Dow Surges 500 Points as CW Index Indicates Upcoming Volatility

Breaking News: The Dow Jones Industrial Average soared by 500 points on Friday, closing at 46,245.41, marking a significant rebound after a turbulent week. This surge comes as New York Federal Reserve President John Williams hinted at a potential interest rate cut in December, sparking optimism among investors. The Nasdaq Composite and S&P 500 also saw gains, closing up 0.88% and 0.98% respectively.

Why It Matters

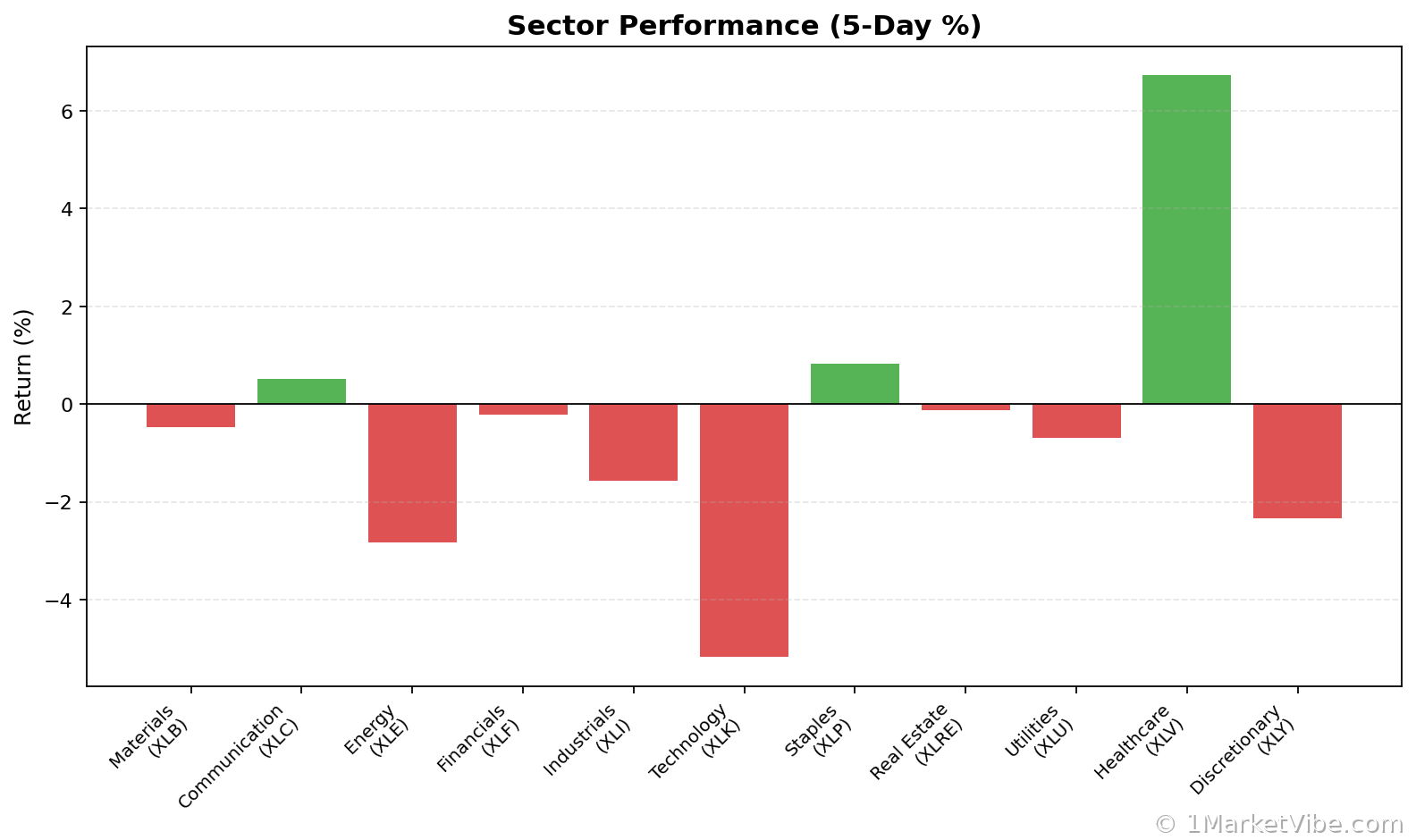

For investors, this rally signals a temporary relief from the week's earlier losses, but it also highlights the underlying market volatility. The potential rate cut, now seen as more likely with a 70% probability according to the CME FedWatch tool, could stimulate consumer spending and boost sectors like retail and technology. However, the broader implications suggest a cautious approach as the market remains sensitive to economic data and Fed decisions.

