Breaking News: BLS Cancels Jobs Report Amid Government Shutdown

In an unexpected turn of events, the Bureau of Labor Statistics (BLS) has announced the cancellation of its highly anticipated jobs report, originally scheduled for release this Friday. This decision comes as a direct consequence of the ongoing government shutdown, which has disrupted numerous federal operations. The absence of this critical data point leaves investors and policymakers without a key indicator of labor market health, increasing uncertainty in already volatile markets.

Why It Matters

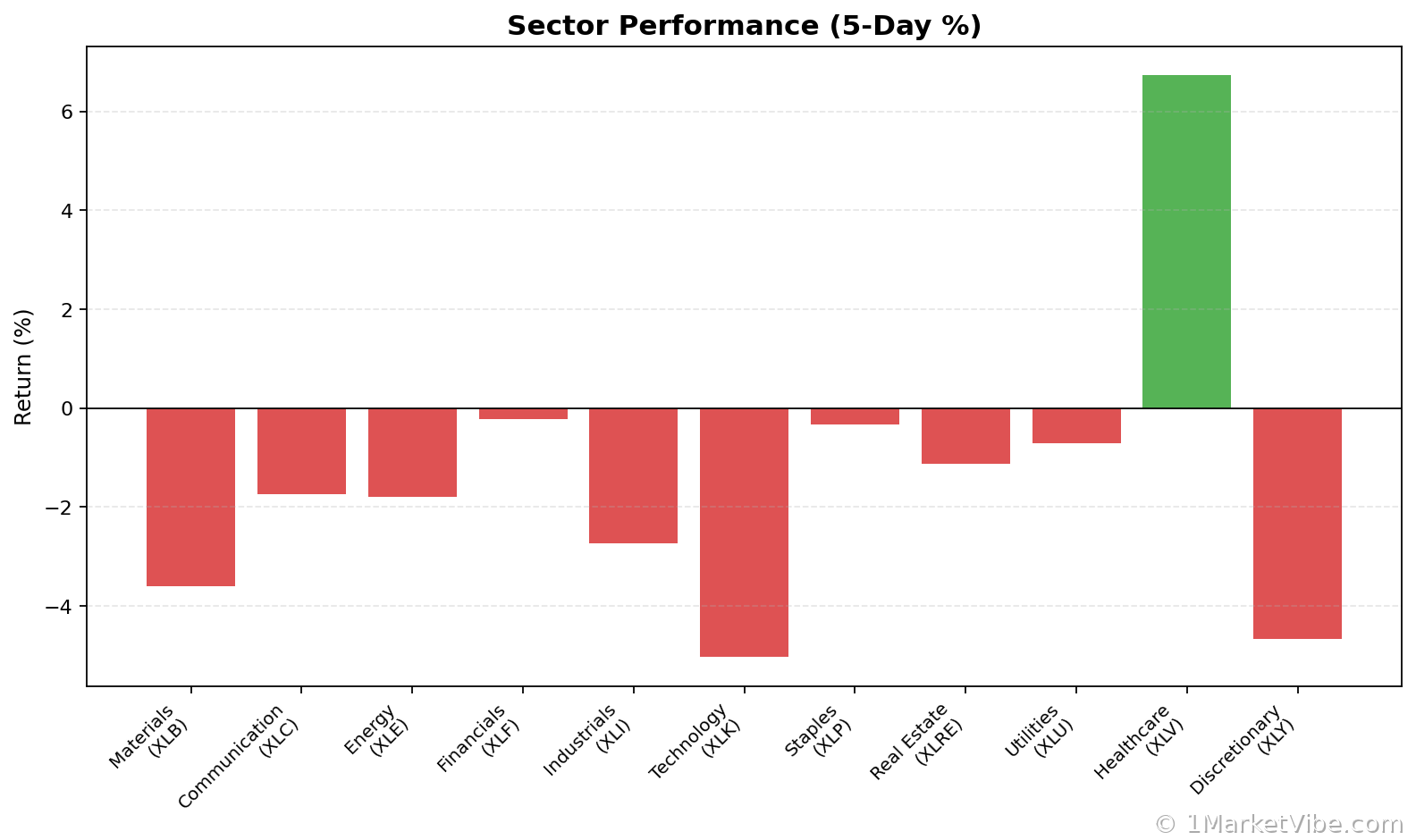

The immediate impact of the missing jobs report is a spike in market uncertainty. Investors rely heavily on this data to gauge employment trends and economic health, influencing decisions on everything from stock investments to interest rate expectations. The cancellation could lead to increased volatility, particularly in sectors sensitive to labor market conditions, such as retail and manufacturing. MarketVibe's CW Index, which currently stands at 7.19, reflects these heightened risk levels, suggesting that this trend was anticipated by its early warning signals.

