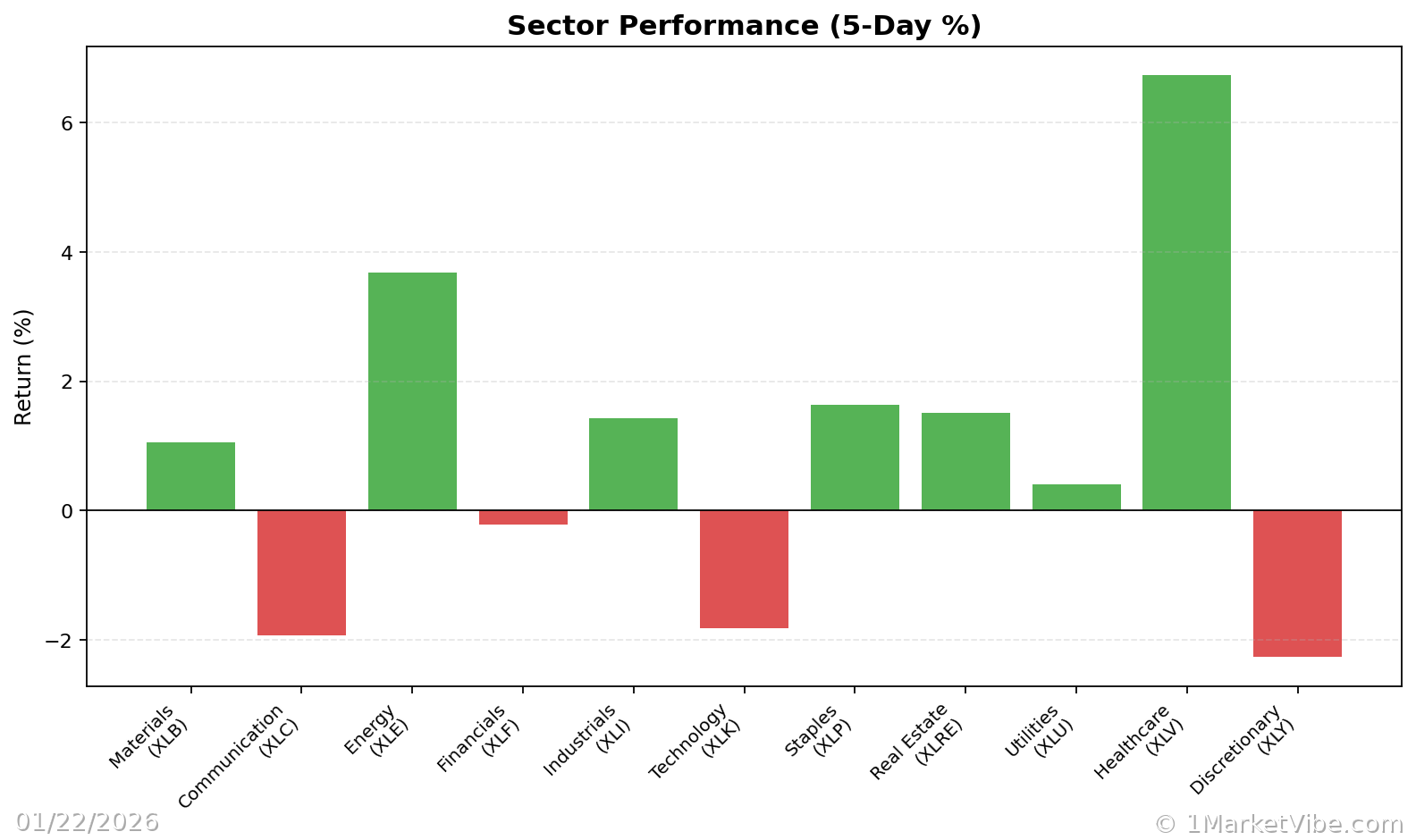

Charts