Market Overview

US and Asian stocks are reeling from a significant downturn, with the US markets facing their worst week since April. This decline is driven by escalating concerns over the high valuations of AI-related stocks. On the other side of the globe, Asian markets are experiencing renewed selloffs, particularly in tech sectors, as investor anxiety mounts. The selloff is a stark reminder of the vulnerabilities present in speculative investments, especially those tied to artificial intelligence.

AI Valuation Concerns

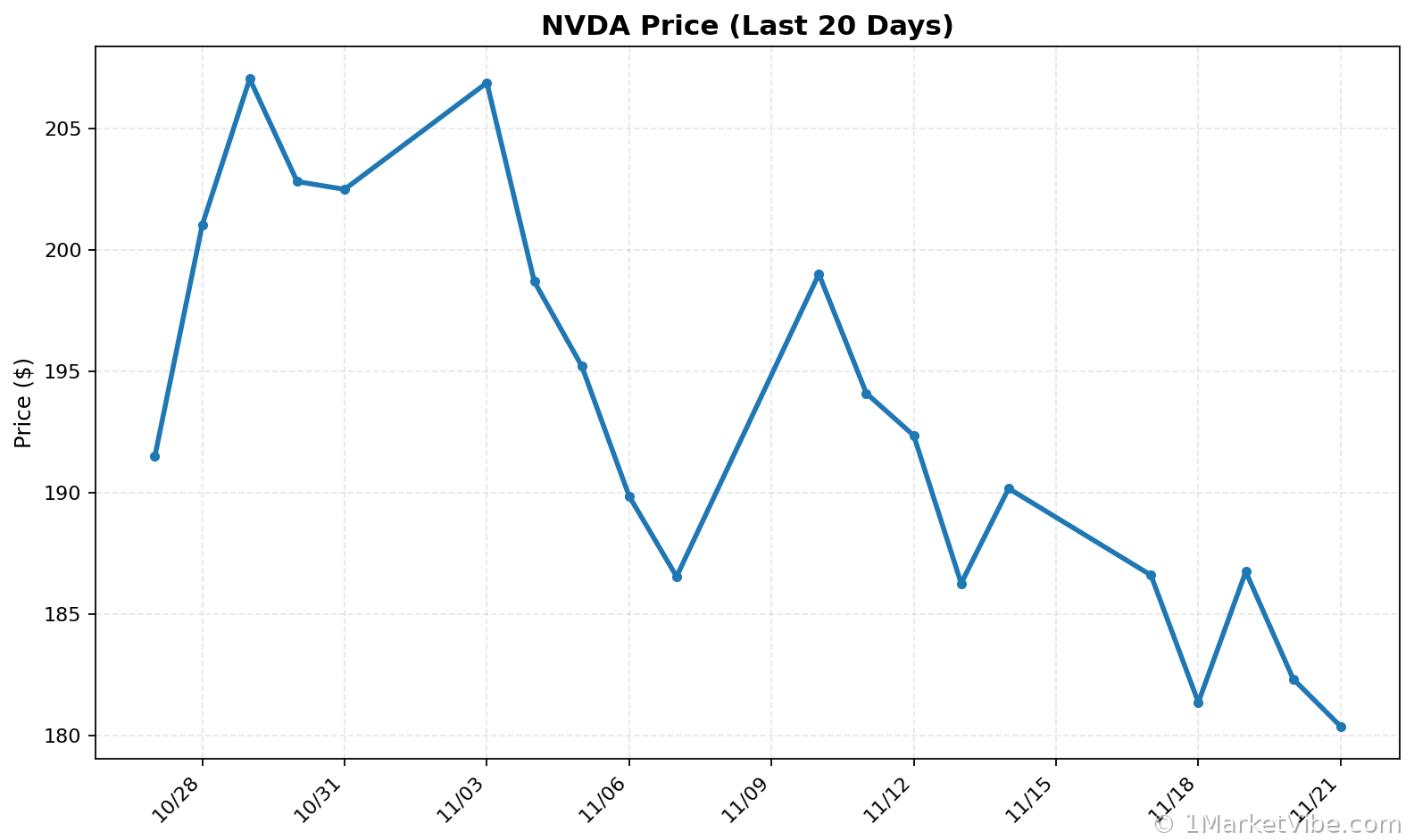

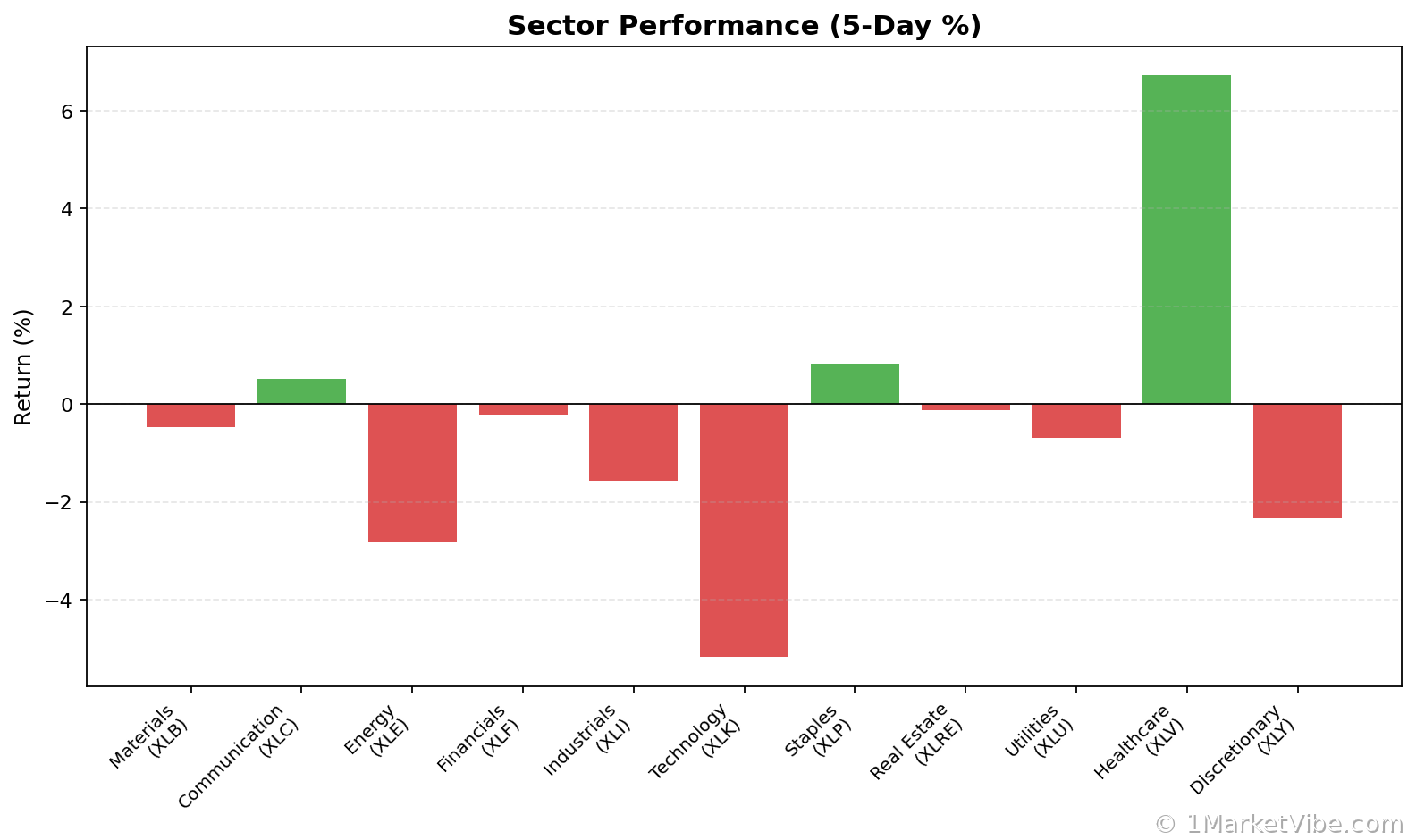

Investors are increasingly wary of the lofty valuations in AI-related stocks. The recent pullback underscores the fragility of speculative investments, which have been buoyed by optimism around AI's potential. Despite strong sales from AI chip giant Nvidia, investor worries persist, indicating that market enthusiasm may have outpaced the fundamentals. This sentiment is reflected in the broader market, where tech stocks are leading the downturn.

Impact on US Stocks

Major US indices have shown notable declines, with tech stocks at the forefront of this downturn. This pattern echoes previous market corrections where valuation fears triggered widespread selloffs. The current situation highlights the risk of overvaluation in tech sectors, which have been significantly impacted by the AI boom. For investors, this means a careful reassessment of portfolio risk is crucial.

Impact on Asian Stocks

In Asia, tech-heavy markets are under significant pressure as selloffs continue. Sector leaders, particularly those involved in AI, are contributing to broader market declines. This trend is exacerbated by global concerns over AI valuations, which have led to increased volatility in these markets. The ripple effect is evident as investors reassess their positions in these high-growth areas.