Context & Background

Historically, government shutdowns have occasionally delayed economic data releases, but outright cancellations are rare. The current shutdown, now in its third week, has left key federal departments without funding, forcing the BLS to suspend operations. This comes at a time when the labor market is under intense scrutiny, with recent reports indicating mixed signals about employment growth and wage inflation. Key stakeholders, including businesses, investors, and policymakers, are left in a lurch, unable to make informed decisions without this vital information.

Market Reactions

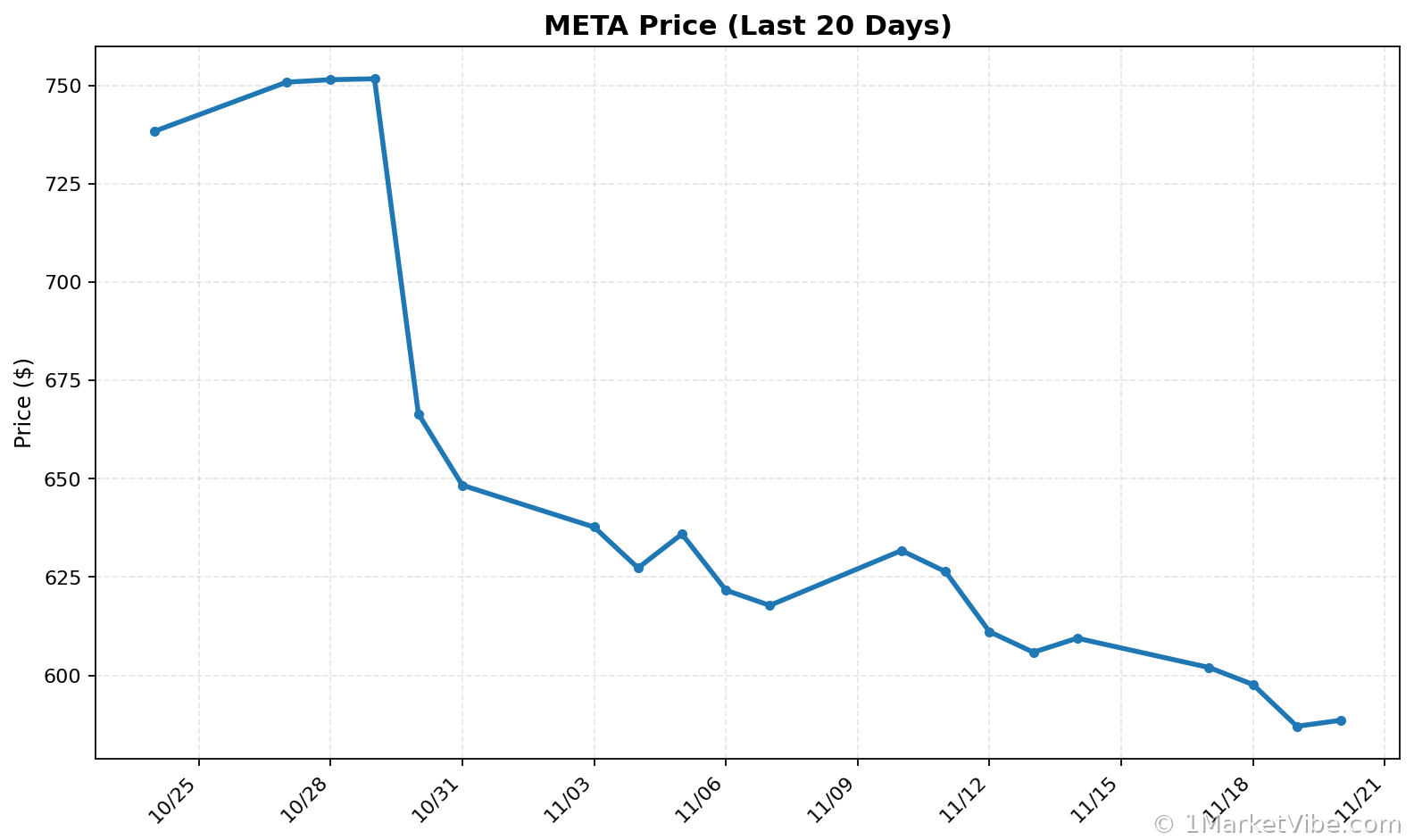

Investor sentiment has remained cautiously neutral, though the absence of the jobs report could lead to increased market volatility. Sectors such as technology and consumer goods may experience fluctuations as investors adjust their strategies in response to the heightened uncertainty. Historical parallels suggest that prolonged data gaps can lead to reactive market behavior, as seen in previous shutdowns where delayed reports resulted in temporary market corrections.

