EU Tariffs Impact Markets as CW Index Forecasts Volatility Spike

- Authors

- Name

- MarketVibe Team

- @1marketvibe

EU Tariffs Impact Markets as CW Index Forecasts Volatility Spike

Brussels, January 19, 2026 – In a significant move, the European Union announced new tariffs on a range of imported goods, sending shockwaves through global markets. The tariffs, effective immediately, target sectors such as technology and automotive, with rates as high as 15%. This decision comes amid escalating trade tensions and has prompted a swift reaction from investors worldwide.

Why It Matters

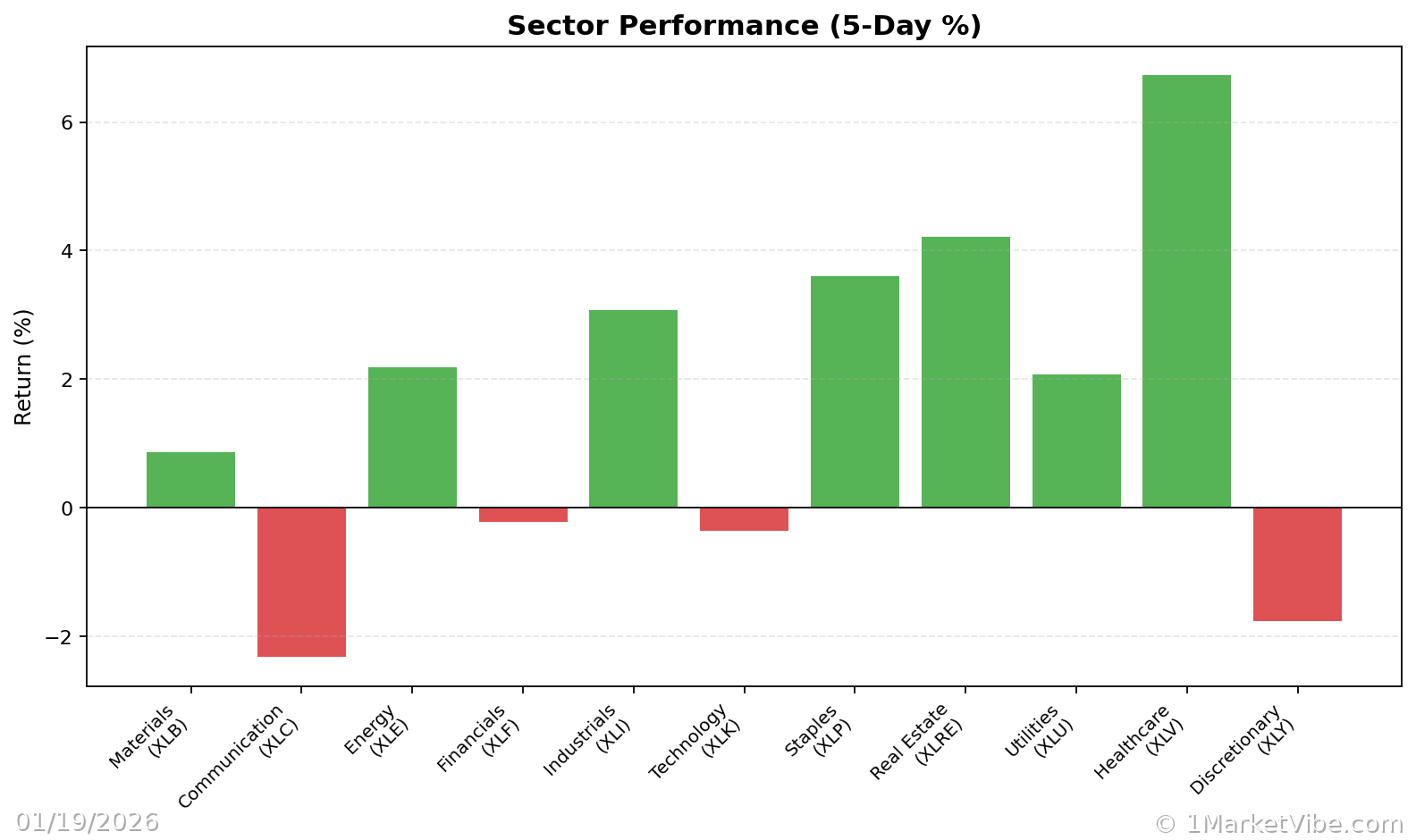

The immediate market impact was palpable. Stock indices across Europe and the U.S. experienced sharp declines, with the FTSE 100 dropping by 2.3% and the S&P 500 down 1.8% by midday trading. For investors, this development signals heightened risk and potential volatility in the coming weeks. MarketVibe's CW Index, which provides early risk signals, ticked up to 4.54, indicating a likely increase in market turbulence. This aligns with the Index's predictive capabilities, which had suggested a volatility spike was on the horizon.

Context & Background

Historically, tariffs have been a double-edged sword, often leading to increased costs for consumers and retaliatory measures from affected countries. The current situation mirrors past instances, such as the U.S.-China trade war in 2018, which led to significant market instability. The EU's decision follows prolonged negotiations over trade imbalances and reflects growing protectionist sentiments.

Key stakeholders affected include multinational corporations reliant on cross-border supply chains. The technology sector, in particular, faces potential disruptions, as many components are sourced from regions now subject to these tariffs.

What's Next

Investors should brace for continued volatility. Analysts predict that the tariffs could lead to a 0.5% reduction in GDP growth for the EU if retaliatory measures are enacted. Key dates to watch include upcoming trade talks scheduled for February 15, which may offer a platform for negotiation and potential de-escalation.

Potential scenarios range from a quick resolution, which could stabilize markets, to a prolonged trade conflict that might exacerbate economic slowdowns globally. Investors are advised to monitor developments closely and consider adjusting their portfolios to mitigate risk.

Conclusion

The EU's tariff announcement underscores the fragile state of global trade relations and the potential for increased market volatility. For investors, this means heightened vigilance and strategic risk management are crucial. As the situation unfolds, staying informed and responsive to market signals will be key.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.