AI Sector Volatility and Its Implications for the Broader Tech Industry

- Authors

- Name

- MarketVibe Team

- @1marketvibe

AI Sector Volatility and Its Implications for the Broader Tech Industry

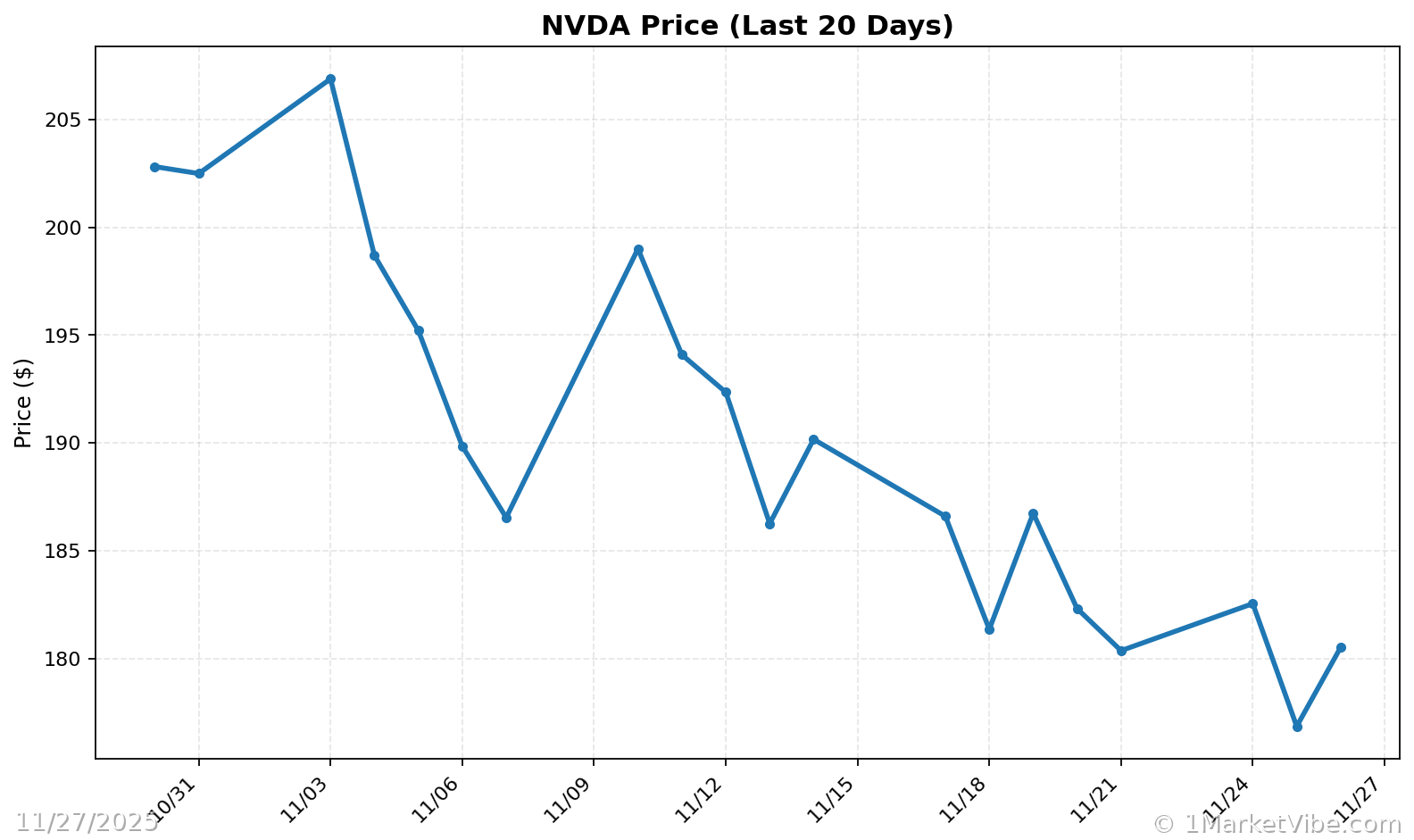

November 27, 2025 – In a significant market shift, Nvidia Corp.'s stock has plummeted by 15% over the past week, sparking concerns about the stability of the AI sector. This decline, observed since November 20, 2025, is attributed to rising competition and investor skepticism about Nvidia's long-term dominance in the AI chip market. The downturn has sent ripples across the tech industry, affecting investor sentiment and raising questions about the future of AI-driven growth.

