AI Bubble Burst: $2.4 Trillion Wiped Out

In a dramatic turn of events, the artificial intelligence sector has seen a staggering $2.4 trillion in market value evaporate, marking one of the most significant downturns in tech history. This sharp decline, reported on November 21, 2023, has sent shockwaves through global markets, affecting both major tech giants and emerging AI startups. The collapse has been attributed to a combination of overvaluation and speculative investments, which have left investors scrambling to reassess their portfolios.

Why It Matters

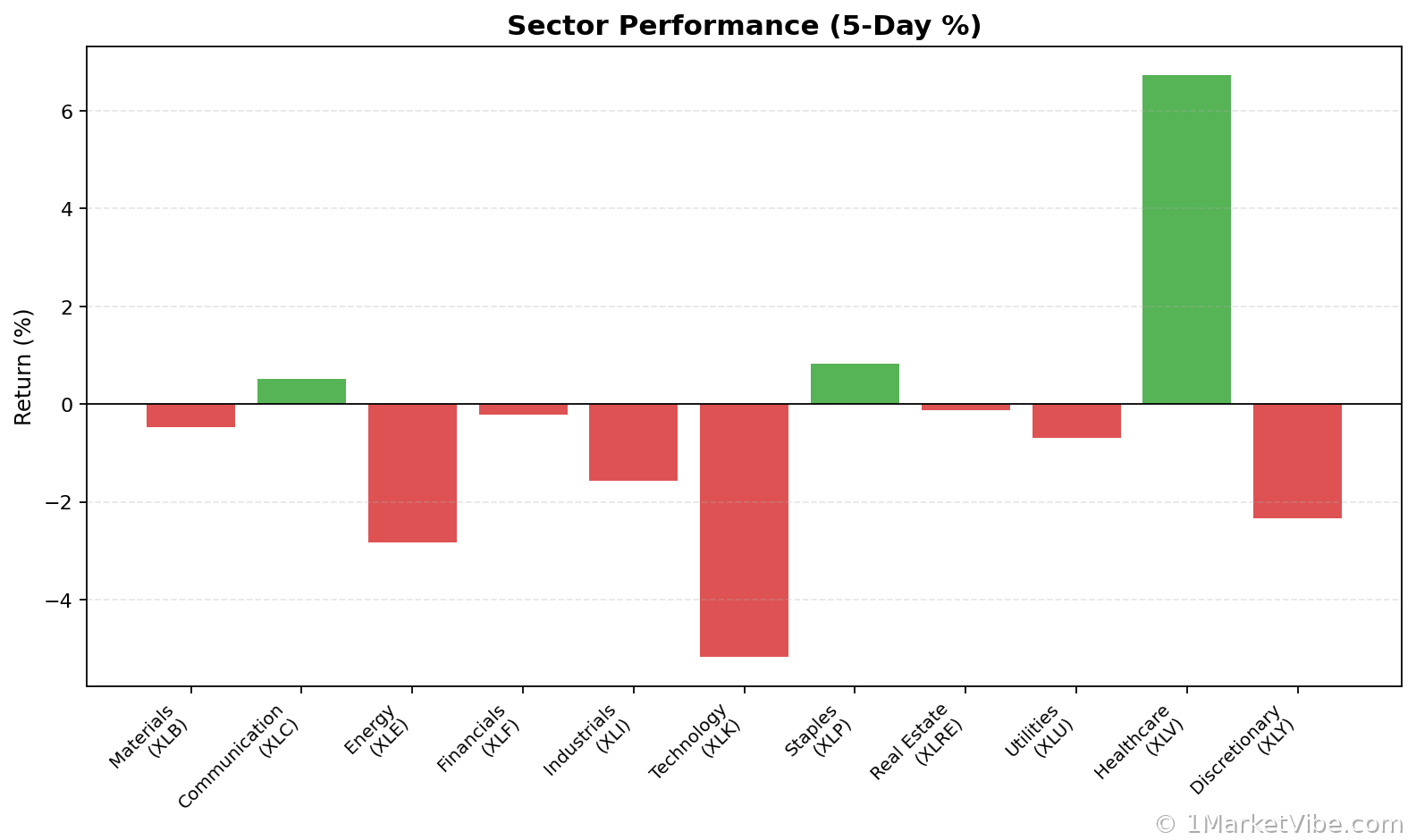

For investors, this massive loss represents a critical juncture in the tech investment landscape. The immediate impact is a significant shift in market sentiment, with increased caution and risk aversion among both retail and institutional investors. The broader implications suggest a potential reevaluation of investment strategies, particularly in emerging technologies. MarketVibe's CW Index, which provides early risk signals, has ticked up to 6.49, indicating heightened market volatility and the need for strategic adjustments.

Context & Background

The AI sector has experienced rapid growth over the past few years, drawing parallels to previous market bubbles such as the dot-com crash and recent cryptocurrency downturns. This growth was fueled by high expectations and speculative investments, leading to inflated valuations. However, external economic pressures, including inflation and geopolitical tensions, have contributed to the current instability. Key stakeholders, including major tech firms and venture capitalists, are now facing significant financial repercussions.

What's Next

Investors should closely monitor upcoming earnings reports and market reactions to gauge the potential for recovery or further decline. Key events to watch include regulatory responses and any shifts in monetary policy that could impact tech valuations. Potential scenarios range from a gradual stabilization of the market to continued volatility if economic pressures persist.

Actionable Insights

- Monitor position sizing: Adjust exposure in affected sectors based on current market conditions.

- Consider hedging strategies: Protect portfolios against further declines if the CW Index continues to trend upwards.

- Stay informed: Track how markets respond in real-time at 1marketvibe.com.

Conclusion

The AI bubble burst serves as a stark reminder of the importance of sustainable growth and realistic valuation metrics. As investors navigate this challenging landscape, the focus should be on balancing risk with opportunity, particularly in emerging technologies. Stay vigilant and informed to make strategic decisions that align with evolving market conditions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.