The Impact of Social Security's Crisis on Your Retirement Portfolio

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Social Security's Crisis: Immediate Impact on Retirement Portfolios

December 1, 2025 - The financial stability of Social Security is under severe threat, with projections indicating that the trust fund could be depleted by 2033, potentially forcing a reduction in benefits by up to 23%. This alarming development was confirmed by the latest report from the Social Security Trustees, highlighting the urgency of reform to ensure the system's sustainability.

Why It Matters

For investors, this news carries significant implications. The immediate market reaction has been one of heightened volatility, particularly in sectors tied to retirement and financial planning. The broader implications are profound: as the cornerstone of many Americans' retirement plans, any instability in Social Security could necessitate a reevaluation of personal retirement strategies. Market sentiment has shifted towards caution, with investors now more wary of long-term retirement assets.

Context & Background

Social Security has long been a critical component of the U.S. social safety net, providing financial support to retirees, disabled individuals, and survivors. However, demographic shifts, including an aging population and a declining birth rate, have strained the system. Historically, reforms in the 1980s and 1990s extended the program's solvency, but today's challenges are compounded by a larger retiree base and fewer workers contributing to the fund.

Retirement Portfolio Implications

- Retirees may need to consider alternative income sources or adjust their spending to accommodate potential benefit cuts.

- Working-age individuals might need to increase their savings rate or diversify their investment strategies to mitigate future risks.

- Investment strategies could shift towards assets that offer more stability or growth potential outside of traditional retirement accounts.

Taxation and Benefits Tug-of-War

The current crisis has sparked a debate over the balance between maintaining benefits for retirees and the tax burden on workers. Potential policy changes could include increased payroll taxes or adjustments to benefit formulas, both of which carry significant political and economic implications.

Historical Context

Past reforms have shown that timely intervention can stabilize Social Security. The 1983 amendments, for example, extended the program's solvency by gradually increasing the retirement age and adjusting payroll taxes. These historical lessons underscore the importance of proactive policy measures to address current challenges.

Market Reactions

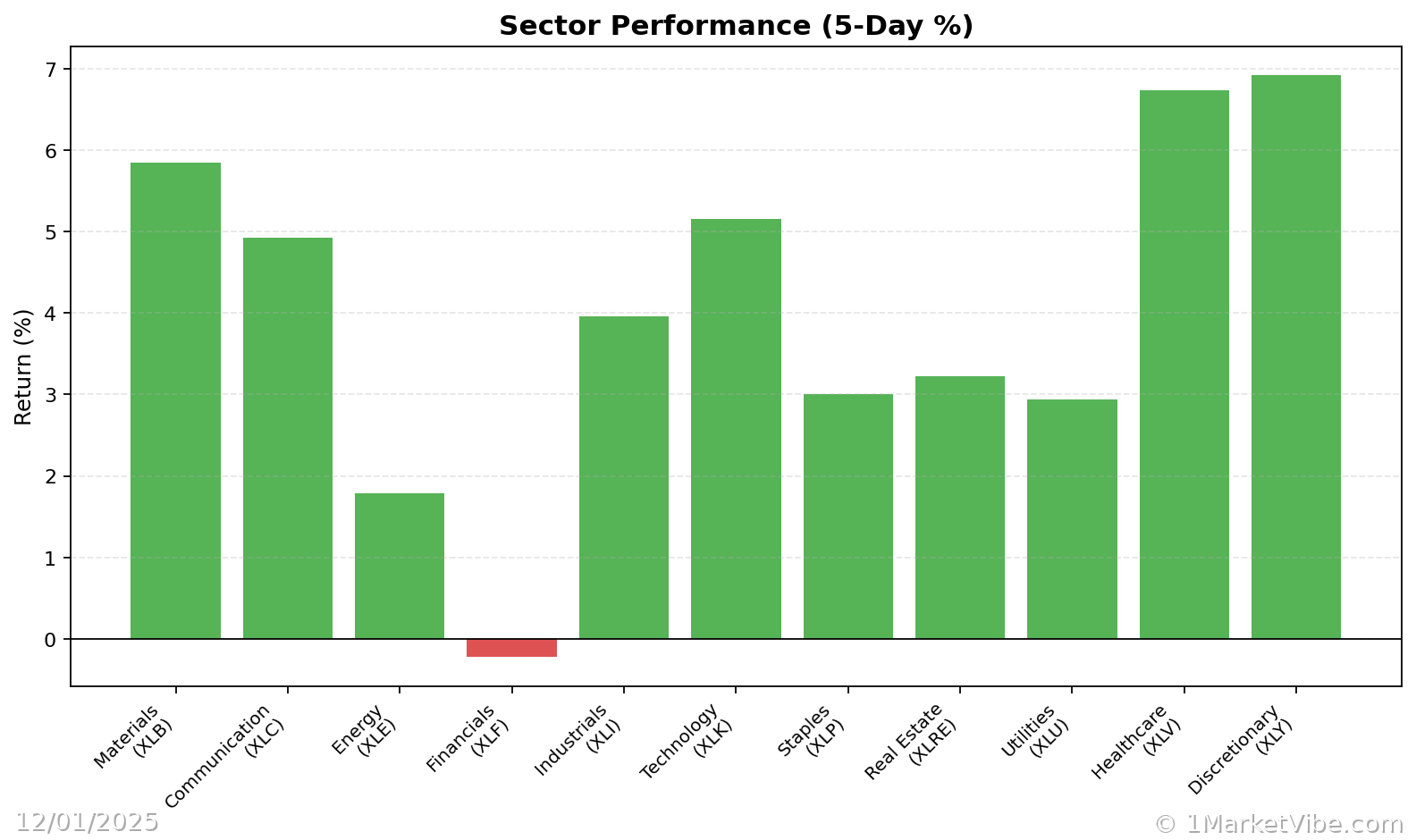

Markets have reacted with caution, as evidenced by fluctuations in retirement-focused stocks and funds. Investors are advised to remain vigilant and consider the potential for reforms that could impact their portfolios. MarketVibe's CW Index, which recently ticked up to 6.32, suggests a heightened risk environment, aligning with these developments.

Future Considerations

Looking ahead, several scenarios could unfold:

- Legislative action to reform Social Security could stabilize markets if perceived as effective.

- Inaction may lead to increased market volatility and further strain on retirement planning.

- Innovative solutions, such as private-public partnerships, could emerge as alternative support mechanisms.

Investors should stay informed on policy developments and consider adjusting their strategies accordingly. Monitoring these changes is crucial to safeguarding retirement portfolios against potential disruptions.

Conclusion

The challenges facing Social Security are significant, with far-reaching implications for retirement planning. As policymakers grapple with potential solutions, investors must reassess their strategies to ensure financial security in the face of uncertainty.

Monitor risk signals as this story develops at 1marketvibe.com.

This content is for informational purposes only and should not be considered as financial advice. Market conditions can change rapidly and unpredictably.

Charts