Dow Extends Losses, Signals Market Concern

Breaking News: The Dow Jones Industrial Average has dropped 200 points, marking its third consecutive day of losses as of October 17, 2023. This decline follows a turbulent week characterized by valuation concerns, sector rotations, and recalibrated expectations for Federal Reserve rate cuts. The persistent downward trend is raising alarms among investors about the broader market's stability.

Why It Matters

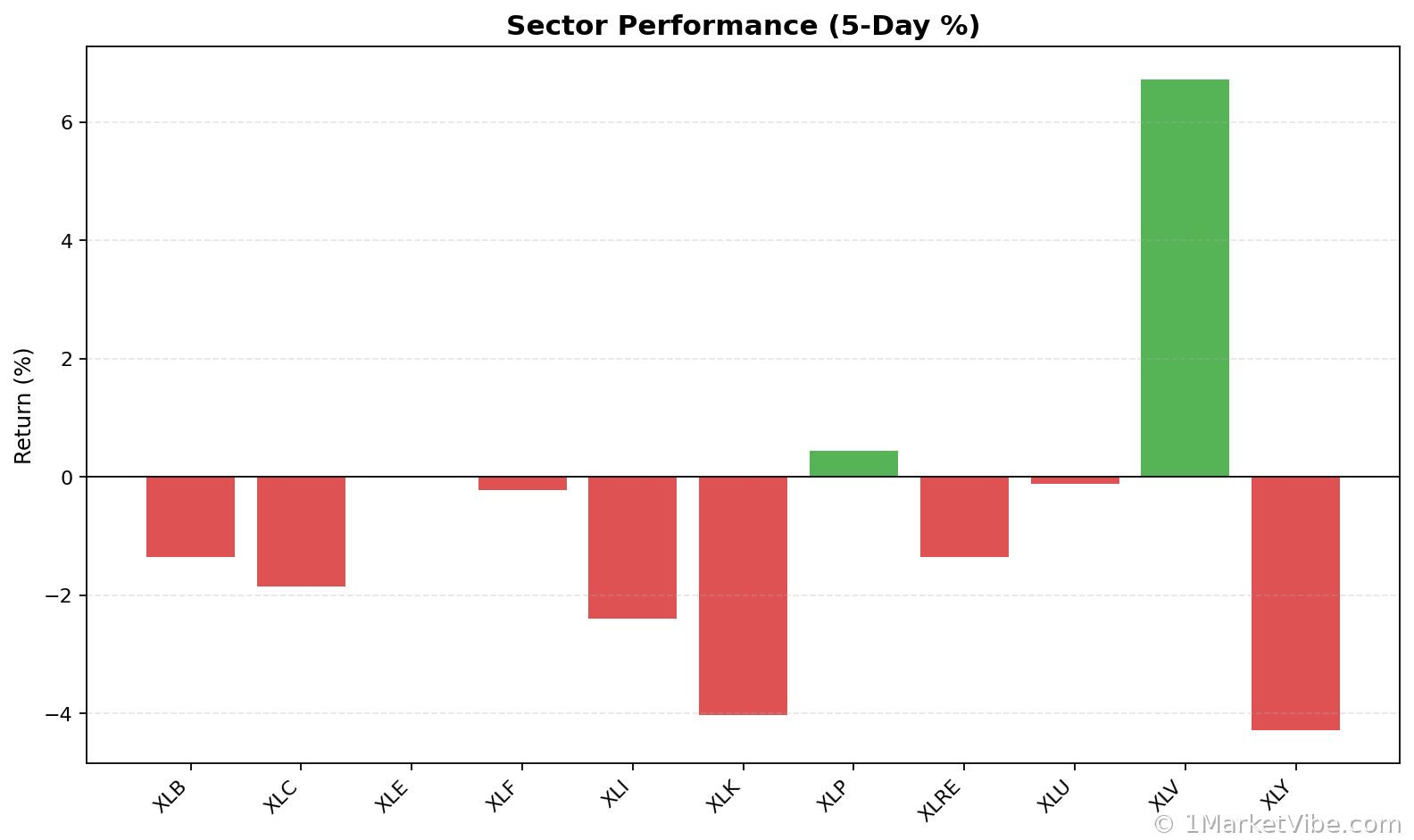

The immediate impact of the Dow's continued slide is a heightened sense of market volatility. For investors, this means increased uncertainty as they navigate potential risks in their portfolios. The broader implications suggest a cautious approach as the market recalibrates to new economic realities. The sentiment shift is palpable, with the CW Index ticking up to 6.3, indicating elevated risk levels that were anticipated by MarketVibe's early warning signals.

