Breaking News: BHP Sets Its Sights on Anglo American Once More

BHP Group has made a fresh takeover approach to Anglo American Plc, aiming to disrupt the London-listed miner's planned acquisition of Canada's Teck Resources Ltd. This strategic move by BHP, the world's largest mining company, was reported by Bloomberg on November 24, 2025, highlighting a significant development in the mining sector. The offer's specifics, including the proposed acquisition price, remain undisclosed at this time.

Why It Matters

For investors, this development signals potential volatility in the mining sector. BHP's aggressive strategy could lead to a reshuffling of market dynamics, affecting stock valuations and investor sentiment. The immediate impact is a heightened interest in both BHP and Anglo American shares, with potential ripple effects across the industry. This move also underscores the competitive pressures within the mining sector as major players vie for strategic assets to bolster their market positions.

Context & Background

Historically, BHP has shown interest in expanding its portfolio through acquisitions, with previous attempts to merge with other mining giants. The current approach towards Anglo American comes amid Anglo's ongoing negotiations to acquire Teck Resources, a deal that would significantly enhance its copper and zinc production capabilities. Key stakeholders in this unfolding drama include shareholders of BHP, Anglo American, and Teck, who are closely monitoring the developments for any shifts in strategic direction.

What's Next

Investors should watch for responses from Anglo American, which may include either a rejection or a counter-offer. The timeline for these developments is uncertain, but any announcements could significantly impact stock prices and market sentiment. Additionally, regulatory scrutiny is likely, given the scale of the potential acquisition.

- Potential Scenarios:

- Anglo American accepts BHP's offer, leading to a significant merger.

- Anglo American rejects the offer, continuing with its acquisition of Teck.

- Regulatory challenges arise, delaying or altering the acquisition plans.

Market Reactions

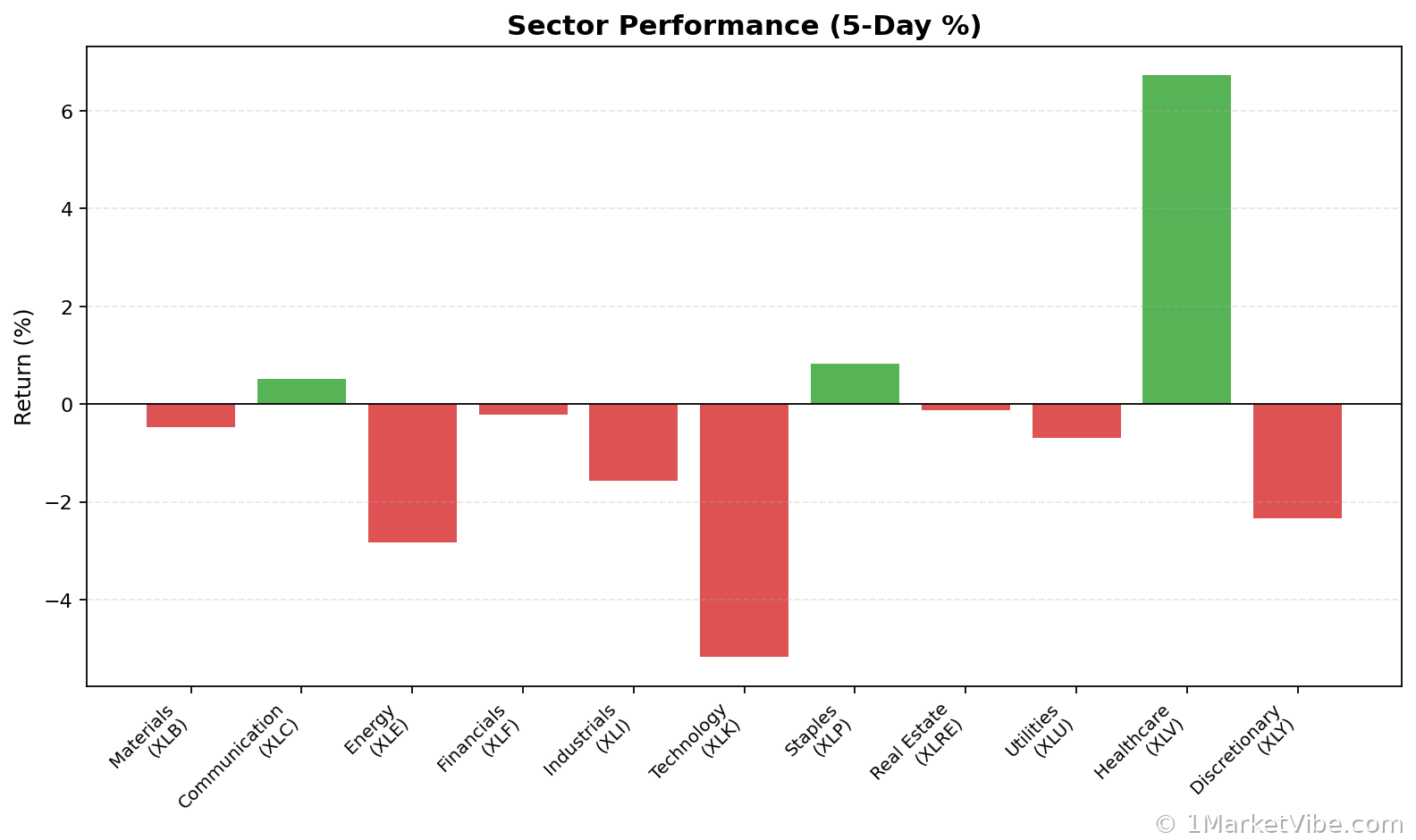

Following the announcement, investor sentiment has been mixed. BHP's stock showed a slight uptick, reflecting optimism about potential growth. Conversely, Anglo American's shares experienced volatility as investors weighed the implications of the takeover bid. MarketVibe's CW Index, while not directly influenced by this event, provides a broader risk environment that investors should consider when adjusting their portfolios.

Industry Implications

This potential acquisition could reshape the competitive landscape of the mining industry. A successful takeover would not only increase BHP's market share but also pressure other mining companies to pursue similar strategic expansions. The broader effects could include shifts in commodity prices and increased consolidation within the sector.

Risks and Considerations

Investors should be aware of the financial risks associated with large-scale acquisitions, including potential debt increases and integration challenges. Regulatory hurdles are also a significant consideration, as antitrust authorities may scrutinize the deal to ensure fair competition.

Conclusion

The unfolding scenario between BHP and Anglo American is a critical development for investors in the mining sector. Monitoring the situation closely will be essential as it evolves. Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly and unpredictably.