AI Momentum and Its Impact on the S&P 500 Amid Risk Signals

- Authors

- Name

- MarketVibe Team

- @1marketvibe

AI Momentum and Its Impact on the S&P 500 Amid Risk Signals

The S&P 500 has experienced a notable upswing, achieving its third consecutive winning day, largely driven by the momentum in AI-related trades. This trend is particularly significant as it unfolds amid a backdrop of moderate risk signals. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.7. This reading is below the critical 7.0 warning threshold, indicating a moderate risk environment. Investors are keenly observing these developments as AI continues to bolster market confidence, potentially stabilizing against emerging risks.

Learn more about how CW Index works at 1marketvibe.com.

AI Trade Impact on Market Dynamics

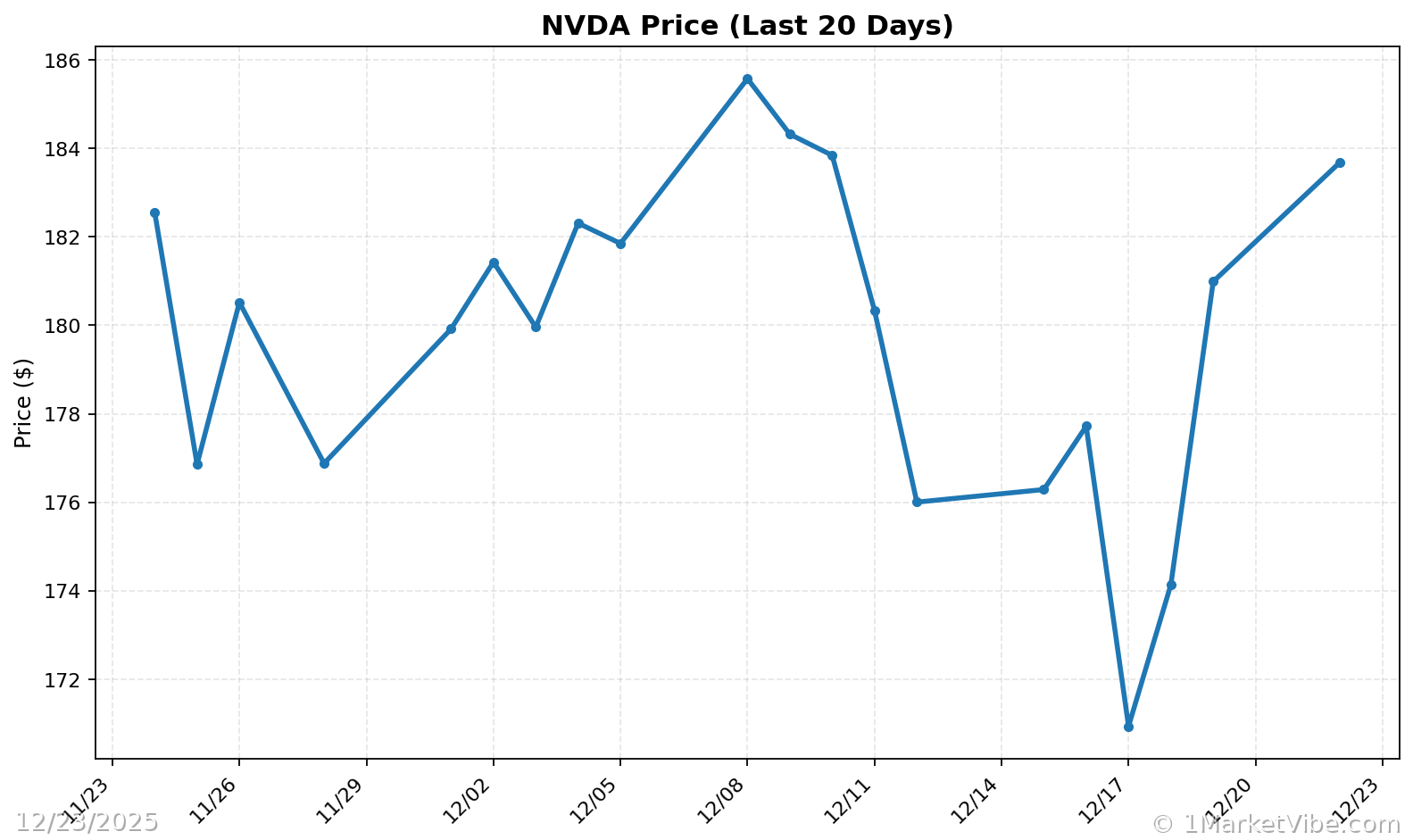

AI-driven trades have become a significant force in the market, enhancing investor confidence and contributing to the recent positive performance of the S&P 500. Key AI stocks such as Nvidia and Micron Technology have posted impressive gains, with Nvidia advancing over 1% and Micron climbing around 4%. These movements underscore the growing influence of AI on market dynamics, acting as a potential stabilizer against moderate risk signals identified by MarketVibe's CW Index.

