Waymo Halts Service: A Key Market Signal for Investors

Introduction

In a surprising turn of events, Waymo, Alphabet's autonomous vehicle division, temporarily halted its robotaxi service in San Francisco following widespread power outages. This incident has sparked discussions about the reliability and future of autonomous vehicles. As investors assess the implications, MarketVibe's proprietary Enhanced CW Index provides a crucial lens through which to evaluate market conditions. Currently at 5.7, the CW Index operates on a 0-10 scale, offering a 4-6 week early warning of potential market corrections by analyzing institutional gold flows and market breadth. With the current reading below the 7.0 warning threshold, it indicates moderate risk, yet the situation with Waymo could shift investor sentiment.

Learn more about how the CW Index works at 1marketvibe.com.

Incident Overview

The power outages in San Francisco, caused by a fire at a substation, led to significant disruptions, including non-functioning traffic signals. Videos on social media showed Waymo vehicles stalled in traffic, unable to navigate the chaotic conditions. This incident highlighted the challenges autonomous vehicles face in unpredictable environments. As the CW Index suggests moderate risk, investors should consider how such operational vulnerabilities might affect Waymo's market position and broader autonomous vehicle sector dynamics.

Waymo's Response

In response to the chaos, Waymo proactively paused its service to ensure safety and reliability. The company stated that while their technology is designed to handle non-functional signals as four-way stops, the scale of the outage required additional caution. This pause raises questions about Waymo's operational resilience and could impact its valuation. MarketVibe's CW Index, with its gold flow component, offers an early warning system that investors can use to anticipate how such incidents might influence market trends.

