Dow Rallies 400 Points Amid Geopolitical Tensions

Breaking News: The Dow Jones Industrial Average surged by 400 points on January 23, 2026, closing at 49,784.01, as geopolitical tensions eased following President Donald Trump's decision to cancel planned tariffs on European imports. This unexpected move sparked a broad-based market rally, with the S&P 500 and Nasdaq also posting significant gains, closing at 6,913.35 and 23,436.02, respectively.

Why It Matters

For investors, this rally represents a temporary reprieve from recent market volatility driven by geopolitical uncertainties. The cancellation of tariffs, which were set to begin on February 1, alleviated immediate concerns about potential trade disruptions between the U.S. and Europe. This development has injected a dose of optimism into the markets, as evidenced by the sharp uptick in stock prices. However, the broader implications suggest that while the immediate threat has been averted, underlying tensions remain, warranting cautious optimism.

Context & Background

The market's reaction comes on the heels of President Trump's announcement at the World Economic Forum in Davos, Switzerland, where he confirmed the suspension of tariffs and hinted at a "framework" deal concerning Greenland with NATO Secretary General Mark Rutte. This announcement reversed the negative sentiment that had gripped the markets earlier in the week when the tariffs were initially proposed. Historically, such geopolitical maneuvers have led to short-term market volatility, as seen in previous tariff-related announcements.

What's Next

Investors should keep a close watch on upcoming geopolitical developments, particularly any further statements from the White House regarding international trade policies. The situation remains fluid, and while the current sentiment is positive, any shifts in policy could quickly alter market dynamics. Additionally, the labor market's stability, as indicated by recent jobless claims data, will play a crucial role in sustaining market resilience.

CW Index Signals

MarketVibe's CW Index, currently reading at 5.5, aligns with this temporary market reprieve, suggesting that recent trends were anticipated. Investors are advised to monitor this index for early risk signals as the geopolitical landscape evolves.

Conclusion

The Dow's 400-point surge is a reminder of the market's sensitivity to geopolitical developments. While the immediate impact is positive, investors should remain vigilant and prepared for potential volatility. Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Sources

- CNBC: Dow jumps 400 points as stocks rebound

- MarketWatch: Jobless claims point to a more stable labor market

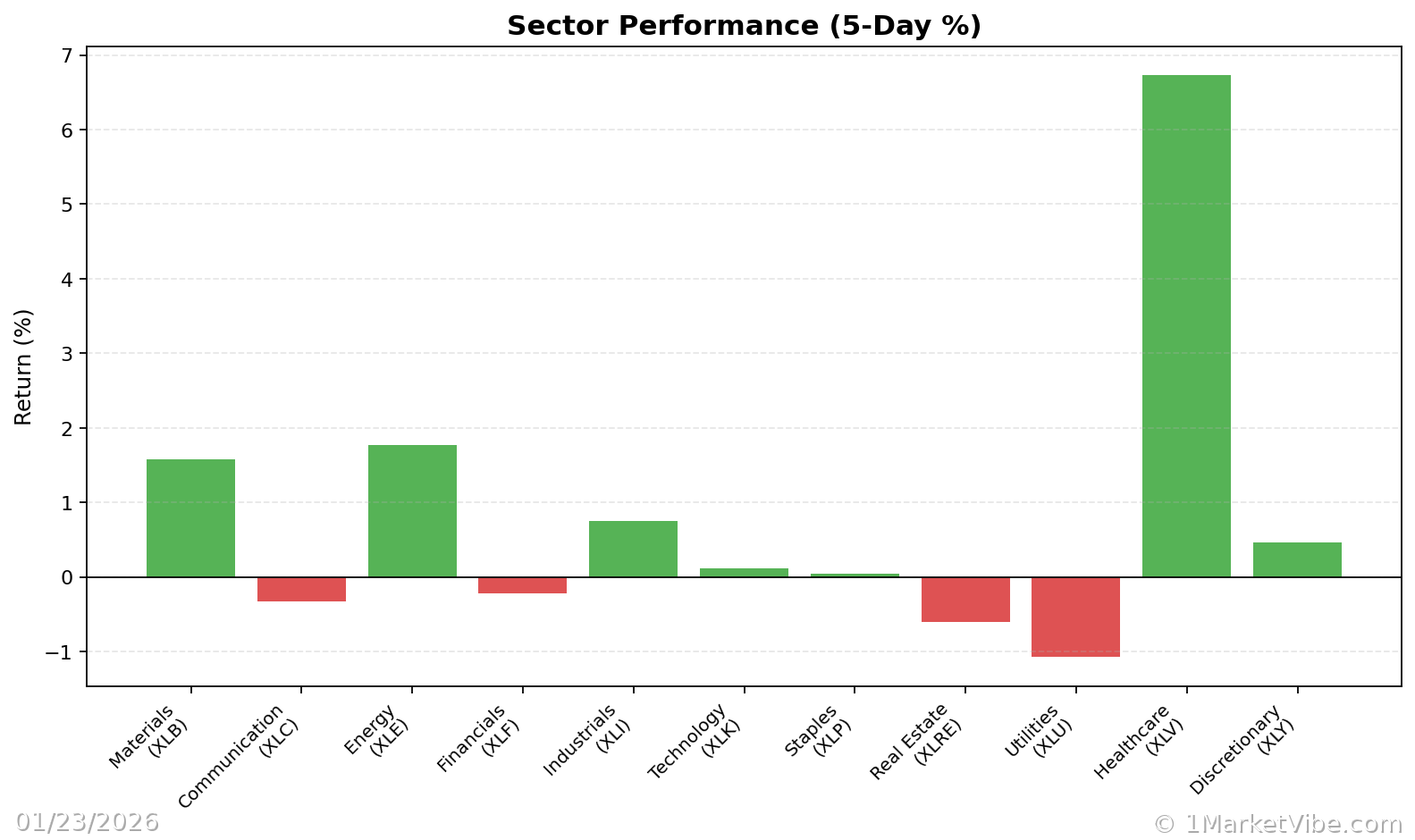

Charts