Fed Rate Cuts as a Catalyst for Economic Growth, According to Treasury Secretary

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Fed Rate Cuts as a Catalyst for Economic Growth, According to Treasury Secretary

January 09, 2026 – In a pivotal announcement, Treasury Secretary Bessent emphasized the critical role of Federal Reserve rate cuts as the "only ingredient missing" for robust economic growth. Speaking at a press conference on Thursday, Bessent underscored the administration's push for lower interest rates, suggesting that such a move could significantly bolster the economy. This statement comes amid ongoing discussions about the Federal Reserve's monetary policy direction as the economy navigates post-pandemic recovery challenges.

Why It Matters

The prospect of Federal Reserve rate cuts has immediate implications for markets and investors. Lower interest rates typically reduce borrowing costs, encouraging consumer spending and business investment, which can stimulate economic growth. However, the sentiment is mixed as investors weigh the benefits against potential risks such as inflation. MarketVibe's CW Index, which tracks economic risk signals, currently reads 5.5, indicating a moderate risk environment that could shift with further rate adjustments.

Context & Background

Historically, rate cuts have been a tool to spur economic activity during slowdowns. The current economic landscape, characterized by moderate growth and inflation concerns, mirrors past scenarios where rate cuts were employed to stabilize and invigorate the economy. The Federal Reserve's previous rate adjustments have had mixed outcomes, underscoring the complexity of monetary policy decisions. Key stakeholders, including businesses reliant on borrowing and consumers with variable-rate loans, stand to be directly affected by any changes in interest rates.

Market Reactions

Markets have reacted with cautious optimism to the possibility of rate cuts. Sectors like housing and consumer goods, which are sensitive to interest rate changes, have shown signs of potential growth. However, the broader market remains vigilant, with investors closely monitoring Federal Reserve signals for clarity on future monetary policy. The sentiment is one of cautious anticipation, as the timing and magnitude of potential rate cuts remain uncertain.

Risks of Rate Cuts

While rate cuts can stimulate growth, they also carry risks. Aggressive cuts may lead to inflationary pressures, undermining long-term economic stability. Investors must consider these risks, balancing the potential for short-term gains against the possibility of increased inflation. The Federal Reserve's challenge lies in calibrating its policy to support growth without triggering adverse economic consequences.

Historical Context

Past instances of rate cuts, such as those during the financial crisis of 2008, provide valuable lessons. While effective in some cases, rate cuts have also led to unintended consequences, including asset bubbles and increased debt levels. These historical parallels highlight the importance of a measured approach to monetary policy.

Expert Opinions

Economists are divided on the necessity and timing of rate cuts. Some argue that the current economic conditions justify a reduction in rates to prevent stagnation, while others caution against premature cuts that could exacerbate inflation. This diversity of opinion reflects the complexity of economic forecasting and the challenges faced by policymakers.

Future Outlook

Investors should keep a close watch on upcoming Federal Reserve meetings and economic indicators. The CW Index's predictive capabilities suggest that market trends could shift in response to policy announcements. As the situation evolves, investors may need to adjust their strategies, considering potential rate cuts and their implications for various sectors.

Conclusion

In summary, Treasury Secretary Bessent's remarks highlight the potential of Fed rate cuts to act as a catalyst for economic growth. However, the path forward is fraught with challenges, requiring careful consideration of risks and benefits. Investors are advised to stay informed and agile as the economic landscape continues to evolve.

Monitor risk signals as this story develops at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult a financial advisor before making investment decisions.

Sources:

- CNBC: Treasury Secretary Bessent's remarks on Fed rate cuts

- MarketVibe's CW Index data

- Historical data on past Federal Reserve rate cuts

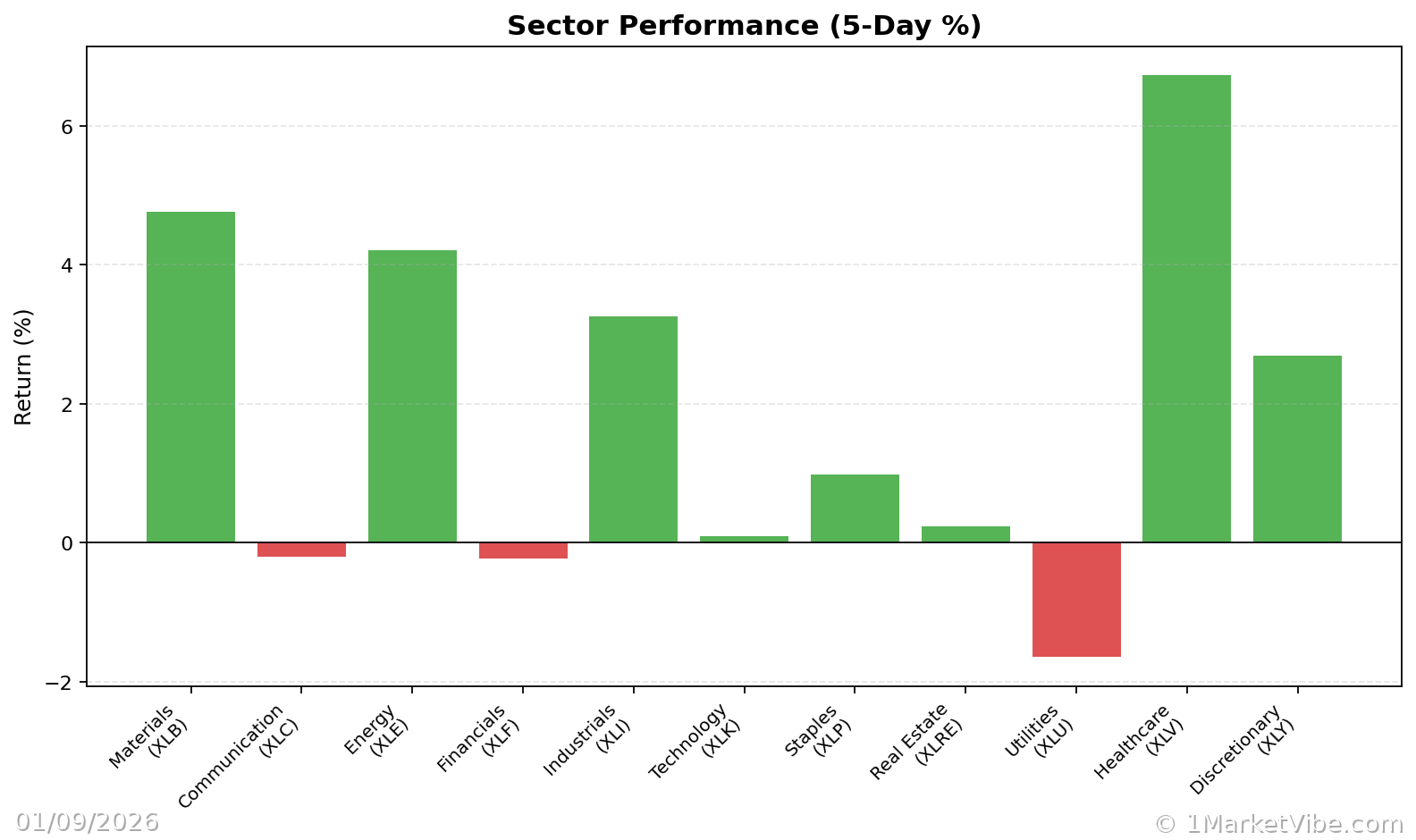

Charts