Fed Rate Decision Uncertainty Amid Inflation Data Delays

Breaking News: The Federal Reserve's upcoming rate decision faces heightened uncertainty as critical inflation data, originally scheduled for release this week, has been delayed. This unexpected postponement leaves the Fed without key metrics needed to assess economic conditions accurately. The delay, announced on October 15, 2023, has sent ripples through financial markets, with investors grappling with the implications for interest rate policy.

Why It Matters

For investors, the absence of timely inflation data injects a significant layer of unpredictability into the Fed's decision-making process. Markets thrive on certainty, and this delay disrupts the usual flow of information that guides monetary policy. The immediate impact is a rise in market volatility, as evidenced by the Dow Jones Industrial Average experiencing a 300-point swing in intraday trading. The broader implications are profound, as the Fed's rate decisions influence borrowing costs, investment strategies, and economic growth projections.

Context & Background

Historically, the Fed relies heavily on inflation data to calibrate interest rates, aiming to balance economic growth with price stability. In past instances, such as the 2013 government shutdown, data delays led to cautious Fed decisions, often erring on the side of maintaining current rates until more information became available. The current economic landscape, marked by post-pandemic recovery and geopolitical tensions, adds complexity to the Fed's task. Key stakeholders, including businesses and consumers, face uncertainty in planning for future expenses and investments.