Context & Background

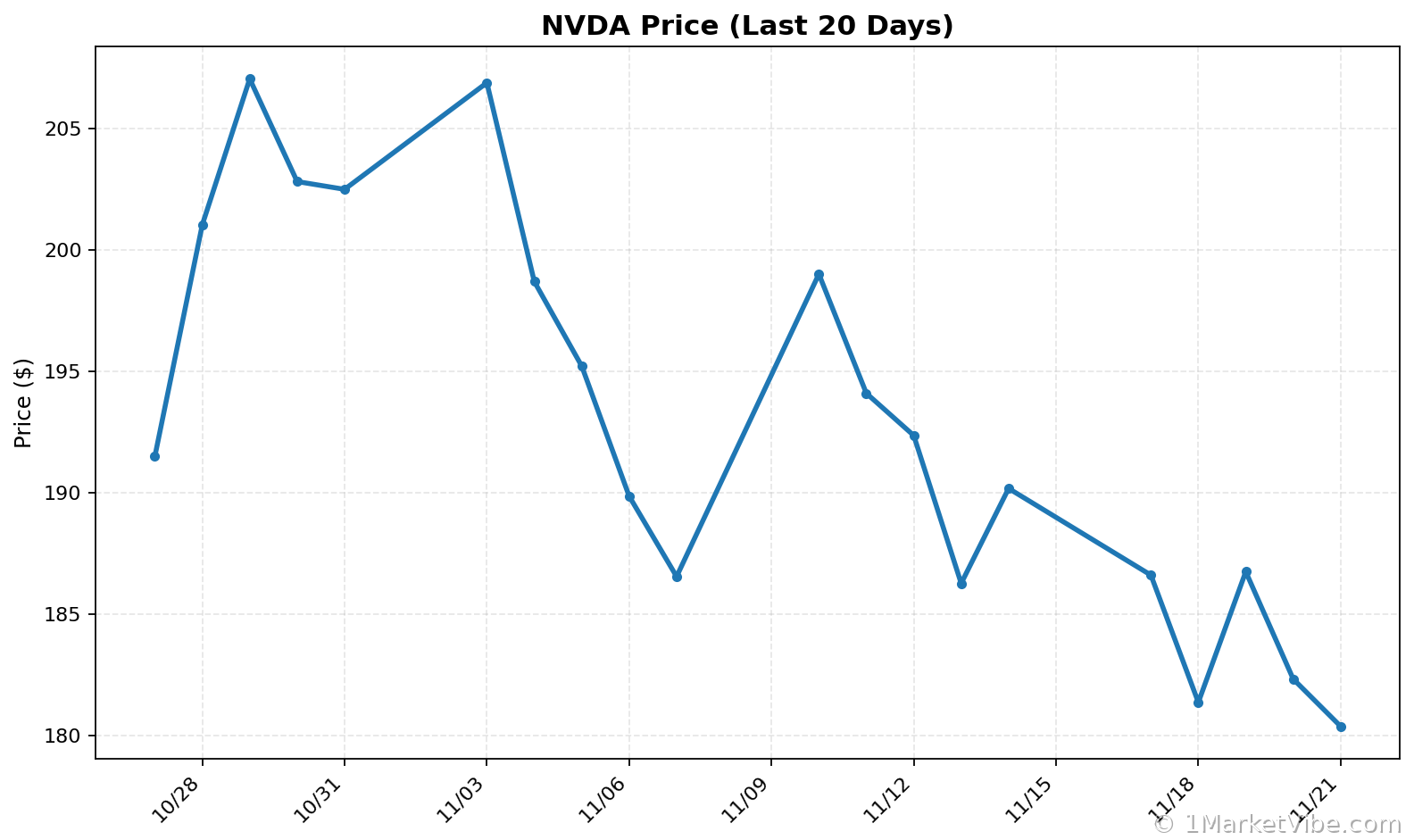

This week's market activity has been a rollercoaster, with the Dow experiencing a sharp decline earlier due to concerns over the Federal Reserve's monetary policy stance. The volatility was exacerbated by a mixed earnings report from Nvidia, which initially drove the market up before contributing to a steep drop. Historical parallels can be drawn to past periods of economic uncertainty where Fed policy played a pivotal role in market movements.