What's Next

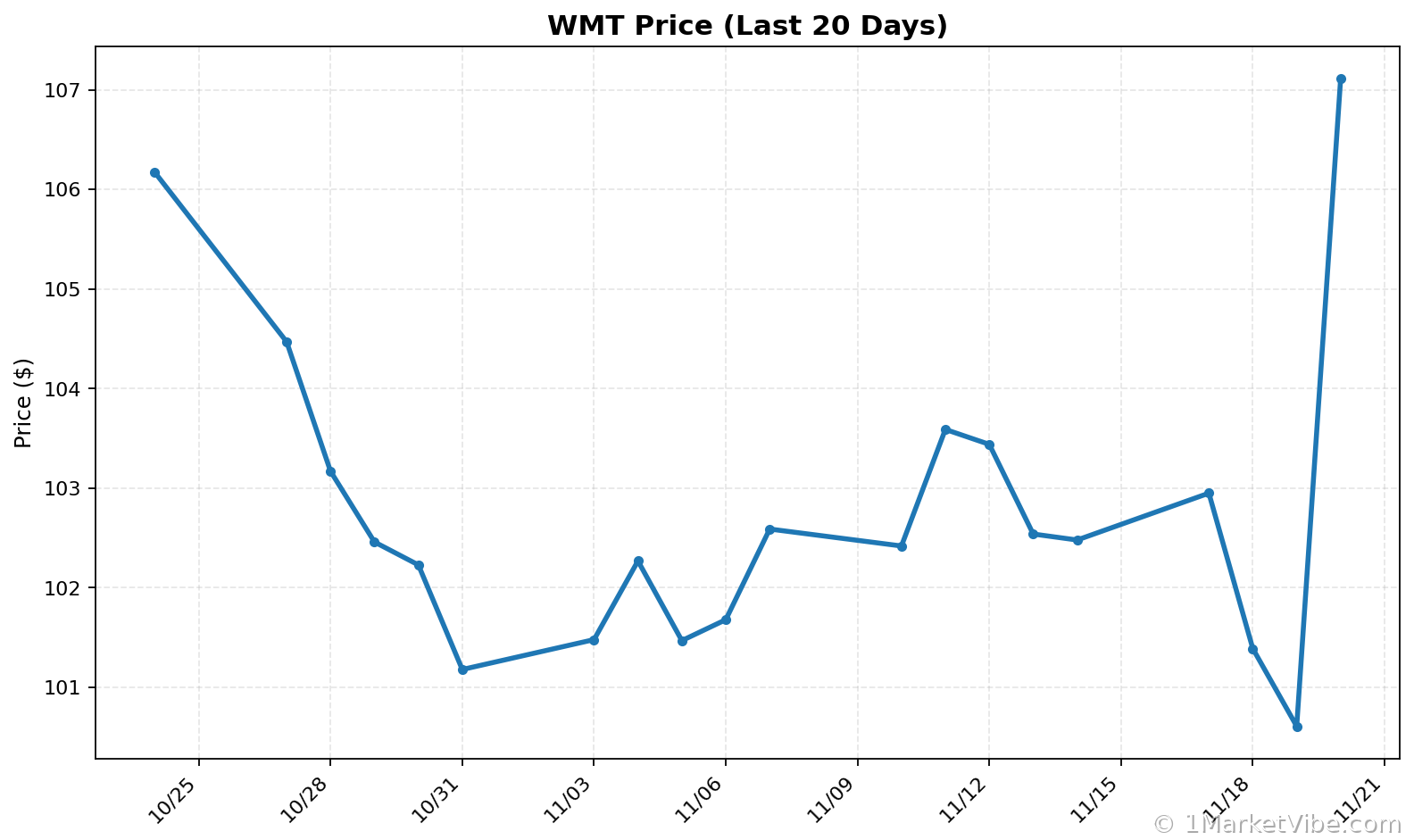

Investors should brace for potential volatility in the coming weeks as markets adjust to the lack of labor market data. Key economic indicators to watch include upcoming earnings reports from major retailers like Walmart, which could provide alternative insights into consumer health and spending trends. Additionally, any developments regarding the resolution of the government shutdown will be crucial in determining when regular data releases might resume.

For investors, this means maintaining a cautious approach and closely monitoring market signals. The CW Index's current reading of 7.19 suggests a need for vigilance, as it continues to track broader risk environments. As the situation unfolds, staying informed will be critical.

Monitor risk signals as this story develops at 1marketvibe.com.

Disclaimer: This content is for informational purposes only and should not be considered as financial advice. Market conditions can change rapidly and unpredictably.

Charts