Investor Sentiment

Despite the volatility, current investor sentiment remains neutral. However, the market's reaction suggests a growing cautiousness among investors, particularly regarding tech sector exposure. For investors, this means closely monitoring risk exposure and considering adjustments to mitigate potential losses. The sentiment shift is a critical factor to watch as markets navigate these turbulent times.

CW Index Connection

MarketVibe's CW Index has ticked up to 6.49, signaling potential market shifts. This development aligns with the index's early warning capabilities, which suggested a predictable trend over the past 4-6 weeks. Investors should take note of these signals as they evaluate their strategies in the face of ongoing market instability.

Conclusion

The current market instability raises significant questions about the future of AI investments. As valuation concerns continue to impact stock performance, investors are advised to remain cautious and informed. Monitoring market responses in real-time and adjusting strategies accordingly will be crucial in navigating these challenges.

Track how markets respond in real-time at 1marketvibe.com

Disclaimer: This content is for informational purposes only and should not be construed as financial advice. Market conditions can change rapidly and unpredictably.

Sources:

- Bloomberg: Asian Stocks to Fall Following Volatile US Session

- Bloomberg: Asia Tech Rout Resumes as Stocks Slide on AI Valuation Fears

- BBC News: US and Asia stocks slide as AI jitters persist

Charts