Tesla's Position

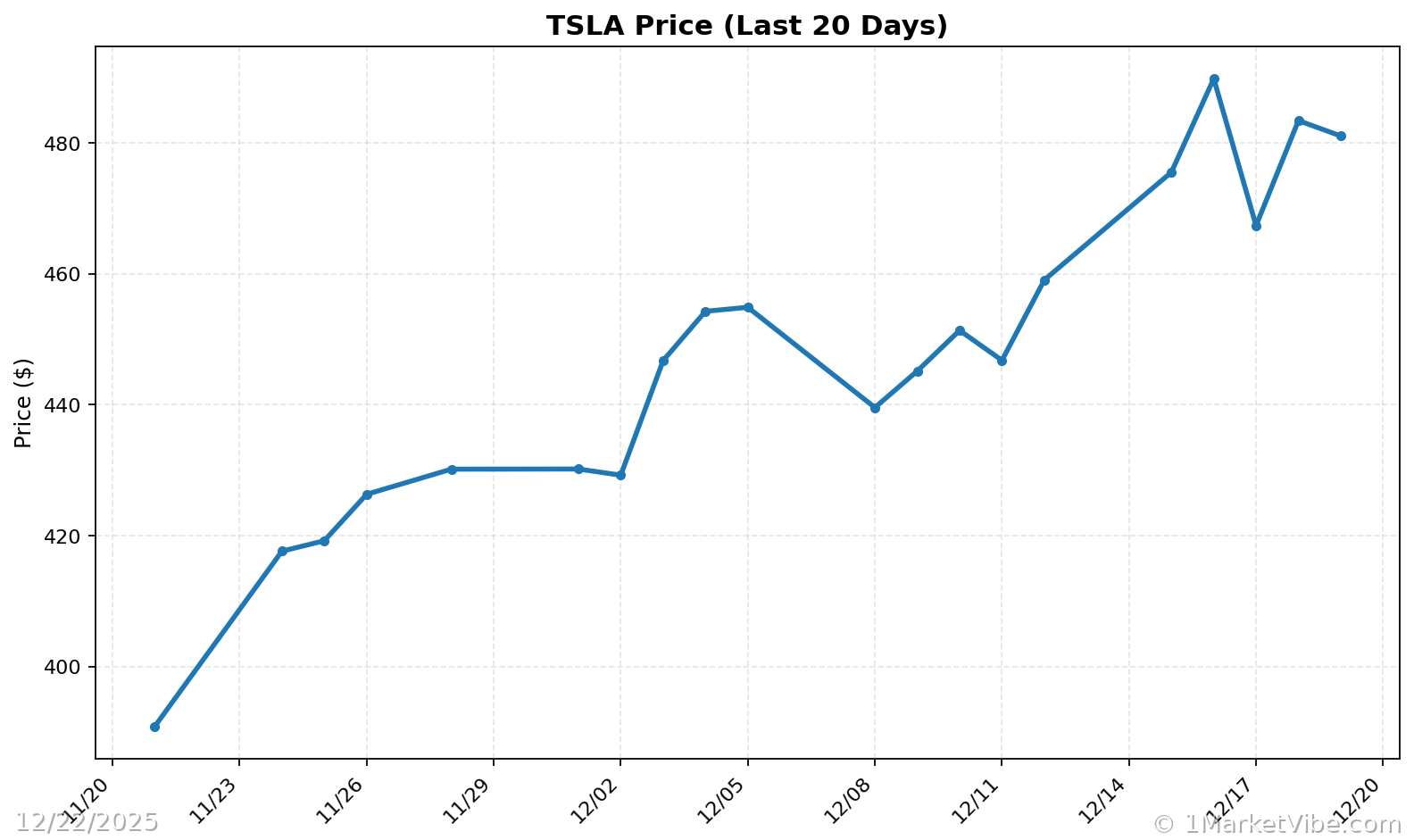

In contrast, Tesla's ride-hailing service, which requires a human driver, remained unaffected by the outages. Elon Musk highlighted this operational resilience, which could bolster Tesla's market perception compared to Waymo. The CW Index at 5.7 indicates that while the current market risk is moderate, shifts in investor sentiment towards autonomous technologies could alter this landscape.