Context & Background

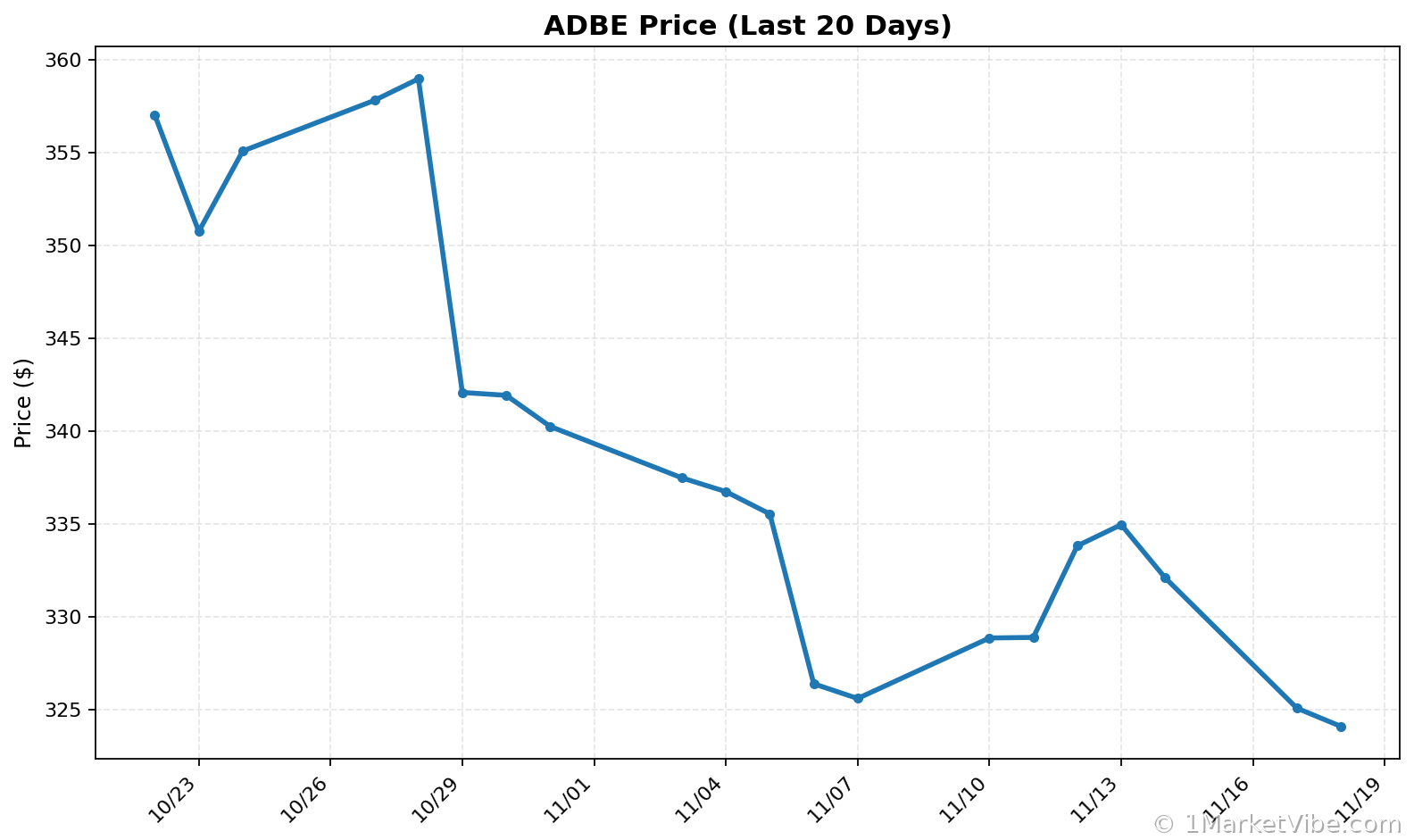

Historically, similar market conditions have led to significant portfolio adjustments by investors. The current downturn is driven by a mix of factors, including fears of overvaluation in certain sectors and changing expectations regarding monetary policy. Key stakeholders, such as tech giants Adobe, Block, and Salesforce, have seen their stocks hit hard, though some analysts suggest these names could rebound by as much as 57% from current levels.

What's Next

Investors should closely monitor upcoming Federal Reserve announcements and economic data releases, which could further influence market dynamics. The next few weeks are critical, with potential scenarios ranging from a market correction to a stabilization phase. Adjusting risk exposure and considering hedging strategies may be prudent as the CW Index continues to reflect heightened risk.

For real-time updates and risk signals, visit 1marketvibe.com.

Sources:

- CNBC: "Dow drops 200 points, extending losses for a third day"

- MarketWatch: "These stocks have been hit hard in 2025 but could surge by as much as 57% from here"

- Barron's: "Quantum Computing Stock Has Tumbled This Year. Why Earnings Have the Market Excited"

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably.

Charts