Global Bond Slide Indicates Market Risk Insights

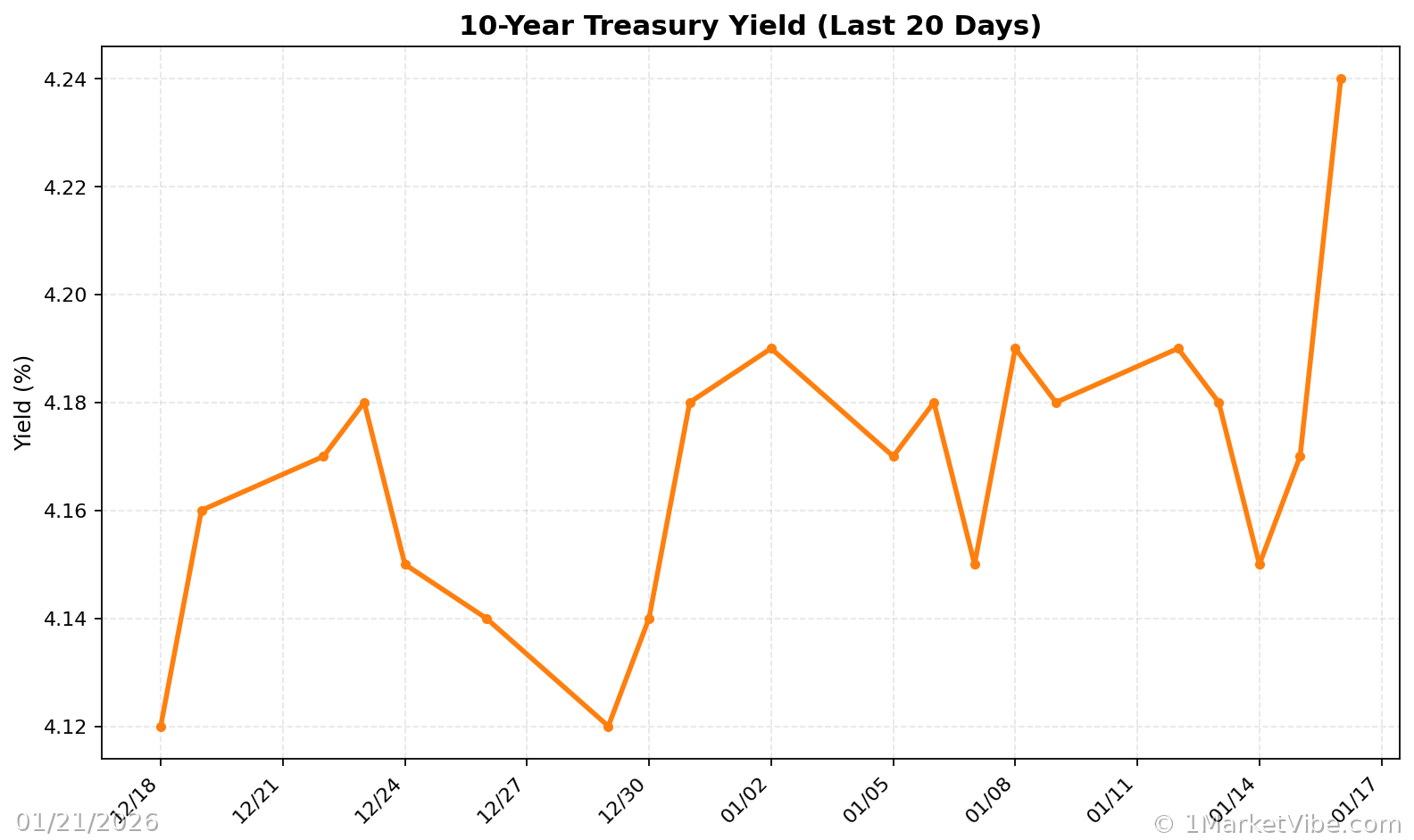

January 21, 2026 – In a dramatic turn, global bond markets have experienced a significant slide, with Treasury yields climbing to their highest levels in over four months. This movement, sparked by a selloff in Japanese bonds, has reverberated across international markets, intensifying concerns about the stability of global financial systems. The bond market turbulence is further exacerbated by ongoing tariff discussions, which have injected additional uncertainty into investor sentiment.