Market Implications

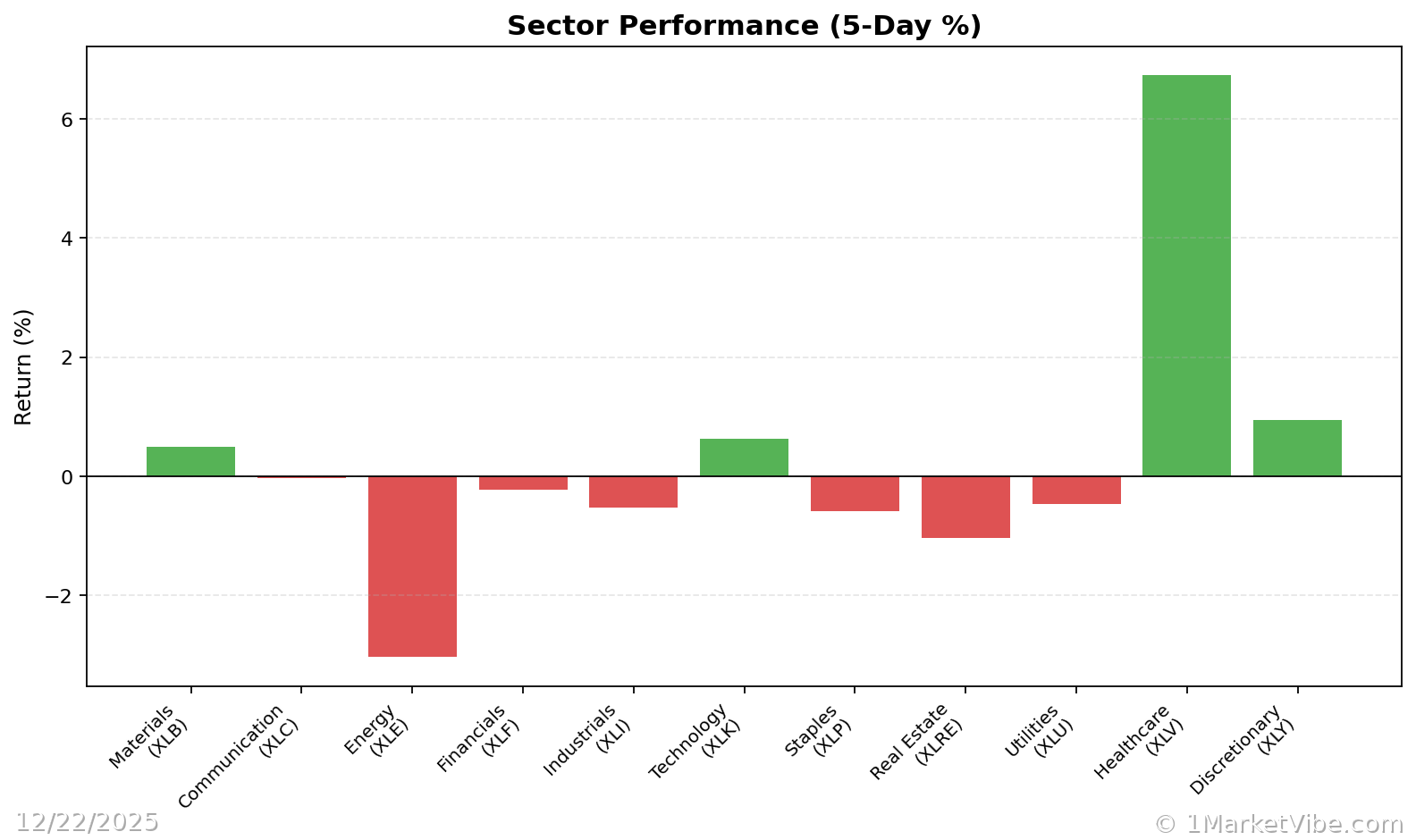

The temporary halt of Waymo's service could have broader implications for the autonomous vehicle market. Investors may reassess the reliability and scalability of fully autonomous services. MarketVibe's CW Index historical patterns show that when the index hit 7.1 in March 2023, markets fell 8.3%. Monitoring the CW Index for movements towards the 6.5 level could provide early signals of increased market volatility in the tech sector.

Public Perception

Public trust in autonomous vehicles is crucial for market growth. Incidents like Waymo's service pause can erode consumer confidence, impacting adoption rates. As the CW Index tracks market breadth, it can help investors gauge broader market sentiment shifts that might arise from such public perception challenges.

Future Considerations

The Waymo incident underscores the need for robust operational strategies and potential regulatory scrutiny in the autonomous vehicle sector. Investors should watch for regulatory developments that could affect market dynamics. MarketVibe's CW Index, with its 4-6 week early warning capability, remains a vital tool for anticipating such shifts.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk.

- Overall market status: Yellow flag, monitor closely.

- Key metric to watch: CW Index movement towards 6.5.

📚 Learn (2-Minute Deep Dive)

The Waymo incident highlights vulnerabilities in autonomous vehicle operations during unexpected events. Historically, the CW Index has provided early warnings of market corrections, as seen in March 2023. The current situation with Waymo could signal a shift in investor sentiment towards tech stocks, particularly those in the autonomous vehicle sector. Monitoring the CW Index for movements is crucial, as it integrates gold flow analysis to provide a 4-6 week advance notice of potential market shifts. Understanding these dynamics is essential for investors looking to navigate the evolving market landscape.

⚡ Act (Specific Steps)

- For conservative investors: Maintain current positions but reduce exposure to autonomous vehicle stocks by 5% if the CW Index approaches 6.5.

- For aggressive investors: Consider short-term hedging strategies in the tech sector if the CW Index trends upwards.