Recent Performance Data

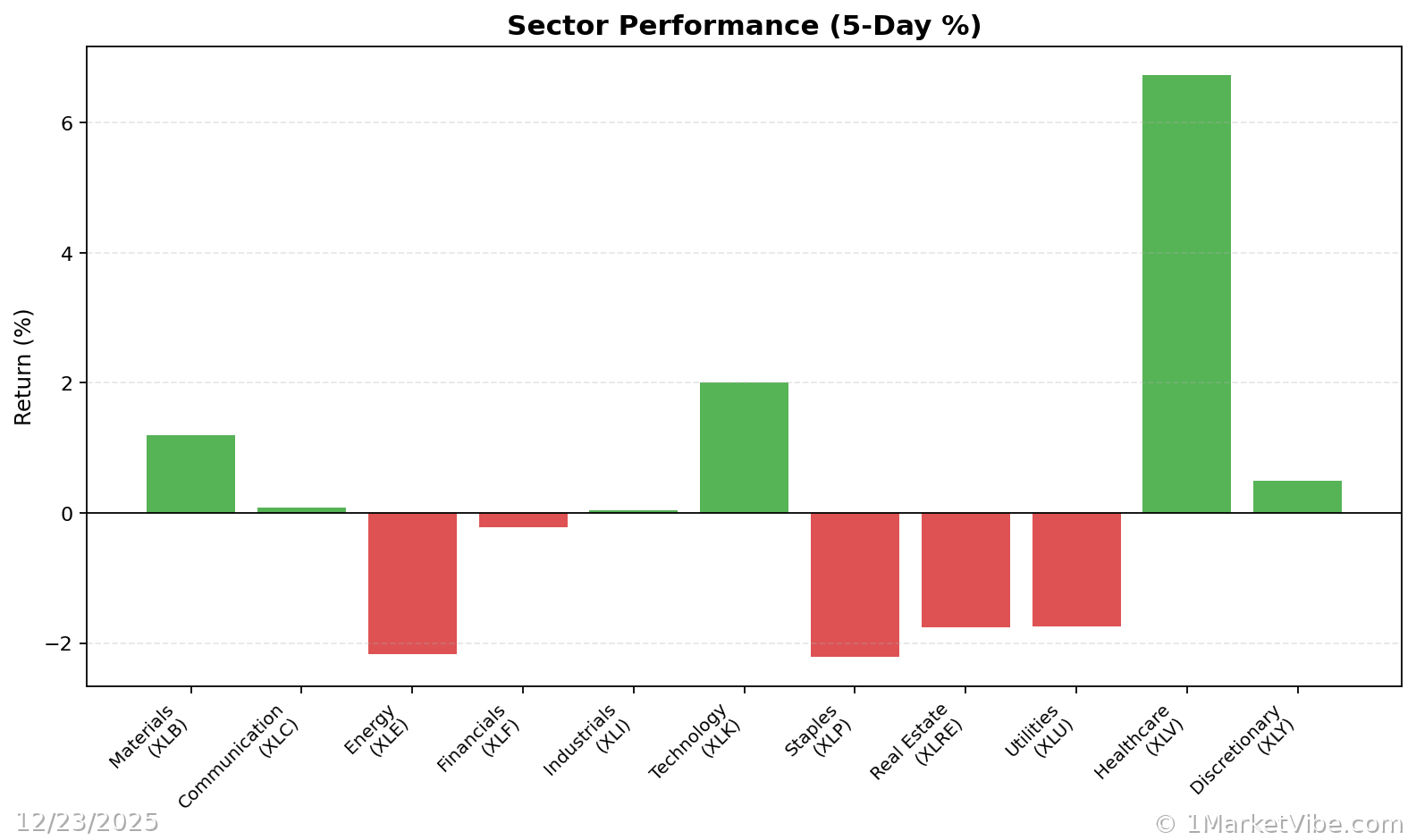

Recent data from CNBC highlights that the S&P 500 rose by 0.64% to reach 6,878.49, marking its third positive day in a row. The Dow Jones Industrial Average and the Nasdaq Composite also posted gains, reflecting a broader market uplift. However, the mixed performance across major averages suggests that while AI momentum is strong, investors remain cautious about the broader market conditions.

CW Index Connection

The current CW Index reading of 5.7 aligns with these market trends, providing a predictive insight into potential market corrections. Historically, when the CW Index hit 7.1 in March 2023, markets fell by 8.3% over the following month. This highlights the importance of monitoring the CW Index closely, especially if it approaches the 6.5 level, which could signal increased risk. The gold component of the CW Index offers a unique 4-6 week early warning, allowing investors to anticipate market shifts proactively.

