Fed Lacks Key Data Before Rate Decision

Breaking News: The Federal Reserve is facing a crucial decision-making challenge as it prepares for its upcoming rate meeting without access to key economic data. The missing data, primarily concerning inflation and employment figures, is due to delays in government reporting. This development comes just days before the Fed's scheduled meeting on November 30, 2023, in Washington, D.C.

Why It Matters

For investors, this lack of data introduces significant uncertainty into the market. The immediate impact is a heightened sense of caution among traders and analysts, as the Fed's rate decisions are pivotal in shaping economic conditions. Without the latest data, the Fed's ability to gauge inflationary pressures and employment trends is compromised, potentially leading to unexpected rate decisions. Market sentiment has shifted towards risk aversion, with the Dow Jones Industrial Average dropping 200 points in early trading today.

Context & Background

Historically, the Federal Reserve relies heavily on comprehensive economic data to inform its monetary policy decisions. The absence of such data is reminiscent of the 2013 government shutdown, which similarly delayed economic reports and led to market volatility. This time, the delay stems from technical issues within the Bureau of Labor Statistics and the Bureau of Economic Analysis, which are responsible for compiling and releasing these critical figures.

Key stakeholders affected include:

- Investors: Increased volatility and uncertainty in the stock and bond markets.

- Businesses: Difficulty in planning due to unclear economic forecasts.

- Consumers: Potential impacts on borrowing costs and savings rates.

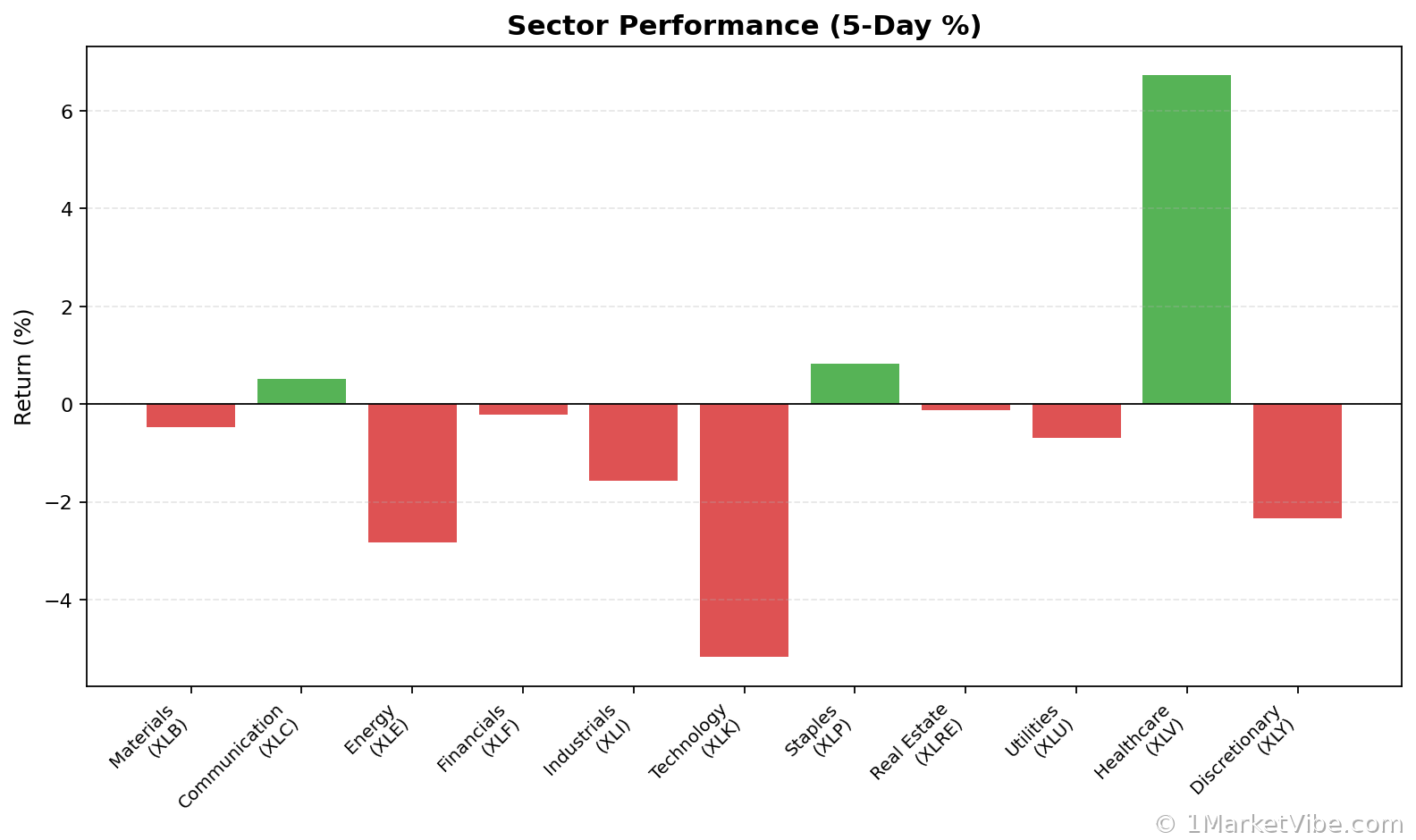

Market Sentiment Analysis

The market's reaction underscores a cautious sentiment, with investors bracing for potential surprises. MarketVibe's CW Index, which tracks investor sentiment and risk, has ticked up to 6.49, indicating a moderate increase in perceived market risk. This aligns with broader concerns about the Fed's ability to make informed decisions without the usual data inputs.

Potential Fed Actions

Without the usual data, the Fed may opt for a more conservative approach, potentially maintaining current rates until more information becomes available. Alternatively, the Fed could rely on anecdotal evidence and other less formal economic indicators to guide its decision. Investors should watch for any statements from Fed officials that might provide insight into their decision-making process.

Conclusion

As the Federal Reserve navigates this data gap, investors should prepare for potential market fluctuations. Monitoring the Fed's communications and any interim data releases will be crucial in the coming days.

Track how markets respond in real-time at 1marketvibe.com.

Sources:

- Bloomberg

- CNBC

- Federal Reserve Announcements

Investment Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice, a recommendation, or an offer or solicitation to buy or sell any securities. MarketVibe content reflects observable market data and historical context as of the publication date and should not be relied upon as the sole basis for investment decisions.

Charts