Market Reactions

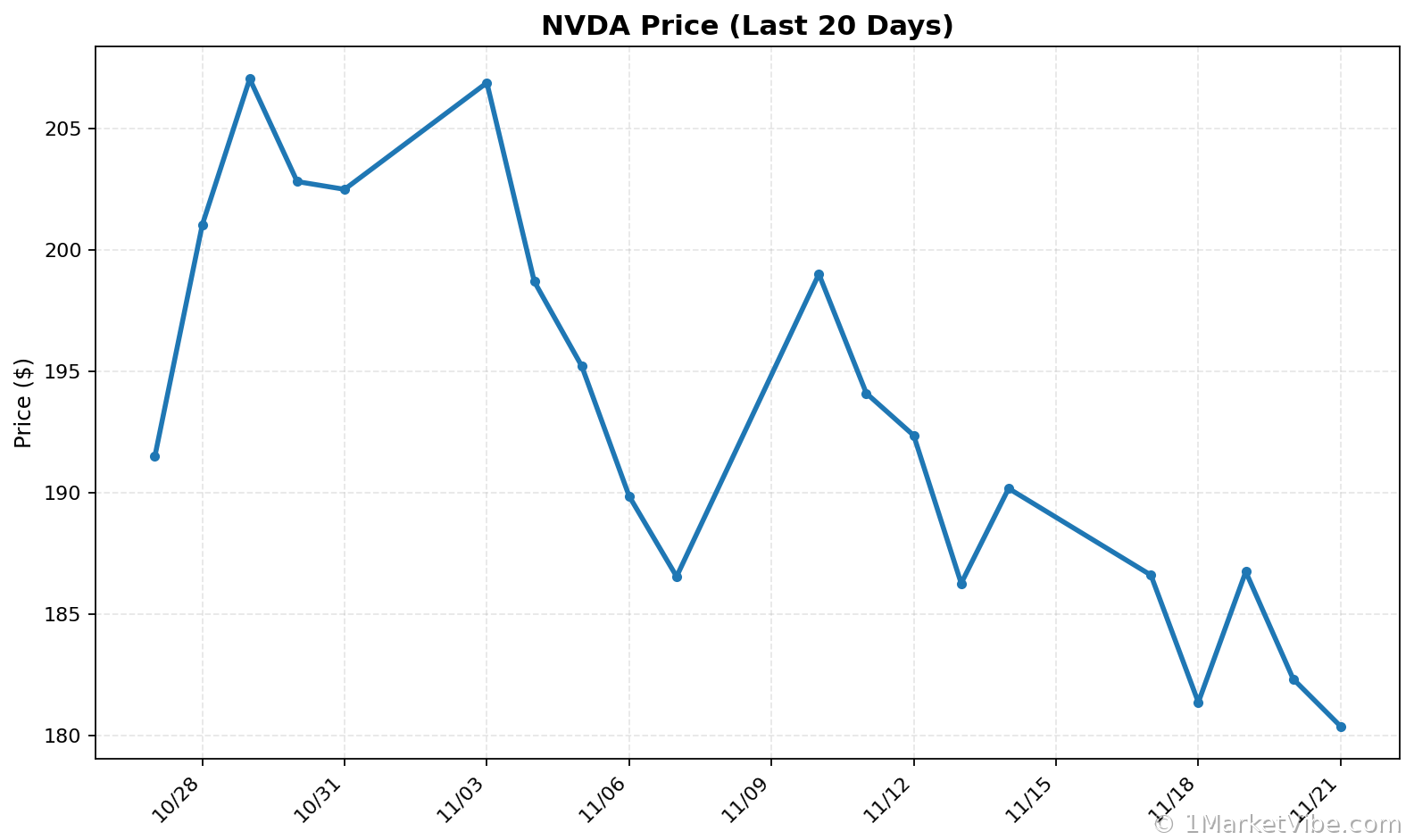

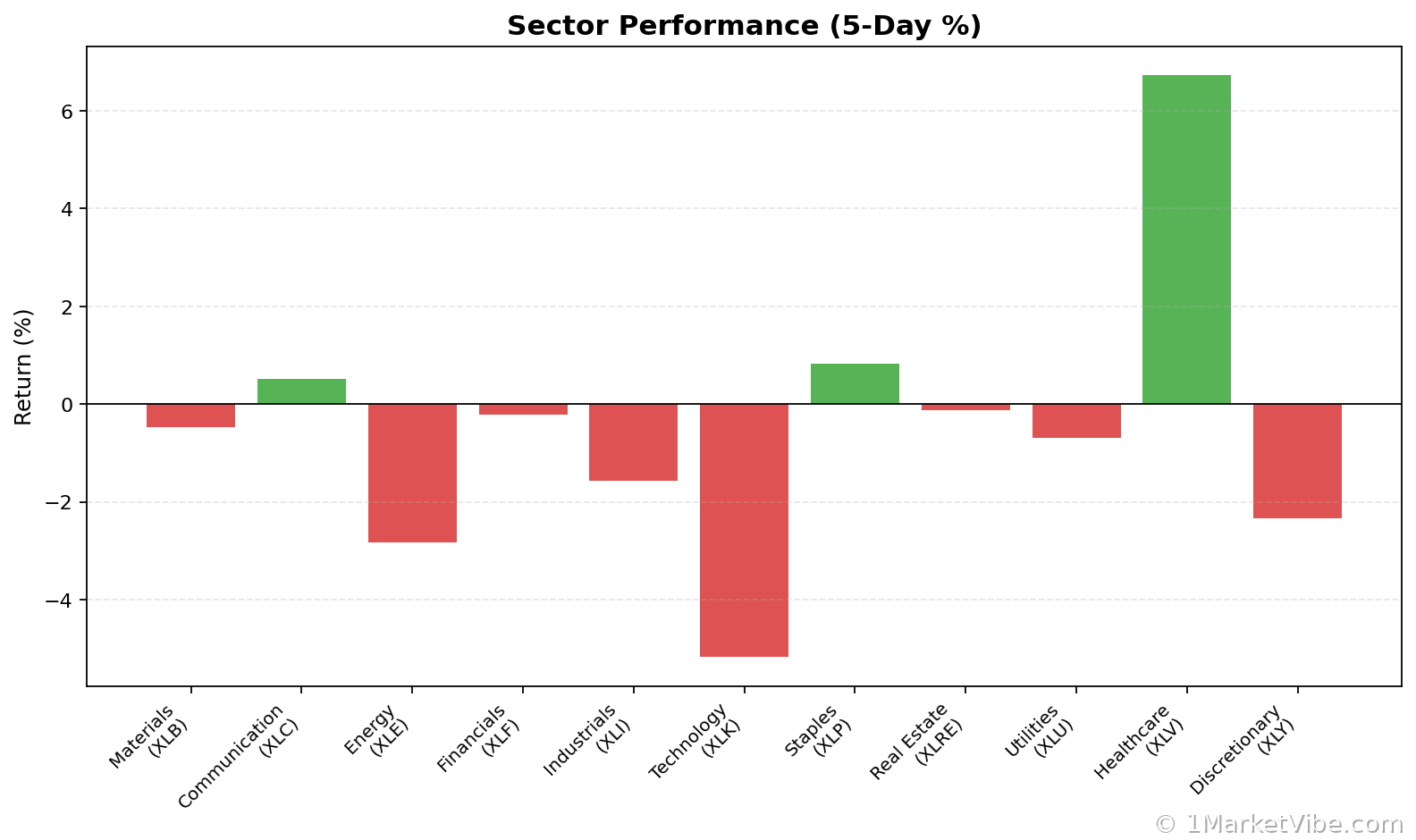

Recent market movements underscore the heightened anxiety among investors. The S&P 500 and Nasdaq Composite both saw increased trading volumes, reflecting a sentiment shift towards caution. Investor sentiment, as tracked by MarketVibe's CW Index, has ticked up to 6.49, indicating a moderate risk environment. This aligns with broader market trends, where sectors sensitive to interest rates, such as real estate and technology, show increased volatility.

Fed's Communication Strategy

In response to the data delay, the Fed has emphasized transparency, aiming to maintain market confidence. Fed Chair Jerome Powell noted the importance of clear communication during uncertain times, stating that "the Fed remains committed to its dual mandate of promoting maximum employment and stable prices." This approach is crucial in preventing panic and ensuring that market participants have a clear understanding of the Fed's policy direction.

Potential Risks

The risks associated with delayed data are multifaceted. For investors, this means potential mispricing of assets and increased difficulty in forecasting economic conditions. Sectors reliant on consumer spending and interest rates, such as housing and automotive, may face the brunt of this uncertainty. Investors are advised to consider hedging strategies and adjust risk exposure accordingly, especially if the CW Index continues to trend upwards.

Conclusion

The Fed's rate decision uncertainty amid inflation data delays presents a challenging environment for investors. As the situation develops, monitoring market responses and adjusting strategies will be crucial. Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Sources

- Bloomberg: Trump Team Internally Floats Idea of Selling Nvidia H200 Chips to China

- CBS News: Transportation Department urges "dressing with respect" on flights

- CNBC: Dow surges 500 points in big market rebound after steep sell-off this week

Charts