- Key Stakeholders Affected:

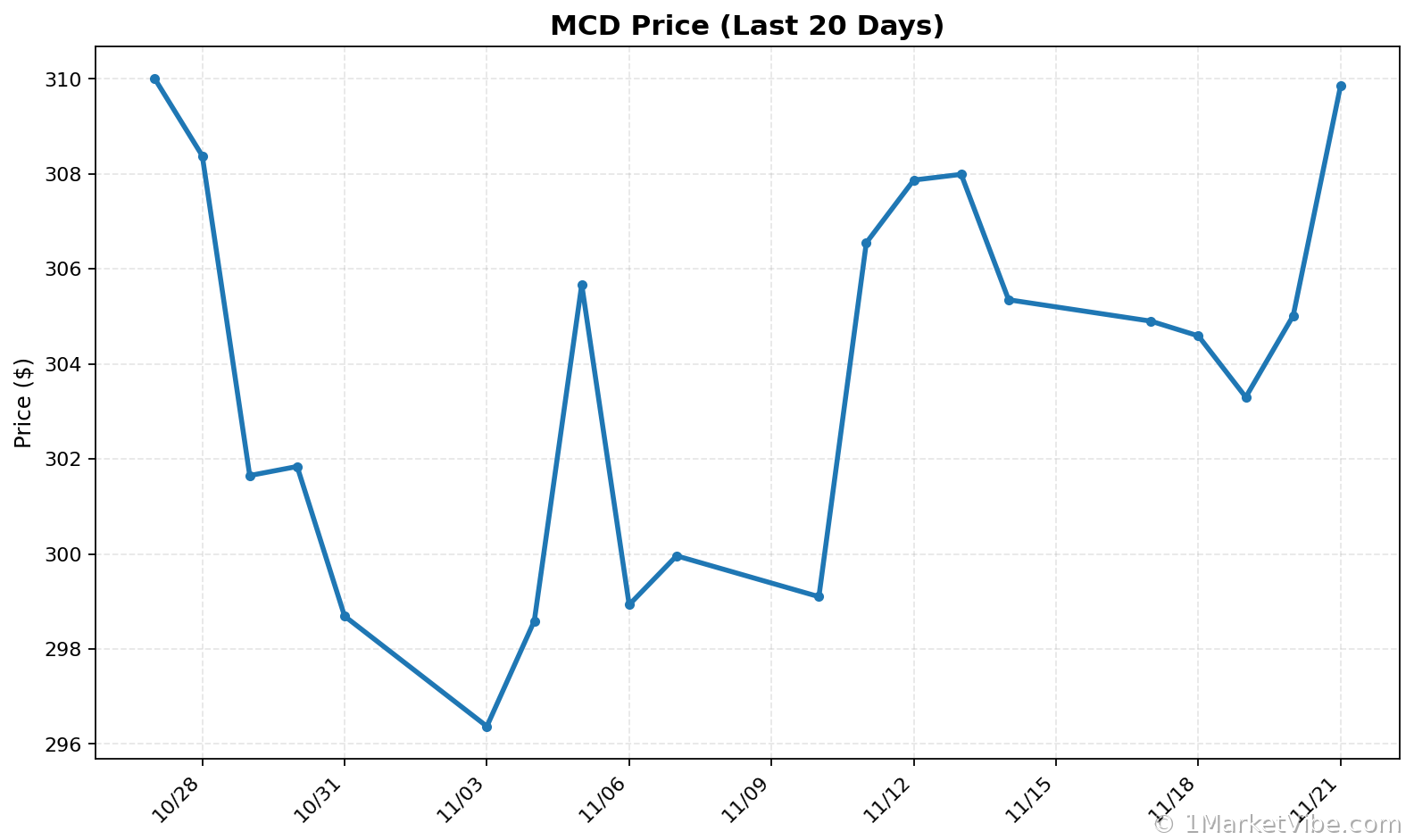

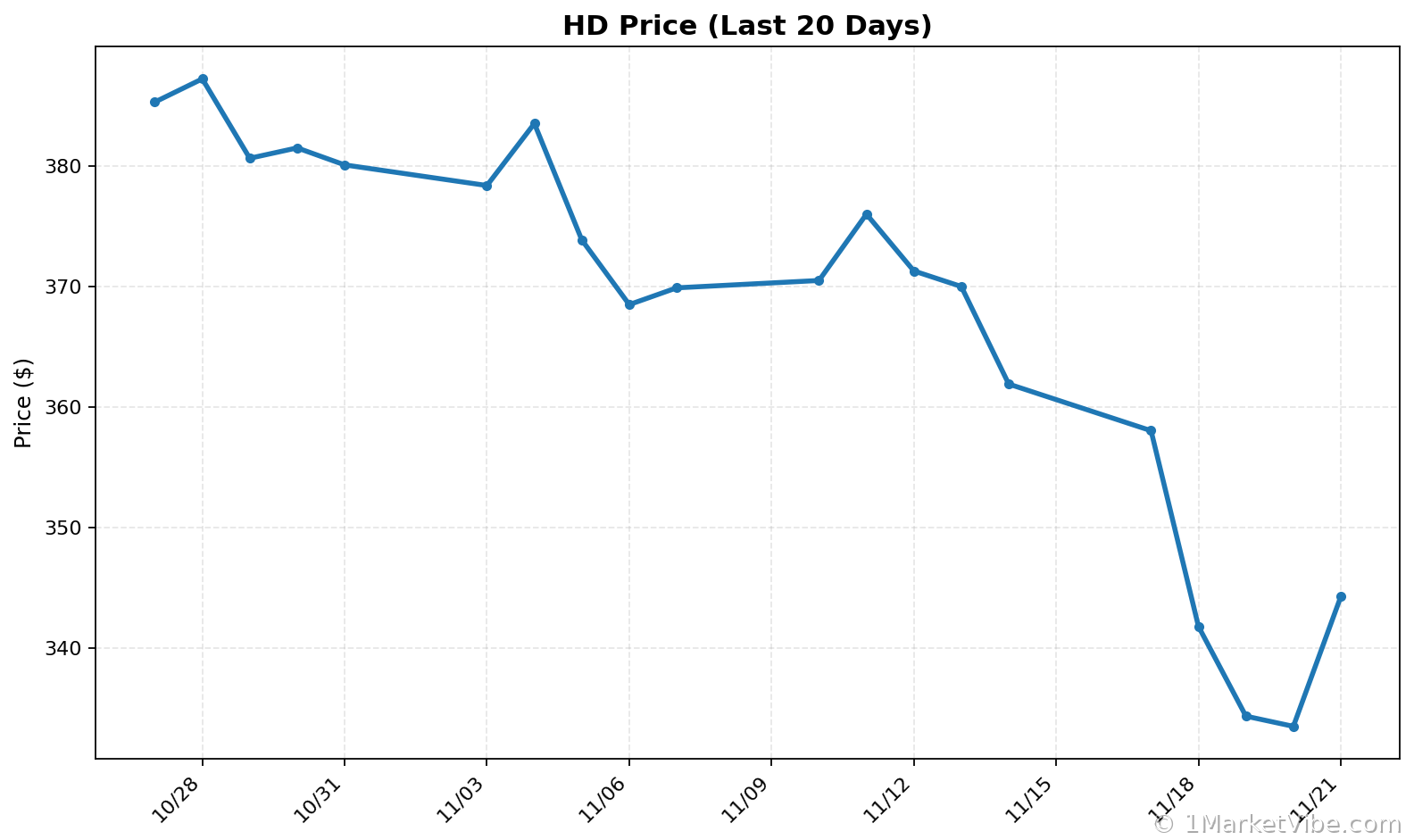

- Retail and Tech Sectors: Companies like Home Depot, Starbucks, and McDonald's are poised to benefit from potential rate cuts.

- Cryptocurrency Market: Bitcoin saw a decline of over 2% on Friday, reflecting broader risk aversion among investors.

What's Next

Investors should brace for continued volatility as the market digests upcoming economic data and Fed communications. The next key event is the December Fed meeting, where a rate decision will be made. Additionally, the CW Index, which has ticked up to 6.49, suggests that this trend of volatility was anticipated, offering a 4-6 week early warning capability.

- Potential Scenarios:

- Rate Cut Confirmation: Could lead to further market rallies, particularly in interest-sensitive sectors.

- Economic Data Releases: Watch for employment and inflation reports that could influence Fed decisions.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts