CW Index at 6.5 and Anticipation of December Fed Rate Cut

- Authors

- Name

- MarketVibe Team

- @1marketvibe

CW Index at 6.5 and Anticipation of December Fed Rate Cut

November 28, 2025 – In a significant development, the CW Index has climbed to 6.5 as markets eagerly anticipate a potential rate cut by the Federal Reserve in December. This anticipation follows a series of economic indicators suggesting a shift in monetary policy. Investors are closely watching the Fed's next move, which could have profound implications for market dynamics and portfolio strategies.

Why It Matters

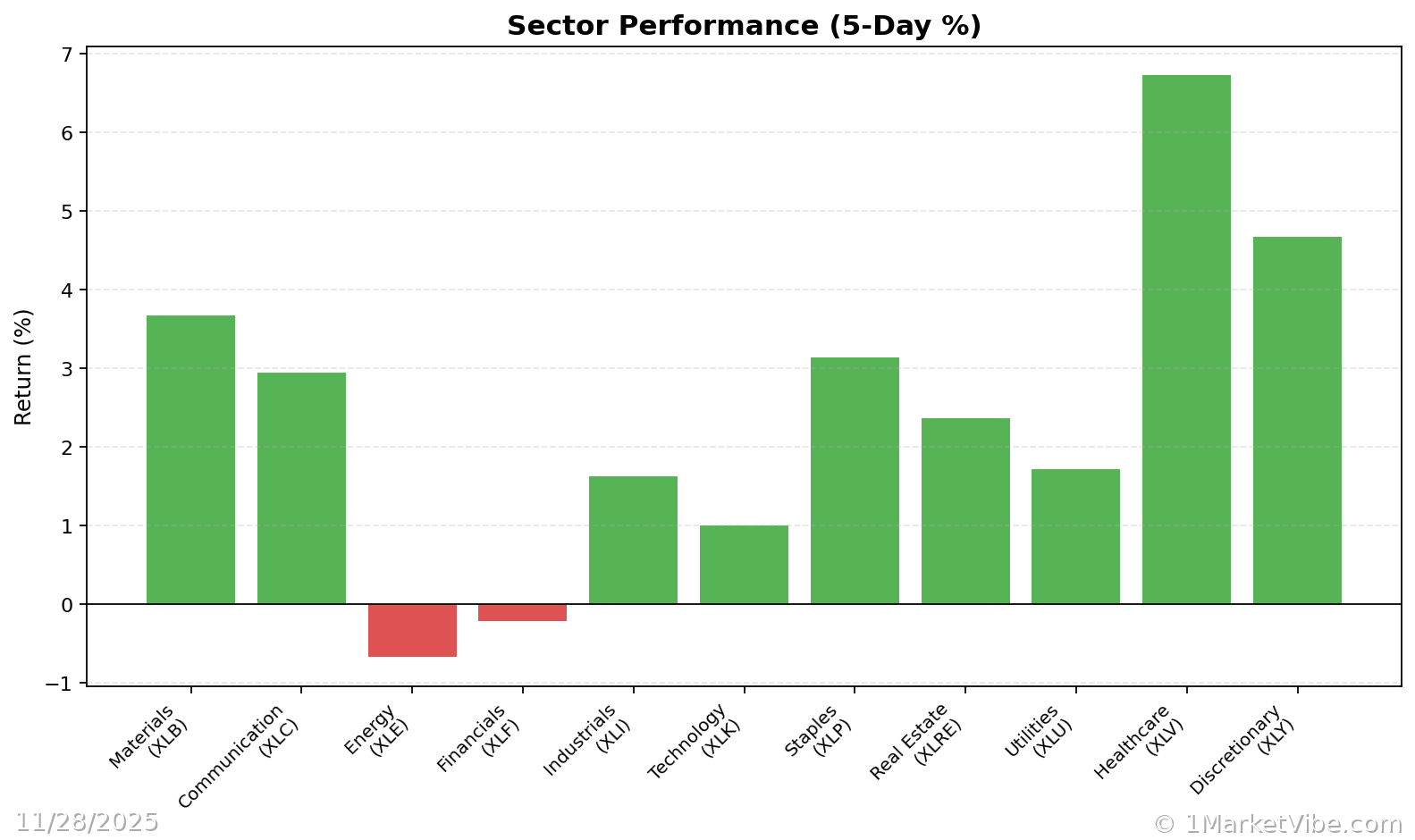

The immediate market impact of a potential rate cut is substantial. Historically, rate cuts have been associated with increased liquidity and lower borrowing costs, which can stimulate economic activity. For investors, this means potential shifts in asset valuations and sector performance. The CW Index's rise to 6.5 signals heightened market risk and sentiment, reflecting investor uncertainty and the need for strategic positioning.

Context & Background

The anticipation of a rate cut stems from recent economic data showing signs of slowing inflation and mixed economic growth. Historically, the Federal Reserve has used rate cuts as a tool to support the economy during periods of uncertainty. Key stakeholders, including financial institutions and large corporations, are particularly sensitive to these changes, as they influence borrowing costs and investment decisions.

What's Next

Investors should watch for the upcoming Federal Reserve meeting in mid-December, where a decision on interest rates is expected. Key economic indicators, such as employment data and consumer spending figures, will also play a crucial role in shaping the Fed's decision. Potential scenarios include a rate cut that could boost market confidence or a hold on rates that might signal caution.

For those tracking market movements, the CW Index's current reading provides an early warning signal of potential risk shifts. As the situation develops, investors should consider adjusting their portfolios to mitigate risks associated with volatility.

Track how markets respond in real-time at 1marketvibe.com

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Sources:

- The Washington Post

- BBC News

- The Verge