Why It Matters

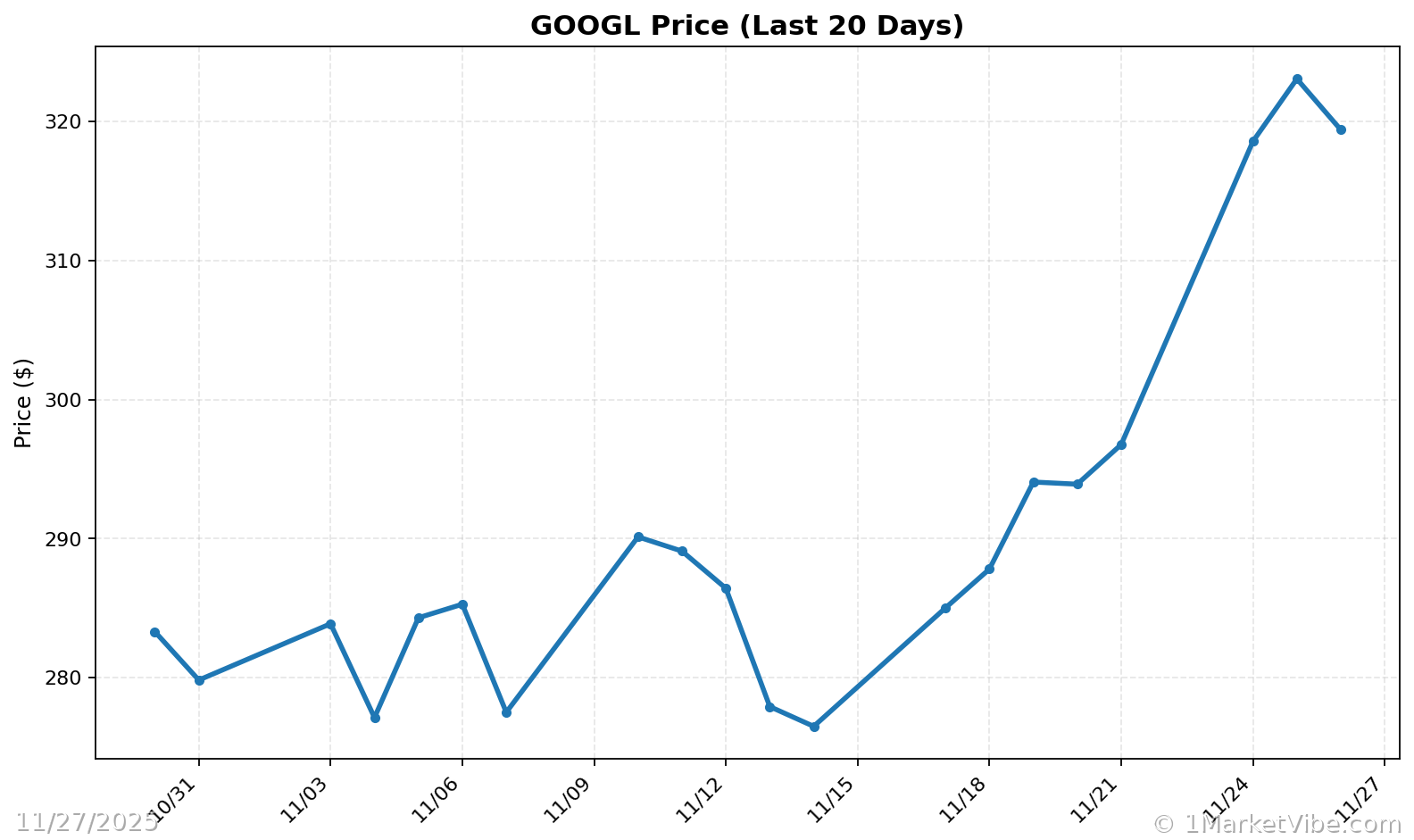

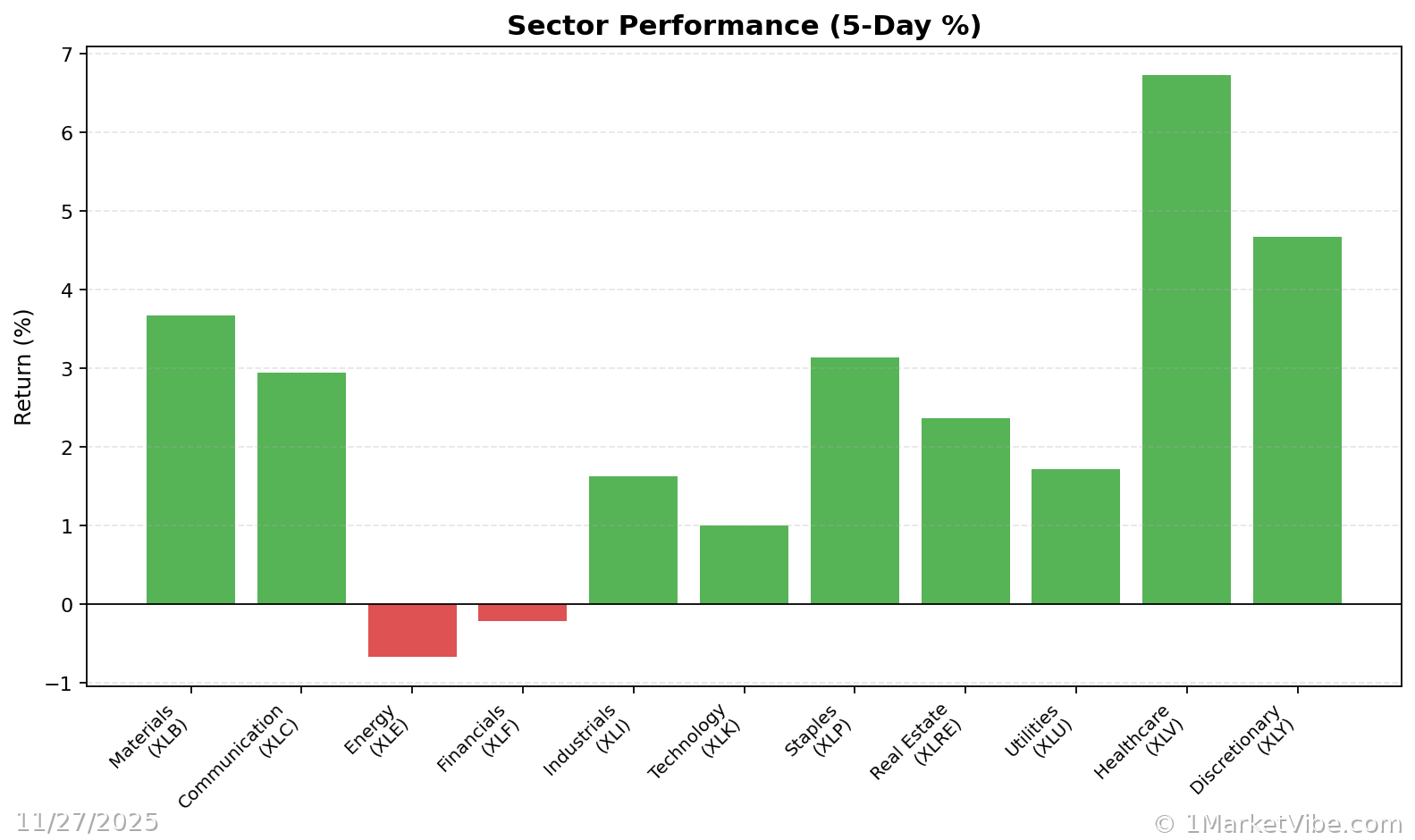

The immediate impact of Nvidia's stock drop is a heightened sense of uncertainty in the tech sector. For investors, this means potential volatility in portfolios heavily weighted towards AI and tech stocks. The broader implications suggest a shift in market dynamics, where the once-unquestioned dominance of Nvidia is now challenged by emerging competitors like Google, which is aggressively expanding its AI capabilities. This development has led to a cautious sentiment among investors, who are now re-evaluating their exposure to AI-related assets.

Context & Background

Historically, Nvidia has been a leader in the AI chip market, benefiting from the surge in demand for AI technologies. However, recent advancements by competitors have started to erode its market share. The company's stock performance has been volatile, reflecting broader tech sector trends. Over the past year, Nvidia's valuation has been buoyed by its AI prowess, but the latest downturn highlights vulnerabilities in its business model. Key stakeholders, including institutional investors and tech-focused funds, are closely monitoring these developments.

What's Next

Investors should watch for several key events that could influence the tech industry's trajectory:

- Earnings Reports: Upcoming quarterly earnings from major tech companies will provide insights into how the AI sector is adapting to increased competition.

- Federal Reserve Decisions: Interest rate changes could further impact tech stock valuations, as higher rates typically lead to reduced investment in high-growth sectors like AI.

- Market Share Shifts: Continued monitoring of market share data will be crucial to understanding the competitive landscape.

Potential scenarios include a stabilization of Nvidia's stock if it can demonstrate resilience through innovation or strategic partnerships. Conversely, a prolonged decline could signal broader challenges for the tech sector.

Conclusion

The recent volatility in the AI sector underscores the importance of diversification and risk management for investors. As the landscape evolves, staying informed about market trends and competitive dynamics will be critical. Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly and unpredictably.

Charts