Sector Analysis

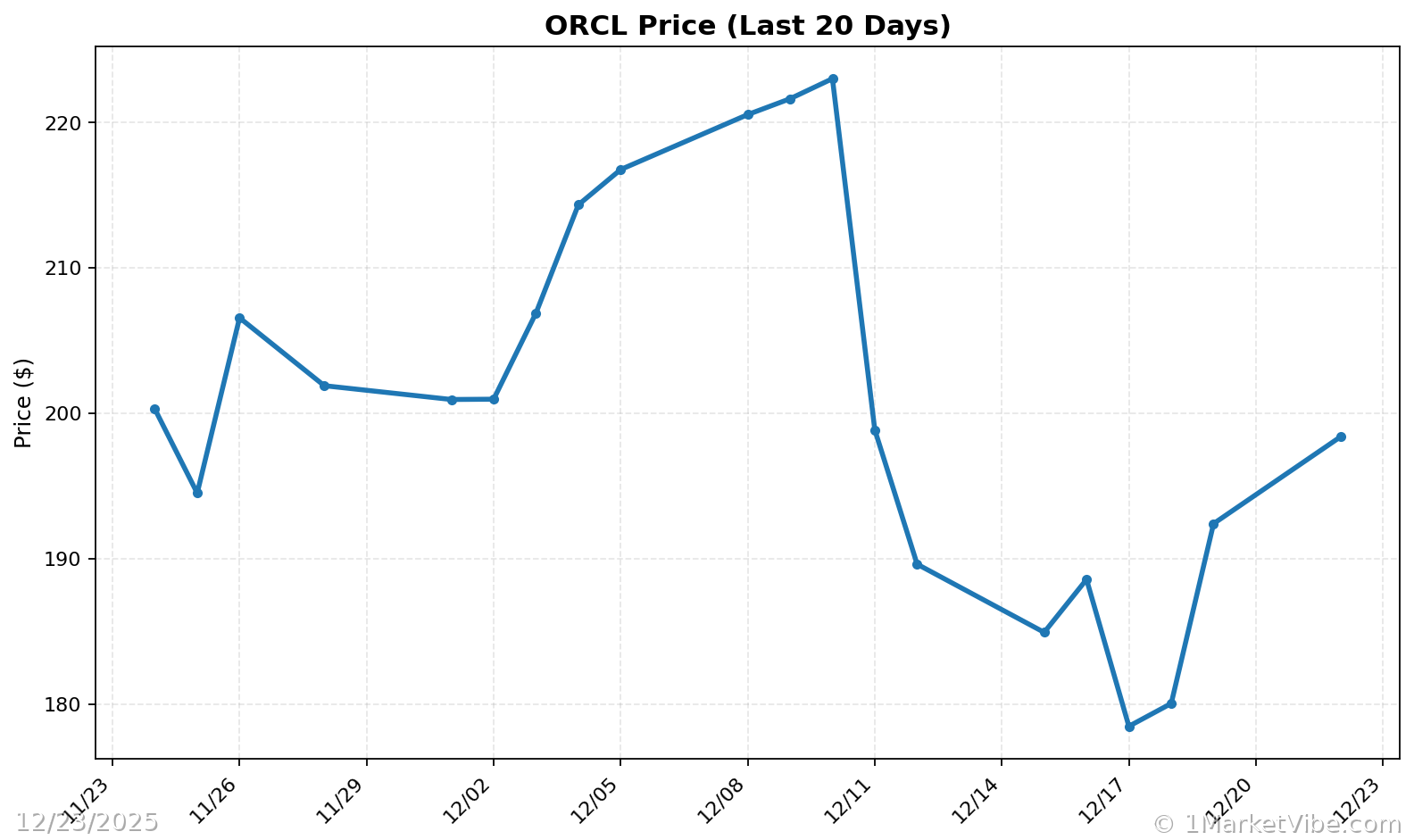

AI's influence is particularly pronounced in the technology sector, where stocks linked to AI developments have shown notable gains. Companies like Oracle, which advanced more than 3%, are benefiting from the AI trade momentum. This sectoral strength is crucial as it provides a buffer against potential volatility in other areas of the market.

Risk Considerations

Despite the positive momentum from AI trades, moderate risks persist. The CW Index's current level suggests that while the immediate risk is moderate, investors should remain vigilant. Market volatility can arise from various factors, including geopolitical tensions and changes in monetary policy. Thus, maintaining a balanced portfolio and monitoring the CW Index for any upward movements is advisable.

Investor Sentiment

Investor sentiment remains neutral as market participants weigh the potential of AI against existing risks. The current environment is characterized by cautious optimism, with investors keen to capitalize on AI-driven opportunities while being mindful of the broader market landscape.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- CW Index at 5.7 indicates moderate risk.

- Overall market status: Yellow flag.

- Key metric to watch: AI sector performance.

📚 Learn (2-Minute Deep Dive)

The current market environment is buoyed by AI-driven trades, which are enhancing investor confidence. Historically, AI momentum has provided a stabilizing effect during periods of moderate risk, as seen in previous market cycles. The CW Index's predictive capability, particularly its gold flow component, offers a valuable early warning system. Investors should monitor the index closely, especially if it trends towards the 6.5 level, which could indicate heightened risk. Understanding these dynamics is crucial as they offer insights into potential market corrections and opportunities.

⚡ Act (Specific Steps)

- Diversify Holdings: Allocate a portion of your portfolio to AI-related stocks, but maintain diversification to mitigate risk.

- Monitor CW Index: Adjust risk exposure if the CW Index approaches 6.5.

- Implement Hedging Strategies: Consider options or futures to protect against potential downturns.

- Stay Informed: Regularly check MarketVibe's updates for real-time CW Index movements.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

AI momentum continues to play a pivotal role in shaping the S&P 500's trajectory, offering a potential stabilizer against moderate risk signals. As the market navigates these dynamics, investors should leverage MarketVibe's tools, including the Enhanced CW Index and Decision Edge™ Method, to make informed decisions. By staying vigilant and proactive, investors can better position themselves to capitalize on opportunities and mitigate risks.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly and unpredictably.

Charts