Fed Rate Cut Hopes Propel Markets to 6.8 on CW Index

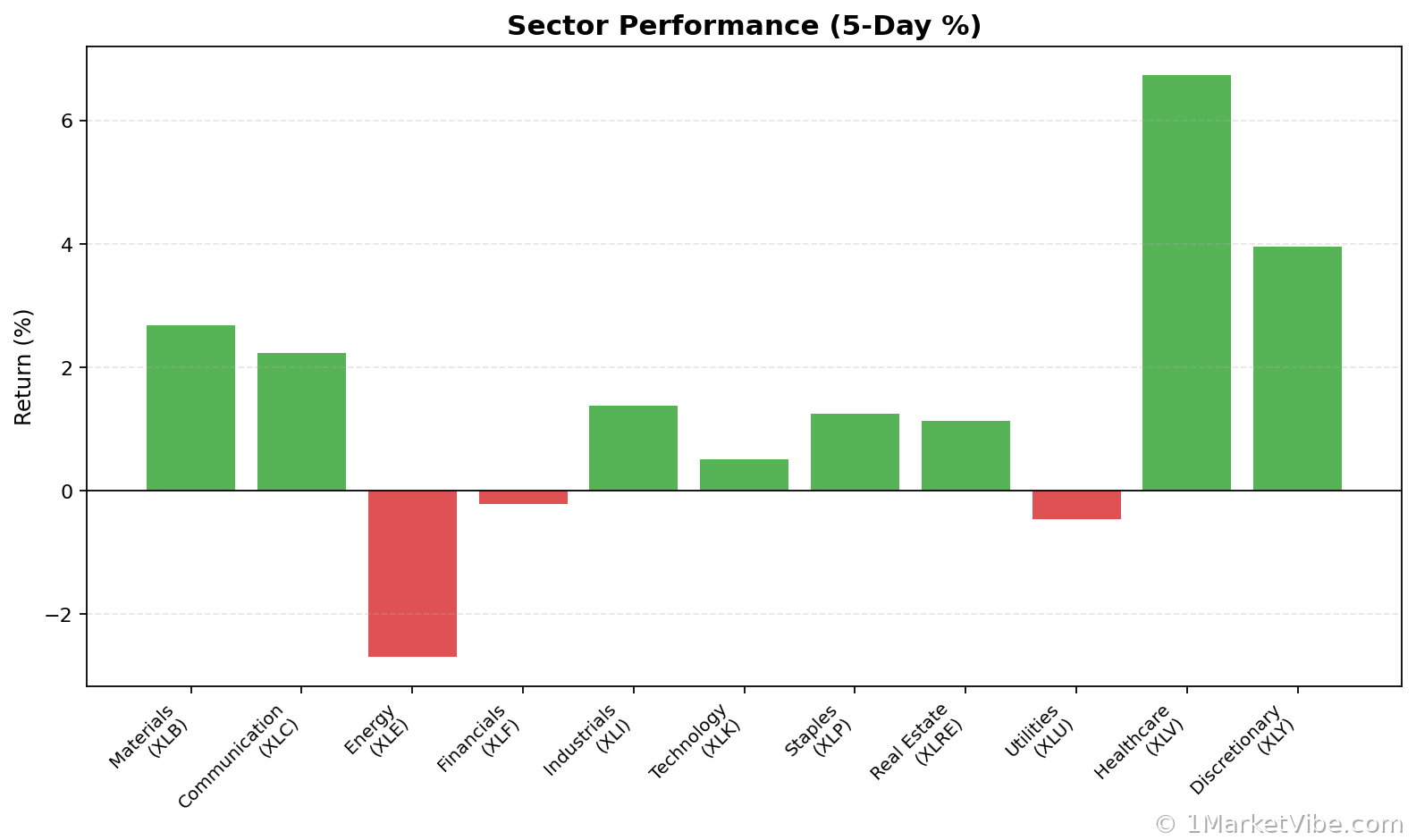

Breaking News: November 26, 2025 — U.S. stock markets surged today as investor optimism soared on the prospect of a Federal Reserve interest rate cut in December. The S&P 500 rose by 0.9%, the Dow Jones Industrial Average jumped 664 points or 1.4%, and the Nasdaq Composite gained 0.7%. This rally was fueled by easing bond yields and a strong belief that the Fed will lower its main interest rate at its upcoming meeting.

Why It Matters

For investors, this potential rate cut is significant as it could stimulate economic growth by making borrowing cheaper for businesses and consumers. The immediate market impact is a boost in stock prices, particularly benefiting smaller companies that rely heavily on borrowing. The Russell 2000 index, which tracks small-cap stocks, led the market with a 2.1% increase. This optimism is reflected in MarketVibe's CW Index, which has climbed to 6.8, indicating moderate risk but a positive sentiment shift.

Context & Background

Historically, rate cuts have been used by the Fed to counteract economic slowdowns. The current anticipation stems from mixed economic data, including weaker-than-expected retail sales and consumer confidence, which suggest the economy might need a boost. Additionally, inflation data showed mixed signals, with wholesale inflation slightly higher than expected, but underlying trends improving. This complex backdrop has led economists to predict a rate cut as a likely move to support the economy.

What's Next

Investors should keep a close eye on the Fed's meeting scheduled for December 10. Key factors to watch include upcoming economic data releases and any statements from Fed officials that might hint at their decision. If the Fed proceeds with a rate cut, it could further propel markets, but investors should also be cautious of potential inflationary pressures that could arise from lower rates.

Conclusion

The prospect of a Fed rate cut has injected optimism into the markets, as evidenced by today's rally and the uptick in the CW Index. Investors are advised to monitor these developments closely, as the Fed's decision will have significant implications for market dynamics and economic growth.

Track how markets respond in real-time at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly, and investors should conduct their own research or consult with a financial advisor.

Sources

Charts