Why It Matters

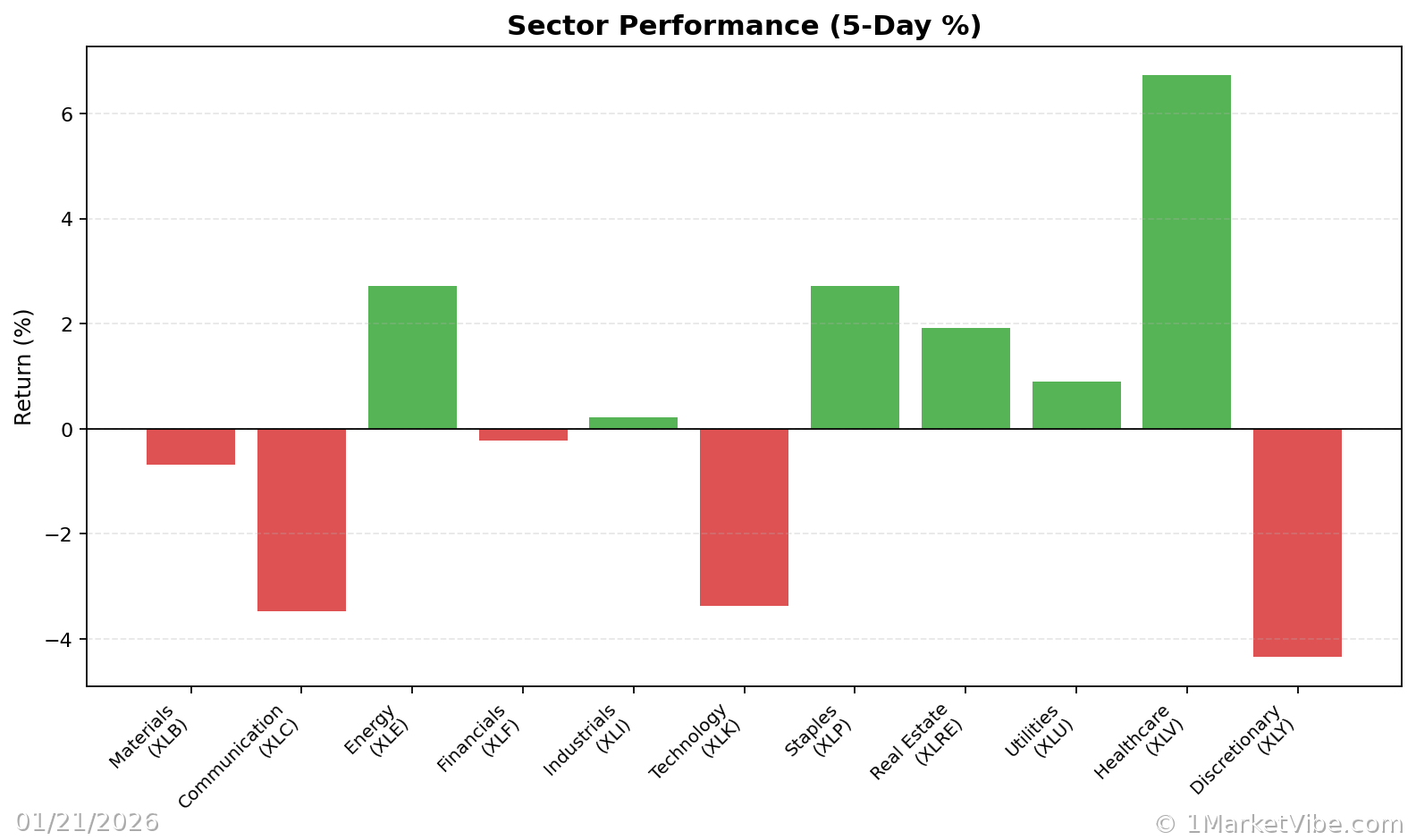

For investors, this bond market decline signals a potential shift in risk dynamics. The immediate impact is a rise in borrowing costs, which could slow economic growth and affect corporate profitability. The broader implications are profound: as bond yields rise, the attractiveness of equities may diminish, prompting a reevaluation of investment strategies. This development aligns with MarketVibe's CW Index, which has increased to 5.9, indicating heightened market risk.

Context & Background

Historically, bond market volatility has often preceded broader financial instability. The current slide is reminiscent of past episodes where geopolitical tensions, such as tariff disputes, have led to market disruptions. The recent selloff was triggered by fears of an impending trade conflict, as the European Union considers a 'trade bazooka' to counteract U.S. tariffs. Key stakeholders, including multinational corporations and central banks, are closely monitoring these developments, as they could influence monetary policy and global trade flows.

What's Next

Investors should watch for upcoming central bank meetings, which may provide further guidance on interest rate policies. Additionally, any developments in tariff negotiations will be crucial in determining the market's direction. Potential scenarios include a stabilization of bond yields if geopolitical tensions ease, or further volatility if trade disputes escalate.

MarketVibe's enhanced CW Index continues to serve as an early warning system, offering insights into potential risk shifts. As the situation unfolds, investors are advised to remain vigilant and consider adjusting their portfolios to mitigate exposure to rising bond yields.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This content is for informational purposes only and should not be considered as financial advice. Market conditions can change rapidly and unpredictably.

Charts