- For balanced portfolios: Diversify holdings with a 10% allocation to gold-based assets as a hedge against potential market corrections.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The temporary halt of Waymo's service in San Francisco serves as a critical market signal for investors. As the autonomous vehicle sector faces scrutiny, MarketVibe's Enhanced CW Index and Decision Edge™ Method provide invaluable tools for navigating these uncertain waters. Built by investors, for investors, MarketVibe offers early warnings and actionable insights to help you stay ahead of market trends.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

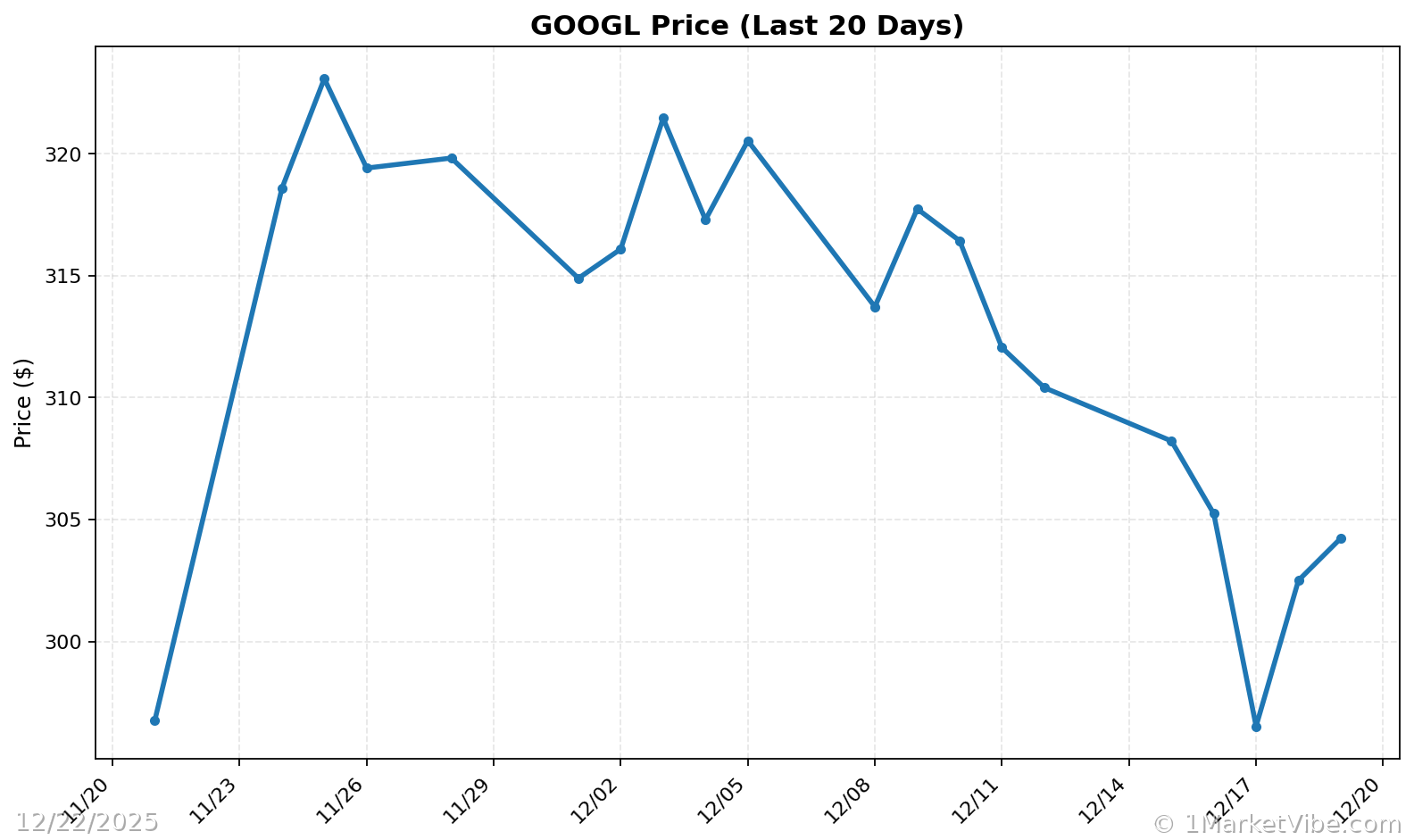

Charts